Combining Multiple Hard Inquiries

Its important not to apply for too many types of credit at one time.

However, the credit scoring models understand that people make multiple hard inquiries to compare terms and rates. So, if youre shopping around for one type of credit, like a mortgage, and make multiple inquiries in a short period of time, they only count as a single hard inquiry.

Lenders have become increasingly lenient in this regard because they know that todays consumers are more likely to perform their due diligence before making a major financial decision. This is true for credit cards or an auto loan as well. They do not impact your credit scores as long as they occur within a 30-45 day period.

Sample Dispute Letter To Remove Inquiries

To further simplify the process of inquiry removal for you, we have provided a sample dispute letter that you can refer to. You can modify it as per your requirements but ensure to include all the aspects mentioned here.

Mail it out to each of the credit bureaus via certified mail, enclose a copy of each of the following:1. SSN card ,2. Recent utility bill 3. State-issued identification.

RE: Investigation Request to Delete Credit Inquires

To whom it may concern,

Following the Fair Credit Reporting Act Section 611 , I am practicing my right to challenge questionable information that I have found on my credit report. I request that you investigate the source of these inquiries, and ascertain that the creditor has a valid purpose, and can verify all my personal information including full name, address, date of birth, and SSN.

I am disputing the following inquiries:1. 2. 3. 4.

If your investigation reveals the inquiry is valid, I request that you provide me with your method of verification as well as the contact information of the source of this verification.

I am granting you a period of 30 days to complete this investigation.

Truly,

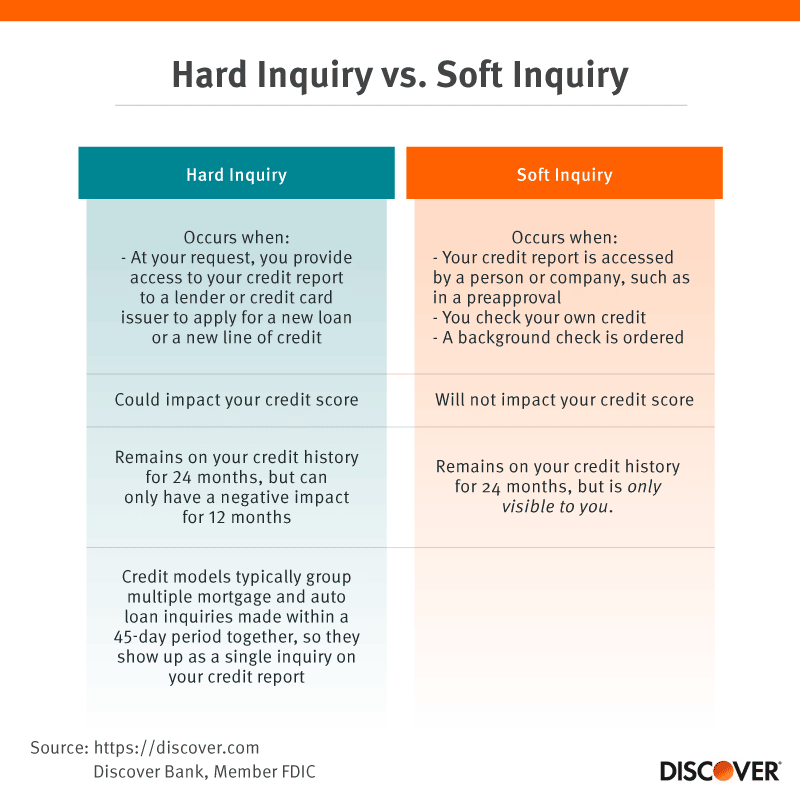

What Is The Difference Between A Hard And Soft Inquiry

When you review your credit reports after applying for a loan, credit card or other form of credit, you’ll likely see the hard inquiry it caused, but you also may see other inquiries, called soft inquiries.

Soft inquiries are often the result of you checking your own credit report, a preapproved offer of credit, or a periodic account review by a company you already do business withbut those aren’t the only events that can cause them. They differ from hard inquiries because they don’t generally reflect an application you’ve submitted for credit, and could even be the result of something like the IRS verifying your identity for your tax refund, for instance. Soft inquiries do not affect your credit scores.

Recommended Reading: How Long To Remove Repossession From Credit Report

Get A Free Copy Of Your Credit Report

Its important to check your credit report frequently at the very least annually, if not more often to catch any irregularities early on.

Under federal law, you have the right to obtain a free credit report from all three major once a year. However, because of the pandemic, all three bureaus are offering free weekly reports through the end of 2022.

You can request yours through AnnualCreditReport.com, the only free credit report website authorized by the federal government. Make sure to check your reports from all three bureaus since each one can include different information from creditors and lenders.

You can also request them by:

Phone: 322-8228

Mail: Download, print, and complete the request form and mail to:

Annual Credit Report Request Service

P.O. Box 105281

Other ways to get your credit report

In addition to your annual report, you can request additional free copies if:

- You were denied credit, insurance or employment in the past 60 days based on your credit

- There are sudden changes in your credit limit or insurance coverage

- Youre receiving government benefits

- You’re a victim of identity fraud

- Youre unemployed and/or will apply for employment within 60 days from the date of your request

To request additional copies, contact the bureaus directly. Heres how to do it:

For a more detailed guide on how to request copies, make sure to read our article on how to check your credit report.

Look For Any Inaccurate Hard Inquiries

Once youve received your credit report, there will be a section for Hard Inquiries. Youll want to scan over the entire report to make sure its accurate, but pay close attention to the inquiry section. If there are any hard inquiries listed here, make sure that you recognize them.

Its important to note that sometimes the company listed that made the inquiry doesnt match exactly with who you did business with. This often happens if a retailer partners with a bank to manage its credit card program.

For example, while you may have thought you were applying for a card with Victorias Secret or Sportsmans Warehouse, you may have a credit inquiry from Comenity Bank, which manages the credit cards for these two retailers. Thus, you may have to do a bit of Google sleuthing to make sure an inquiry is legitimate.

You May Like: How To Get A Dispute Removed From Credit Report

What Else Do Credit Bureaus Report On

Your credit score is essentially broken down into five major categories.

Payment History

The most important factor contributing to your credit score is your payment history. In order to have a decent credit score, it is vital that you have a relatively clean payment history. That means you make your payments on your loans and bills on or before the due date.

Your credit mix is the variety you have in your credit accounts. Some different financial accounts that would contribute to your credit mix are:

- Checking accounts.

Debt vs. Income

Your debt-to-income ratio refers to how much debt you have compared to how much your income is. Generally, lenders like to see that a consumer makes more money than they owe.

Your credit history timeline refers to how long you have had open and active financial accounts. Having active financial accounts shows that you have experience handling your own finances.

Hard Credit Checks / Hard Inquiries

Have you ever wondered why does your credit score go down when it is checked? When lenders request official records of your credit report, they perform what is known as a hard credit inquiry. Many credit requests within a short time, especially if those requests are not approved, may indicate to lenders that you are a reckless and possibly irresponsible borrower.

Does Your Credit Score Go Up When Something Falls Off

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Read Also: What Is Syncb Ntwk On Credit Report

Bankruptcies And Other Public Records

Depending on the type of public record, most will stay on your credit report for seven to 10 years.

Bankruptcies, for example, generally vary according to whether it was a Chapter 7 or a Chapter 13 .

All bankruptcies may report for 10 years from the filing date, though discharged chapter 13 bankruptcies usually stick around for seven years.

Also Check: Is 565 A Good Credit Score

How Does A Hard Inquiry Affect Credit

While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good , the impact may be even less. That said, itâs helpful to know that credit inquiries make up about 10% of your total FICO score. Keep in mind there are other credit-scoring companies and models that a lender could use.

If youâre looking to secure a large loan, like a mortgage, you may not want to apply for other new credit around the same time. This may help minimize the risk that your credit scores will drop before you apply for the larger loan.

You May Like: How To Dispute Negative Items On Your Credit Report

What Are Other Ways To Improve Your Credit Score

You canbuild healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

How Important Is It To Remove Inquiries From Your Credit Report

Inquiries are the least important items to remove from your credit reports, compared to other negative items like missed payments and delinquent debts.

They have a relatively low effect on your credit scores and cause less and less damage over time. Because they only affect your credit score for 12 months and drop off entirely after two years, hard inquiries are by no means the worst thing you can have on your credit report.

Many negative items stay on there for anywhere between seven and ten years. So if your credit history is riddled with several derogatory marks, removing hard inquiries should be your last priority as you work on increasing your overall scores.

It often helps to talk to a professional credit repair company to help you analyze your credit reports and prioritize issues that need to be addressed. They have the legal know-how of what your rights are with your different creditors and how likely you are to get certain items removed.

Don’t Miss: Does Closing A Credit Card Affect Your Credit Score

Why Did My Credit Score Drop When I Paid Off Collections

The most common reasons credit scores drop after paying off debt are a decrease in the average age of your accounts, a change in the types of credit you have, or an increase in your overall utilization. It’s important to note, however, that credit score drops from paying off debt are usually temporary.

How To Remove All Inquiries From Your Credit Report

Most people think that their is only dependent on their repayment history. That is not true. There are several factors that credit bureaus use to formulate your credit score. One of those factors is how many inquiries are present on your credit report.

Although inquiries are a minor factor in your overall credit score, they can affect a lenders decision to extend credit to you as a customer. It could cause you to get a higher interest rate or hinder you from getting approved for a loan altogether.

If you have wondered the following:

- How long do inquiries stay on your credit report?

- How to dispute a credit report and win?

- How long do hard inquiries stay on your credit report?

- How to remove negative items from the credit report yourself?

Youll want to keep reading.

In this article, well lay out all the details about inquiries on your credit report. Well talk about where they come from and how they impact your credit score. Most importantly, well show you how to remove inquiries from a credit report.

Also Check: How Long Does A Dismissed Bankruptcy Stay On Credit Report

Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed incur separate fees in most states. So, dont do this if you intend to apply for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

What Happens To Hard Inquiries Over Time

Any negative information on your credit report including hard inquiries will eventually fall off. And a hard inquiry sticks around for much less time than, say, an account in collection or bankruptcy.

According to credit experts, hard inquiries stay on your report for two years, but only impact your credit score for the first year .

But what does this mean for your actual credit score?

Read Also: Do Apartments Show Up On Credit Report

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, co-president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

When Should You Not Focus On Removing Inquires

If your credit score is below 680, it is probably due to prior negative payment history, collections or public records. You would need to address these items first with credit bureau disputes and either debt validation or pay for deletions for collections and engaging creditors for late payments.

Additionally, other factors linked to high credit utilization, the age of your credit accounts and lack of revolving credit may also be suppressing your score

Recommended Reading: How To Access Free Credit Report

How To Remove Negative Items From Your Credit Report Yourself

First, it’s important to know your rights when it comes to your credit history. Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the bureaus find that the information you disputed doesnt belong in your record or is outdated, they are obligated to remove it.

Common credit report errors include payments mistakenly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number or identifying information.

Bear in mind that correct information cannot be removed from your credit report for at least seven years. So, if your score is low due to down because of accurate negative information, youll need to repair your credit over time by making payments on time and decreasing your overall amount of debt.

Here are some tips to help you repair your credit history:

Why Credit Inquiries Could Hurt Your Credit Score

The type of credit inquiries you have could impact your credit report and credit score. For example, a hard credit inquiry could reflect negatively, and may even bring your overall credit score down.

This is because those who have recently applied for a new loan and/or additional credit can be viewed as a more risky borrower. This is particularly the case if you already carry large loans or credit balances.

Hot Tip: In most instances, a hard credit inquiry will remain on your credit report for up to 2 years. However, there are instances where negative information may remain on your credit report for 7 to 10 years.

You May Like: What Is The Best Credit Rating

How Much Does A Hard Inquiry On Your Credit Report Hurt

For people with extensive credit histories, a single credit application and hard inquiry has no effect or a fairly minimal one.

If youve lost points because you applied for a lot of credit in a short time span, take heart. Credit applications are not a major factor in calculating your credit scores.

VantageScore describes recent credit behavior and inquiries as less influential. Applications for new credit account for 10% of FICO scores.

But people who have short credit histories or few accounts may see a bigger change.

If youre trying to build credit, every point counts, and pulling back on new applications for a few months should restore lost points. Particularly if you are taking out a mortgage, wait until after closing to apply for new credit.

Multiple hard inquiries can put a serious dent in your credit, particularly if you are new to credit, and its an easy mistake to make. Say youve just rented an apartment. The leasing agent may check your credit. And then you may apply for financing for furniture. Then you decide you want a card with travel rewards, so you apply for a couple of those. That could be four credit inquiries within a short period, and it could result in a lower score.

Statistics cited by FICO show that people with six or more recent inquiries are eight times as likely to file for bankruptcy as those with none, and scoring formulas reflect that.

In the meantime, focus on the two things that have the most powerful effect on your scores: