What Is A Good Credit Score In Canada

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

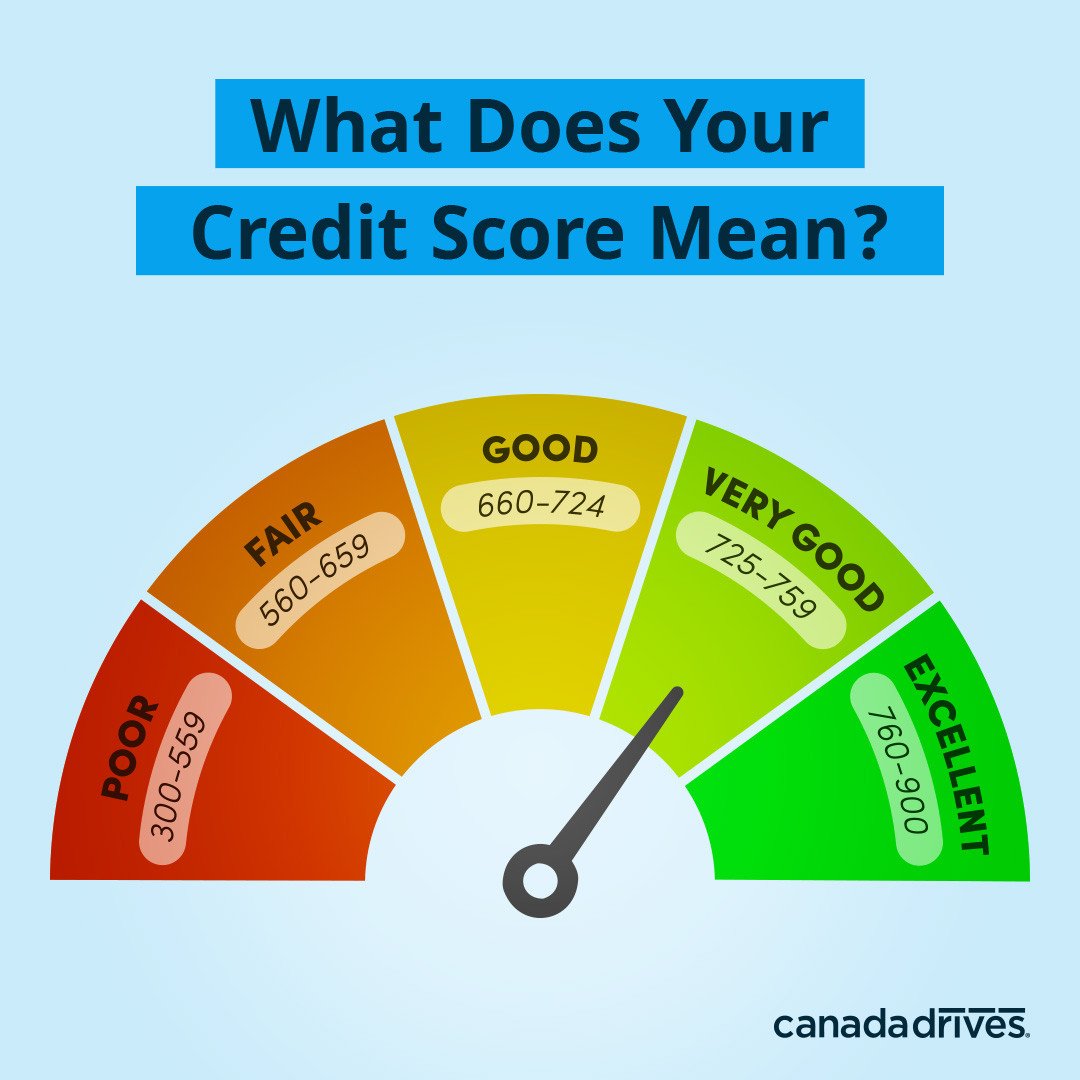

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, thats excellent. If your score is between 700 and 780, thats considered a strong score and you shouldnt have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and youll start finding it more and more difficult to qualify for a loan.

Unsecured Cards For Bad Credit

If you dont want to or cant provide the funds for a security deposit, unsecured credit cards are still available for people with bad credit. Unsecured cards for bad credit usually come with higher-than-average interest rates, no benefits and no rewards. You can still build credit with an unsecured credit card, but its important to do your best to pay your balance in full each month to avoid interest charges and practice positive credit use while you do so.

He Has Two Hard Inquiries

A hard inquiry, or “hard pull,” means that a lender or credit card issuer has pulled your credit report from one of the main three credit bureaus, Experian, Equifax or TransUnion. Hard inquiries may cause your credit score to fluctuate slightly, compared to a soft inquiry, which doesn’t pull your credit and has no effect on your score.

Of the two hard inquiries listed on Droske’s credit report, one is older than 12 months so it no longer calculates into his credit score. The second inquiry was three months prior to the report but didn’t affect his score at all. “Every inquiry does not automatically deduct points off of your credit report,” Droske says.

Read Also: Can You Check Your Credit Score For Free

Building A Good Credit Score

Every financial decision you make may impact your credit score and your ability to get a job, loan, credit cards, basic utilities and services, even rent an apartment or lease a car. Good financial choices help lenders and businesses see you as low-risk. You’ll be more likely to receive financial opportunities, including higher credit limits and lower interest rates.

Are you wondering how to establish credit that will improve your credit report? You’ve come to the right place.

How to build credit history that benefits you:

Start earlyThe length of your credit history is a key factor in determining your credit score

Start smallLenders assume you don’t plan to live within your means when you apply for a lot of credit in a short period of time

Open store charge card or credit cards to build creditPay your balance in full each month or keep your balance low. If you don’t qualify for a store charge card or credit card:

How to rebuild your credit score:

Create a planDevelop a time frame and budget for paying off current debts

How To Check Cibil Score By Pan Card Online

Your credit score is a measure of your credit health. Read on to understand how you can check your latest CIBIL Score using your PAN card online.

When looking to get insights to their financial wellbeing, many turn to the CIBIL score. This is a marker assigned by the TransUnion CIBIL – a credit rating agency. This score is based on your history with credit. It takes in account your repayment history and patterns, ability to handle debt, and whether or not you can utilise credit well. Naturally, it is important to keep tabs on your score, and you can do so online. You can check CIBIL score on various digital service providers. Lenders like Bajaj Finserv also allow you to check your CIBIL Score for free.

The process does differ based on the service provider, but does share certain similarities. For instance, you will have to provide basic KYC information, and this is mainly standardised. In fact, most services allow you to check CIBIL score by PAN card since this document is linked to most of your financial accounts. To know how to complete the process to check CIBIL score by using your PAN information, read on.

Steps to check CIBIL score by PAN card on the CIBIL website

One option to check CIBIL score online is to go to the official CIBIL website. The process is fairly easy and here is a step-by-step guide to follow.

Step 1: Go to the official CIBIL website

Step 2: Click on GET FREE CIBIL SCORE & REPORT

Step 5: Verify your identity with the OTP

Also Check: Is 795 A Good Credit Score

Pay Your Bills On Time Every Time

Perhaps the best way to show lenders you’re a responsible borrower is to pay your bills on time. Payment history is the most crucial factor with the FICO credit scoring models, accounting for 35% of your FICO® Score, so it’s essential you pay your bills on time.

Fortunately, if you fail to pay a bill by its due date, you can correct the mistake and stave off negative consequences to your credit score. Typically, lenders don’t report missed payments to the credit bureaus until they’re 30 days past due, so make sure to pay any outstanding bills before then.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Recommended Reading: How Much Does Credit Score Affect Mortgage Rate

How To Aim For The Highest Credit Score Possible

If you really, really want to fight for every possible point, we have some strategies that can help:

-

Pay every bill on time, every time. Payment history is the biggest factor in your score, so a misstep there can really set you back.

-

Keep your credit balances well under 10% of your credit limits. Credit utilization the amount of your credit limits in use is another highly influential factor in your score. The lower you can get it, the better.

-

Have multiple credit accounts, and installment loans as well as .

-

If your credit history is on the short side, ask to be an on an old, established credit card with a spotless payment record and low credit utilization.

-

Check your credit reports to spot errors that could hold down your scores.

-

Apply for new credit only if you really need it.

Get Credit For Rent And Utility Payments

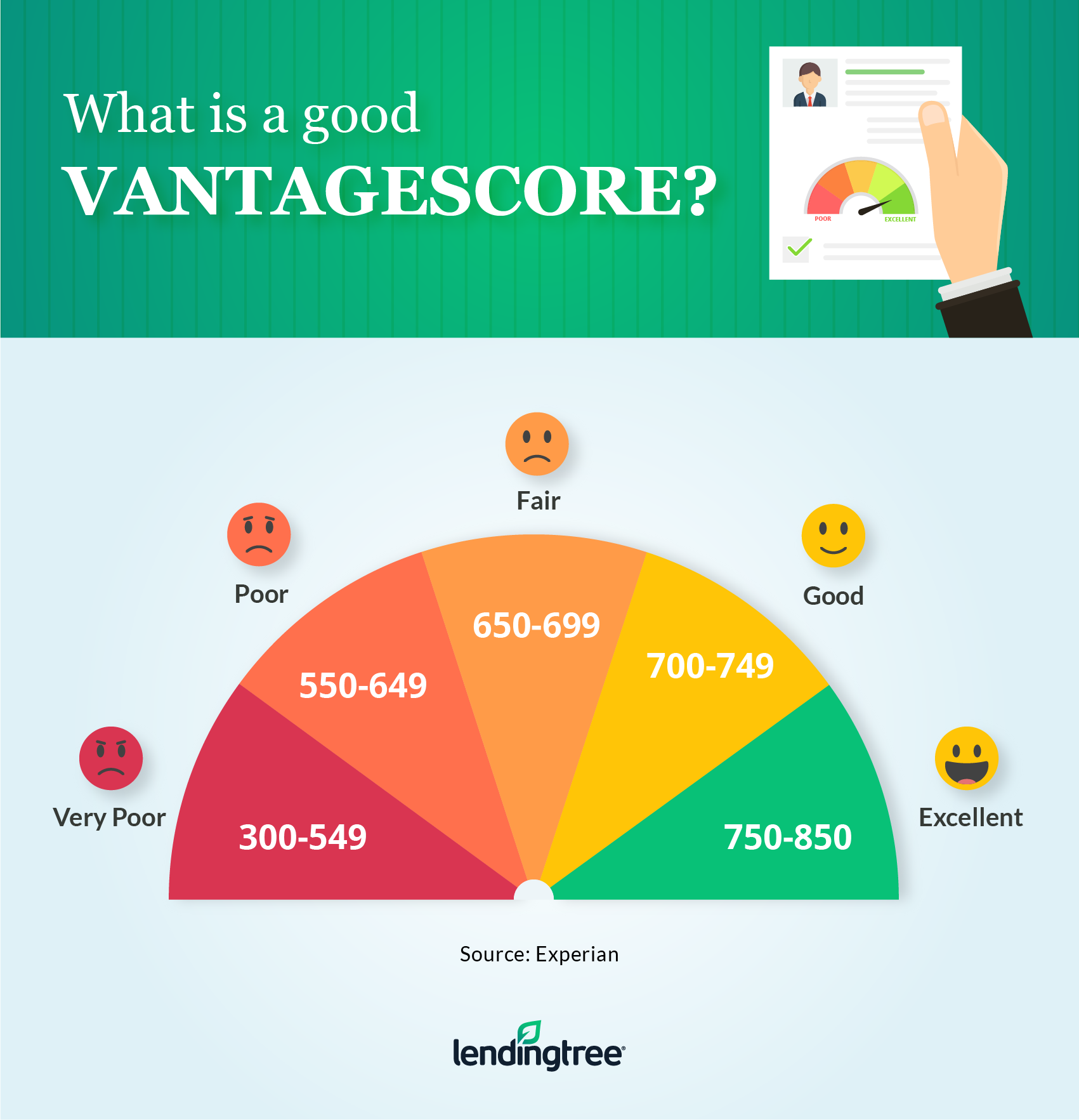

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

» LEARN:How Canadians can get a better credit score

You May Like: Is 734 A Good Credit Score

S To Improve Your Credit Score Right Now

Leslie CookKristen Bahler11 min read

A good credit score can make navigating difficult economic times a little bit easier.

Rising interest rates have made it more expensive to take out all kinds of new credit, from student and personal loans to and mortgages. But building up your credit score can offset some of these expenditures.

A high score helps you qualify for a lower rate when you take out a new loan. And the lower interest rate that comes with a high score makes saving money for your monthly payments easier and frees up cash you can use to pay down other debt. Or just save for a rainy day.

If your credit score is less-than-stellar, here are some concrete steps you can take to improve it. It may take time, so the sooner you start, the better.

Does Checking Your Credit Score Lower It

When a consumer checks their own credit score, it is treated as a soft credit inquiry that is not reflected on their credit report. For that reason, checking your credit score does not lower it. Instead, are based on five major factors: payment history , amount of debt , length of credit history , amount of new credit and credit mix . We recommend you check your credit score at least once a month.

Also Check: Which Credit Report Is Most Important

Is Achieving The Best Credit Score Realistic

Is an 850 credit score possible? Yes.

However, only 0.5 percent of consumers ever reach the 850 score. Thats OK, because a credit score of 740 is usually what you need to qualify for the best interest rates.

Experts recommend that consumers with a credit score of 800 focus on maintaining their score, rather than raising it.

He Has No Missed Payments

Perhaps the most important factor in your credit score is on-time payments. In fact, both FICO and VantageScore list payment history as the top factor in calculating your , since paying your bills on time demonstrates that you pose a lower credit risk to lenders.

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago.

So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

Of course, you don’t need to score an 850 to qualify for even the best rewards cards. With good or excellent credit, you could qualify for the American Express® Gold Card, which gives members 4X points per dollar on eligible purchases at restaurants, 4X points at U.S. supermarkets and 3X points on flights booked directly with airlines or on Amextravel.com. Terms apply.

Editor’s note: Scoring models have different algorithms, and credit scores can vary from day to day. This specific breakdown was based on Jim Droske’s credit report pulled on Dec. 18, 2018, which used the FICO 8 model. Jim Droske recently pulled a Wells Fargo credit rating using the FICO 9 on March 4, and it shows a perfect 850. But a credit report he pulled on March 11 using the FICO 8 model shows 842. A perfect credit score on one report doesn’t mean the same for every scoring model but it will probably be close.

Editorial Note:

Read Also: When Does Usaa Report To Credit Bureaus

How To Get Your Fico Score

Experian offers free credit reports online, including the FICO Score. In addition, many credit cards and banks offer credit scores and similar tools for their customers. AmEx, Citi, Bank of America, and Discover all offer FICO scores as a free perk for their cardholders.

In addition, credit monitoring services frequently include free credit scores and reports, including FICO scores.

Does Avoiding Hard Inquiries Raise Your Credit Score

Yes, having hard inquiries removed from your report will boost your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

Don’t Miss: When Does Discover Report Credit Utilization

Consider Getting A Credit

If you have a poor credit history, you might want to think about getting a credit-builder credit card. These are cards designed for people who either have made little previous use of credit or who have a bad credit history. But credit limits on these cards are often low and the interest rates are high. This reflects the level of reassurance your credit file information provides to lenders.

Butbe aware that the interest rates charged are much higher than standard credit cards. Typically, youll be paying over 30% in interest a year, which is another reason to try to pay off any balance in full each month. Otherwise, you might end up in debt that you struggle to get out of, which could harm your credit rating even further.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Recommended Reading: Does Getting Married Affect Your Credit Score

How Credit Scores Are Calculated

Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Scoring models may use different factors, or the same factors weighted differently, to determine a particular score. However, consumer credit scores generally share a few similarities:

- Scores are calculated based on the information in one of your credit reports.

- Scoring models try to predict the likelihood that a borrower will be 90 days late on a bill in the next 24 months.

- A higher score indicates a person is less likely to fall behind on a bill, and vice versa.

The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of 300 to 850and a score in the mid-600s or higher is often considered a good credit score. .

Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores. Here, we’ll focus on the actions you can take to help improve your credit scores.

The Importance Of Checking Your Credit Score

Regularly checking your credit score is important because it:

Helps you better understand your financial situation. Without knowing your credit score, its impossible to fully understand your financial circumstances. Having a comprehensive understanding of your score can help you decide whether its a good time to buy a home, apply for an auto loan or make other large purchases.

Makes it easier to improve your score and qualify for better rates. By understanding your score and how it was calculated, you can take strategic steps to improve your credit score over time, or build it for the first time. In fact, many scoring websites let users simulate changes to their score based on various factors like on-time payments, extra payments and new credit applications.

Lets you compare financial products based on eligibility requirements. Knowing your credit score can give you an idea of whether youre likely to qualifyand whether its worth applying. Whats more, lenders typically offer a personal loan prequalification process that lets prospective borrowers see what kind of interest rate they might qualify for based on income and creditworthiness.

May include red flags of fraud. Regularly checking your credit score makes it easier to spot out-of-the-ordinary activity that could indicate fraud. By recognizing a large and unexpected increase in your credit usage soon after it happens, you can file a dispute and get your credit back on track more quickly.

Don’t Miss: How To Get Chapter 7 Off Credit Report