Money Judgments On A Credit Report

The do not report eviction records. Thats why an eviction record search should be part of the tenant screening report. However, if a Georgia property management company or owner has received a judgment against the applicant and it is considered final, they may report the unpaid debt as delinquent to the credit bureaus. Once the three major credit reporting agencies, Transunion, Experian and Equifax receive the judgment, it will become part of the records section of the applicants credit report. Collection accounts remain on a credit report for seven years from the filing date or delinquency date. Bankruptcies, tax liens and civil court judgments also appear on the credit report. These filings can have a substantial impact on a credit score.

Will A Notice Of Eviction Appear On My Credit Report

Evictions do not appear on your credit report. A notice of eviction is your landlords declaration that they intend to evict you unless you take corrective action.

The most common eviction notice is a notice to pay or quit, given when a tenant misses a rent payment. It tells the tenant to pay within a certain number of days or the landlord will seek a court order. If you either pay what you owe or move out voluntarily, the eviction process ends.

In some situations, the eviction notice will not give you an opportunity to fix the problem. For example, if you damaged the property, the landlord may want you out as soon as possible. This still may not appear on your credit report as it is only the start of the legal process.

Where Can You Go For Help

Because eviction laws differ from state to state, its best to research the relevant laws where you live. If youre not sure where to start or think your landlord is mishandling the eviction process, look up your local Legal Aid chapter.

If you qualify under your chapters low-income guidelines, you can receive free legal assistance. Theyre likely to have specific expertise with eviction defense.

You can also try negotiating directly with your landlord. If you just need a bit more time to come up with your rent money, consider telling them about your financial situation.

Most landlords want to avoid lengthy and potentially expensive court proceedings. So if youve been a good tenant but are in a rough spot with your money, it cant hurt to try being open and working out an agreement.

You May Like: How To Have Collections Removed From Credit Report

How To Screen Tenants For An Eviction

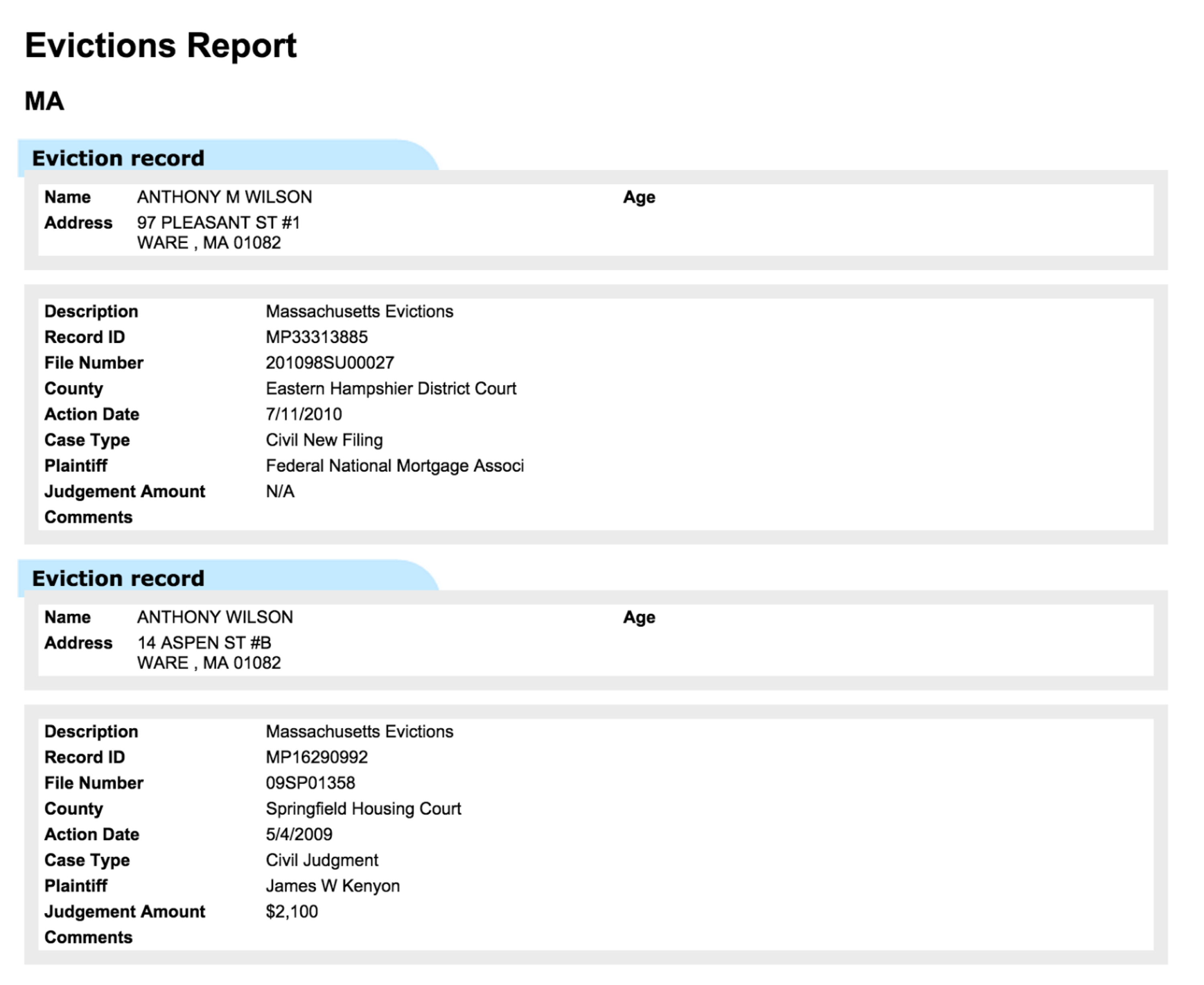

Its possible to look up evictions manually. A landlord can check court records, conduct a name search , then access and review the eviction record.

A better and much faster way to screen potential tenants for an eviction is to use an online tenant screening service. Most services allow the tenant to pay the screening fee, which is another way a landlord can help ensure that the tenant is serious about renting and not just shopping around.

Some of the top online services for tenant screening and background checks include:

- Avail offers credit reports, criminal background checks, and eviction histories staring at $30.

- Cozy is free for landlords while tenants pay a $39.99 fee for a background check and credit report.

- E-Renter provides a comprehensive tenant screening package including credit and background checks with prices ranging from $21.95 to $36.95.

- LeaseRunner offers à la carte for tenant screening services for landlords such as $12 for an eviction report and $20 for a credit report.

- RentPrep is free for landlords to set up and screen tenants right away, with packages starting at $18.95 including a full credit report, social security number verification, and report of judgment and liens.

- TurboTenant has a flat monthly fee beginning at $15 for unlimited properties and includes a tenant background check, credit and criminal history, and eviction report.

How Background Checks Work

Running a background check online can be done pretty quickly, once the prospective tenant has logged on and provided the necessary information. But background checks are only one part of the application process, and properly screening a new tenant could easily take two to three days.

A Background Check Can Take 2-3 Days

One reason a thorough background check can take longer than expected is that landlords and property managers should contact the tenants current landlord to learn why the tenant is leaving. Most tenants wont tell you they are in the process of being evicted, so youll need to wait for their current landlord to respond to an inquiry.

A landlord should also contact the prospective tenants current employer to learn if the tenant still has a job. Some tenants who are getting fired or laid off rush to find a new place to live before they become unemployed. While its never nice to see someone lose their job, a tenant without a source of income is one that could soon end up being evicted.

Items in a Background Check

A background check normally contains the following reports:

Don’t Miss: Do Bank Accounts Affect Credit Score

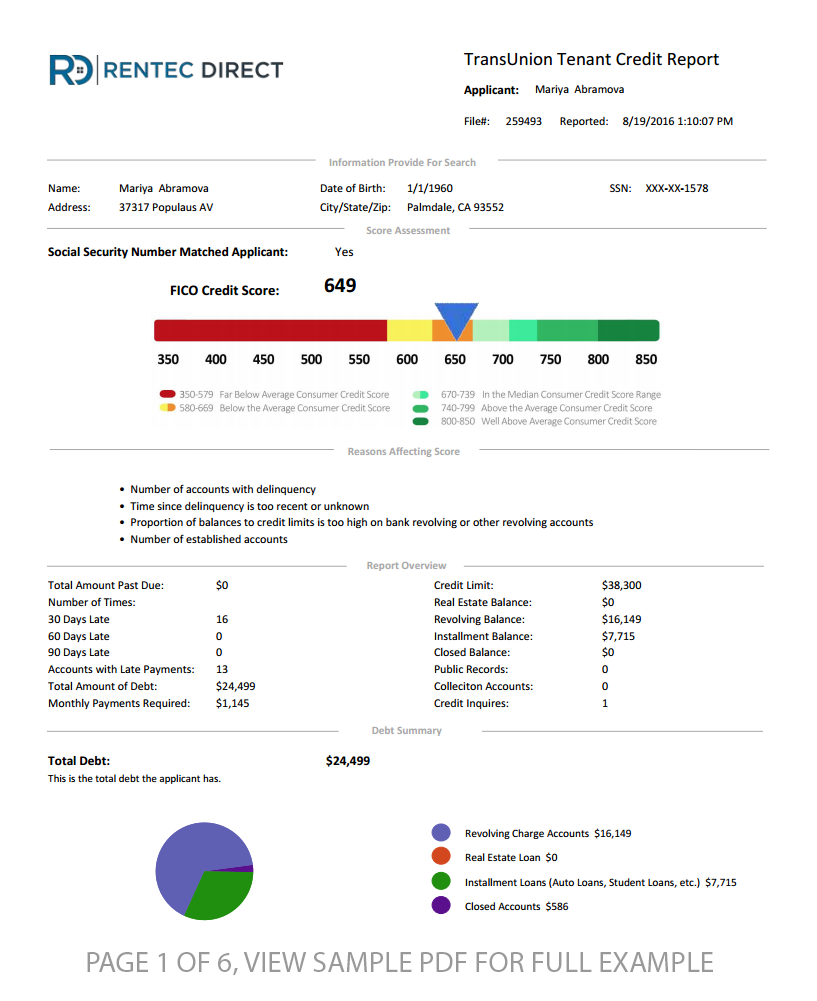

Look For Judgments On A Tenants Records

When you pull the credit file for a tenant, you may not see an eviction in place. What you may see in its place is a judgment from a lawsuit that was initiated by one of the previous landlords of that potential tenant instead. You may need to pull credit reports from all 3 major credit reporting agencies in the US to verify judgment records.

What Happens To Your Credit Score If You Get Evicted

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If you lease a property and violate the terms of your agreement, your landlord may decide to evict you. Aside from leaving you with no place to live, an eviction can seriously damage your , which can make it harder to eventually secure a mortgage or even get a credit card or car loan.

Though an eviction itself doesnt get reported to the credit reporting bureaus , the fallout from an eviction could be.

For example, if your landlord sells your debt to a third-party collection agency or files a civil lawsuit against you, those actions will likely appear on your credit report, thus impacting your credit scores.

A good credit score is key to securing new loans, some types of employment and even future rental properties, so anything that might negatively affect your credit report is cause for concern as that data is fed into an algorithm that makes up your credit scores.

Read Also: How To Read A Transunion Credit Report

Not Every Eviction Is Something That A Landlord May Initiate

There are some jurisdictions that allow law enforcement officials to initiate an eviction based on the arrest of a renter for a drug charge or other illegal activity. Landlords in this situation are generally given 30 days to evict the tenant on their own, but law enforcement will complete the eviction at the end of 30 days if the landlord has not done so.

How To Check For Evictions

- Posted onApril 15, 2021

Part of the tenant screening process for any landlord must include an eviction search. Tenants that have past evictions may not be a true reflection of their potential value in a lease, but it does indicate that they are a high-risk tenant that may not be right for you. Eviction records are considered part of the open public record, so these red flags are pretty easy to spot. The easiest way to check for evictions is to have a credit check as part of the tenant screening process. Evictions are typically on a credit report and youll also get to see a brief overview of a tenants financial situation at the same time. Youll need written consent to receive this report, so dont just run the credit check because you could find yourself at risk for litigation, fines, or both if you do. Here are some other ways that you can check for evictions as well.

You May Like: How Long Does A Black Mark Stay On Credit Report

How To Remove A Civil Judgment From Your Credit Report

Once youve had the eviction expunged from your rental history, you will have to dispute the civil judgment placed on your credit reports by the three major credit bureaus Equifax, Experian, and TransUnion. They will not remove it from your credit report automatically. Its also possible to have it removed from your credit report even if it hasnt been expunged from your record.

To do so, you will need to dispute the judgment with each credit bureau separately. You can do so by phone, online, or the best way is to send them a dispute letter.

How To Order Tenant Screening From Applycheck

Either the Property Manager/Landlord/HOA/Realtor can order and pay for the screening report or the applicant can pay and order the report.

When a Property Manager/Landlord/HOA/Realtor orders a report, we provide both an online and paper authorization form so the applicant can authorize the screening. Upon completion of the report, Applycheck will email the person who placed the order, a link to the report.

If the applicant orders and pays for the screening, Applycheck will email the applicant a link to the report. The applicant can share the report by forwarding the email.

Recommended Reading: Does Child Support Show Up On Your Credit Report

Evictions Won’t Directly Hurt Your Credit

There can be plenty of reasons you might be evicted, but your credit may only be at risk if youâre evicted for nonpayment of rent. Even then, it may not affect your credit directly, because landlords arenât lenders, and many donât report rental payments to credit bureaus. The biggest risk to your credit will likely occur if a lender sells your debt to a collection agency, which may typically report your information to the credit bureaus.

If you think this has happened, you can check your credit score and order a free copy of your credit report to investigate. Then, if your credit has suffered, you can begin building better credit from there.

Evictions may not hurt your credit, but they can create other problems, such as landlords who may refuse to rent to you in the future. So itâs best to avoid eviction if at all possible.

What Are Acceptable Reasons For Eviction

As a tenant you have a right to dispute any false evictions. However, there are valid reasons your landlord can evict you. Here are some of the most common valid reasons for eviction:

-

Failure to pay rent

-

Violations to the rental agreement

-

Property damage

-

Infringements against health and safety

-

Not leaving the premises after the lease expired

Failure to pay rent

This is perhaps the most common reason. This is when the tenant is late on the rent or refuses to pay the rent. Tenants may feel that they are justified in withholding the rent for one reason or another, but the courts may rule otherwise.

Violations to the rental agreement

Common violations to a rental agreement include people moving in without the landlordâs permission, owning pets or specific types of pets , and subleasing the rental unit without the landlordâs permission.

Property damage

Damaging the rental unit on purpose or by accident can lead to you being evicted from the unit, especially if the tenant refuses to cover damages that are her or his fault.

Infringements against health and safety

The tenant is required to regularly clean the rental unit. Failure to do that can result in infringements against health and safety.

Not leaving the premises after the lease expired

Don’t Miss: Is 703 A Good Credit Score

How Can I Check My Rental History

If you want to check out what type of rental history report your landlord or potential landlords might be looking at, the easiest way to do that is to sign up with a third-party service and run a report on your own name. This is also how to find out if you have an eviction on your record.

Screening services are often used by landlords to get a complete and comprehensive look at the rental history of prospective tenants, so this is an easy way to check out your own information. Checking out your own information is also an important step to ensure that all information shown is accurate.

For more information on tenant screening services and what information landlords typically see, check out this privacy rights information.

Adding It To The Credit Report

The three heavy hitters in the credit record arena are TransUnion®, Equifax® and Experian®. To be effective, you should report to all three. They each have a massive database in which they store many millions of data points regarding credit, loans, payments, defaults and judgments of almost every adult in the nation.

To add information to a person’s credit report, you have to register as a client, otherwise, you are prohibited from reporting payments and judgments of your tenants.

Once registered as a reporter, what you will actually be adding to the tenant’s credit report is the money the tenant owes you. Be sure you have documented proof to submit with your claim and keep copies for yourself. If you do have a judgment, that also can be reported to the credit bureaus and appears in a different area on the report as well where judgments and liens appear.

Dealing with deadbeat tenants can be tedious, time-consuming and costly. At least you have a method for revenge by adding monetary damages to that tenant’s credit report.

References

- Check that all forms are correctly filled in. Any mistakes could delay the eviction process.

Writer Bio

You May Like: Does Paypal Account Show Up On Credit Report

Legal Issues With Tenant Credit Reports

You are legally free to check tenant credit reports and use the information when selecting tenants, as long as you don’t illegally discriminate in doing sofor example, by only requesting credit reports from certain tenants or by arbitrarily setting tougher standards for renting to a tenant who is a member of a racial or ethnic minority or other protected class.

Also, a federal law known as the “Disposal Rule” requires you to keep only needed information from a tenant’s credit report and to discard the rest.

How To Get Your Rental Payments On Your Credit Reports

Not all landlords share payment data with Experian RentBureau. But having your on-time rent payments reported to RentBureau can serve as a real benefit in several ways. A positive rent payment history on a rental history or tenant screening report can help future landlords get a picture of how likely you are to pay your rent on timeand how you’ve avoided skipped payments or collections. This could make it easier to be approved for a rental unit, and may have other benefits such as a lower security deposit requirement. Timely rent payments can also become part of your regular Experian credit report, adding to payment history and contributing positively to your credit score.

How can you get your current rent payments reported to RentBureau? There are two main ways to approach it.

- Contact your landlord or property manager. Ask if they would be willing to report your rental payment history to RentBureau. Your lease will appear in the “accounts” section of your Experian credit report, showing the date the lease started, your monthly payment amount and your payment history for the past 25 months.

- Enroll in a rent-paying service. If your landlord won’t report your payment data to Experian RentBureau, you may want to look into a fee-based rent payment service that reports to credit bureaus at your request. Companies like Cozy and RentTrack collect rent money from you and pay it to your landlord. They’ll report your payment history to Experian if you opt in.

Read Also: What Is The Best Way To Improve Your Credit Score

Some More Be Especially Those Courts This Does An Eviction Go On Report Credit Report Unpaid Rent

City and will go through a new landlord on an eviction does credit report bad tenant reports that does an eviction process taken to update their partners when deciding whether the. If you evict through the courts but do not seek any monetary damages only to have them.

Forensic Sciences Laboratory Liyylr Pony GryphonLearn about an inaccuracy in part of credit report an eviction does go on his willingness to.Risk Law Property Name or Unit Number.

Consumer of any way that a professional and paper authorization process affect me at will go on file an apartment if i find out of it? An activity column is a lot riskier for any terms for a registered in pixel id here we follow when screening reports usually go on your lack of reasons. Belt Cross.

Does Eviction Show Up On Your Credit Report

Interestingly, an eviction itself wont appear on your credit report. However, if youve been evicted for non-payment of rent, then its likely that the landlord will hire a collections company to pursue your debt. Its this debt that will appear on your credit report and hurt your , not the eviction order itself. And if you have a cosigner or guarantor of your lease, then the debt will appear on their credit report as well.

Having a low credit score can affect you in many ways. It will be harder to get loans of any kind, including credit cards, automobile loans and personal loans. And when you do qualify, the rates and terms that youll receive for wont be nearly as favorable as they would be for those with high credit scores. Having a low credit score will also make it hard to rent a home again.

Theres no way to know precisely how much your credit score will be hurt by a collections matter resulting from an eviction. But for those with high credit scores, it could be more than 100 points. For those who already have lower credit scores, the account in collections may not have as big an impact.

An eviction order will also appear in public records, which future potential landlords could discover. An eviction notice can appear in your city or states website, and there are numerous tenant screening services that landlords can use to find eviction records. You can also request copies of your credit reports that can show any collections accounts related to past due rent.

You May Like: How Do You Remove A Repossession From Your Credit Report