Lower Your Credit Utilization

Try to re-work your budget to pay off your credit card balances and other debt. This will lower your and ultimately increase your credit score.

Is your available line of credit really small? Ask an existing creditor to extend your maximum amount on one of your current credit cards. This will also lower your credit utilization.

Recommended Reading: 824 Credit Score

Debt Consolidation Loans And Utilization

A strategy for reducing credit utilization rapidly is to use a personal loan to consolidate your credit card debt. Taking out a loan and using it to pay all or most of your outstanding credit card balances can reduce your utilization ratio to zero. This can save you money, because personal loans typically charge lower interest rates than credit cards.

This strategy obviously won’t reduce your overall debt, but can still help your credit score improve relatively quickly because installment debt such as personal loans aren’t included in utilization calculations. Just beware the temptation to run up new balances and utilization ratios on those freshly paid-off cards. If you start charging on them again, your utilization ratioand your financial situation in generalwill suffer.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: How Long To Increase Credit Score 50 Points

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

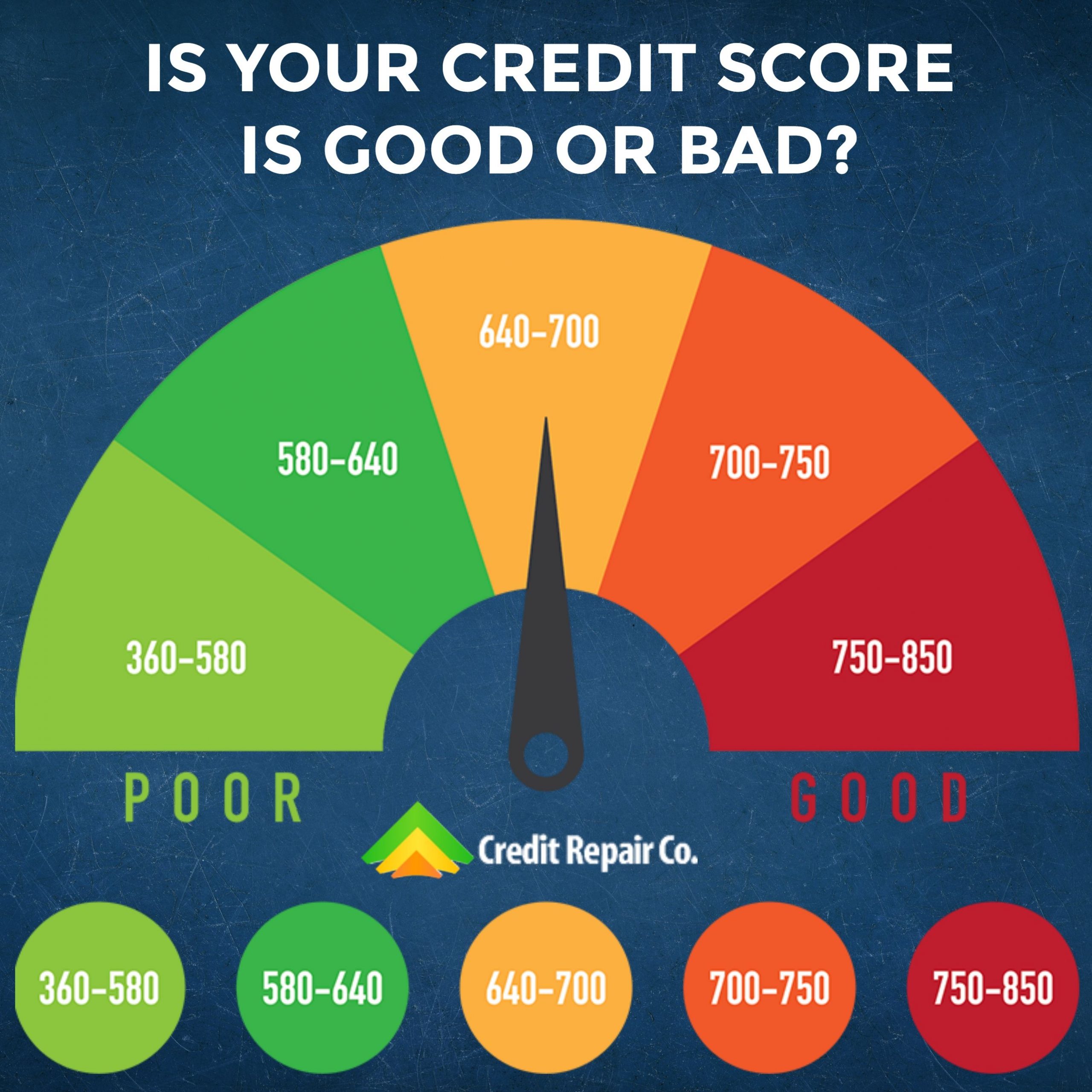

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

Learn About Credit Score Ranges From Fico And Vantagescore And How They Classify Excellent Good Or Poor Credit Scores

By Allan Halcrow | American Express Freelance Contributor

7 Min Read | January 31, 2020 in

Figuring out what a credit score of 640 means isnt really as tough as cracking the Da Vinci Code. But by the time youve considered the various credit score scales , it can certainly feel that way.

Fortunately, you dont need to be the hero of the Da Vinci Code to make sense of your . Thats because the different scales are more similar than different, and the scales are divided into credit score ranges whose names are simple and easy to remember .

Although cracking the credit code wont help you save the world, knowing the credit score range where your score lands can help you understand how lenders may view you in terms of credit risk. That could help you plan various aspects of your life, including the likely success of credit card, loan and rental applications, and whether you can expect to be offered favorable interest rates. And if you dont like the implications of your credit score range, you can take actions that could change it.

The two most commonly used credit scoring models, FICO and VantageScore, both rank credit scores on a scale from 300 to 850 and divide the scale into five credit score ranges. The ranges differ somewhat between the two models, and also have different names. If youve heard of higher scores, its either based on old information or industry-specific scoring models.

- Superprime

- Subprime

Equifax Credit Score Rangesand Others

Read Also: Syncb/ntwk

Better Chances For Approval

Many businesses use credit scores to determine whether to approve your application. When you have a poor credit score, there’s a greater chance your applications will be denied because creditors may consider you to be a risky borrower. With an excellent credit score, you have a much better chance of being approved since your credit history shows you’ve borrowed responsibly in the past.

Outside those circumstances, youll find its much easier to apply for credit cards and loans when you have an excellent credit score. However, you can quickly ruin an excellent credit score by making too many credit applicationsespecially in a short period of time.

Can Too Much Available Credit Hurt Your Score

In general, no. The more available credit you have, the lower your credit utilization ratio is likely to be, and that translates into a higher credit score.

However, if youre the type of person who looks at your available credit as a free license to increase your debt, more available credit could backfire. For example, if you request a credit limit increase and then go out and spend up to that limit, access to more credit can hurt you more than it helps you.

There are instances of fraud or identity theft where someone can max out your credit card. So requesting a lower limit across your cards also limits the amount of funds that can be stolen from a single card, while perhaps leaving you some available balance with the remaining cards that were not stolen.

Read Also: Chase Sapphire Preferred Score

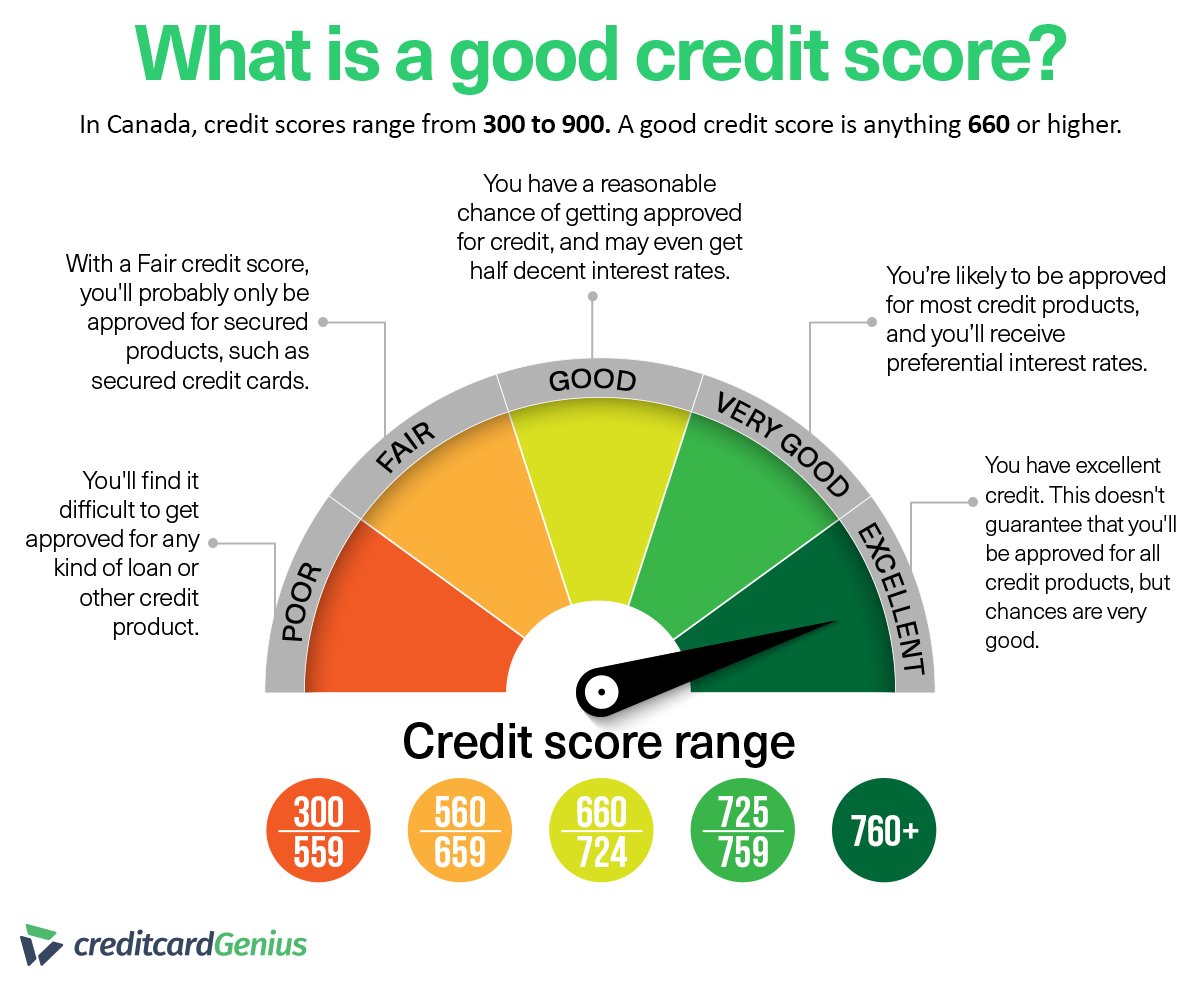

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?

First, let’s answer the question you are here to find out:

Monitor Your Credit Regularly To Avoid Major Issues

Many things can hurt your credit score, including how much of your available credit you’re using. In most cases, though, you can address potential issues before they inflict significant damage on your credit profile.

Experian’s free credit monitoring service allows you to view your Experian credit report and your FICO® Scoreâ powered by Experian data whenever you want. You’ll also get real-time alerts when changes to your credit are made, such as new accounts, credit inquiries and more.

As you monitor your credit score and reports regularly, you’ll have the information you need to build and maintain an exceptional credit history.

Don’t Miss: 524 Credit Score Good Or Bad

How Your Available Credit Impacts Your Credit Score

How much debt you have makes up 30% of your credit score. With that being said, the lower your credit utilization ratio, the higher your score is likely to be because youll have more available credit. According to an Experian report, here are the average credit utilization ratios for each FICO credit score range.

| FICO Score |

|---|

| 6% |

Catch Credit Report Errors Early

Credit report errors can quickly turn a good score into a bad credit score, so its important to stay on top of your credit report. You can get a free credit report every year from all three major credit bureaus Experian, Equifax and TransUnion via AnnualCreditReport.com.

If you find any reporting errors that negatively impact your credit score, you can dispute them.

You can also monitor your credit more regularly through a wide range of free credit score and monitoring sites, like and .

Read Also: Will Paypal Credit Affect Credit Score

How Much Credit Limit Can I Get With 700 Credit

In the 700 club, your credit limit will likely be close to the average credit limit of $4,200, said Ted Rossman, senior industry analyst at Bankrate. That limit can vary based on income and other debt. With an average credit score, expect to pay around the average credit card interest rate of 16 percent, Rossman said.

What Can You Do To Increase Your Chances Of Approval

If you worry your credit score isn’t quite where a desired lender may want it to be for approval, there are a few things you can do to improve your credit score, so you’ll be able to walk away with the personal loan that has the most favorable rates and terms.

Continue to make debt payments consistently and on time. Skipping a payment or making a late payment can be a red flag to lenders. Plus, making on-time monthly payments can actually help you increase your credit score .

Pay down as much existing debt as possible. Lenders want to make sure you aren’t taking on more debt than you can afford, and your debt-to-income ratio can give clues about how much debt you have in relation to the money you earn. A high debt-to-income ratio is typically considered to be around 36%. You might reduce your amount of existing debt by slightly increasing the amount you put toward your balance each month, or by making extra payments.

You May Like: Print My Credit Report

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Whats The Average Credit Score For People With Mortgages In Your State

While its common for mortgage lenders to look at FICO scores in their application review process, we turned to Credit Karmas vast collection of VantageScore 3.0 data to get a broad picture of the credit health of people getting mortgages.

Below, you can see the average TransUnion VantageScore 3.0 credit score of homeowners in each state who recently opened a mortgage.

In general, people in the Northeast or on the West Coast who got mortgages had VantageScore 3.0 credit scores averaging 720 or above on the higher end of the spectrum.

On the flip side, the Gulf Coast, Midwest and Southern coastal states tended to have some of the weakest average credit scores .

| State |

|---|

Also Check: Does Uplift Do A Hard Credit Check

Having A High Credit Score Could Give You Access To More Favorable Loans Credit Cards And More

Good credit. You mayâve heard the term more times than you can count. Thereâs a reason for that.

Itâs because credit can touch many parts of your life. For example, it may impact where you live, how much money you can borrow and how certain employers may view your job application. Read on to take a closer look at the benefits of good credit and how you could work on improving your own.

Is 645 A Good Credit Score To Buy A House

If your credit score is a 645 or higher, and you meet other requirements, you should not have any problem getting a mortgage. Credit scores in the 620-680 range are generally considered fair credit. ⦠With a 645 score, you may potentially be eligible for several different types of mortgage programs.

Also Check:

You May Like: Repo On Credit Report

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Improve Your Creditworthiness By Adopting The Strategies Used By Those With High Credit Scores

Without even knowing it you might be doing things that are damaging your credit score, which affects your ability to get credit and the interest rate you pay when you do get credit. A 2014 survey by Credit.com found that consumers sometimes dont understand which actions will and will not help them improve their credit scores.

To take the right steps to boost your score, you need to start by understanding the basics of credit scores. The FICO credit score is the most widely used score in lending decisions and ranges from 300 to 850. A FICO score of 750 to 850 is considered excellent, and those with a score in that range have access to the lowest rates and best loan terms, according to myFICO.com, the consumer division of FICO. A score of 700 to 749 is good, and those with a score in this range will likely be approved for loans but might pay a slightly higher interest rate. A score of 650 to 699 is considered fair, and those with a score in this range will pay higher rates and could even be declined for loans and credit, according to myFico.com.

You can get a free VantageScore 3.0 and a credit score from Experian through . provides a free VantageScore and a TransUnion credit score with its credit report card. And Quizzle offers a free VantageScore 3.0 from Equifax. Or you could pay $19.95 per FICO score from each of the three bureaus at myFICO.com.

Read Also: Aargon Agency Complaints

How To Improve Your Credit Score

If you have an average credit score or worse, its worth taking steps to improve your score over time. Heres are some moves you can make:

- Pay your bills on time every single month. Late and missed payments are the single biggest factor affecting your score.

- Lower your credit utilization. Credit utilization is measured by how much of your credit limit you use. For example, if you have a $10,000 limit and debt of $5,000, youre utilizing 50% of your available credit. If possible, aim for 30% or less overall and on individual credit cards.

- Check your credit report. You can check your credit reports from each of the three credit bureaus once a year for free through annualcreditreport.com . Reviewing your credit reports can help you spot any errors that may be having a negative impact on your score so you can take steps to correct them.

- Consider a secured card. If you have poor or bad credit, building a credit history with a secured card can be a good way to start. Choose a secured card that reports to all three credit bureaus for the best chance having your good payment behavior improve your credit standing.

Related: Should You Worry About No Credit Score?

Why Experts Say 760 Is The Credit Score To Aim For

While it might be exciting for some to aim to join the 850 club, it comes with no additional benefits that you likely won’t already get with a 760 score.

“The best published interest rates for auto loans are 720+ and for mortgages 760+,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “As such, I always tell people, shoot for 760 or better. That way, they’re safe for all loan types and cards.”

For Jim Droske, president of the credit counseling company Illinois Credit Services , the threshold is 760 as well. But he says aiming for 780 is even better to be “the safest” in any type of lending situation. Anything higher, though, won’t be more beneficial, nor would it get you a better offer with more favorable terms.

“If you’re above 760, or 780, certainly you’re already getting the best you can get,” Droske tells CNBC Select. “You’re already hitting that pinnacle of what care about.” A high enough credit score shows lenders and credit card issuers that you are less of a risk and more likely to pay back the loan, versus if you had a lower credit score.

“Anything above that is really just maybe a little pride,” says Droske. “When you have already reached the summit, no need to look for a ladder.”

You May Like: Leasing Desk Screening