Blue Cash Preferred Card From American Express: Best Rewards At Us Supermarkets For Excellent Credit

Why we picked it: This cards time-honored 6% cash back at U.S. supermarkets , unlimited 3% cash back on U.S. gas station and transit purchases, and 1% on everything else remain impressive thanks to another everyday category unlimited 6% on select U.S. streaming subscriptions.

Pros: The welcome offer sweetens the deal, an offer to earn a $300 statement credit after spending $3,000 in purchases within the first 6 months.

Cons: Its tough to find something not to love about this card, but you may find the ongoing $95 annual fee to be an unfortunate piece of the pie.

Who should apply? If the Blue Cash Preferreds tiered categories are ones that you find yourself often using, this is a card that can earn you significant rewards for the pump and your pantry.

Read our Blue Cash Preferred® Card from American Express review.

Blue Cash Preferred Card From American Express

Best overall cash back for families

- This card is best for: People with big, on-the-go families who can get the maximum benefit from the rewards rates at U.S. supermarkets at U.S. gas stations, on select U.S. subscriptions services and on transit.

- This card is not a great choice for: Anyone who dislikes annual fees. This cards $95 annual fee is $0 introductory annual fee for the first year, but after that introductory period youll need to maximize the rewards categories to offset the yearly cost.

- What makes this card unique? It includes complimentary ShopRunner membership , which offers free two-day shipping at checkout with 100+ online merchants.

- Is the Blue Cash Preferred Card from American Express worth it? If youre looking for excellent cash back returns to go with your excellent credit, this family-friendly card is one of the top choices on the market.

Jump back to offer details.

For Flat Rate: American Express Simplycash Preferred*

If you want a cash-back credit card but dont want the fuss of figuring out how the spending categories work, consider the American Express SimplyCash Preferred card. You get a flat rate of 2% cash back on everything you buy, periodwith no limit to how much you can earn. Plus, for new members, theres a juicy 10% cash-back promotional offer for the first four months . Additional cards are free , which will appeal to couples or families who want to combine their reward earnings. The drawback to be aware of is that rewards can be redeemed only once per year.

- Annual fee: $99

Also Check: Does Affirm Show Up On Credit Karma

Don’t Panic If Your Credit Score Drops Slightly It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

The impact of a slight credit score drop is near meaningless

It’s inevitable at some point that your credit score will drop. However, this shouldn’t be a cause for panic, especially if it’s only a slight dip. In general, the impact of your score going down a small amount is near meaningless. Have a watch of this video to see why:

What Factors Compose An Insurance Companys Fsr Rating

AM Best ratings are composed of findings from many sources including these major sources:

- Balance Sheet The asset, liability and equity accounts on the insurance companys balance sheet, and its relationships, are reviewed to analyze the companys financial flexibility and risk management.

- Enterprise Risk Management The insurance companys preferences for risk and how the company manages its risk based on its corporate objectives is analyzed.

- Operational Performance The long-term financial stability, balance sheet strength and historical performance of the insurance company are analyzed and incorporated into the credit rating.

- Business Profile The insurance companys market position, competitive strategy, pricing, data quality and underwriting performance, along with other business statistics are analyzed.

- Rating meetings A financial analyst is assigned to the insurance company by AM Best to keep the company up-to-date on its AM Best ratings and to assess its financial strength, management practices and company goals on an ongoing basis.

Also Check: What Is Syncb Ntwk On Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

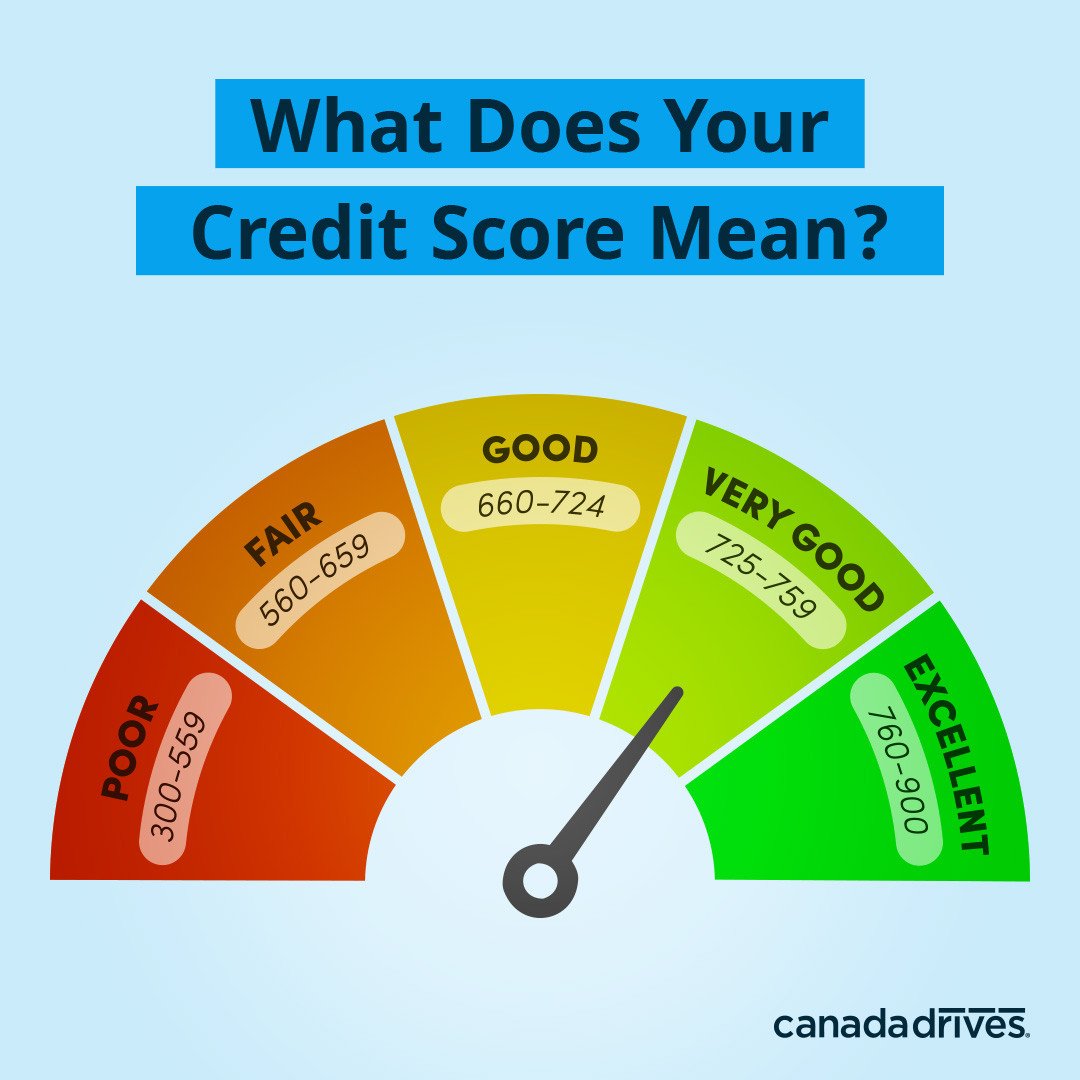

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Usually, you can access your report online within a day or two. Or you could have to wait up to 10 days to get your report by email or mail.

Contact these credit reporting agencies for your free credit report:

Since different agencies can hold different information, you may have a credit report with more than one agency.

Some credit reporting agencies may provide your credit score for free check with them directly.

Alternatively, you can get your credit score for free from an online credit score provider, such as , Finder or Canstar. This usually only takes a few minutes.

Typically, you agree to their privacy policy when you sign up, which lets them use your personal information for marketing. You can opt out of this after you sign up.

Avoid any provider that asks you to pay or give them your credit card details.

Also Check: What Is Attcidls On My Credit Report

Pc Financial World Elite Mastercard*

Due to its association with Loblaws stores and Shoppers Drug Mart, the PC Optimum program offers members access to a wide variety of ways to earn PC Optimum Points, including gas, drug store and grocery purchases. With an earn rate of 30 points per $1 in Loblaws-owned stores , 45 per $1 at Shoppers Drug Mart, and 10 everywhere else, this card is one of the best no-fee cards for gas and groceries on the market. Its simple to redeem points. You simply show the card at checkout anywhere PC products are sold and get $10 back for every 10,000 points. Theres even an included package of travel and car rental insuranceand it carries no annual fee.

- Annual fee: $0

- Earn rate: 30 points per $1 in Loblaws stores and PC Travel 45 points per $1 spent at Shoppers Drug Mart 30 points per litre at Esso and 10 points everywhere else

- Income requirement: $80,000 or $150,000 , as well as a $15,000 minimum annual spending requirement

- Additional perks: Travel insurance car rental coverage

Mortgage Debt Grew By 2% In 2020

- 44% of U.S. adults have a mortgage.

- The average FICO® Score for someone with a mortgage in 2020 was 753.

- The percentage of consumers’ mortgage accounts 30 or more DPD decreased by 46% in 2020.

Mortgage debt represents the largest outstanding debt in the U.S., and in 2020 consumer balances grew by 2%the same rate they grew from 2018 to 2019. Despite the pandemic, consumers across the country still bought homes, many fueled by the record drop in interest rates that accompanied the economic decline. Nearly half of all adults in the U.S. have a mortgage, and the average FICO® Score among these homeowners is more than 40 points higher than the national average.

Mortgage accounts saw the second largest decrease in accounts 30 or more DPD, dropping by 46% in 2020. Compared with 2019’s drop from the prior year of 6%, 2020’s improvement in 30 or more DPD accounts is significant.

This is likely due to the fact that the CARES Act and other government intervention provided relief for mortgage borrowers, giving those impacted by COVID-19 the right to request a forbearance. During forbearance, it was stipulated that mortgage accounts could not be reported negatively to the credit bureaus, a move that helped insulate consumer credit scores.

You May Like: What Is Syncb Ntwk On Credit Report

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Top 10 Best Credit Rating Agencies In The World

A is in real terms a custodian of trust that has been reposed in them by investors after years of honest and correct reporting.

Importance of can be gauged by the fact that maximum participation from retail investors has been seen from 2014-2016 as reported by Economic Times in December 2016.

Investors have reaped year-on-year returns at 12.9% for mutual funds. 14.8% for insurance and 12.5% for saving deposits. Gold continued to be the most favored asset class with current year investments going at 65.9 lakh crore in 2016.

The following tables support the data presented above and most of this research is done by credit rating agencies to give accurate information.

You May Like: What Credit Score Do You Need For Affirm

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

What Are The Benefits Of Having Higher Credit Scores

Thankfully, you dont need a perfect score to qualify for some of the best rates on loans and mortgages. Scores in the 700s can qualify you for great interest rates from lenders. Get your scores anywhere above 760 and youll likely be offered the best rates on the market.

Why is this the case? Because banks and credit card companies care less about the specific numbers on your credit reports and more about the broad credit score range where your scores fall.

For example, FICOs score bands look like this.

- Poor: 300-579

- Very good: 740-799

- Excellent: 800+

Improving your scores from 740 to 790 will likely have little effect on your interest rate offers since both scores fall in the very good range. But moving your scores from 650 to 700 could mean getting lower interest rate offers.

If you want to improve your scores and get as close to 850 as you can, youll need to understand what causes your scores to go up or down.

Also Check: What Is Syncb Ntwk On Credit Report

How Will You Use The Card

The first question that will help you make a decision: How will you use the card? Cards for excellent credit fall into several basic types, and deciding which type suits you best will help you narrow your options. Here are the types of credit cards for excellent credit, and when you might want to consider each one.

| Type of credit card | When to consider this type of card |

|---|---|

| Balance transfer card | You have a balance on a high-interest card, and you’d like to find a 0% interest balance transfer deal to save money. |

| Low-interest card | You plan to finance a major purchase like an appliance or piece of furniture on your new card and pay it off over time. |

| Cashback credit card | You will pay your balance off in full each month and would prefer to get rewarded for everyday purchases with a cash bonus. |

| Travel credit card | You plan to pay off your balance in full each month, will use your card for travel purchases, and would like to rack up points or miles toward future trips. |

Become An Authorized User

If you dont have a lengthy credit history, ask a family member who has excellent credit to add you as on their oldest credit cards. Your score can increase if the credit card issuer reports information to the credit bureaus for authorized users. However, the downside is that your score can decrease if the primary cardholder misses a payment and its reported on your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

Also Consider: Scotiabank Gold American Express*

The Scotiabank Gold American Express has been a longtime favourite for Canadians, especially those who travel. The first thing youll notice about this card is the Scotia Rewards earn rate is a very healthy 5 points per $1 on groceries, dining and entertainment. Gas gets 3 points per $1, as do spends in two other categories: Public transit and eligible streaming services. All other purchases earn you 1 point per $1 spent. This card also doesnt charge a foreign transaction feeits one of the very few Canadian cards to offer this perk. Consider it a 2.5% bonus on all foreign currency transactions, including online purchases.

- Annual fee: $120

- Welcome offer: You can earn up to 50,000 points by spending $1,000 in everyday purchases in the first 3 months. You can also earn an additional 20,000 points when you spend $7,500 in everyday purchases in your first year. Apply by November 21 2021.

- Earn rate: 5 points per $1 spent on groceries, dining and entertainment 3 points per $1 on gas, public transit and eligible streaming services and 1 point per $1 on all other purchases

- Income requirement: $12,000

Also Check: Does Lending Club Hurt Your Credit

Do Coronavirus Payment Holidays Affect Credit Files

At the start of the coronavirus pandemic, lenders were offering coronavirus-related payment holidays on mortgages, credit cards, loans etc to customers struggling to make repayments. You needed to have applied for a payment holiday by 31 March, and if you did, here’s how taking one might have impacted your credit file:

- The first six months of a payment holiday shouldn’t be reported as missed payments on your credit file. But even if the payment holiday’s NOT on your credit file, lenders can still find out about it in other ways eg, they can see your mortgage balance isn’t going down and can use that information to help their decision when you next apply for credit.

- Further help after a six-month payment holiday WILL go on your credit file. Lenders are supposed to report any further ‘forbearance’ after you’ve had six months of payment holidays to credit reference agencies. Your lender should let you know if the support it’s offering you would affect your credit report.

For more information on the help currently available, and whether it’ll affect your credit file, see our Coronavirus Finance & Bills Help guide.

MSE weekly email