What Are The Different Categories Of Late Payments And Do They Impact Fico Scores

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off . Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

How To Check A Credit Score

The free annual credit reports do not include your credit score, or more accurately, scoresyour credit score from each of the credit bureaus will vary based on the information each has. Lenders also use slightly different credit scores for different kinds of loans.

How to get your credit scores then? Here are a few ways:

Buy a score directly from the credit reporting companies or from myfico.com. Look at a loan statement or a credit card statement. Some financial companies provide credit scores for customers as a perk. Use a credit score checker. Some services give consumers access to their credit scores but charge for premium services like checking a score daily. Other sites may require that you sign up for a credit monitoring service with a monthly subscription fee in order to get your free score. Sign up for an app like SoFi Relay, which provides free weekly updates on your credit score and tracks all of your money in one place.

When signing up for credit score checking websites, its important for consumers to look at the terms of service and ensure theyre not being charged for premium services they do not want.

Also, its best to avoid an educational credit score vs. a score that a lender would use. For some, there will be a meaningful difference, the Consumer Financial Protection Bureau says.

Recommended: Does Checking Your Credit Score Lower Your Rating?

The Problem With Credit Reporting

Looking to establish your credit history or boost your credit scores before buying a house or making a large purchase? Youll want to make sure your positive credit history is reported.

But heres the thing: Not all lenders report your activity to credit bureaus. If they do, they might not report to all three of the major credit bureaus, either. Credit reporting is a voluntary practice, and credit card companies dont always reveal which credit bureaus they report to. Some companies, like Capital One, explicitly state that they report your credit standing to the three major credit bureaus. Others may not reveal that information so openly.

All in all, its best to keep your credit in good standing across the board. You can do this by making on-time payments in full and keeping your balances low.

Recommended Reading: How To Unlock Experian Account

What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

How Do Fico Scores Consider Loan Shopping

In general, if you are loan shopping – meaning that you are applying for the same type of loan with similar amounts with multiple lenders in a short period of time – your FICO® Score will consider your shopping as a single credit inquiry on your score if the shopping occurs within a short time period depending on which FICO® Score version is used by your lenders.

Also Check: Voluntary Repossession Drivetime

How Often Does Your Credit Score Update

When you think of credit score ratings, its a sure bet the three big credit agencies come to mind: TransUnion, Equifax, and Experian. Each of these bureaus can update your credit instantly, monthly, or whenever lenders provide new information.

All it takes is a positive or negative change to your information. Its also possible that differences in your score result from which credit score system FICO or VantageScore is used to calculate your score.

Asking The Right Questions About Your Credit Score

Since your credit score is based on whats in your credit reports, the only way it will rise or fall is if there are changes to the information contained in your reports. So the real question is, How often do credit REPORTS update?

The answer to this question is more complicated, namely because its completely up to individual creditors when they choose to report your account activity to the credit bureaus.

Its further complicated by the fact that anything if they choose not to. There are no laws on the books mandating that they must.

And it gets even more complicated when you factor in that creditors, even if they do choose to report your account activity, may not choose to report it to all three bureaus, which is also not against any laws. So your separate credit reports may not even reflect the same information.

Also Check: The Lowest Fico Credit Score Is Brainly

Is Your Credit Karma Score Accurate

Investopedia reached out to Credit Karma to ask why consumers should trust Credit Karma to provide them with a score that is an accurate representation of their creditworthiness.

Bethy Hardeman, the former chief consumer advocate at Credit Karma, responded: The scores and credit report information on Credit Karma comes from TransUnion and Equifax, two of the three major credit bureaus.

We provide VantageScore credit scores independently from both credit bureaus. Credit Karma chose VantageScore because its a collaboration among all three major credit bureaus and is a transparent scoring model, which can help consumers better understand changes to their credit score.

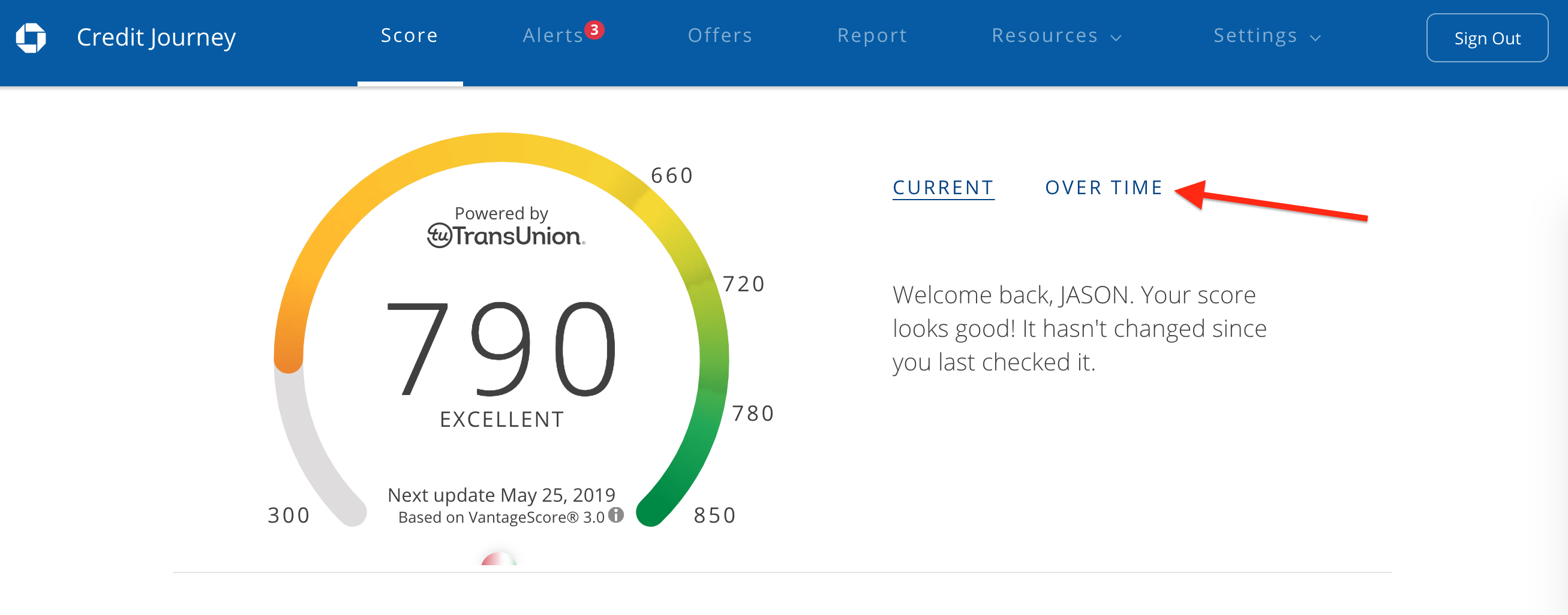

Read Also: Whats My Credit Score Chase

How Often Do Lenders Report To The Credit Bureaus

At this point, you can probably see how many variables are at play when figuring out how often you can expect a credit score update. Now, lets start to examine how often lenders report to credit bureaus.

Lenders tend to report to credit bureaus monthly, but their schedules vary, so they may report less frequently.

For instance, when it comes to credit cards, the billing cycle is the center of everything. Generally, a credit card billing cycle is 28 to 30 days long. At the end of your billing cycle, the your account information to the credit bureaus. Changes to your account, such as payments, may take up to 45 days depending on your billing cycle when the payment was made.

If youre worried about your reporting frequency and would like an exact number, its worth asking your lender which credit bureaus they report to and how often they do so. However, remember that every lender will have different arrangements, so youll need to contact each one separately.

You May Like: Is An 850 Credit Score Possible

Whats A Good Fico Score

A good FICO score depends on many factors and can be interpreted by different lenders in different ways. There is a broad understanding of the levels though.

- Excellent FICO score = 800 and above

- Very good FICO score = 740-799

- Good FICO score = 670-739

- Fair FICO score = 580-669

- Poor FICO score = 579 and below

As your FICO score is just one aspect of what a lender checks when assessing creditworthiness, having a fair or poor score does not prevent anyone accessing credit. That credit may be more expensive and be offered by a narrower range of lenders but there is still lots of credit out there for all kinds of FICO scores.

Will Netflix Pick Up The Mist for Season 2?

What Are The Minimum Requirements To Produce A Fico Score

In order for a FICO® Score to be calculated, a credit report must contain these minimum requirements:

- At least one account that has been open for six months or more.

- At least one account that has been reported to the credit reporting agency within the past six months.

- No indication of deceased on the credit report .

Recommended Reading: How To Check Itin Credit Score

Learn More About Credit Score Updates

Author: Sean P. Egen

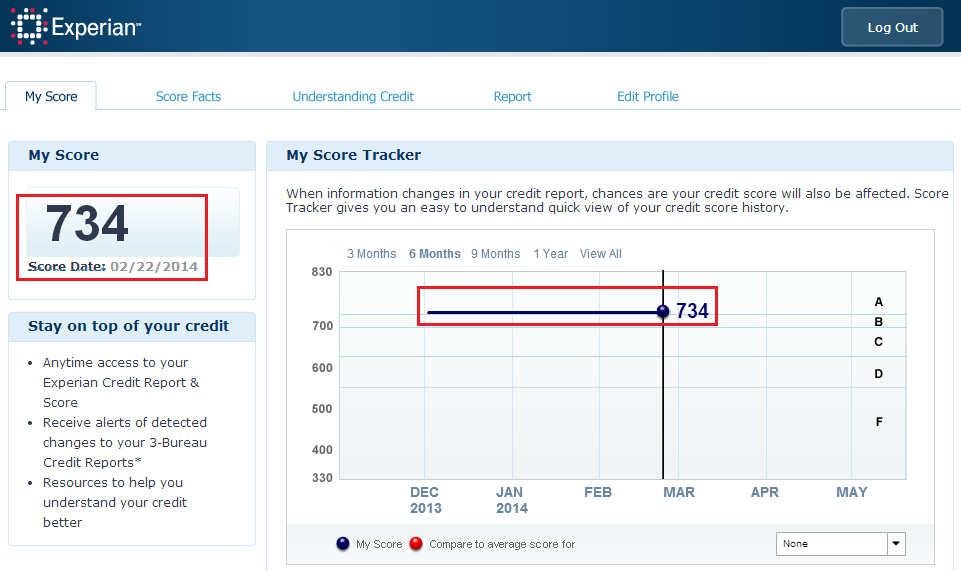

One of the most common questions asked about credit scores is: How often does my credit score update?

Think of your credit score as being similar to a grade point average , only instead of telling you how youre doing in your school classes, it indicates how well youre managing your credit. Like a GPA, your credit score is a representation of your efforts at a specific point in time. In the case of your GPA, that point in time is when your report card is issued. With a school report card, that GPA doesnt update again until the end of the next quarter or trimester or semester, when your teachers turn in grades and you get your next report card.

Unlike a report card, your credit score doesnt just update at the end of a specified length of time. It is continually updating based on the information contained in your credit reports from the three major credit bureaus. When a potential lender checks your credit score, the information contained in your credit reports is run through a creditscoring modelusually FICO©Score or VantageScore©right then and there, and they get a threedigit score based on whats in your credit reports at that precise moment.

So, the answer to the question above is: Your credit score updates continually.

But, if youre concerned with raising your credit score and the timing involved, youre asking the wrong question.

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range thats considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each cards credit limit

Read Also: What Credit Score Do You Need For An Apple Card

How Long Does It Take For Your Credit Score To Update After Paying Off A Debt

Again, it can take one to two months for your credit score to update after you pay off a debt. If it takes longer, you can contact your lender and ask them when theyll notify the credit bureaus.

How to tell when an item on your credit report was last updated

If you look at your credit report, each credit account should have a line that says Date Updated, Last Reported, or something similar. 1 This date indicates when the data furnisher last provided information about this account to the credit bureau in question.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

You May Like: How To Report Death To Credit Bureaus

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

Re: What Date Each Month Do Bureaus Update

Bureaus update daily, sometimes many times during the day — it depends on when the creditors send the information to the bureaus.

There is no preset time for a bureau to update. Once they do update, your score updates, too. If a bureau updates 3 times in one day, you could even have 3 different scores in one day.

| FICO8 |

You May Like: Aargon Agency Inc Collections

How Long Will Negative Information Remain On My Credit Reports

It depends on the type of negative information. Heres the basic breakdown of how long different types of negative information will remain on your credit reports:

- Late payments: 7 years from the original delinquency date.

- Chapter 7 bankruptcies: 10 years from the filing date.

- Chapter 13 bankruptcies: 7 years from the filing date.

- Collection accounts: 7 years from the original delinquency date of the account

- Public Record: Generally 7 years

Keep in Mind: For all of these negative items, the older they are the less impact they will have on your FICO® Scores. For example, a collection that is 5 years old will hurt much less than a collection that is 5 months old.

Your Score Can Change When Your Credit Report Is Updated

Credit scores are calculated by performing complex statistical analysis on data compiled in your credit reports at the national credit bureausExperian, TransUnion and Equifax. The bureaus update your to reflect new information about your credit usage, including:

- Payments you’ve made

- Changes in your credit card balances

- Your total outstanding debt

- New credit applications you’ve made or new loan or credit accounts you’ve opened

- If you use Experian Boost, your credit scores based on Experian data can also reflect your utility and cellphone payments.

The receive information about your activity in reports from the credit card issuers, lenders and potentially other companies with whom you have financial relationships.

Don’t Miss: Affirm Credit Score For Approval

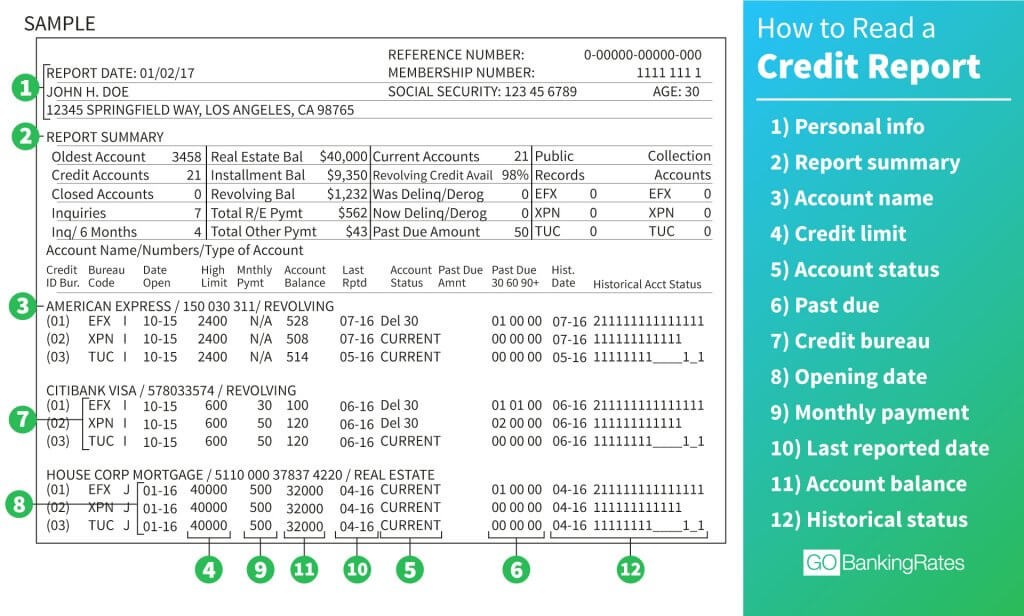

Types Of Information On Your Credit Report

- Personally identifiable information your name, address, Social Security number, date of birth, employment information

- mortgages, credit cards, auto loans, etc.

- a list of everyone who accessed your credit report within the last two years.

- Public records and collections foreclosures, bankruptcies, and debts that have been sent to a collection agency

How Is A Credit Score Calculated

So, how exactly is your credit score determined? Well, there are a number of different things that go into that magic number you see. Here are the five main factors that affect your credit score:

- Payment History Your payment history accounts for around 35% of your credit score and typically has the greatest imapct on your credit score. Paying your bills on-time and in-full are the best ways to create a strong and healthy payment history.

- This ratio has a significant impact on your credit score as well. It accounts for around 30% of your credit score and refers to the amount of credit youve used in relation to how much you have. For example, if you have one credit card with a credit limit of $2000 and have used $1000 of that credit limit, then your would be 50%. Generally, the higher your ratio, the more negatively it can impact your credit. Most experts recommend you keep your credit utilization ratio below 30%.

- Your credit lenght refers to the average age of all your active credit accounts. The older your accounts are the more of a positive effect it can have on your credit score.

- Adding a variety of different credit products can also have a positive impact on your credit score. Lenders like to see that you are capable of handling different types of debt.

- When you apply for a credit product most lenders will conduct a hard credit check, which can negatively impact your score.

Trying to figure out why your credit score dropped? Read this.

You May Like: Does Carmax Take Credit Cards