Decide If Refinancing Your Vehicle Is The Right Move

Refinancing your auto loan makes sense if you can get a lower interest rate and monthly payment than what you currently have, but it may come at the expense of getting a longer-term loan. Extending your auto financing term could lead to you paying more interest overall.

Here are a few things worth factoring into your decision on when to refinance your car loan:

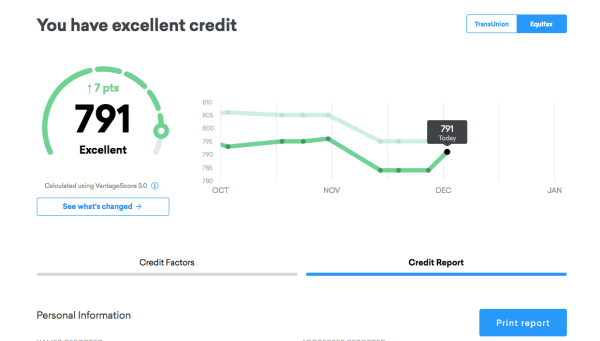

- Your credit score: If you have poor credit, work to repair it before you try refinancing your auto loan. This is because your credit history will impact whether you qualify for auto refinancing and the rate and terms youre given.

- How long youve had your car loan: Wait between six months and one year after your loan term begins before applying for refinancing. This should give your credit score enough time to recover from hard credit inquiries that were made when you took out your original loan.

- The economy and interest rates: You wont be able to maximize the return on refinancing your vehicle if interest rates are skyrocketing. Wait until they begin to drop to ensure you get the lowest annual percentage rate and monthly payment possible.

How We Chose The Best Auto Refinance Companies

When looking for the different auto refinance companies in the industry, we considered several criteria.

- Financial stability – We looked at each companys financial stability to make sure theyd be able to meet their refinancing obligations.

- Loan options – We looked for auto refinancing companies that offered competitive interest rates, zero to no upfront fees and flexible or reasonable vehicle restrictions.

- Customer experience – We looked at each companys complaints with the Consumer Financial Protection Bureau or the Federal Trade Commission . We also checked whether each company was transparent regarding its partners, underwriters and fees.

- Financial products – We also took into account each companys array of financial products and interviewed representatives from some companies.

We also interviewed representatives from companies as part of our research process. Still, though we always try to include accurate and up-to-date information on regulatory and legal actions, we dont claim this information is complete or fully up to date. As always, we recommend you do your own research as well.

Should You Refinance Your Auto Loan

Borrowers refinance car loans for different reasons. They may need to remove a co-borrower from an existing auto loan. Or they may want to shorten the loan term to pay it off sooner. Two of the most common reasons for refinancing a car are to reduce expenses and save money.

Refinancing your car loan makes sense:

If your credit has improved. If youve made consistent, on-time payments for six to 12 months since getting your car loan, and the lender has been reporting these payments to the credit bureaus, you might now qualify for a lower interest rate.

If a car dealer marked up your interest rate. When you got your original loan, the car dealer might have charged you a higher interest rate than you could have qualified for elsewhere or can still qualify for with refinancing.

If you cant keep up with payments. Refinancing to extend the length of the loan can lower your car payments, but dont take this step lightly. Extending the loan term means you will pay more interest and more in total over the life of the loan, but thats still a better option than missing payments or facing repossession.

If interest rates drop. If auto loan rates in general fall lower than when you first got your car loan, refinancing could be an opportunity to take advantage of these lower rates.

NerdWallets auto loan refinance calculator can help you compare loans and rates to determine how much you could save with refinancing.

» MORE:Pros and cons of refinancing a car

Don’t Miss: How Long Is A Delinquency On Your Credit Report

When To Refinance Your Auto Loan

Refinancing a loan can help borrowers meet a few different goals. Refinancing may result in a lower interest rate, which saves you money on loan repayment, or it could bring down your monthly payment and help you balance your budget.

Here are some of the scenarios where refinancing makes sense:

If your credit has improved. Credit scores are one of the main factors that determine loan qualification. If your credit scores have improved since you took out your current loan perhaps due to your recent history of on-time car payments you may be able to qualify for a refinance loan with lower interest rates.

If you cant afford your current payments. Refinancing can make loan payments more affordable in a few ways. If you take out a new loan with a longer repayment term, the monthly payments will be lower. Just be aware that longer repayment can result in paying more interest over time. Alternatively, if your new loan has a lower interest rate it could also lower the monthly bill.

When interest rates have dropped. Interest rates are partially determined by market forces. If market rates have dropped since you took out your current loan, a refinance could be a way to get you into a better rate.

While your cars value is high. The value of your car is another factor that impacts auto financing. Youre more likely to qualify for better rates, or a higher refinance loan amount, if the vehicle has high value in comparison to what you owe on your loan.

What Is The Best Company To Refinance An Auto Loan With

There isnt a clear-cut best company to refinance with, as every applicant has different needs.

For example, if you have a very low credit score, you may find Auto Credit Express is your best option. Thats because the network partners with more than 1,200 different lenders many of whom deal specifically with bad-credit applicants.

If youre looking to take out a loan for more than you owe on your car, youll likely find RoadLoans.com is your best option. Thats because the networks cash-out refinancing allows you to borrow up to 90% of your vehicles total Kelley Blue Book value.

You can use part of the proceeds to pay off your existing loan and keep the rest for yourself to spend how you choose. Not every refinance company offers this kind of loan.

But, if youre looking for a company with a name you likely know and trust, you may consider Capital One to be the best. The worldwide brand has a long history of success and offers numerous financial products that meet the needs of all consumers.

Read Also: Does Apple Card Pull Credit Report

What Credit Score Do I Need To Refinance My Car

Lenders look at your entire financial profile, but that doesnt mean you cant estimate your chances of qualifying based on the factors weve mentioned. RateGenius analyzed 2020 auto refinance loan data and determined average credit scores by three metrics:

Generally, the higher your DTI and LTV, the better your credit score must be in order to get approved. The average credit score of approved applicants with DTIs above 50% was 725 far from excellent, but still a good score.

You might be more surprised to hear that the average credit of an approved applicant with an LTV between 100% and 109% was a 714. In other words, these borrowers existing car loans were upside-down and they still got approved.

Unsurprisingly, borrowers did not need an excellent credit score if their income exceeded $75,000. More income translates to an easier time affording more debt. So, if your score doesnt qualify as good, you can still make up for it in other areas. Likewise, if you have a good score, you arent guaranteed to qualify if the other application factors arent on par.

Auto Refinance Calculator

How To Refinance Your Car Loan

Refinancing a car loan is relatively simple. It involves the same basic steps that you would take to get a new car loan.

Read Also: Is 626 A Good Credit Score

Shop Around And Compare Lenders

Each lender weighs factors differently when calculating auto refinance rates and offers. Start with local banks and credit unions when shopping around. Most financial institutions offer car loans, and you may qualify for special discounts at the bank where youre a member. Once you have those rates in hand, compare them to offers from other lenders to get a better sense of which provides the best deal.

How Does Car Refinancing Work

The process of auto refinancing is actually fairly straightforward. It works in a similar manner to the original purchase. However, unlike haggling about the value of the vehicle, you are locked into the cost associated with the original purchase. Essentially, the new lender buys your debt and then lends that amount to you, typically at a lower rate and with an improved term.

Read Also: Which Information Is Included On A Person’s Credit Report

How Soon Can You Refinance A Car Loan With Bad Credit

Some lenders have their own requirements, but technically, you can refinance your car loan right away, even with bad credit. However, loans often come with fees such as application fees and origination fees, meaning youll have an expense you wont recoup each time you refinance.

And even if they dont, your credit score can take a hit when you refinance or even apply for a refinancing loan. In general, its good to wait at least a year before refinancing.

Usaa Personal Loans: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Also Check: Does Mortgage Help Credit Score

What Affects Refinance Auto Loan Interest Rates

A number of factors go into calculating your interest rate when you refinance your auto loan. Lenders use the following to determine the interest rate and repayment terms they offer you:

- : A higher credit score will result in lower interest rates. Borrowers with poor credit will receive much higher rates and may have trouble securing loans.

- Loan term: In most cases, the longer the loan term is, the higher your interest rate will be.

- Vehicle age: Some banks dont offer loans for older cars. For those that do, borrowing money for a vehicle of an older model year will often come with a higher interest rate.

- Loan-to-value ratio: Your lender may adjust its rate based on how much you still owe on the car compared to how much it is worth. This is known as LTV.

No matter what rates you see advertised, your rates will likely vary. Only borrowers with the best credit can qualify for a lenders starting APR or a rate near it. Most lenders offer free quotes online or over the phone. We recommend getting personalized quotes from several lenders and comparing them before making a decision.

An auto loan calculator or other similar tool can help you see the full cost of your loan.

When To Consider Refinancing Your Auto Loan

There are a few instances when you might want to consider refinancing your auto loan. Here’s how to know if your situation is right.

- Your credit score has improved. If you were given a relatively high interest rate on your current auto loan due to a low credit score, an improved credit history might help you score a lower interest rate on a refinance loan. Avoid applying too early, though. If you think your credit score will improve even more over the next few months, consider waiting until it’s higher to get the best terms possible.

- Interest rates are dropping. Auto loan rates can rise and fall, depending on several economic factors. When rates are on the decline, you may have an opportunity to save some money with a refinance loan.

- You’re at risk of default. If you’re struggling to get by and don’t want to lose your car to repossession, reducing your car payment could give you the breathing room you need. Even if you don’t qualify for a lower interest rate, you may be able to get a lower monthly payment by applying for a refinance loan with a longer term.

Also Check: When Does Citi Report To Credit Bureaus

Usaa Personal Loan Reviews & Transparency

Category Rating: 3.3/5

- Better Business Bureau: USAA is not BBB accredited, and is not rated due to government actions against them. According to the BBB, USAA had to reach a settlement for failing to honor stop-payment requests and failing to complete error investigations. In addition, they had another action taken against them for failing to have an effective risk management program. Both of these cases were settled in January 2019.

- Consumer Financial Protection Bureau: USAA has around 80 complaints filed against their personal loans with the Consumer Financial Protection Bureau. Some reasons for personal loan complaints include USAA charging late fees when they should not have and people having fraudulent accounts opened in their name.

- WalletHub: USAA has an average rating of 3.7/5 from over 6,800 user reviews.

- Transparency: While USAA does openly disclose the terms of their personal loans online, their use of a simple calculator rather than a pre-qualification check makes it more difficult for customers to know the rates they might get. In addition, USAA isnt clear about their minimum credit score or income requirements.

USAA is highly rated by their members, and their personal loans have brought about very few complaints. However, USAA has failed to keep up with some government standards regarding how they operate, which has made its reputation fall with the Better Business Bureau.

Refinancing A Car Loan

Join millions of Canadians who have already trusted Loans Canada

Want To Lower Your Car Payments?

Speak with a Loans Canada representative today and learn how you can refinance your car loan and save. Call us today at:

Note: Program is currently not offered in Quebec.

Every year, you go through long-term budget arrangements and try to find new ways to save. Car refinancing has the potential to improve your monthly budget. Those who entered into a subprime auto loan and have since gotten a raise, reduced debt, or improved their credit, may be eligible for refinancing. To learn whether auto refinancing is the right step, its important to learn the options available to you. Armed with this information, you can make an informed decision and choose the best possible refinancing arrangement.

Also Check: When Do Companies Report To Credit Bureaus

How To Improve Your Credit Score

The only way to access the lowest rates, however, is to improve your credit score. This takes time and discipline, but the financial rewards for doing so are worth it. Here are some steps you can take to work on your score:

- Meet your obligations: Making your required monthly payments on-time and in-full is a critical part of raising your credit score. It wont go up immediately, but over time a good payment history will lead to an improved score.

- Pay down debts: Making more than the required minimum payment to your debts and reducing your overall debt can help improve your credit score.

- Diversify your credit: If you only have one or two forms of credit, such as credit cards or an auto loan, taking on other types of debt and meeting your payment obligations can improve your credit mix. This can lead to an overall increase in your credit score.

- Dont apply for too many loans: While you do want to have a diverse portfolio of credit products, applying for too many types of loans in a short period of time can hurt your score. Take time between applying for loans and dont overextend yourself.

What Credit Score Is Needed To Refinance With Capital One

Capital One sets several minimum standards for its auto loans, with requirements changing depending on whether youre purchasing a vehicle or refinancing your existing ride. The banks minimum credit score for refinancing an automobile is 540, whereas the minimum needed to purchase a vehicle is 500.

Applicants must also have between $1,500 and $1,800 in verifiable monthly income. The lower your credit score, the higher the income requirement.

Capital One does not accept refinance applications from residents of Alaska or Hawaii.

A minimum credit score of 540 is required to refinance your auto loan with Capital One.

Those arent the only requirements for approval any vehicle up for refinancing must be no more than seven years old and have a minimum of $7,500 still owed on the loan. You must also be current on your payments to a lender that is FDIC-insured and currently reporting your payment history to at least one major credit reporting bureau.

If you meet these requirements, you can apply directly on the banks website and receive a credit decision within 24 hours.

Recommended Reading: How To Unlock My Credit Report