Length Of Credit History

Time is on your side where credit is concerned and 15% of your score is based on the length of your credit history.

This refers to how old each open account on your credit report is as well as the average age of your accounts combined. A longer credit history shows lenders youre fiscally responsible and it benefits your score.

What Makes A Perfect Credit Score

The blueprint for achieving an 850 credit score is straightforward.

- Pay your bills on time all the time. This includes not just your credit card bills, but also your mortgage, loans and other debt obligations including medical debt.

- Keep your credit card balance and other revolving credit close to or at zero. When using credit cards, pay them off every month. And use a small percentage of your overall credit limit: less than 7%.

- Maintain a long credit history. Longer than 15 years, in fact. If you have several credit card accounts, you need to keep your older accounts open.

- Use different types of credit responsibly. Having different types of credit shows you can manage different types of debt.

- Request credit sparingly. Keep your credit inquiries well spaced out preferably once every 12 months.

Keep A Credit Account Mix

This article from Nerdwallet discusses several tips to get every possible point on your way to the highest credit score. One of these tips is to have several credit accounts, including installment loans. Even if you succeed in getting the highest credit score, it points out, youre unlikely to keep it month after month.

My comment: Save for my student loans, which I paid off several years ago, Ive only had credit card and mortgage accounts. No car loans, though: I buy used cars with cash. So my current credit profile includes both revolving debt and amortizing debt .

Early on, though, I made the mistake of closing several of my credit card accounts and eventually ended up with just two. Ive stuck to using only one of them for the past 10+ years.

» Further reading: 19 Simple Ways to Improve Your Credit Score.

You May Like: Does Qvc Report To Credit Bureaus

His Total Credit Limit Is High

Droske’s total available credit limit across his six credit cards was $82,700, according to the credit report he provided. Given Americans have an average credit card limit of $22,751, he has much more available credit to his name yet he’s smart about how he uses it. “You have to use it, but not abuse it,” Droske says.

What Credit Score Is Needed For An Auto Loan

The required creditworthiness for a car loan depends on each lender. However, a credit rating of 500 to 579 is generally considered bad credit as 500 is the average minimum credit cost for a car loan. It will be extremely difficult to find a bank, loan company or finance company that will lend you money for a loan.

Dont Miss: Does Paypal Credit Report To Credit Bureaus

You May Like: Syncb/ppc Credit Card Login

Keep Old Credit Card Accounts Open

It is better to keep your unused credit cards open so that you will be having a longer average credit history and a larger amount of available credit.

Additionally, a part of your credit score is determined by your credit history. On considering the age of each account and how long its been since you used one. While your payment history and amount owed make up the bulk of the score.

Maintain Good Habits And Be Patient

If you feel like youre doing everything right and your credit score hasnt yet passed 800, you might simply have to wait. Fifteen percent of your credit score comes from the length of your credit historywhich means that even if you have been practicing responsible credit habits since you opened your first credit card, it might take a while for those habits to earn you an exceptional credit score.

It might also be hard to achieve an 800 credit score until you have a mix of credit under your name. Were not saying you should take out a mortgage or a car loan just to get your credit score over 800, but if the only credit accounts on your file are credit cards, you might struggle to reach that 800 credit score. If thats the case, dont worryhaving excellent credit is just as good, and youll receive nearly all of the benefits that come with a near-perfect credit score.

Also Check: Fico Score 820

What Is The Best Credit Score You Can Get

- A score above 600 gives you a good chance of being approved for a home loan. However, this may vary depending on the sofa used.

- A score of 670+ is considered excellent credit, greatly increasing your chances of getting a home loan.

- Values below 600 are considered high to very high risk.

Disadvantages of paying off a car loan earlyHow does paying off a car loan early hurt your credit? How Early Payment of a Car Debt Can Affect Your Score. Both revolving loans and installment loans can improve your credit balance, which can help improve your credit score.How much does it cost to pay off a car loan?Heres an example usin

Fair Credit Vs Good Credit

Having fair credit generally puts you near the middle of credit score ranges. As scores improve, the numbers go up. Good credit scores are a step above fair scores. A good credit score with FICO falls within 670 and 739, while VantageScoreâs good range is from 661 to 780.

The better your credit, the better a candidate you may be for things like credit cards. But thatâs just the start. Having strong in a number areas:

- A higher credit score may improve your chances of qualifying for a credit card that best fits your situationâwhether youâre looking for a good rewards program or a low APR.

- Mortgages and other loans: Strong credit can also help you qualify for mortgages, auto loans and more.

- Interest rates: If you qualify for a loan or credit card, the lender may use your credit score when setting your interest rate or credit limit. Generally, a higher credit score may help you get better terms.

- Rental applications: Landlords may pull your credit report to help them decide whether you qualify for an apartment lease.

- Employment applications: With your written permission, employers may pull your credit reports during a background check.

- Insurance premiums: Depending on state laws, insurers may consider your credit history when determining premiums.

- Deposits: Cellphone providers and utility companies may decide to waive security deposits for people with strong credit.

Read Also: How To Remove Repossession From Credit Report

You May Like: How To Notify Credit Reporting Agencies Of Death

A Perfect Credit Score Of 850 Is Possible But It Probably Doesn’t Matter

Money, Home and Living Reporter, HuffPost

Lyn Alden recently accomplished something that few people have: She earned an 850 .

The Atlantic City, New Jersey, resident, who provides market research to individual investors and financial professionals, achieved her perfect credit score three months ago, up from 841 in prior months and 832 a year ago.

It was no easy feat. Out of the 200 million Americans who have FICO credit scores the most commonly used credit scoring model only about 1.4% have perfect 850s, Bloomberg reported.

Alden points to her long credit history, no missed payments and very low credit utilization for her 850 score. I dont open new accounts too frequently to churn for credit card rewards and have successfully paid off numerous student loans, she added.

But what, exactly, is the winning formula for a perfect credit score? If there is one, no one except perhaps the credit scoring analysts truly know. There is a multitude of factors that affect scores, and they can change depending on your specific situation. Plus, FICO keeps its scoring model largely a secret.

Even so, we do know the basic factors that influence credit scores. So if youre chasing the elusive 850, you have to crush it in every category.

Have A Credit History

You not only want a good record of paying your bills and credit cards on time, but you also want a long history of doing so. The older your credit accounts are, the better your credit score will be. You want to have credit accounts that have been open for 10 years or more.

Length of credit history accounts for 15% of a credit score, and closing old accounts can affect your credit score, Ross says.

You May Like: Does Carvana Report To Credit Bureaus

How To Negotiate Credit Card Payoff

Category: Credit 1. Settling Credit Card Debt | FTC Consumer Information Debt Settlement Companies Debt settlement programs typically are offered by for-profit companies, and involve the company negotiating with your creditors to Feb 17, 2021 How to negotiate debt with your credit card company · Step 1: Understand how

Is Achieving An 850 Credit Score Worth It

You dont need a perfect credit score to get the white-glove service from lenders. A score in the excellent range higher than 750 is generally considered enough to get you some of the best interest rates currently available.

The incremental value of a higher score in terms of lower rates generally fades once you cross the 750 mark. Car insurance rates, car loans, mortgages and personal loan rates arent going to get any lower once youre in the top credit bracket.

So is working towards a perfect credit score worth it? If youre currently outside of the excellent credit range, the answer is a resounding yes. Building your credit to the high 700s can get you access to the best terms mainstream lenders have to offer.

Don’t Miss: How Do I Get A Repossession Off My Credit

Pay Your Bills On Time All Of Them

Paying your bills on time can improve your credit score and get you closer to an 800+ credit score. Its common knowledge that not paying bills can hurt your credit score, but paying them late can eventually hurt also.

I think a lot of people dont really understand that there isnt a bill thats really too small, says Thomas Nitzsche, a certified credit counselor and financial educator with ClearPoint Credit Counseling Solutions, and the owner of an 800+ credit score.

If a bill goes unpaid long enough and the debt is sold to a third-party collection agency, that will be reported to credit bureaus, Nitzsche says. But being late can lead to fourth-level reporting parties, such as online searches, that credit bureaus can become aware of.

From late utility bill payments to magazine subscriptions or even $10 medical co-pays that people dont think are important enough to pay on time, all bills should be paid on time.

Any bill I get is treated as a serious situation, he says.

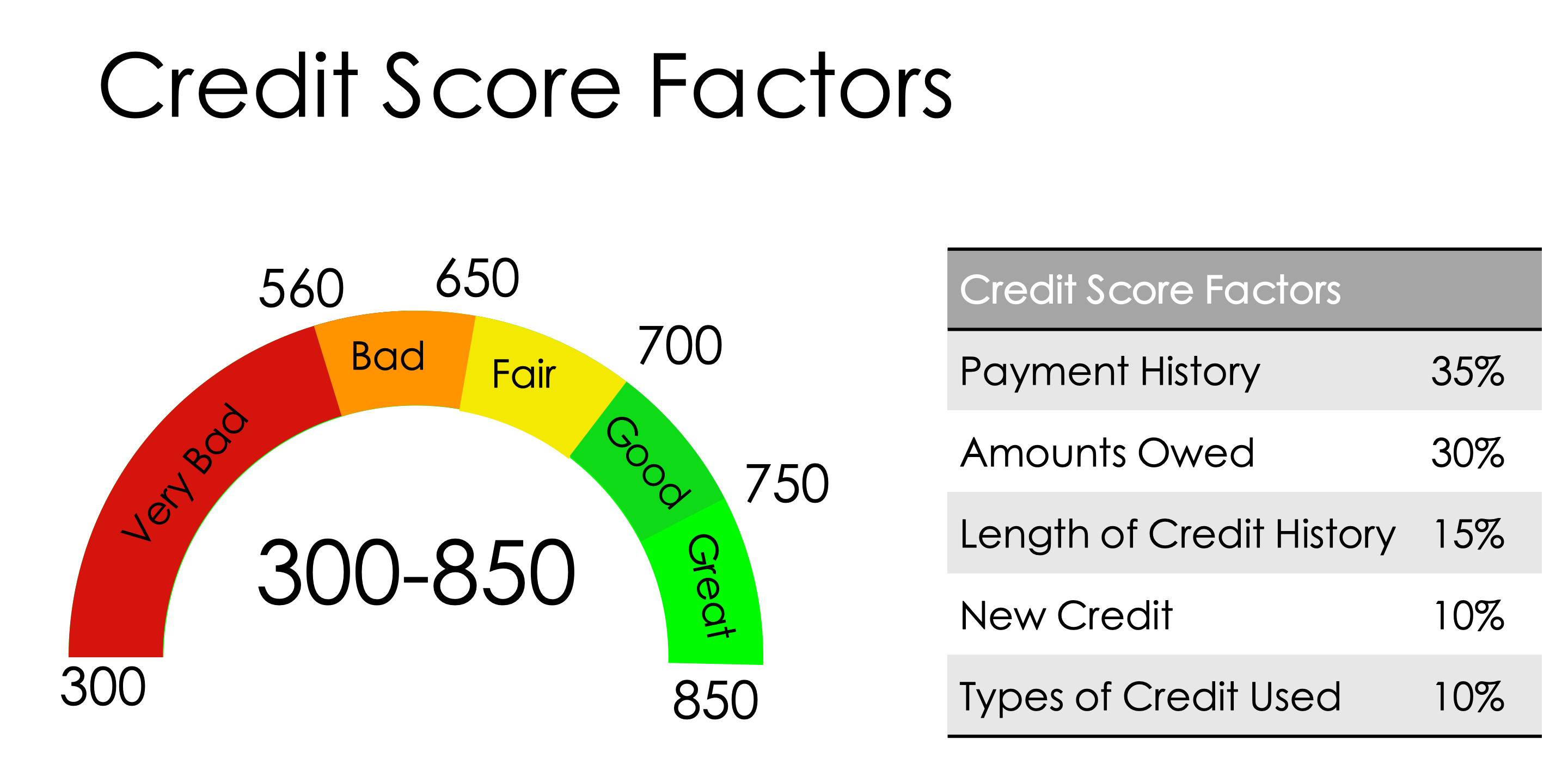

Payment history counts for 35% of a credit score, says Katie Ross, education and development manager for American Consumer Credit Counseling, a national financial education nonprofit group.

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

Read Also: Amazon Credit Card With Itin Number

Stay Away From Negative Items

An article on Credit Karma reports the results of an interview with people who achieved an 850 credit score. One of their findings is that in order to get a perfect score, nothing negative can show up on your credit report. They discuss late payments as one example, mentioning that you cant have late payments on your credit card.

My comment: I remember one instance in the past when Id completely forgotten about my credit card bill. It was a silly mistake: Id switched phones and forgot to set a new bill payment alert. My credit score fell by about 25 points because of it. I believe it took 3 to 4 months for it to go back to 850.

Absent that lone slip off, I havent had any other negative items on my credit report for a long while.

Credit Score: Is It Good Or Bad

Your 850 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit.

21% of all consumers have FICO® Scores in the Exceptional range.

Less than 1% of consumers with Exceptional FICO® Scores are likely to become seriously delinquent in the future.

Read Also: Is 688 A Good Credit Score For A Mortgage

How Does It Work

Although there are many different , your main FICO score is the gold standard that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Explore Your Refinancing Options

Now may be a good time to refinance your car loan or your mortgage. Doing so can save you money in the long term and potentially help your credit by making it easier to keep on top of future payments.

Although it is possible to refinance when you have bad credit, youll reap much greater rewards with a top credit score. For example, youll get better interest rates, which will save you money and may allow you to pay off the loan quicker.

Read Also: Zebit Report To Credit Bureau

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Length Of Credit History 15%

This category takes into account age-related factors such as the average age of your accounts, the age of your oldest account, and the ratio of seasoned to non-seasoned tradelines.

The more age your accounts have, the more they will help your .

Age goes hand-in-hand with payment history, because the more age an account has, the more time it has had to build up a positive or negative payment history. Together, age and payment history make up 50% of your credit score, which shows how important it is to open accounts early and make every single payment on time.

This is also why we always say that focusing on age is the #1 secret to unlocking the power of tradelines.

According to FICO, the age of the oldest account of people who have 650 credit scores is only 12 years, compared to 25 years for people who have credit scores above 800. In addition, individuals with fair credit have an average age of accounts of 7 years, compared to 11 years for those with excellent credit.

Cultivating an 850 credit score takes years of maintaining a positive credit history.

FICO reports that the average age of the oldest account of consumers who have 850 credit scores is 30 years old.

Also, keep in mind that it may be impossible to achieve an 850 credit score without a certain amount of age, even if you do everything else perfectly. So if you have stellar credit habits but havent yet been able to join the 850 credit club, you may just need to wait patiently for your accounts to age.

Also Check: How Long Does Car Repossession Stay On Credit

Don’t Be Afraid To Increase Your Credit Limit

It’s sometimes puzzling to me why consumers resist when lenders offer a credit limit increase, or why they fear asking for a higher credit limit. If you’re a compulsive spender, this fear would be justified. In all other cases, I’d suggest cardholders embrace the idea of higher credit limits.

The idea here is simple: The higher your credit limits, the less likely you are to use more than 30% of your aggregate credit, which is the line-in-the-sand point where your credit score could be dinged. Yes, increasing your credit limit will likely involve your lender taking a hard look at your credit report, and it may result in a temporary loss of a few points on your credit score. But over the long term it could help lower your credit utilization rate, which will have a considerably more positive impact on your credit score as long as you remain responsible with your spending.