Open A Secured Credit Card

Having no credit can make it hard to get a regular, unsecured credit card. Secured credit cards are much easier to get because they require a cash security deposit. This protects the credit card issuer if you cant repay your balance.

With most secured cards, the size of your deposit will dictate the size of your spending limit. For example, if you put down a $200 deposit, youll typically get a $200 spending limit.

Other than the deposit, secured credit cards operate the same way as unsecured cards. You can use them to make purchases, including online purchases. Then, youll receive a bill each month.

If you pay your credit card bill in full and on time every month, youll build up a positive payment history. Over time, your credit scores should improve. Most secured credit cards will upgrade you to an unsecured card after your credit improves. When your account is upgraded or you close it in good standing your deposit will be returned in full.

Read Also: Syncb/ppc On Credit Report

If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can apply for Apple Card when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments. If your application is approved with insufficient credit to cover the cost of the device you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or use Apple’s Trade-in program.

How Does Upgrade Loans Work

Upgrade caters to customers who need support with building credit and offers different options for personal loans. Its loans can be used for purposes such as home improvement, major purchases and debt consolidation.

You can apply online, choose your loan type and amount and receive funds within days of being approved. There are no prepayment penalties, and low rates are available for qualifying customers.

Also Check: How Do You Remove Inquiries Off Your Credit Report

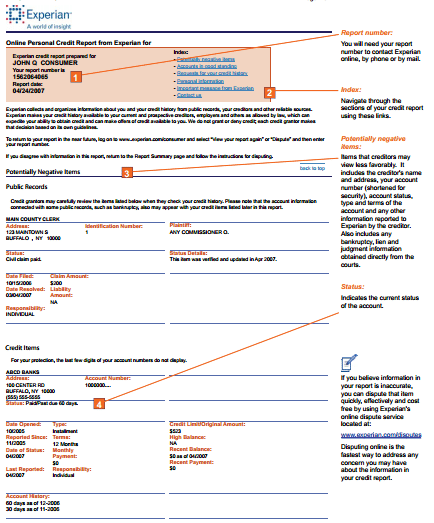

Applying For Credit: How It Works

When you apply for a new loan or credit card, lenders evaluate various pieces of information as they decide whether theyre willing to loan you money and under what terms. A key piece of information is your credit report, which includes items like your loan payment history and credit card balances.

To access your credit report, lenders must submit an inquiry, which is then reflected on your credit report .

Lenders also evaluate your credit score. A credit score is a three-digit number based on the information in your credit report. Multiple companies have models that calculate credit scores. VantageScore and FICO, for example, both provide scores that operate on a scale from 300 to 850.

While credit scoring models rely most heavily on your payment history and , about 10 percent of your score is determined by how much new credit you have, including the number of recent inquiries on your credit report.1

How Easy Is It To Use The Card

Using this card is fairly easy, but it does have a couple of setbacks. Its not available for cash withdrawals, making it a poor option if you have to have quick cash. There are no cash advances, either. Although you can transfer all of your funds from this account to any other through a great online platform, the lack of this feature really reflects poorly on the card. Using this card for credit itself, which can be up to $20,000, on the other hand, is the easiest thing in the world. Since most things about the credit, initial APR, and pay-off time are determined automatically on preapproval, you dont have to do any thinking when you open it. Most of these things are going to depend on your prior credit history, which is a great thing in itself.

Using this card to improve your credit is also top of the line, as it reports to TransUnion, Equifax, and Experian. All the management, monitoring, and actual optimization of this card are done through the internet, through the online website of the Upgrade Visa Credit card. The website comes with an interactive GUI interface, making the actual usability aspect of this card one of its best features. The best part about the interactivity, monitoring, and alerts that this website gives you? All of them are free of charge and are courtesy of opening an account on the website and using your card.

Read Also: How To Increase Credit Score With Credit Card

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Other Steps To Begin Establishing Credit

While being an authorized user may help, there are several other steps an individual can take to begin establishing their own credit history:

- Open a secured card. If you are unable to qualify for a traditional credit card on your own, consider opening a secured credit card account. With a secured credit card, you’ll make an upfront security deposit and, in return, receive a credit card with a credit limit typically equal to the deposited amount. If you default on the card, meaning you stop paying your bill, the card issuer will close the account and keep your depositsomething that typically results in credit score harm. Because the lender can use the money you deposited to cover the debt if you fail to pay as agreed, these accounts are typically easier to qualify for.

- Ask someone to cosign. If you have a close family member with a strong credit history, you may be able to qualify for a small loan or credit card by asking them to cosign for you. Keep in mind that any late payments made on the account will show on both your credit report and your cosigner’s report, so take extra care to ensure you are managing the account responsibly.

- Add your bills to your credit report with Experian Boost®ø. With Experian Boost, you can add your on-time utility, cellphone or streaming service payments to your credit history. The process to add these payments is fast, easy and secure. You will receive a free updated Experian FICO® Score at the end of the sign-up process.

Thanks for asking.

Recommended Reading: Does Klarna Show Up On Credit Report

Is The Card For You

This card is not a good choice for someone with excellent credit who generally pays their balance in full or for someone who cant afford to tackle a sizable installment payment every billing cycle. If this sounds like you, know that you can get more benefits out of a card that offers more robust rewards and other money-saving perks than the Upgrade.

The rest of the credit-card-carrying-pack, especially those who have fair credit and sometimes carry a balance, may find that the Upgrade cards unique spin on financial discipline without any hidden costs could be a welcome change from the norm.

What We Love About The Upgrade Personal Loan

Upgrade loans stand out because of their consumer-friendly features, such as credit monitoring tools, low minimum credit score requirements, and competitive interest rate offers.

Upgrade’s personal loans are designed to appeal to borrowers with a wide range of incomes and credit scores. Interest rates and fees are competitive when compared to similar lenders. What sets Upgrade apart from the competition is that it offers interest rate discounts to borrowers who agree to send funds directly to creditors when applying for a debt consolidation loan. It is also one of the few lenders that provide joint, co-signed, and secured loans.

The loans have comparable rates and fees to other online lenders targeting similar audiences. Still, Upgrade differentiates itself with features like rate discounts for setting up auto payments or having payments sent directly to creditors on debt consolidation loans. Upgrade is also one of few lenders to offer joint, secured, and co-signed personal loans.

Personal loans or credit cards with cash rewards

Upgrade has two lending products: personal loans and credit cards. Both provide attractive features and tools, but one may serve you better depending on your circumstances. Upgrade’s credit card is a great way to borrow money at a reasonable rate and build your credit score.

Responsible underwriting policies

Don’t Miss: How To Report A Death To Credit Bureaus

How Can I Access My Credit Score

To access your credit score for a fee, you can contact the credit reporting agencies. There are also websites that offer a free VantageScore. A VantageScore is not the same as a FICO® Credit Score, and there are differences in how they are calculated. Some banks and credit card companies also provide credit scores to their eligible customers. Wells Fargo now provides access to FICO Credit Scores to eligible customers through Wells Fargo Online®. When comparing scores, be sure to understand what kind of credit score you are looking at , what score version it is, and when it was last updated. For more information, view: understanding the difference between credit scores.

Types Of Credit Inquiries

Credit reporting bureaus differentiate between two types of inquiries: hard and soft.

- Hard inquiries occur when a financial institutionlike a bank, credit card company or mortgage lenderaccesses your credit report because you are applying for credit. Hard inquiries are typically only made with your permission and are reflected in your credit score.

- Soft inquiries occur when someone accesses your credit reportbut not because you are applying for new credit. Requesting a copy of your own credit report generates a soft inquiry. Employers or landlords might also submit soft inquiries as part of their background checks. Additionally, a lender may submit a soft inquiry to provide you with personalized loan options and/or pre-approval offers. Soft inquiries can be made without your permission and are not reflected in your credit score.

At Upgrade, when you check your rate for a personal loan we perform a soft inquiry on your credit report, which does not impact your credit score. If you receive a loan through Upgrade, we will perform a hard inquiry, which may impact your credit score. A new borrower may see a small drop in their credit score when they receive a new loan, but the score typically climbs back up with time and on-time payments.

Hard Inquiry: How It Impacts Your Credit Score

Rate Shopping

Also Check: Does An Eviction Go On Your Credit Report

Upgrade Cash Rewards Visa Vs Capital One Quicksilverone Cash Rewards Credit Card

If your credit is fair, you typically arent eligible for cards with both good terms and rewards. The Capital One QuicksilverOne Cash Rewards Credit Card is an exception. Although it carries a $39 annual fee, it also earns an unlimited 1.5% cash back on all purchases. If you spend at least $2,600 per year on the card, youll break even with the cost of the annual fee.

This is not a card to own if you typically carry a balance as it comes with a higher than average APR of 26.99% . This interest rate far outweighs the value of any rewards and can easily be bested by a card like the Upgrade card.

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range that’s considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each card’s credit limit

Recommended Reading: What Credit Score Do You Need For Amazon Prime Visa

How Does The Upgrade Card Work

The Upgrade Card is neither a credit card nor a traditional personal loan it is a card with a credit line that offers easy-to-use installment payment terms. Qualifying cardholders are offered a default line of credit, APR and repayment term based on creditworthiness. The card now also offers unlimited 1.5% cash back on every purchase. All of these features are available for absolutely no fees.

To get started with the Upgrade Card, youll first need to apply to see your available credit line and interest rate. If you are approved, youll be given a default APR and installment payment term. Possible terms currently include 24, 36 and 60-month repayment plans, with APRs ranging from 8.99% to 29.99%. You can be extended a credit line from $500 to $20,000.

You have two options for taking advantage of your Upgrade Card line of credit either making purchases on your card anywhere Visa is accepted or having funds transferred to your bank account.

Whichever option you choose, all the purchases or transfers within a statement period will be grouped into an installment plan based on your predefined terms. Youll have set, equal monthly payments designed to help you pay off your debt quickly and painlessly.

Tip: To add to its flexibility, Upgrade Card allows users to prepay their card balance with no fees or penalties. If you free up funds to pay off your line in full, you can do so via your online account.

Get The Credit You Deserve

When you upgrade to Sezzle Up, you choose to report your payment history to the credit bureaus. By making your payments on time, you can increase your credit score. And we increase your spending limit so you have more buying power.

It may take up to 60 days from sign-up before you see any Sezzle activity on your credit report. Sezzle is reporting to TransUnion, Experian, and Equifax.

You May Like: How To Repair Your Credit Report

Upgrade Loan Interest Rates

Upgrades personal loans typically have annual percentage rates between 7.46% to 35.97%. The lowest rates require autopay and direct payment. Rates vary based on your credit score, your credit usage history, the loan term and other factors.

For example, a $10,000 loan with a 36-month term and a 17.98% APR provides $9,500 after fees and requires a monthly payment of $343.33. In addition to the APR, Upgrade also charges an origination fee of 1.85% to 8%. Late fees start at $10.

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

Don’t Miss: Is 700 A Good Credit Score To Buy A Car

Upgrade Vs Happy Money

Happy Money has tighter credit requirements, but it offers lower rates than Upgrade.

The lender is focused on debt consolidation and financial health. Like Upgrade, Happy Money offers direct payment to creditors on debt consolidation loans. Happy Money also provides members with unique psychology-based advice and insights into their cash flow.

» MORE:Happy Money personal loan review

Do All The Upgrade Cards Earn Rewards

Yes, but rewards vary by card:

-

The Upgrade Cash Rewards Visa® earns 1.5% cash back on all purchases when you pay them back.

-

The Upgrade Triple Cash Rewards Visa® earns 3% cash back in home, auto and health spending categories and 1% on everything else, also earned when you pay eligible purchases back and also applied to the next month’s balance.

-

The Upgrade Bitcoin Rewards Visa® Credit Card works a bit differently. You earn 1.5% back as you make payments on your balance, and those earnings are used to purchase bitcoin on your behalf. Theyre held in a wallet provided by NYDIG, a custody and trading platform.

Depending on your credit history and other financial factors, you may qualify for a version of the card that doesnt offer rewards.

Read Also: How To Raise Credit Score

Become An Authorized User On A Credit Card

Becoming an authorized user on someones credit card can also boost your credit score.

Youll benefit from their on-time payment history, as well as their account history.

Youre not the primary account holder, though. So only become an authorized user if you trust this person to be responsible with their credit account.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: How Often Does Experian Update Your Credit Score