What Is A Good Paydex Score

The PAYDEX score ranges from 1 to 100. Maintaining a PAYDEX score of at least 75 shows lenders, vendors, and suppliers that youre relatively low risk and likely to make repayments on time. A score below 75 may indicate you have a high risk of late payments, and a score below 40 is poor.

Read on for more on how scores are calculated and what each score range indicates about your ability to make payments.

Understand What Business Credit Reports Are And Why They Are Vital To Your Business Creditworthiness

Money is key to growing your business, and if you dont have the cash for expansion right now, youre probably looking for business funding. Business lenders rely on several factors to decide on the businesses they are going to finance. They typically use a business credit report that shows your payment history and a calculated credit score when deciding what terms to grant you.

Here, well dig into what these business credit reports are, how theyre calculated and what they mean to you.

What Factors Affect A Business Credit Score

-

Longevity How long have you been in business? If youve been in business for several months or years, that will contribute to raising your score.

-

Revenues What are your annual revenues? If your business is bringing in revenue, that may have a positive impact on your score.

-

Assets What assets does the business own? If you have some assets, such as property, this is likely to raise your credit score.

-

Outstanding debts – What loans and credit cards do you currently have? If you are using credit responsibly and paying it off on time, this will have a positive impact on your credit score, and make it more likely that you can get approved for a loan if you apply for one.

-

Personal and business loan history and credit history How long have you had both personal and business credit? What loans have you had in the past, what were the value of those loans and how quickly did you pay them off? If you have some history that indicates your likeliness to pay back loans in the future, this can affect your score, as well as making you more attractive to lenders.

-

Public Records – UCC filings and other reports including liens and judgments against you.

-

Industry Risk – Some industries like bars and restaurants are historically riskier than others, and lenders view them differently based on historical data.

Read Also: How Long Does Something Stay On Your Credit Report

The Blue Business Plus Credit Card From American Express

- 2X Earn 2X Membership Rewards® points on everyday business purchases such as office supplies or client dinners

- 1X 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter

- 2X Earn 2X Membership Rewards® points on everyday business purchases such as office supplies or client dinners

- 1X 2X applies to the first $50,000 in purchases per year, 1 point per dollar thereafter

Develop Good Financial Habits

One of the common challenges small businesses face is the occasional need to access additional cash. Whether you face a large seasonal order or a slow-paying customer that puts a crimp in your cash flow, short-term challenges are typical for business owners.

To put yourself in the best possible position for future borrowing, its essential to establish business credit quickly. Youll also want to manage business finances carefully to ensure that your credit builds into an asset for future business growth. Thats as simple as paying bills on time and in full, and not over-relying on credit.

Building your business credit score can pay off in a big way, giving you more options to grow your business in the months and years to come.

You May Like: Do Medical Collections Affect Credit Score

What Is Business Credit Used For

Your businesss credit can affect a variety of decisions, including the following:

- Your eligibility or rates on loans, including Small Business Administration, or SBA, loans

- The businesss insurance premiums

- The net terms and credit limit you receive from vendors and suppliers

- Your ability to raise money from investors

- Whether you qualify for contracts with other organizations

How To Report To Dun & Bradstreet

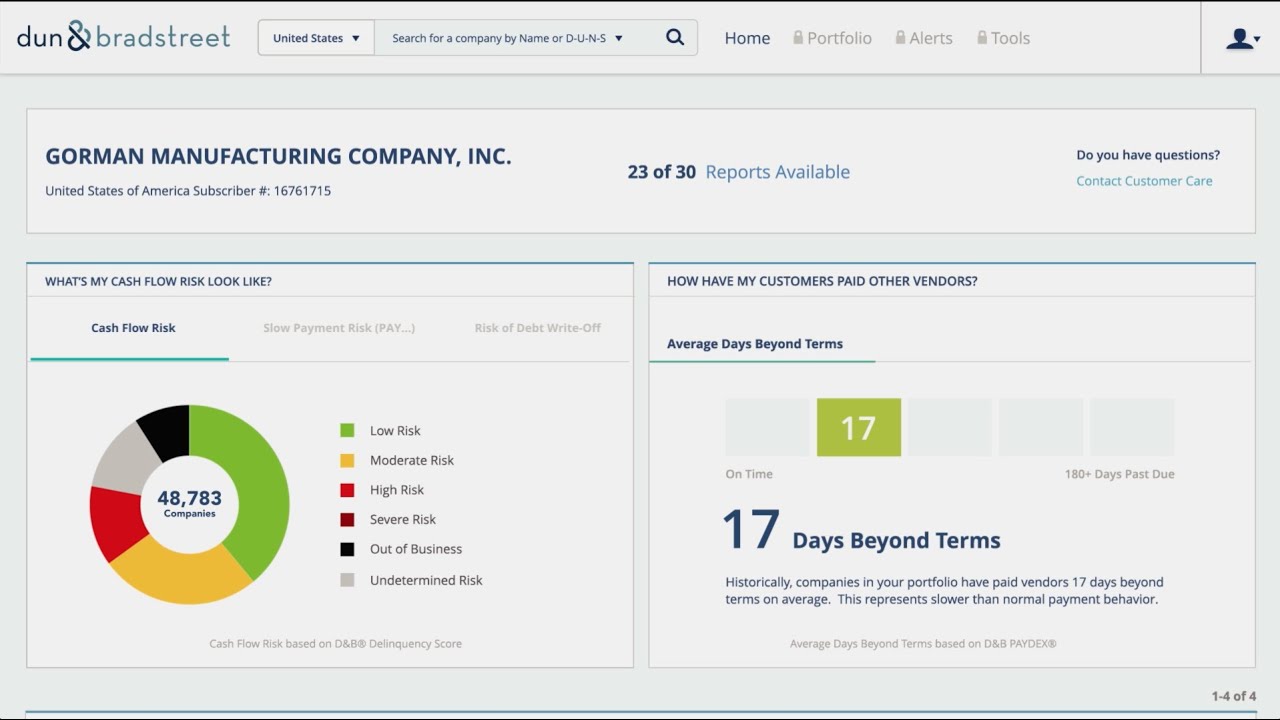

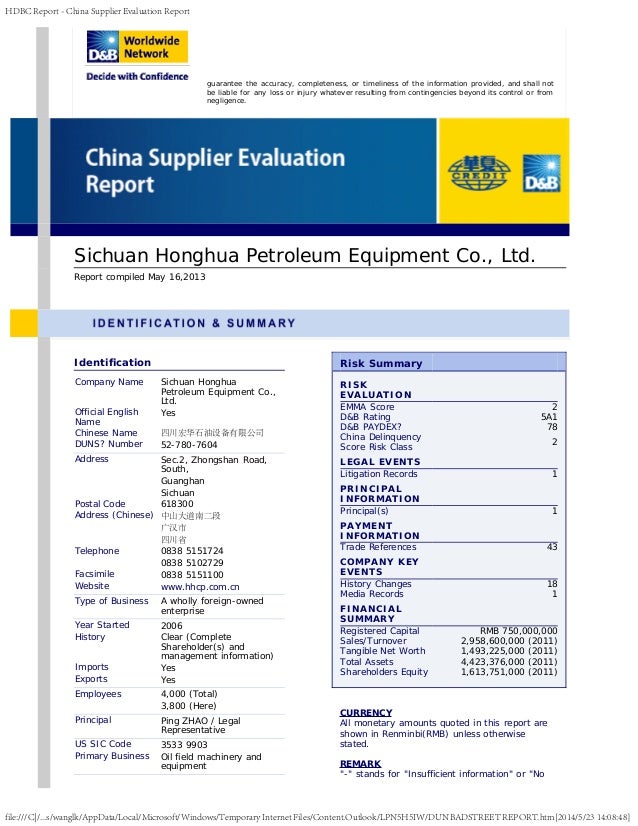

Dun & Bradstreet offers several commercial credit report and score products, but its best known for its Paydex score. It has more than 12,000 trade partners around the world contributing more than 1.5 billion updates to trade information each year.

To get started reporting, you can contact your Dun & Bradstreet Relationship Manager, visit D& Bs website or call D& B at 844-201-9144.

Generally, you can report to Dun & Bradstreet if you become part of its Trade Exchange Program. There is no cost to report. You must have at least 300 active credit customers, or be a member of its DNBi or PPP service. You may be able to connect your Quickbooks account to make reporting easier.

As a bonus, youll get stickers you can put on your invoices that note you report to Dun & Bradstreet. They may give your customers the nudge they need to pay on time.

Learn more about Which Credit Cards Can Help You Build Business Credit

Also Check: How To Look Up Credit Score

Delta Skymiles Reserve Business American Express Card: Best For Delta Air Lines Flyers

If Delta Air Lines is your preferred carrier, the Delta SkyMiles Reserve Business American Express Card can significantly enhance your travel experience both on the ground and when flying the airline.

Youll be treated to elite-like benefits such as complimentary seat upgrades when available, access to Delta Sky Clubs when flying the airline and more. If you are trying to earn Delta Medallion elite status, this card provides you with the opportunity to earn valuable Medallion Qualification Miles through spending and help you move up the rungs of the elite-status ladder. Other key benefits include your first checked bag free, priority boarding and savings on in-flight purchases. and priority boarding.

Standout benefits:

- Lounge benefits when flying Delta the same day access to the Delta Sky Club and Amex Centurion lounges.

- Annual round-trip companion certificate good for travel in Main Cabin, Comfort+ or even first class each year upon card renewal. This benefit alone can easily exceed the cost of the cards the $550 annual fee .

- This card earns 15,000 Medallion Qualification Miles when you spend $30,000 on purchases in a calendar year, up to four times per year.

How To Apply For A Business Credit Card

If you own a small business or just do freelance gigs, you could be eligible for a business credit card. You dont necessarily need a tax ID or an Employer Identification Number to qualify for a business credit card if youre a sole proprietor with a small business or side gig, you can usually enter your Social Security number instead.

You May Like: How To Get Free Credit Report From Transunion

Business Credit Card Issuers And Credit Bureaus

In order to build business credit, your business needs to have its business credit history reported to business credit bureaus. Commercial or business credit bureaus are agencies to report on your business credit. Some of them overlap with personal credit bureaus while others are unique to business credit. There are three major business credit bureaus:

Each one of these agencies collects credit data and creates its own credit reports. Each of the three business credit bureaus provides its own business credit scores based on the credit reports it generates, as well as each bureaus individual credit scoring models. The Small Business Exchange is often associated with business credit. However, the SBFE is not a business credit bureau and instead passes along data from lenders to four different credit reporting agencies, Dun & Bradstreet, Equifax, Experian, and LexisNexis, the last of which is not a credit bureau but collects and reports business credit activity.

How Do I Get A Free Business Credit Score Report

The best way to get a free business credit report summary is to sign up for Navs free business credit builder plan. Nav is currently the only online platform that offers this, and it includes information from the major commercial business credit bureaus, which includes Dun & Bradstreet, Experian, and Equifax. The free plan also comes with personal credit score summaries, 24/7 business and personal credit alerts, cash flow alerts and insights, and one-on-ones with credit and lending specialists.

For a full credit score report, youll need to upgrade to a paid plan.

You May Like: Does Closing A Bank Account Affect Credit Score

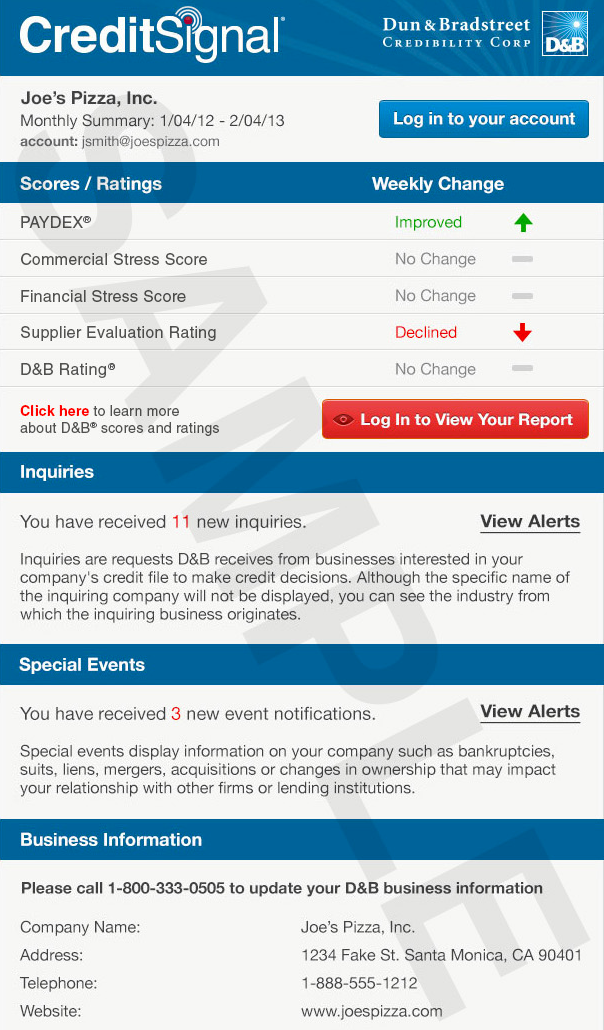

Bonus Tip: Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and fix any inaccuracies as soon as possible. Get in the practice of checking credit reports and digging into the particulars, and not just the scores.

We can help you monitor business credit at Experian, Equifax, and D& B for only $24/month. See: .

Fix Business Credit

So, whats all this monitoring for? Its to fix business credit inaccuracies in your records. Mistakes in your credit report can be fixed. But the CRAs often want you to dispute in a particular way.

Disputing credit report errors commonly means you precisely itemize any charges you challenge.

Prepaid Business Credit Card Overview

This prepaid business card is designed to give every business the opportunity to build business credit. Businesses who cannot be approved for an unsecured business credit card will find this as an ideal solution.

Whats more important, is this sets you up for acquiring an unsecured line of business credit with the card issuer.

Here are some highlights:

- Track business expenses and automate expense reports

- Preload your card for as much as needed anytime

- Reports your payments to DUN and Bradstreet and SBFE monthly

How are you paying for your business expenses?

When it comes to organizing and streamlining business expenses, a prepaid business credit card can save you time and money. Separating business spending from your personal spending makes it easier to manage accounts and get taxes correct at the end of the year.

One of the easiest ways to use a prepaid business card is for paying day to day business expenses. These payments are transactions your company is already making so why not have that activity build your business credit?

- Are you using business checks?

- Are you using automatic bill pay?

- Are you using a credit card?

- Are you using a business debit card?

- Are you paying cash?

None of these helps build your business credit. What if all your business expenses would report to your business credit reports each and every month? With a prepaid business credit card, you can accomplish just that. This is the basic fundamentals of building business credit.

Don’t Miss: Can Collection Agencies Remove Information Your Credit Report

How Business Credit Card Data Ends Up On Credit Reports

The best-known commercial credit reporting agencies in the United States are Dun & Bradstreet, Equifax and Experian.

So with business credit especially, it can be tough to find lenders and vendors that report. Thats why this kind of information is important.

Right now, American Express, Capital One, Chase, and Citi all report to Dun & Bradstreet. Chase and Citi also report to Experian and Equifax. But Capital One also reports to Experian.

This can change in the future. So make certain to consult a provider if you are uncertain.

Best Business Credit Cards Of August 2022

Articlesby Nick Ewen This page is a marketplace where our partners can highlight their current card offers. The reviews and insights represented are editorial, but the order in which cards appear on the page may be influenced by compensation we may receive from our partners.

If youve got a business new or old, big or small you should consider getting a small business credit card. Here are the best business cards from our partners.

Terms & restrictions apply.See rates & fees

Read Also: How To Put A Lock On My Credit Report

Starting A Business With Bad Personal Credit

You can build strong business credit even with poor personal credit. But you may need to get creative when applying for financing since lenders will likely review your personal finances until your company develops its own credit profile.

Start by formally establishing your business. Then look into financing options like:

- Trade credit

- Secured business credit cards

- Revenue-based financing

With discipline and responsible financial management, you should be able to develop strong credit for your business that won’t be impacted by your personal credit situation.

What Is The Paydex Score

The PAYDEX® score is a business credit score thats generated by Dun and Bradstreet . Their model analyzes a business payment performance and gives it a numerical score from 1 to 100, with 100 signifying a perfect payment history.

Just like a consumers creditworthiness hinges on a FICO score, a businesss creditworthiness is determined by a scoring system as well. One business credit score that is typically used by lenders, vendors, and suppliers to judge whether a business is qualified for different financing products is the PAYDEX score.

A business D& B PAYDEX score is used much like an individuals FICO score. It helps lenders, vendors and suppliers determine whether to approve you for financing and on what terms. Typically, the better the score, the more generous the terms extended. This can save your business money and give you more time to pay for supplies or services, leveling out cash flow.

In order to establish a PAYDEX score, youll need a Dun & Bradstreet number, or a DUNS number.

You May Like: How To Remove Delinquency From Credit Report

Information Youll Need To Provide

When filling out an application form for a business credit card, there are some extra pieces of information required in addition to what you might provide for a personal credit card application.

This is likely to include:

The name of your business

If youre the sole owner of your small business, you might not even have a designated name for it. If this is the case, dont worry, youre allowed to use your own name instead.

Contact information

Similarly, if you dont have a separate business contact number and mailing address, you can also use your own here too.

A Taxpayer Identification Number

There are two numbers you could use for this, depending on how your business is set up. If youre the sole business owner, you can use your Social Security number. Or, in the instance that you employ staff or have a more formal business structure, then you should use your businesss Employer Identification Number. You can easily get an EIN on the IRS website.

Your industry

Its up to you how you want to describe your business you can either use more rigid categories like travel, food and drink, or retail, or you can describe the exact service you provide should your business type not fall into those categories.

How long youve been in business

This ones pretty self-explanatory.

Revenue and expenses

This is the part where you enter how much money your business makes and how much your outgoings were to run your business.

Open A Business Bank Account

A dedicated business banking account is essential to keep a clear divide between your personal and business life. It makes your business more legit and will keep your finances organized. Open the bank account with your business name and EIN.

A checking account in itself won’t build business credit. But your banking history is often something lenders look at when you apply for credit.

And plus, it helps you establish a relationship with your bank, which can help when you apply for business loans and credit down the road.

You May Like: How To Check My Fico Credit Score

Chase Ink Business Credit Cards Overview

Chase Ink Business Preferred is one of three Ink Business Visa credit cards offered through Chase, each of which have their own set of rewards.

Chase also offers travel rewards cards for Southwest and a United travel reward card. For now, I want to share a quick side-by-side comparison of the three Ink cards before diving deeper into the Business Preferred card.

With Chase Ink Business Preferred, 1 point is equal to roughly 1 cent cash back or 1.25 cents worth of travel rewards. For businesses with higher spending, because of the higher reward caps, Preferred is the Chase Ink card to strive for.

Tips For Building Business Credit With Credit Cards

If one of your goals is a good business credit rating, consider getting a business credit card. Many entrepreneurs think their business has to be well-established and profitable to qualify, but that is not always the case. Card issuers are often more interested in the personal credit score of the owner who applies, and will often consider income from a variety of sources, not just the business itself.

To build strong business credit using a business credit card, make sure you:

Don’t Miss: Does Having More Than One Credit Card Affect Credit Rating