What Going Into Collections Means

Depending on the type of debt owed, collections can affect you in different ways. If your debt is unsecured, such as credit card debt, and you default on your payments with that debt sent to collections, the credit card company would stop trying to collect the debt from you. Instead, the collections company that your debt was sent to, would pursue the debt and try to collect money from you. If your debt was secured, such as an auto loan and you default, then the lender might repossess your car, sell it at auction, and sell the remainder of debt you owe to a collections company. Lenders can collect money from debt in the following ways:

- Contact you on their own and ask for payment using their internal collection department.

- Hire a collection agency to try and collect.

- For revolving debt, such as credit card debt, the credit card company could sell your debt to a collection agency, which would then try to get the money from you.

- For installment loan debt, such as an auto loan, the lender may repossess the car, sell it auction, and then sell the remaining debt to a collection agency.

The federal Fair Debt Collection Practices Act strictly regulates how debt collectors can operate when trying to recover a debt. For example, they can’t threaten you with imprisonment or make any other kind of threat, if you don’t pay. However, they can and typically do report the unpaid debt to credit reporting agencies.

Stage : A Collection Account Is Created

Future lenders desire to see a full report of your credit management history before deciding whether or not to offer you a new extension of credit or a new loan. This credit history is something used again, if youre approved, to determine how much to charge you for financing.

The presence of any collection accounts on your credit reports, whether paid or unpaid, is indicative of elevated risk. This is very important information for a lender to know when reviewing your application for credit. The Fair Credit Reporting Act allows for even paid collection accounts to remain on consumer credit reports for seven years from the date of default for this reason.

My Account Is In Collections But Its Not Showing Up On My Credit Report Now What

If the charge in question doesnt appear on the credit report it is possible that the charge in question has not been reported to either of the credit reporting companies. This actually is good news, because you dont have to work to get it removed. If you feel the charge is valid, pay the charge. Sometimes collection agencies will settle for less than the stated amount if never hurts to ask. Make sure to keep copies of all correspondence. If the charge isnt on your credit report and you believe it to be false, dont ignore it. It might still make it on your report if you do nothing. Instead, write to the collection agency and dispute the charge. Offer as much documentation as you have to strengthen your case. Send your correspondence via certified mail so that you have proof the agency received your letter.

Just because a collection agency says you owe them money doesnt necessarily mean their claim is valid. However, how you deal with their claim will likely affect your ability to get credit at the best rates in the future. It pays to be proactive.

Rating of 3/5 based on 19 votes.

Read Also: What Score Do You Need For An Amazon Credit Card

Have A Professional Remove Collections From Your Credit Report

If this all seems like too much for you to handle, and you are worried about trying to take on a collection agency on your own, theres an entire industry devoted to credit repair that is ready to help you.

A professional credit repair company like Lexington Law could help restore your credit usually within three or four months.

They wont take any action you couldnt take yourself. Since credit repair is all they do, itll work faster and more efficiently.

You would need to budget some money for the monthly payments, which average about $100 depending on the plan you choose.

Theres also a one-time set-up fee for most .

But if you want to get your personal finances back on track without spending your free time on the phone or writing letters, you should consider this kind of service provider.

Debt collections come in many forms.

Whether its an unpaid medical bill, a cell phone bill, or even an $18 library book you never returned, unpaid debt can lead to negative information on your credit report.

It looks especially bad when the negative item comes from a collection agency.

Collections accounts tell other creditors you let an old debt go three or maybe even six months without paying.

When you apply for new credit, lenders know your old lenders lost money on your accounts.

So a collection account will have a negative impact on your ability to apply for new credit whether its a mortgage, a major credit card, or a personal loan.

How To Get A Collection Removed From Your Credit Reports

Advertiser Disclosure

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Advertiser relationships do not affect card ratings or our Editors Best Card Picks. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. When you click on any Apply Now button, the most up-to-date terms and conditions, rates, and fee information will be presented by the issuer. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines.

Also Check: Paypal Credit Minimum Score

What Makes Up Your Credit Score

Your is calculated using different scoring models, such as the VantageScore and FICO. These are the two most widely used credit-scoring models, and each has its own proprietary metrics and criteria. However, both models have one thing in common: they use data from the major credit reporting agencies to generate your score.

If you want to repair bad credit, it’s important to understand what factors VantageScore and FICO evaluate when generating scores.

VantageScore 4.0 Scoring Model

VantageScore prioritizes total credit usage, balance and available credit. Basically, the model first evaluates the amount of credit you have available to use and how much of it you’re using. Using 30% or more of your available credit can lower your score since lenders usually consider it a red flag.

Other factors considered include your credit mix, payment history, credit history length and new accounts.

FICO Scoring Model

The FICO score is the industry standard its the oldest credit scoring model and what most lenders use to evaluate a person’s creditworthiness. FICO’s scoring has five categories, each with a percentage value indicating how much weight they place on each:

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

Also Check: Zzounds Credit Approval

Ways To Get Something Removed From Your Credit Report

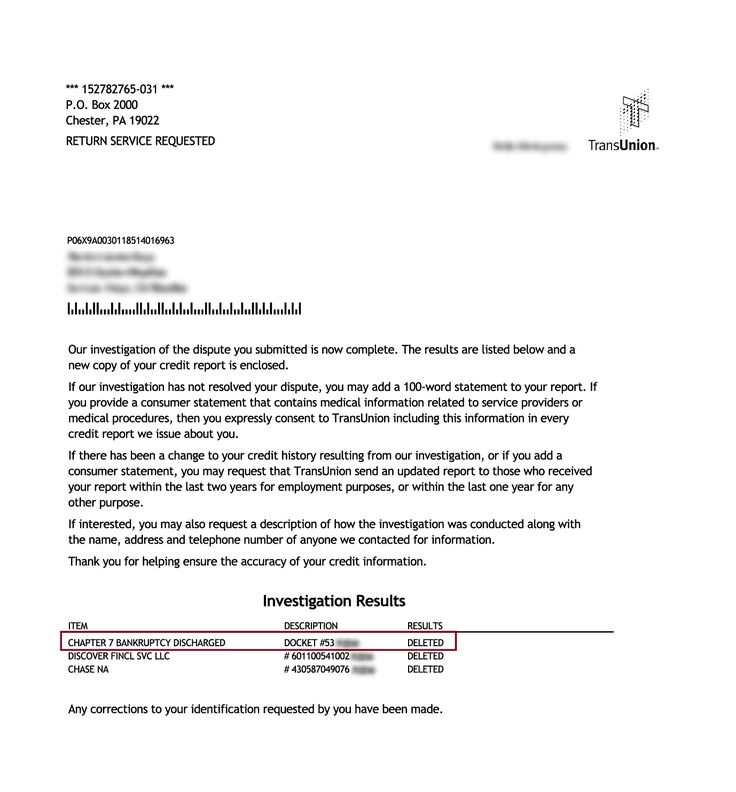

Before you get started, note that if your negative information wasnt the result of an inaccuracy or crime, neither Equifax or TransUnion will remove it from your credit report prior to the designated date. Otherwise, there are 6 different ways to get an error or other negative incident removed from your credit report:

Wait For It To Go Away Naturally

Normally, timely payments and other positive incidents will stay on your credit report indefinitely and will improve your credit score over time. On the other hand, negative information will remain in your credit history for several years, the length of which depends on the incident. Common examples of negative information include:

- Late/missed payments = 6 years

- Consumer proposals = 3 years

- Bankruptcies = 6 7 years

In these cases, the simplest way to deal with the negative information is to wait until Equifax and/or TransUnion clears it from your report. As mentioned, whether the incident was intentional or accidental, neither bureau will remove it immediately, because it was technically your responsibility to pay your debts on time.

File a Dispute

Although waiting for the negative information to be removed is the most convenient option, remember that it can damage your credit score while its on your credit report. You may not want to wait for years, during which you could get denied for new credit.

- For the dispute to have grounding, be sure to provide any proof you have that shows that the incident was not your fault

Use Donotpay To Remove A Medical Collection Account From Your Credit Report

DoNotPay has products that can save you time and money on various tasks you may have found difficult to complete with your busy schedule. With the Clean Credit Report product, DoNotPay can assist you in cleaning your credit report in one of four ways.

- Debt Validation Request

- Help To Identify And Dispute Errors

- Goodwill Removal Request

- Pay To Delete Negotiations

How to clean up your credit report using DoNotPay:

If you want to clean up your credit report but don’t know where to start, DoNotPay has you covered in 3 easy steps:

You can also check out our other credit products, including Credit Limit Increase, Get My Credit Report, Keep Unused Cards Active, and more!

Don’t Miss: Navy Federal Personal Loan Approval Odds

What Are Collection Accounts

Itâs important to understand that thereâs a difference between original creditor accounts and collection accounts. Creditors specialize in loaning money and collection agencies specialize in collecting money. Additionally, consumer protections under the Fair Debt Collection Practices Act apply to debt collectors and collection agencies, not original creditors. When an original creditor account remains unpaid for several billing cycles, it may be referred to a collection agency and become a collections account.

The company loaning your money when you first secure a line of credit or you begin incurring charges related to a service, through a bank, credit card issuer, or medical provider, is an original creditor. Once you miss a payment, unpaid collections for the account can be assigned to a collection agency. The collection agency will likely be paid a percentage of what they collect or they may be paid a flat amount to pursue your debt. Debt collectors buy delinquent accounts for pennies on the dollar and attempt to collect the debts they now own.

Collection Bureau Inc Complaints

Most collection agencies have numerous complaints filed against them with the Consumer Financial Protection Bureau and the Better Business Bureau . Its because they often report accounts inaccurately and/or for harassment. If you are being harassed by a collection agency, you should also file a complaint.

You have many consumer rights under the Fair Credit Reporting Act and the Fair Debt Collection Practices Act . Lexington Law knows that you have rights, and Collection Bureau, Inc. does too.

Recommended Reading: How To Check My Credit Score Without Ssn

Get All Three Of Your Credit Reports

Your three credit reports from consumer reporting agencies Equifax, Experian and TransUnion are not identical.

The old debt in question might be listed in some credit reports but not others. To find out, get a copy of all three of your reports. Federal law entitles you to request a free copy of each report once every 12 months. You can download them for free at AnnualCreditReport.com.

Once you find out which bureaus are listing the debt, contact them. Your credit report will include contact information and dispute instructions. Equifax, Experian and TransUnion will give consumers free weekly credit reports until April 20, 2022.

Why this is important: If youre only looking at the copy of your credit report from one credit bureau, you may be missing inaccurate information that is on another report.

Who this affects most: Mistakes with credit reports can happen to anyone with old debt on any of your credit reports.

Can Debt Collectors Remove Negative Information From My Reports

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms. Therefore, it’s just as important for them to see your negative credit history as your positive history.

If you discover, however, that negative information is still on your credit reports after seven years and you have paid off the amount as agreed, you should immediately file a dispute.

You can dispute the negative information sooner if it appears on your credit reports multiple times. You can also dispute the information if it’s a result of fraud or identity theft. It’s important to report the fraud or identity theft immediately to the three nationwide credit bureaus so that you can get your financial life back on track.

Be warned that there are many companies that claim they can have negative information removed from your credit reports for a fee. However, neither you nor a third party can get negative but accurate information removed.

Don’t Miss: How To Delete Inquiries

What Happens When A Debt Is Sent To Collections

Being sent to collections means the original creditor has given up on trying to collect debt that a consumer owes. This normally happens after 180 days of no payment. Typically the lender sells the account to a collection agency in order to recoup some of their lost money.

Once a debt is sold to collections, the agency begins their efforts to contact you for payment. Sometimes, collection agencies dont report the debt to the credit bureaus if it is paid in a timely manner.

Regardless of your situation, remember that if you are contacted by a collection agency, that you do have rights under the Fair Debt Collection Practices Act.

S To Remove Collection Accounts From Your Credit Report

If youve had collections listed on your credit report, then you know it can drop your FICO score significantly.

In This Article

But how do you remove collection accounts from your credit profile?

This article provides some proven strategies to help you get collections removed from your credit report and increase your credit rating.

Recommended Reading: Do Landlords Report To Credit Bureaus

How Do You Get A Collection Removed From Your Credit Reports

Lets begin with the brutal truth. If theres an accurate collection account on your , the odds that youll be able to get it removed before its been there for the maximum allotted time seven years from the date of the original delinquency are slim.

Even so, there are a few steps you can take to try to get it removed faster. Theyre just unlikely to work.

When You Pay A Collection Account Will It Be Removed From Your Credit Report

A lot of people think paying a collection will automatically remove it from their credit report, like my old Sprint bill.

Its important to know the collection wont be removed from your credit report even if you pay it off.

Itll just be relabeled as a paid collection instead of an unpaid collection.

New lenders will still see the collection account when they pull your credit report.

Even if you do get approved for a loan, youll likely pay a higher interest rate.

Recommended Reading: Does Klarna Build Credit

What To Know About Debt Collection

What types of debts are covered under the law?

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA. Business debts are not.

Can debt collectors contact me at any time or place?

No. Debt collectors cant contact you before 8 a.m. or after 9 p.m., unless you agree to it. They also cant contact you at work if you tell them youre not allowed to get calls there.

How can a debt collector contact me?

Debt collectors can call you, or send letters, emails, or text messages to collect a debt.

How can I stop a debt collector from contacting me?

Mail a letter to the collection company and ask it to stop contacting you. Keep a copy for yourself. Consider sending the letter by certified mail and paying for a return receipt. That way, youll have a record the collector got it. Once the collection company gets your letter, it can only contact you to confirm it will stop contacting you in the future or to tell you it plans to take a specific action, like filing a lawsuit. If youre represented by an attorney, tell the collector. The collector must communicate with your attorney, not you, unless the attorney fails to respond to the collectors communications within a reasonable time.

Can a debt collector contact anyone else about my debt?

What does the debt collector have to tell me about the debt?

What if I dont think I owe the debt?

What are debt collectors not allowed to do?