How Many Credit Cards Is Too Many

In general, if you have one or two credit cards on hand, youre good to go. But if you pay off your bill in full every month, never use more than 30% of the credit you receive, and make informed choices, then its not necessarily bad to have a lot of credit cards, especially if they provide a diverse array of benefits.

Your Income And Expenses Matter Too

Dont forget that your income and expenses can affect your chances of getting a loan just as much as your credit.

When you apply for a credit card, Synchrony is likely to ask about your annual income and monthly housing payments.

Synchrony does this because it wants to know how much money you have left over each month to make credit card payments.

Consider this example:

If you make $1,000 per month and spend $70 on housing, its unlikely you can pay the bills on a new credit card. If you make $8,000 a month and spend $3,000 on housing, theres a much better chance you can make payments.

How Often Does Discover Raise Your Credit Limit

Discover doesnt explicitly reveal its policy regarding raising your credit limit. However, anecdotal information is available from many sources. In fact, one of our editors reports that her Discover card, which she said shes owned for one and a half years, has already given her an automatic increase.

Automatic increases are best. The reason is that you will not be charged with a hard pull when the credit card company reevaluates your credit. In contrast, when you request a higher credit line, Discover will require a hard pull that can damage your score.

Now, asking for an occasional increase for one of your cards wont have a substantial impact on your score. However, if you make requests to multiple cards, your score could be significantly hurt, as it indicates a need for more credit that may be due to financial distress.

You can do a few things that invite your card issuer to reevaluate your credit limit without you requesting it. The first is to make your card company aware when your income increases or fixed expenses decline.

Many credit card websites allow you to maintain your personal profile that includes your annual income online. Make sure you include secondary sources of household income, such as Social Security or retirement account benefits, student financial aid, and self-employment income.

Also Check: What Is A Fair Credit Score Number

Re: When Does Discover Report

I have a related question– do all cards generally report the actual statement balance?

This month, I had PenFed credit card report a large balance while the statement balanace was almost $0. It appears to have included charges incurred during the two days after the statement was cut. In fact, the charges were first pending and then once they settled, they reported the balance that same day and I did not even have a way to pay the new post-statement balance if I wanted to.

Pay Your Bill Twice Monthly

If youve got a big expenditure, and you know youre going to go over 30%, you could pay down your balance twice that month. This may help you keep your credit utilization as low as possible. This isnt necessarily a good tactic to use every month but can help in a pinch. The Apple Card* will have this feature built into the app Apple plans to launch later this year.

Also Check: Does Afterpay Affect Your Credit Score

When Are Credit Scores Updated

Your credit score isnt included on your free weekly reports, but knowing the information in your report can help you understand credit score movements. When information is received by the credit reporting agencies, its typically added to your credit reports immediately. And when the information in your credit report changes, your scores may as well. How much they change depends on what information is updated. For example, making one more on-time payment may not cause your score to jump significantly after a year of consistent payments. But if you significantly lowered your balances across your credit cards, you may see some positive score movements. Making payments consistently and keeping balances low are good ways to keep your credit on track. Over time, with these good habits, you should see your score continue to improve.

Is Business Credit Linked To Personal Credit

Business credit reports and personal credit reports are kept completely separate. Thats true even of credit agencies such as Equifax and Experian, both of which have both consumer and personal credit reporting agencies. However, certain credit scoring models may use information from both personal and business credit to create a single credit score. The best example of this is the FICO SBSS score which can use personal and business credit data to create a FICO credit score used in small business lending decisions.

Find Funding Fast

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Read Also: What Is The Best Credit Report Website

How And When Are Credit Card Payments Reported To Bureaus

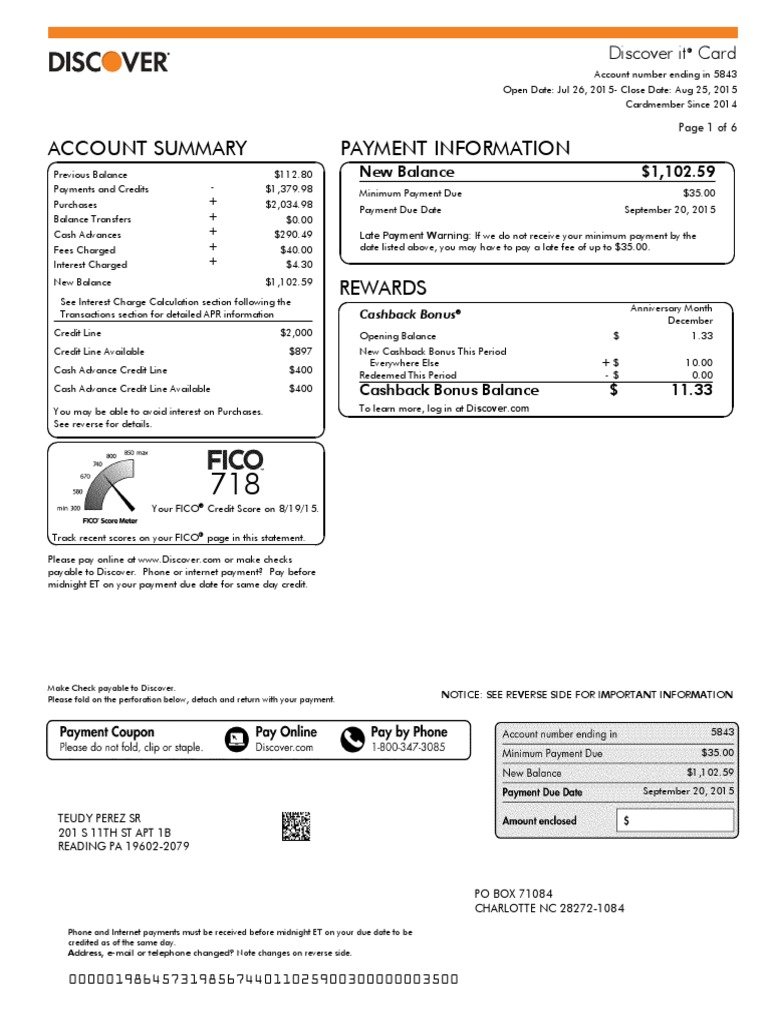

Commonly, credit card issuers report cardholder activity to the three major credit bureausExperian, TransUnion and Equifaxat the end of every billing cycle. Billing cycles can vary between 28 and 31 days, and reporting schedules vary by lender. Your lenders may also report to each bureau at different times, only report to specific bureaus or not report your payment history at all. This means you could theoretically check your score every week and see a different number each timeespecially if you have multiple credit cards or other forms of debt that are all reported at different times each month.

Because changes to your account aren’t reported immediately, you may check your credit report and think it doesn’t look current. Your credit report may show a different account balance than what you see on your credit card statement, but that’s typically not anything to worry about. Because credit card issuers don’t constantly report your account status, the balance you see there will reflect what it was the last time it was reported to the bureaus.

Get Familiar With Your Score

Because credit scores can change so frequently as new data gets added or removed from your credit reports, checking yours daily or weekly isn’t necessary. Free credit monitoring from Experian can alert you to changes in your credit report and scores, so you can more quickly take action if necessary. These regular updates will give you a chance to look over what has been reported recently, see bigger-picture trends and help you understand how your credit habits help shape your credit score.

Read Also: How To Remove Payday Loans From Credit Report

What Is A Good Credit Utilization Rate

In a FICO® Score or score by VantageScore, it is commonly recommended to keep your total credit utilization rate below 30%. For example, if your total credit limit is $10,000, your total revolving balance shouldn’t exceed $3,000. Generally, a low credit utilization ratio is considered an indicator that you’re doing a good job of managing your credit responsibilities because you’re far from overspending. A higher rate, however, could be a flag to potential lenders or creditors that you’re having trouble managing your finances.

Why Is Syncb/ppc On My Credit Reports

Some people report that their old PayPal Credit or Bill Me Later accounts are now appearing on their credit reports for the first time. So why the change?

When PayPal Holdings owned these accounts, it was likely not reporting on them to the bureaus. Now that Synchrony Bank has taken the accounts on, it seems that theyre getting reported to the bureaus.

There are a few different areas of your credit reports where you might see SYNCB/PPC heres how it might be showing up and what to do about it.

Recommended Reading: Is 626 A Good Credit Score

Recommended Reading: What Credit Score To Lease A Car

Keep An Eye On Your Credit

Seeing SYNCB or SYNCB/PPC suddenly show up on your credit report can throw you off, especially if youve never seen the acronym before. To avoid any surprises, make sure to check your credit score and report frequently so you can catch any suspicious activity. You can use a credit monitoring service such as Harvest to keep track of your credit with a free credit score.

For more information on credit and credit reports, check out our comprehensive credit guide or check out our FAQs.

You May Like: When Does Comenity Bank Report To Credit Bureaus

Keep Old Or Unused Accounts Open

You might think that you should close your old accounts, like your beginners credit card from back in the day, but doing so will reduce your total available credit. This drop will raise your utilization rate and hurt your credit score.

Instead of closing your old accounts, use them occasionally so that your creditors keep them open.

Takeaway: Try to keep your credit utilization rate low

- Your credit utilization is the amount you owe on your revolving credit accounts relative to the total amount of available credit you have.

- Your credit utilization rate can be calculated for each individual account or across all of your revolving accounts. Both contribute to your score.

- In many credit scoring models, the ideal credit utilization rate is between 1% and 10%. If thats not a realistic goal, try to keep it below 30%.

- To lower your credit utilization rate, try to increase your credit limits, curtail your spending, and avoid closing old and unused accounts.

Article Sources

Recommended Reading: When Does Chapter 7 Drop Off Credit Report

Risks To The Primary Account Holder

There is a lot of trust involved in making somebody an authorized user. Because you have permission to use the credit card, you can run up debt and not be liable to the credit card issuer for payment. If the primary account holder expects you to pay them for the amount you charge, it can be difficult to force the issue if you choose not to pay.

Consequently, both parties need to be clear on the expectations regarding how you use the credit card. For example, you may only be allowed to use the card for emergencies or necessities, such as groceries and gas.

The agreement may be to check with the primary account holder before using the card. This way, you can avoid not being able to complete the transaction if the card has reached its limit, or the primary account holder simply wants a say regarding what youre buying.

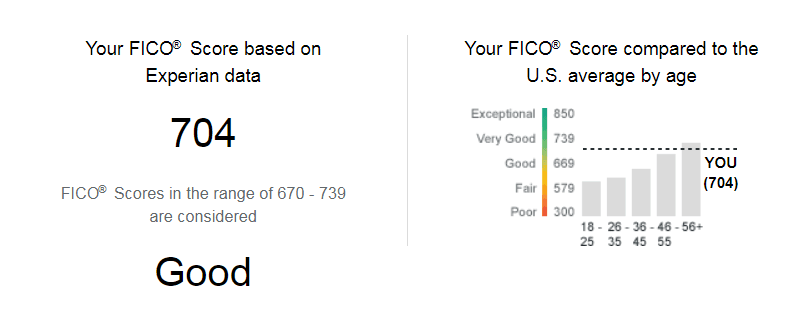

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Also Check: What Is The Minimum Credit Score To Rent An Apartment

Rule #: Keep Your Balances Low By Only Charging What You Can Afford

In addition to making on-time payments, it’s essential to keep your balance low relative to your available credit limit. There are two main benefits to maintaining a small balance:

- Low balances help increase your credit score.

- You’re more likely to pay off your balance in full and on time.

Many factors determine your , but a significant portion comes from credit utilization. In other words, this is the ratio of what you owe to your total credit limit. For instance, if you have a credit limit of $1,000 and charge $500 to your card, your credit utilization would be 50%.

While there’s no clear definition of your credit utilization, experts believe that you should keep it under 30%. Anything higher than that can decrease your credit score. To achieve a low credit utilization ratio, you should typically charge less than you can afford. By keeping a low balance, you minimize the chance that you’ll spend more than you can pay off at the end of the month.

Finally, don’t view your credit card as an extension of your budget. You should never charge more than what you can currently cover in your bank account. It’s tempting to spend ahead based on what you know you’ll get paid, but it’s a bad practice. If you lose your job or run into an emergency, you won’t be able to cover those charges. People don’t intend on having credit card debt it builds slowly and becomes a vicious cycle that becomes hard to break.

How High Is Too High

Okay, so we know that credit utilization ratio is important. But whats a desirable ratio?

Obviously, the lower your credit utilization ratio is, the more positive the impact will be on your credit score. Conversely, the higher it is, the bigger the negative impact will be.

Generally speaking, the FICO scoring models look favorably on ratios of 30 percent or less. At the opposite end of the spectrum, a credit utilization ratio of 80 or 90 percent or more will have a highly negative impact on your credit score. This is because ratios that high indicate that you are approaching maxed-out status, and this correlates with a high likelihood of default.

Thats at least the theory, since the credit bureaus generally provide only vague information about the exact impact of your credit utilization ratio, and virtually everything else in your credit score calculation for that matter. For that reason, the better strategy is to simply work to reduce your credit utilization ratio, rather than looking to target a certain desired level.

You May Like: Is 626 A Good Credit Score

Ask Your Creditor To Increase Your Card Limit

If you have a card with a $5,000 limit, and youve spent $2,500, you have a 50% utilization rate. You can call your card issuer and ask for a limit increase up to, say, $25,000, if you’ve had a change in income. This change in your card limit puts you at only 10% utilization, which could make a substantial difference to your credit score. Note, though, that credit bureaus can also ding you for requesting additional credit, since this can result in a hard inquiry to your credit report.

If you have made a few late payments or have high credit utilization, your card issuer could reduce your . Consider whether your circumstances will make a good case for a limit increase before you ask for one.

How To Lower Your Credit Utilization Ratio

- Spend minimally with your credit cards each billing cycle.

- Request a from your credit card issuer to give yourself more room to maintain low credit utilization.

- If you havent opened a new card account in a while, consider applying for a new card to raise your total available credit.

- If you have low limits on your cards, consider spreading your spending across multiple cards to keep your per-card credit utilization low.

- Monitor your utilization regularly to keep yourself from spending over your target threshold.

- Consider paying off your credit card balances as payments are posted instead of waiting until they are due.

See the online credit card applications for details about the terms and conditions of an offer. Reasonable efforts are made to maintain accurate information. However, all credit card information is presented without warranty. When you click on the “Apply Now” button, you can review the credit card terms and conditions on the issuer’s web site.

As seen on:

Don’t Miss: How To Self Report To Credit Agencies

How Does Credit Utilization Affect Your Credit Score

One of the differences between FICO and VantageScore is how they weight your credit utilization rate. Nevertheless, credit utilization is one of the most influential factors contributing to your credit score in any major credit scoring model.

How Credit Utilization Affects Your FICO Score

How Credit Utilization Affects Your VantageScore

Constantly overusing a credit line can result in a bad credit score and seriously limit your access to new credit. If you plan on applying for a new credit card, auto loan, or mortgage in the near future, then youll do yourself a huge favor by first working to improve your credit score. One of the easiest ways to start is to reduce your credit utilization.

Why you should pay your full credit card balance

It’s a myth that you should leave a small balance on your credit card to prove that youre actively using it. In most cases, your account balance is already on your credit report by the time your credit card payments are due. 4Paying off your credit card balances could also help your credit score because FICO and VantageScore reward consumers who have fewer accounts with a balance. 35

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.

Also Check: What Credit Score Is Needed To Finance A Car