Credit Score Mortgage Loan Options

The minimum credit score you need to get a mortgage varies from lender to lender, but generally speaking experts recommend having an excellent report card on your own financials. A good place for those looking at getting started in this area of personal finance would be with their local bank as they will usually have more flexible guidelines than other sources do when it comes time apply!

If you have a low credit score, don’t worry! You can still get approved for an unconventional mortgage loan. In most cases your conventional mortgage will require at least 620 points on the scale – but if yours is below 795 than there’s always hope yet .

A credit score of 760 or higher can get you a mortgage interest rate as low at 2.825%. If an individual with good scores pays $300k towards their loan and takes out 20 years worth they will end up paying 268$ more than someone who has bad marks when it comes time pay back the principal balance.

The Average Fico Score Increase In The Last Decade

Between 2010 and 2020, the average FICO score has increased by approximately 24 points. The average FICO score in 2010 was 687, while todays average FICO score in the United States is 711.

This trend increase in credit score statistics also seems to appear in different age brackets, as illustrated in the data above in Experians and The Ascents reports.

Can I Get A Car / Auto Loan W/ A 795 Credit Score

Trying to qualify for an auto loan with a 795 credit score is cheap. There is little to no risk for a car lender .

Taking out an auto loan out with a 795 credit score, should be easy.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Don’t Miss: What Does Your Credit Score Mean

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.

Maintain Your Good Credit

The first thing you need to think about when you have a very high credit score is how to make sure that you dont lose all the progress that youve made.

To keep your credit score high, follow these tips:

- Pay all of your bills on time.

- Avoid opening any new credit accounts .

- Avoid closing old accounts.

- Send a debt validation letter demanding proof of any future debts that anyone tries to collect from youthis is one of your rights under the Fair Debt Collection Practices Act .

Read Also: How To Get My Experian Credit Score

What Is A Good Credit Score And How You Can Maintain It The

What is a good credit score? According to credit information company, TranUnion CIBILs website, the closer your score is to 900, the higher are

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A

Having a good credit score is an important part of your financial health. How can you get an 800+ credit score? Read on to find out!

What Does Not Count Towards Your 795 Credit Score

There are many things that people assume go into their 795 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

You May Like: How To Get My Credit Score Up

Take Our Quiz: The Truth About Credit And Debt

- Look for cards that reward your spending patterns. If you buy a lot of gas, for example, a card that pays 5% cash back on fuel purchases will serve you well. Cash-back cards often let you use the rewards you’ve accumulated as a statement credit toward purchases, lowering your bill. A card that carries an annual fee may be worthwhile, but first do the math to decide whether the rewards you earn will outweigh the fee. Some cards waive the annual fee for the first year, giving you time to determine whether the card works for you.

If you are just getting started with credit , a secured card, which requires you to make a deposit as collateral, can help you build a credit history and score. Retailers may offer you enticing discounts if you sign up for their store credit cards, and retail cards are often easier to obtain than other cards. But keep in mind that both cards often come with low credit limitsmeaning that your credit utilization could easily push past the recommended 30% mark when you use the card to make purchases.

What Number Is Perfect Credit

Asked by: Theo Conroy

A perfect credit score of 850 is hard to get, but an excellent credit score is more achievable. If you want to get the best credit cards, mortgages and competitive loan rates which can save you money over time excellent credit can help you qualify. Excellent is the highest tier of credit scores you can have.

Recommended Reading: How To Remove Inquiries From Credit Report Sample Letter

What Can I Get With A 700 Credit Score

What a 700 credit score can get you. Your credit score is used by lenders to see if you qualify for financial products and to set the interest rate you’ll pay. With a 700 credit score, you’ve crossed over into the “good” credit range, where you can get cheaper rates on financial products like loans and credit cards.

Protect Your Credit Score From Fraud

Identity thieves are always on the lookout for people with good credit scores, eager to hijack their hard-won credit history. To guard against this possibility, consider using credit monitoring and identity theft protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.Credit monitoring is also useful for tracking changes in your credit scores. It can spur you to take action if your score starts to slip downward, and help you measure improvement as you work toward a FICO® Score in the Exceptional range .

Benefits of improving your score to:

Don’t Miss: When Will Bankruptcy Come Off My Credit Report

Credit Score Is It Good Or Bad How To Improve Your 795 Fico Score

Before you can do anything to increase your 795 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

The Credit Score Needed To Buy A Car

According to Investopedia, the average credit score you will need to purchase a car is 661 and above15.

You may be able to find financing options with a bad credit score, but you will generally need a cosigner or more money to put down towards your car loan when you have bad credit since you are a nonprime or subprime borrower.

You should also consider the role insurance scores play in your car buying journey as credit scores help insurance companies assess risk when you apply for insurance. Make sure your credit score is correct with Experian or other bureaus before you apply for insurance.

You May Like: Does Paypal Affect Credit Score

Consider Consolidating Your Debts

You can consolidate your debts by taking out a debt consolidation loan and using the loan to pay off your other debts. The primary purpose of debt consolidation is to reduce the number of payments and amount you pay each month.

With a 795 credit score, you can make the most of this approach because youll qualify for loans with low interest rates. If you have primarily revolving debt, this approach could further strengthen your credit by reducing your credit utilization and improving your credit mix. It also reduces the risk of late payments because you have fewer accounts to manage.

However, there are some potential downsides to think about. For example, if the loan term is long, then you may end up paying more overall in interest, even if your monthly payment is lower. If you do consolidate your debts, make sure to keep your old accounts open so that you dont reduce the amount of available credit you have.

Credit Score: Is It Good Or Bad

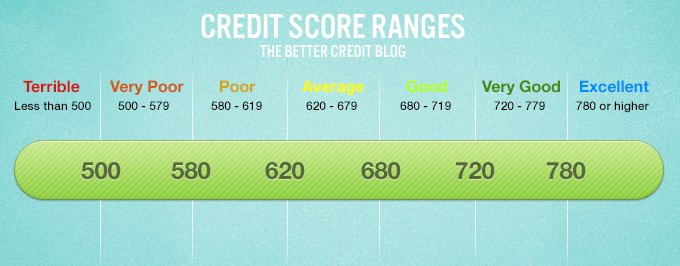

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 795 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

25% of all consumers have FICO® Scores in the Very Good range.

In statistical terms, just 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Recommended Reading: How Long Does It Take To Dispute Credit Report

Credit Score Car Loan Options

If you have a credit score of 795 or lower, it will be difficult to get approved for an auto loan. If approved at all – which may not happen even with high interest rates- your new car could end up costing double what its original price before depending on age and where in America that particular dealership is located! According CarsDirect’s statistics about average rates across different States: 10% if buying New Auto Deals 16+Percentage Points More Than Used Car Loans!

People with poor credit who need a new car loan have other alternatives such as:

- Apply for a secured car loan where you provide additional collateral

- Get a cosigner who has excellent credit for your auto loan

795 credit score credit card options

If you want to get a secured credit card, make sure that the deposit is at least as much of your limit. This means if someone wants an $1K secured card with no security features but just enough for today’s essentials – they’ll need put down 1000 bucks!

If you want to get a credit card, your score should be at least 600. Cards with high limits and interest rates are only available for people who have excellent financial records or can afford an collateral deposit before they’re approved as well!

795 Credit Score: Personal Loan Options

How to check your credit score for free

Take a closer look at your credit with our FREE credit assesment tool which includes your scredit score, a negative item summary and a recommended solution.

What affects your credit score

What Happens If Your 795 Score Goes Up Or Down

If your score moves, then you have to plan accordingly and fix it accordingly. Sometimes when it moves it is only slightly, while other times it might be a drastic change that happens on your credit score. Either way, it is important to monitor your score for these changes.

If your score goes up, which it is able too a bit, then you do not want to do anything to fix it. This is a great thing. Whether you are lower or higher, having a score that gets higher is never a bad thing or something to worry about.

If the 795 score gets lower then the individual will want to look into many factors that might have caused a negative impact on the score such as just opening a new account, defaulting on a loan, being late with payments or using too much of the available credit that they have. When either of these is a problem, you can fix it according to the issue. Paying down your credit usage, making on time payments, catching up with the defaulted loan or waiting out new accounts until they become older are all fixes. Hard credit checks can also negatively impact your score, so it is important to note that these will go away with time.

As a general rule of thumb, you always want your score to go up and never down. When it goes down, it is important to note why it is and then change the issues that the score is having so that it goes back to where it was or higher.

You May Like: Does Credit Karma Hurt Your Score

Is It Possible To Get A Credit Score Of 850

Its possible to achieve an 850 FICO® Score. However, its very difficult to get your score this high. An 850 credit score means that you have nearly perfect credit management. Very few people actually hold a perfect 850 credit score. Consumers with this score are incredibly unlikely to default on their loan obligations. If you can achieve an 850 credit score, youll have access to nearly any type of loan or card.

No lender will expect you to have an 850 credit score, no matter what youre applying for. Its possible to buy a home, go back to school and get a personal loan even if you have less-than-ideal credit. However, if youre still determined to make it into the perfect credit club, you can use these tips to start your journey toward an 850-point score.

What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

Recommended Reading: How To Raise My Credit Score Fast

Canadian Credit Scores And What They Mean

There is no definitive model for what certain credit scores mean to all lenders and creditors. One lender may consider credit scores of 760 to be excellent, while another may consider scores above 780 to be excellent. It all depends on what scoring model that specific lender uses and how they use it during their approval process. That being said, if youre interested in knowing what your credit scores mean, here are some general guidelines that can help.

| Range | Meaning |

| Excellent | Individuals with a rate of 760 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan. |

| Very Good | This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available. |

| Good | An individual who has credit scores that fall within this range has good credit and will typically have little to no trouble getting approved for the new credit. |

| Fair | Scores in this range indicate that the individual is a higher risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates |

| Poor | Credit scores that fall in this range may indicate that a consumer has trouble making payments on time or is in the process of building their credit history. |

Take Our Quiz: Will It Sink Your Credit Score

The amount you owe on your credit cards as a proportion of your card limitsknown as your credit utilization ratiois another important score component. FICO high achievers with scores higher than 795 use an average 7% of the credit available to them. There are no hard-and-fast rules to pinpoint the optimum ratio, says Can Arkali, principal scientist at FICO. But in general, the lower your utilization, the better. As a guideline, experts often recommend using no more than 30% of the credit available to you to show lenders that you can manage credit responsibly. But if raising your credit score is a priority, keep utilization under 10% on each credit card you have, says Beverly Harzog, consumer credit expert and author of The Debt Escape Plan.

- Paying down your credit card balances multiple times per month can help keep your utilization down, says Jeanine Skowronski, managing editor at . Your card issuer may allow you to set up e-mail or text message notifications when your balance reaches a level that you specify. Another tactic: Ask your card issuer to raise your credit limit. If you’ve been using the card for several months and paying your bills on time, the issuer may grant your request. But be sure that you have the discipline not to increase your spending, too, cautions Harzog.

Recommended Reading: Will Getting A Credit Card Improve My Credit Rating