First Changes To Reporting Of Medical Collection Debt Roll Out July 1 2022

Equifax, Experian and TransUnion are jointly introducing the first phase of changes to the reporting of medical collection debt that were announced earlier this year.

Effective July 1, 2022, all medical collection debt that has been paid by the consumer in full will no longer be included on U.S. consumer credit reports. In addition, the time period before unpaid medical collection debt will appear on a consumer’s credit report is being increased from six months to one year, giving consumers more time to address their debt before it is reported on their credit file.

These changes precede an additional measure set to occur in the first half of 2023, namely the removal of medical collection debt with an initial reported balance of less than $500 from credit reports.

We are dedicated to fostering the economic health of individuals and communities, said Mark W. Begor, CEO Equifax Brian Cassin, CEO Experian and Chris Cartwright, CEO TransUnion. Unexpected expenses, such as the cost of an unplanned medical visit, can be a hardship for many families. These changes will realign our approach to medical collection debt reporting in a manner that is designed to help consumers focus on their personal well-being.

Equifax, Experian and TransUnion are also providing free weekly credit reports through the end of 2022 via AnnualCreditReport.com.

For additional resources on medical collection debt and credit reporting, please visit Equifax.com, Experian.com or TransUnion.com.

When Was Paid Medical Collection Debt Removed From Credit Reports

As of July 1, paid medical collection debt should no longer be included on consumer credit reports for the three credit reporting agencies. The United States Public Interest Research Group encourages Americans with prior medical debt collections to check their reports to confirm that paid debts have been removed.

Another change will also go into effect in the first half of 2023. Equifax, Experian and TransUnion have said that any medical collection debt below $500 will no longer be included on credit reports. Most medical collection debt on credit reports is under $500, according to the CFPB .

Equifax Experian And Transunion Have Revised Their Policies Around Medical Collection Accounts In Credit Reporting

The major credit bureaus have updated their rules for sending medical bills to collections, which is expected to remove nearly 70% of medical collections debt from credit reports.

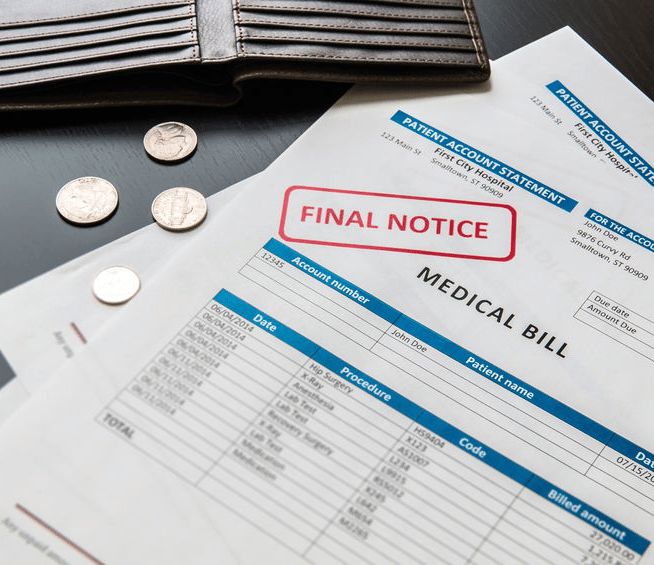

Medical debt is a costly burden that weighs on millions of patients who seek life-saving care it’s the leading cause of bankruptcy in America and the largest source of personal debt among consumers.

In an effort to support those who are faced with unexpected hospital bills, Equifax, Experian and TransUnion will soon remove nearly 70% of medical debt in collections from credit reports.

“Medical collections debt often arises from unforeseen medical circumstances,” credit bureau executives said in a joint statement. “These changes are another step were taking together to help people across the United States focus on their financial and personal wellbeing.”

Keep reading to learn more about the agencies’ new policy around medical debt reporting, as well as how to pay off unpaid hospital bills in collections. You can also enroll in free Experian credit monitoring services through Credible.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Next Steps: How Can I Keep Medical Collections From Ever Appearing On My Credit Report

These tips could help you keep medical bills off your consumer credit reports.

Medical Bills That Go Into Collection Will No Longer Damage Credit Reports Once They Have Been Paid

Listen to article

Millions of Americans will now see a cleaner bill of health on their credit reports, making it easier for many to get an apartment or apply for a loan.

Effective July 1, the three major credit reporting bureaus have removed medical debts that went into collection but were subsequently paid. In the past, these types of debts would remain on reports for as long as seven years.

Continue reading your article witha WSJ membership

Recommended Reading: How To Fix Credit Score Fast

Medical Debt Forgiveness Act

In February of 2021, Jeff Merkley of Oregon introduced the Medical Debt Relief Act of 2021 in the Senate. The House version was sponsored by Katie Porter of California.

The proposed bill would institute a one-year waiting period before medical debt could be reported on a credit report. The debt also could not be added to a credit report if the debt was fully paid or settled. The bill also removes those debts already on credit reports.

There is nothing more outrageous than the fact that after a family has paid their medical debt, their credit is still destroyed as if that debt remains unpaid, Merkley said.

In addition, the law would require the debt collector to notify the consumer in writing before reporting medical debt to a consumer reporting agency.

The bill is being considered by House and Senate committees.

Sen. Chris Van Hollen of Maryland, also has introduced the Medical Debt Collection Relief Act of 2021, which would restrict certain debt collection activities until the COVID-19 pandemic is deemed over, or for 18 months after the bill is passed. Actions that would be prohibited would include reporting negative information about the individual to consumer credit agencies.

We should never allow medical debts to ruin livelihoods, Van Hollen said in a statement when the bill was proposed.

In 5 Us Households Has Medical Debt

Roughly 1 in 5 U.S. households has medical debt, according to the Consumer Financial Protection Bureau. Some arent insured, while others struggle to pay deductibles and other cost-sharing. Insurance billing is byzantine, to say the least, and its easy to lose track of a bill while your insurer decides how much, or whether, to pay.

Many of these unpaid bills wind up on peoples credit reports. The CFPB found medical debts on 43 million credit reports last year, and medical debts made up 58% of all bills in collections as of the second quarter of 2021. Collections can depress your credit scores, which can make it harder to get loans or require you to pay higher interest rates. Bad credit also can cause you to be turned away from jobs or apartments, and require you to pay more for car and home insurance.

Newer versions of credit scoring formulas treat medical debt less harshly, since research shows health care bills arent as reliable as a gauge of creditworthiness compared to other types of collections. But most lenders still use older credit scores that dont distinguish medical debt from other overdue bills.

Rather than wait for lenders to update to the latest credit scores a process that could take years, if it ever happens the CFPB announced on March 1 that it would investigate whether medical debt should be included on credit reports at all.

Read Also: How To Get Your Free Credit Report From Experian

New Consumer Tips Released To Help Americans To Erase Paid Medical Debt From Credit Reports

Medical debt negatively impacts the credit scores of millions of Americans. This problem is so prevalent that one in five Americans had a medical bill they could not pay at the time they received care. Those bills often end up in debt collections, and then show up on a persons credit report. In 2021, 43 million credit reports listed medical debts in collection.

U.S. PIRG Education Fund released a tip sheet that Americans can use to ensure any paid medical debt has been removed from their credit reports. The tips explain how to obtain a free copy of credit reports, where to check to make sure paid medical debt has been removed, and how to dispute any mistakes in a credit report.

Until now, medical debt, even when it is paid off, remained on a credit report for up to seven years. But a new policy voluntarily announced in March by the three major credit bureaus Equifax, Experian and TransUnion changes how paid medical debt will be reported on credit reports starting on July 1.

Its incredible to think that even when you pay off your medical debt, the credit bureaus continue to penalize Americans by lowering their credit scores, said Patricia Kelmar, U.S. PIRG Education Funds health care campaigns director. Consumers have been denied auto loans, credit cards and mortgages and low credit scores can even impact hiring decisions by potential employers.

The three promised changes include:

Ask For A Cash Discount

Once youre sure your bill is correct, ask the hospital if there is a cash discount for paying in cash, or if theres a payment plan available, McCall says.

If you dont have enough in your emergency fund to pay your medical bill, a payment plan through your health care provider can be a better option than turning to a credit card or personal loan to cover the cost.

Your health care provider may offer a no-interest or low-interest payment plan to spread out your payments over time without the added cost of high interest rates.

Read Also: How To Remove R9 From Credit Report Canada

What Is Changing About The Way Credit Reporting Agencies Report Medical Debt

As of July 1, medical debt will be removed from your credit report as soon as it is paid. This applies to new debt or existing debt that may be bringing down your credit score.

At the same time, medical debt will not be recorded in your credit rating until it has been delinquent for one year. Previously, medical debt could appear in credit ratings after six months.

Beginning next year, only medical debt of at least $500 can be reflected in your credit rating. Medical debt below that amount will not be recorded by credit rating agencies.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: What Credit Score Is Needed To Buy A Lawn Mower

Most Medical Debt Will Be Dropped From Consumers’ Credit Reports

Medical bills have become a source of major financial trouble for millions of Americans, amounting to the largest source of personal debt in the U.S. Now, the top three credit reporting agencies plan to drop most medical debt from consumers’ credit reports starting this summer.

Equifax, Experian and TransUnion on Friday said that they are making a number of changes to the way they handle medical debt on credit reports, which is a record of a consumer’s borrowing and repayment. Lenders use credit reports to determine whether a consumer is a good bet for a loan, which means a poor can make it hard to get a mortgage, car loan or other products. Credit reports can also affect people’s ability to rent an apartment and even get a job.

The announcement comes as federal regulators and consumer advocates are increasingly scrutinizing the issue of medical debt, with the Consumer Financial Protection Bureau earlier this month criticizing the nation’s medical billing system for failing consumers. Errors related to medical debt are common on credit reports, and consumers often have difficulty clearing up the problems, the agency said.

Roughly 1 in 5 U.S. households carry debt related to health care, according to the CFPB.

The three top credit reporting agencies said they are making several changes in how they handle medical debt. They include:

Consolidate Medical Debts Into A Fixed

One common way to repay debt is with an unsecured personal loan that you repay in fixed monthly payments over a set period of months or years. Since personal loans have fixed interest rates, they may offer more favorable repayment terms than variable-rate credit cards.

Personal loan lenders determine interest rates and eligibility based on a borrower’s credit score. Applicants with excellent credit will qualify for the lowest rates possible, while those with bad credit may not be eligible at all.

You May Like: Is 649 A Good Credit Score

Why Medical Debt Is So Tricky For Consumers To Manage

McCall explains that its often difficult for consumers to know what expenses theyre on the hook for and what will eventually be paid by insurance, if they have coverage.

An account that went to collections but has since been paid stays on your credit reports for about seven years after it gets sent to collections. Were punishing consumers for something that happened unexpectedly seven and a half years ago, that theyve paid off, McCall says. Theyre still being punished for it.

Read more: How To Remove Collections From Your Credit Report

Errors in medical billing make matters worse, McCall explains. Medical bills frequently include coding errors, which could result in the patients financial responsibility being far larger than expected.

McCall of this: When she was in the hospital giving birth, she was given an aspirin. But the bill she received later indicated that instead of being charged for one aspirin she was charged for the entire bottle .

The credit reporting system forces patients and their families to pay bills whose accuracy they doubt, said Consumer Financial Protection Bureau Director Rohit Chopra in a statement on March 1. The announcement from the three credit bureaus came shortly after the CFPB announced it would scrutinize credit bureau practices regarding medical debt and investigate potential improvements to the medical billing and collections system.

Lack Of Accountability And Standards For Collections Practices

According to complaints to the CFPB, consumers may not be aware that they owe a medical debt or have time to resolve it, before a collection account appears on their credit report. The absence of any standard of how delinquent a medical debt has to be before it appears on a credit report means this can happen anywhere between 30 180 days past the billing date. When collectors substitute active efforts to contact a consumer with a report to credit reporting agencies, they impose a huge cost on consumers.

You May Like: What Day Does Capital One Report To Credit Bureaus

Check Your Credit Reports

After July 1, check to see if any paid medical debt that had been on your reports is gone. Thanks to the Covid-19 pandemic, you are entitled to one free credit report a week from each of the big three credit reporting businesses through the end of the year.

The reports are available through AnnualCreditReport.com.

“You should always be checking your credit report,” said Chi Chi Wu, staff attorney at the National Consumer Law Center.

That’s because mistakes can happen. More than one-third of Americans found at least one error on their credit report, according to a 2021 Consumer Reports investigation. However, the Consumer Data Industry Association, which represents the credit scoring companies, called the Consumer Reports story “completely false and misleading.”

On the other hand, a 2012 study by the Federal Trade Commission found 25% of Americans had a mistake on their credit reports.

Cfpb Publishes Analysis Of Potential Impacts Of Medical Debt Credit Reporting Changes

Removing Paid Collections Will Have Limited Benefit Across Consumer Groups

WASHINGTON, D.C. Today, the Consumer Financial Protection Bureau published an analysis of how actions announced by the three largest national consumer reporting companies Experian, Equifax, and TransUnion will affect people who have allegedly unpaid medical debt on their credit reports. Nearly half of those with medical collections appearing on their credit reports will continue to see them there even after the changes fully go into effect next year. The medical collection tradelines that will remain on credit reports after the changes will likely represent a majority of the dollar amount of all medical collections currently reported.

The credit reporting system should not be used to coerce people into paying medical bills that they do not owe, said CFPB Director Rohit Chopra. Todays report analyzes recent changes announced by the Big Three credit reporting conglomerates, and it is clear that more work must be done to address medical debt credit reporting problems.

Among other findings from todays report:

The changes announced by Experian, Equifax, and TransUnion followed a CFPB report published earlier this year that highlighted how medical bills are a burden on one in every five consumers who are forced into an opaque system to resolve billing and credit reporting issues.

Recommended Reading: Is Your Fico Score Your Credit Score