How Can You Improve Your Credit Score

There are a few key things you can do to help improve your credit score. Start by always making your payments on time. This is the number one factor in determining your credit score. Additionally, try to keep your balances low and avoid using more than 30% of your credit limit. Another way to improve your credit score is by diversifying your credit mix by having a mix of different types of credit, such as a mortgage, auto loan, and credit card.

Whats Missing From The Apple Card

Ill be the first to acknowledge that the Apple Card has its downsides.

To maximize this card, youll need an iPhone or iPad. If you dont have one, youll have little use for the Apple Card. And if you lose your phone and dont have the physical card, youll also lose access to the account and to being able to make purchases, at least temporarily.

The card doesnt come with many bells and whistles. For example, it doesnt offer a sign-up bonus or benefits like purchase protection and extended warranties. If youre after rewards or benefits that can be used for travel, its not a good choice either. But because the Apple Card is a Mastercard, it does offer a range of other benefits, including fraud protection, identity theft protection, and a free ShopRunner membership that provides free two-day shipping from some websites.

The cards rewards structure also falls short of top competitors because of the limited amount of 3% cash back categories, while 2% cash back is available only on Apple Pay purchases. Youll only receive 1% cash back when you use the actual card.

Apple Card

- At our partners secure site

Citi® Double Cash Card

- At our partners secure site

Blue Cash Preferred® Card from American Express

Editors Score:

- $0 introductory annual fee for the first year, then $95.

Read Also: Fedup-4u

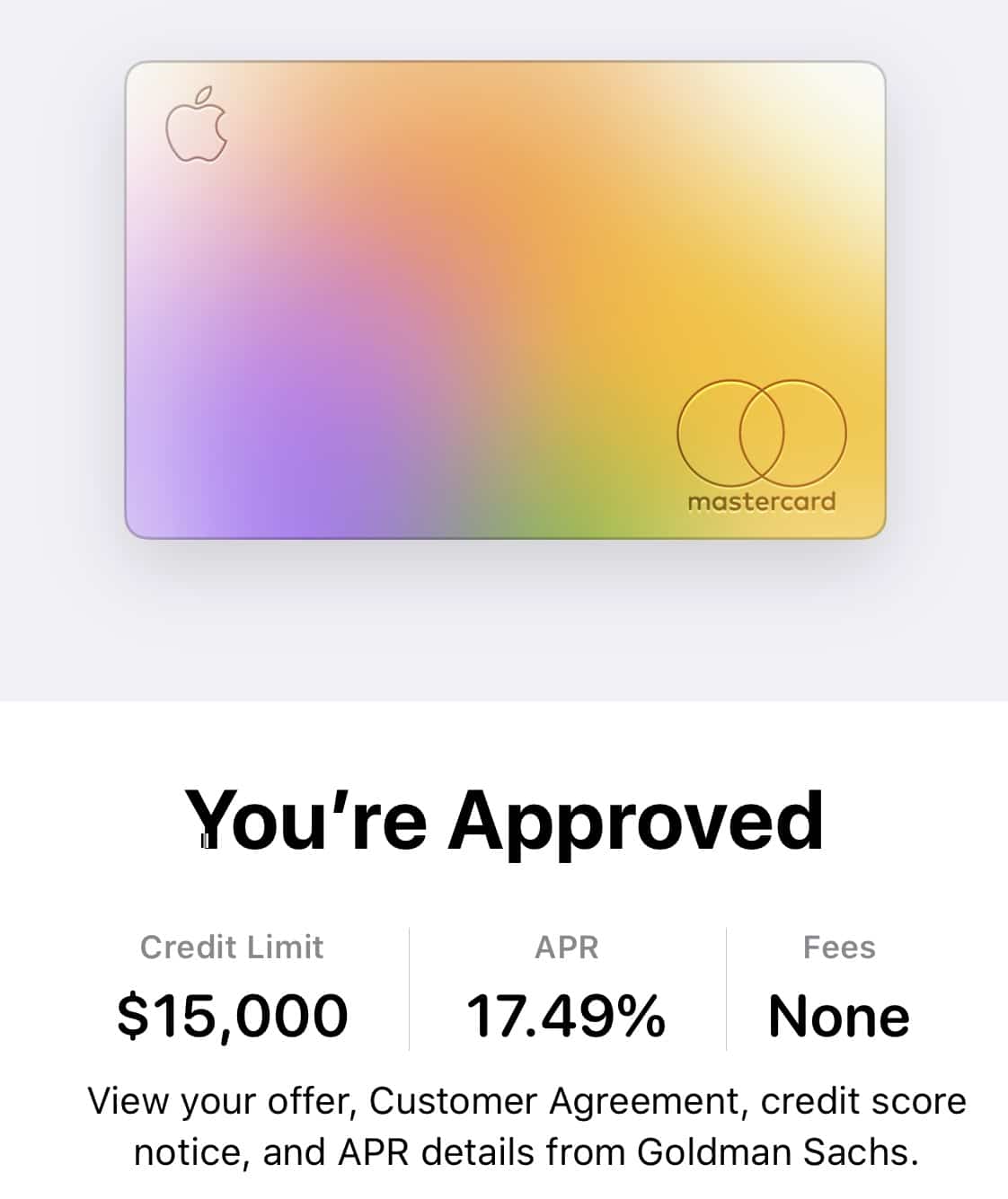

Next Steps To Apple Card Approval

Potential applicants who know their credit score and other requirements for Apple Card approval are likely informed enough to decide whether signing up for the card makes financial sense. People considering the Apple credit card can apply quickly and easily by filling out the form on Apples website, receiving a pre-approval decision in as little as a minute.

However, all is not lost for those with low credit scores or poor credit reports. Several steps to improving a credit score include regularly monitoring credit reports and not canceling old cards. By following these steps, among others, applicants who were once denied an Apple Card may find approval later.

Information is accurate as of Sept. 29, 2022.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

Also Check: How To Unfreeze Your Credit Report

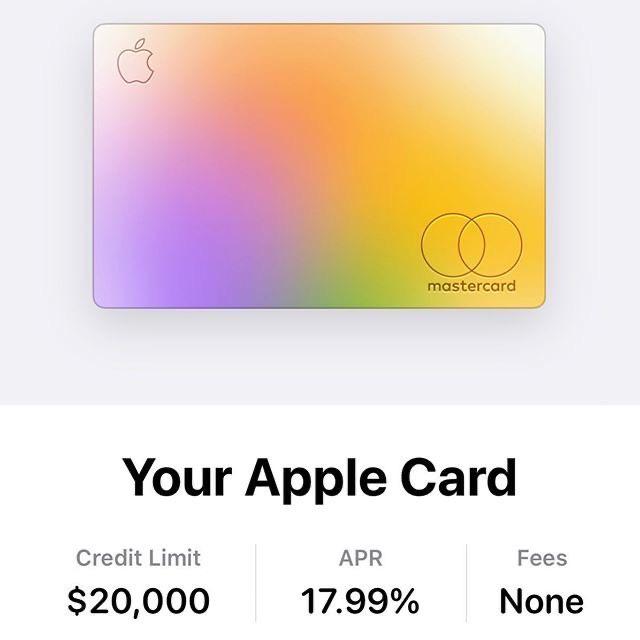

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

This Card Is Best For

- Seeks to maximize cash back earnings across spending categoriesCash Back Strategist

- Resists or refuses an annual fee on principle or due to costAnnual Fee Averse

- Affinity creates desire for rewards and perks with particular brandBrand Loyalist

Apple Card is designed first and foremost for iPhone users who already use Apple Pay as their preferred digital wallet app. In terms of cash back potential, its most rewarding for a) people who are into all things Apple, from devices to downloads, and b) consumers people who regularly make purchases from their mobile device. And of course, Apple makes it as easy as possible to manage your account through the app so you dont have to chase down paper statements or try to remember where you spent money.

Beyond that, you may like this card if youre looking for cash back rewards with no annual fee and no foreign transaction fee.

Dont Miss: Does Opensky Report To Credit Bureaus

Recommended Reading: How To Remove Ad Astra Recovery From Credit Report

How To Maximize Your Rewards

Maximizing rewards with the Apple Card is all about strategic spending. First, youll want to use the card to pay for any Apple purchases you plan to make, including things like recurring subscription services. This will get you that juicy 3% Daily Cash rewards rate.

Next, you can continue earning 3% Daily Cash by using your card at that short list of partner merchants mentioned above. If you spend $20 a day on Uber and Uber Eats, for example, thats $219 a year you could pocket.

Using your card with Apple Pay everywhere else is the third way to maximize rewards, scoring you that cash back at the 2% rate.

What you might want to consider, however, is skipping using this card at merchants or websites that dont accept Apple Pay. For example, if you regularly buy groceries from a gourmet grocery in your neighborhood that doesnt take mobile payments you might be better off with a card that pays 2% or 3% back at supermarkets instead.

Ways To Improve Your Credit

After you face having your Apple Card application denied, joining the Path to Apple Card program can make sense. However, there are plenty of financial moves that can help you improve your credit on your own.

While the steps required to boost your credit score are the same regardless of what your goals are, Apple offers the following tips to improve it enough to qualify for the Apple Card.

- Pay all your bills on time. Since your payment history is the most important factor that makes up your FICO score, on-time payments on all your bills can give you a boost. Likewise, late payments on credit cards and other bills can damage your credit score more than other credit mishaps.

- Reduce your unsecured debts. The second most important factor that makes up your FICO score is how much debt you owe in relation to your credit limits. This is the reason Apple recommends lowering your personal loan and credit card debt. Doing so can decrease your , which can raise your credit score in a short amount of time.

- Resolve past-due balances. If you have any late bills lingering from your past, pay them off or get them resolved in another way. Apple points out that accounts past due provide a proportionate effect on your approval odds based on how late they are. The Apple Card website has this to say: If you have an account thats 30 days past due, prevent it from going 60 days past due. If you have an account thats 60 days past due, prevent it from going 90 days past due.

Recommended Reading: What Does Fraud Alert Mean On Credit Report

How To Check Your Credit Score For Free Before Applying For Apple Card

For more on Apple Card, check out our hands-on and how-to coverage below:

Determine If Youre Eligible For The Apple Card

To be eligible for the Apple Card, you must meet the following criteria:

-

Age and geographic requirements: You must be a U.S. citizen or resident, with a physical U.S. address who is at least 18 years old. A military address is also allowed. You may need to prove your identity with a photo ID.

-

Technical requirements: Your iPhone and other Apple devices must be compatible with Apple Pay. Upgrade to the latest iOS if you havent yet, sign in to your device with your Apple ID and use two-factor authentication.

Is there a credit score requirement for the Apple Card? Neither Apple nor the card’s issuer, Goldman Sachs, has specified a credit score range for the card. Apple has said it wants the card to be widely available, suggesting that applicants don’t need excellent credit . Credit cards in its class generally require at least good credit .

Also Check: How To Order Free Credit Report

Where Is Your Apple Card Credit Card Number Located

The titanium Apple Card features a minimalist, security-focused design that doesnt include a credit card number. To look up your Apple card number, open your Wallet app, locate your Apple Card, tap the card number icon, complete the authentication step to prove that its really you and the Wallet app will reveal your credit card number.

Will Having An Apple Card Application Denied Hurt My Credit Score

Applying for a new credit card almost always results in a hard pull of your credit report, which temporarily knocks a few points off of your credit score. The impact of a hard pull is the same whether your application is approved or declined.

However, the Apple Card is unique in that it requires only a soft pull when you apply. This means your credit score wont be impacted if you are denied the Apple Card or if you are approved and decide not to move forward with your application. This is a rare feature and could make the card particularly appealing if youre in the market for a soft pull credit card.

That said, if you accept an Apple Card offer and open a new line of credit, a hard pull will be recorded in your credit report.

Read Also: How To Get Paid Collections Off Of Credit Report

Apple Card: All The Details On Apple’s Credit Card

Apple in August 2019 released the Apple Card, a credit card that’s linked to Apple Pay and built right into the Wallet app. Apple is partnering with Goldman Sachs for the card, which is optimized for Apple Pay but will still works like a traditional credit card for all of your transactions.

There’s a lot of fine print associated with the Apple Card, so we’ve created this guide to provide details on what you can expect when signing up for the card. Apple Card has been available since 2019, and Apple is continuing to add new features. You’ll find everything that you need to know about Apple Card below.

What You Can Do If Your Application Is Approved With Insufficient Credit Or It’s Declined

If your application is declined, a message with an explanation is sent to the primary email address associated with the Apple ID you used to apply for Apple Card. The message might show your credit score. If information provided by a credit bureau contributed to your application being declined, you can request a free copy of your credit report from that credit bureau using the instructions in the email you receive.

If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

You May Like: How Often Does Your Credit Score Update On Credit Karma

The Titanium Apple Card

With Apple Card you can make digital Apple Pay payments, but Apple is also providing a physical card. Since this is a credit card designed by Apple, it is, of course, unique among credit cards.

Its made entirely from titanium, which is laser etched with your name. The front of the card does not have a card number or an expiration date listed, and on the back, theres no CVV and no signature. If someone finds or steals your card, theres no real way for them to use it, at least for online purchases.

The physical Apple Card does not support contactless payments itself you need to use your iPhone for Apple Pay payments. There is no cost for the card and there is no fee associated with replacing it if you lose it.

The titanium Apple Card weighs in at 14.7 grams, which is heavier than the Chase Sapphire Preferred and lighter than the AMEX Platinum, both of which are also considered heavier weight cards.

Apple Card Approval Odds What Credit Score Is Needed For The Apple Credit Card

First things first: Apple and its credit card issuing partner Goldman Sachs publish very little information on card approval odds or credit scores needed to qualify for the Apple Card credit card. Most of this article is based on information from past successful applicants. It is an educated guess but still a guess!

That said, the Apple Card is relatively easy to be approved for compared to other credit cards on the market. But that doesnt mean everyone will be approved.

Also Check: Does A Payday Loan Affect Your Credit Rating

Apple Juice Runs Through Your Veins

Siri is your spirit guide. Every device in your home, car and office comes from the Apple store . Getting 3% cash back on your numerous Apple purchases would be a big boon, and for all other purchases, youre already well accustomed to waving your phone over the point-of-sale device at checkout. Heres a quick look at the current Apple Card rewards categories:

|

Rewards |

|---|

Recommended Reading: Les Schwab Credit Score Requirement

What Credit Score Is Needed For The Apple Credit Card

The Apple Card is the first credit card Goldman Sachs, Member FDIC, has made available to consumers, with unlimited 2% daily cash back in stores and online through Apple Pay. Consumers also have the option to buy Apple products using interest-free installments with the Apple Card.

These perks and others may make this card a popular choice for applicants. However, not everyone is eligible for card approval, particularly if their credit score isnt up to par. Potential cardholders should research the necessary qualifications for obtaining an Apple card, including finding out the minimum credit score needed.

Also Check: Is 585 A Good Credit Score

How Do You Apply For An Apple Card

Applying for an Apple Card takes just minutes on your iPhone. First, you will need to sign in to iCloud with your Apple ID. Open the Wallet app and tap the add button, then select Apple Card. From there you will fill out or update your personal details like your name, phone number, residential address, and annual income. Accept the terms and conditions to complete the application.

The digital Apple Card will be added to your Wallet app if your application is successful. You can request a physical card and wait a few days to receive it in your mailbox.

Some credit cards offer points and rewards that lose their value. But Apple Card gives you up to 3% Daily Cash back on your purchases. It’s real cash, it’s unlimited, and you get it the next day.

Requirements To Get Apple Card

To get Apple Card, you must meet these requirements:

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn’t a P.O. Box. You can also use a military address.

- with your Apple ID.3

- If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

- You might need to verify your identity with a Driver license or State-issued Photo ID.

Read Also: Does Sba Disaster Loan Show Credit Report

Apple Card* Vs Chase Freedom Flex

The Chase Freedom Flex card has a generous rewards structure with no loyalty to Apple required. For an annual fee of $0, the card earns 5% cash back on eligible purchases in rotating categories, 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases.

Chase has been known to include retailers like Amazon, Target and Walmart as quarterly bonus categories and if youve been eyeing a new Apple device, youd fare better with the Flex. Plus, the Freedom Flex comes with a terrific welcome bonus: $200 bonus after spending $500 on purchases in the first 3 months from account opening and 5% cash back on grocery store purchases on up to $12,000 spent in the first year. For many consumers, the Freedom Flex is likely a more rewarding option overall than the Apple card.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Is 704 A Good Credit Score