What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range thats considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each cards credit limit

Read Also: What Credit Score Do You Need For An Apple Card

The Credit Scoring Model Varies

Different credit reporting agencies may utilize separate scoring models, affecting how your credit score is calculated. It is one reason why credit scores can vary so significantly. One model may prioritize some facets of your credit more than others, such as late payments or your debt-to-income ratio.

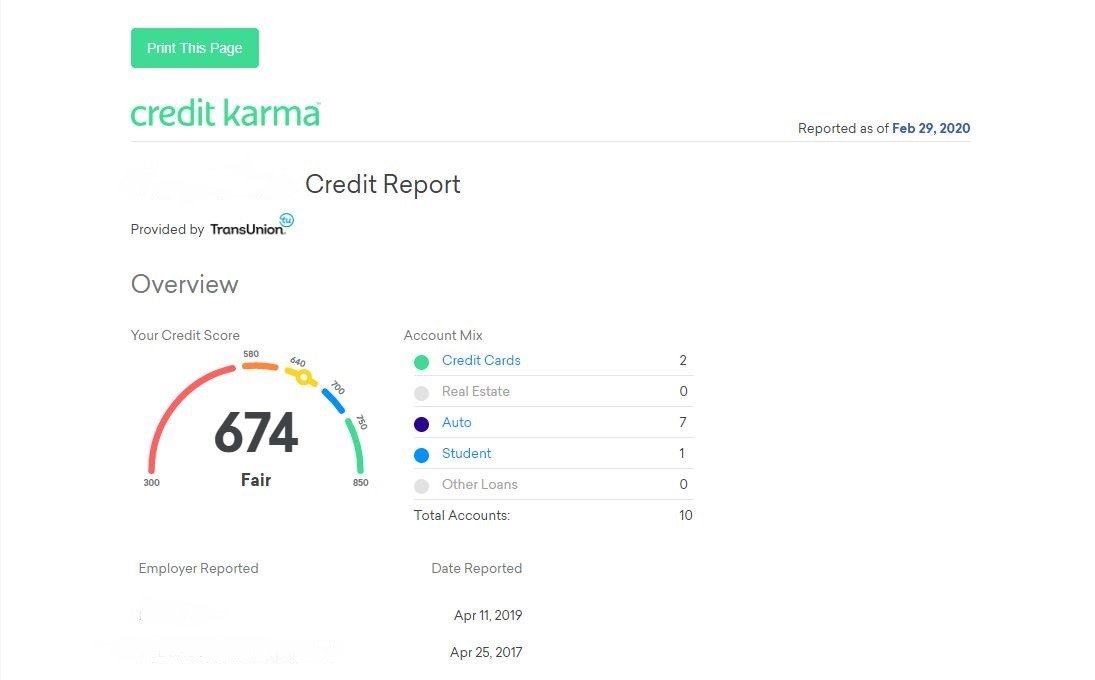

For its part, Credit Karma does not use the popular FICO® score for your credit.

Instead, it uses the Vantage 3.0 credit score that is based upon TransUnion and Equifax reporting.

Are Free Credit Reports Worth It

Purchasing your credit reports can get expensive, especially if you need to review your credit report multiple times a year. Accessing a free credit report allows you to stay on top of your credit without the hefty price tag. Plus, you can use more than one free credit report service at a time for a comprehensive look at your credit across all three major credit bureaus.

Read Also: How To Remove Address From Credit Report

Which One Is Better For You

To determine which one is better for you, ask yourself a few questions:

- Are you looking to apply for new credit soon? You will need a score lenders actually use win for Experian.

- Would you still consider yourself a credit beginner? Perhaps Credit Karma is a good fit.

- What credit scores are your potential lenders using? If theyre using FICO, youll want to go with Experian. For VantageScore, youll want Credit Karma.

- Which specific features do you need when building credit? Credit monitoring services, monthly score updates, identity protection, score tracking, and credit score planners are a few options.

- Do you like using robust digital tools to help you out? Experian, all the way.

Ultimately everyones credit goals are different, so youll have to make the choice for yourself.

As someone who has used both, Id recommend Experian since you get so much more for free. Credit Karma is great to start with. It helps you learn about credit basics and still offers credit score monitoring.

Getting your Experian credit report comes with one of the best credit monitoring services, identity monitoring, and solid recommendations for borrowers with good credit. If you decide you want access to better tools, theyre in the same place.

A reasonable monthly fee grants you up to $1 million in identity theft insurance along with access to specialized tools to help you grow your credit. The only thing they dont give you is a good credit score. Youll have to earn that one.

How Do You Dispute A Credit Karma Score

If you spot an error on your TransUnion credit report, you can use feature to dispute the error. To find that option, scroll to the bottom of the erroneous account snapshot and click the button labeled Dispute an Error. Youll then need to fill out a form about your dispute. Once you submit the form, TransUnion will review the disputegenerally within 30 daysand notify you about any resulting changes to your credit report.

Have you tried using our Direct Dispute feature? . This should help! Feel free to reach out to us if you have any difficulty.

Read Also: How To Get Missed Payments Off Credit Report

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

Address:80 River St., STE #3C-2, Hoboken, NJ,07030

Whats Next: How A Daily Credit Score Helps You Make Financial Progress

Practically speaking, we realize you might not need to check your credit reports every single day. But in some cases like if youre applying for a new account or youre working hard on building credit and want to closely track your progress it can be tough waiting to see a credit score update.

Now that Credit Karma is checking your Equifax and TransUnion credit reports every day for any changes, you can know sooner when either of those scores have changed and possibly get a better understanding of why.

Also Check: Why Did My Credit Score Go Down When Nothing Changed

After Paying Off Debt

The length of time it takes for your credit score to update after paying off debt depends on the type of obligation you retired, the timing of your final check, and any additional spending if applicable.

- Your balance reaches zero after paying off installment loans and stays at zero. Your score should reflect this permanent change within ten days of your last billing period end date.

- Your balance can reach zero after paying off a revolving credit cardbut will not stay at zero if you continue charging purchases to the account. Your score should reflect this temporary change within ten days of your last billing period end date.

Ascend Federal Credit Union

1. Ascend Federal Credit Union Home | Facebook The official Facebook page of Ascend Federal Credit Union. Equal Housing Lender. Federally insured by NCUA. We respect free speech and monitor all social media Ascend Federal Credit Union is a nonprofit financial cooperative started in 1951 in Tullahoma, Tenn. Originally,

Also Check: Does Credit Report Show Bank Accounts

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

Your Credit Scores Can Change When Lenders Report To The Credit Bureaus

Your credit scores can also change when new information is reported to the credit bureaus by your lenders or creditors reflecting things like on-time payments and paying off or increasing debt.

Depending on how many accounts you have, and when each lender reports your information to the credit bureaus, your credit scores could change every month, every week, every day or even multiple times in the same day.

Read Also: How To Get A Mortgage With Poor Credit Rating

Asking The Right Questions About Your Credit Score

Since your credit score is based on whats in your credit reports, the only way it will rise or fall is if there are changes to the information contained in your reports. So the real question is, How often do credit REPORTS update?

The answer to this question is more complicated, namely because its completely up to individual creditors when they choose to report your account activity to the credit bureaus.

Its further complicated by the fact that anything if they choose not to. There are no laws on the books mandating that they must.

And it gets even more complicated when you factor in that creditors, even if they do choose to report your account activity, may not choose to report it to all three bureaus, which is also not against any laws. So your separate credit reports may not even reflect the same information.

Also Check: The Lowest Fico Credit Score Is Brainly

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

Also Check: Does Checking Credit Score On Credit Karma Lower It

What Is Credit Karma

Credit Karma is an American multinational personal finance business established in 2007. As of December 2020, the company is a brand of Intuit, the owner of the popular TurboTax DIY tax preparation service.

The in exchange for information regarding your spending habits.

So, how does the company make money?

Best For Daily Updates: Wallethub

WalletHub

Unlike some other services which offer weekly or monthly updates of your credit report, WalletHub offers daily updates.

-

Suspicious activity is identified and flagged quickly

-

Free credit score available

-

Access to TransUnion report only

-

Account required

Your credit report information can change frequently as your creditors send in updates to the credit bureaus. Weekly or monthly updates can keep you a bit out of touch with your credit report details. WalletHub is the only site that provides free daily updates to your full credit report information along with a summary of important changes to your credit information.

Youll have the most updated information from your TransUnion credit report, allowing you to act quickly to changes or suspicious activity on your credit report. WalletHub also provides personalized credit advice based specifically on your credit information.

In addition to your free credit report, youll also have access to your free credit score , which allows you to quickly see where your credit stands and how potential lenders might view your credit risk. Theres no credit card necessary to sign up and you wont damage your credit by using the service, even if you check your credit report every day.

You May Like: How To Get Paid Collections Off Of Credit Report

How Often Do Lenders Report To The Credit Bureaus

At this point, you can probably see how many variables are at play when figuring out how often you can expect a credit score update. Now, lets start to examine how often lenders report to credit bureaus.

Lenders tend to report to credit bureaus monthly, but their schedules vary, so they may report less frequently.

For instance, when it comes to credit cards, the billing cycle is the center of everything. Generally, a credit card billing cycle is 28 to 30 days long. At the end of your billing cycle, the your account information to the credit bureaus. Changes to your account, such as payments, may take up to 45 days depending on your billing cycle when the payment was made.

If youre worried about your reporting frequency and would like an exact number, its worth asking your lender which credit bureaus they report to and how often they do so. However, remember that every lender will have different arrangements, so youll need to contact each one separately.

You May Like: Is An 850 Credit Score Possible

How Often Does Your Credit Score Update

When you think of credit score ratings, its a sure bet the three big credit agencies come to mind: TransUnion, Equifax, and Experian. Each of these bureaus can update your credit instantly, monthly, or whenever lenders provide new information.

All it takes is a positive or negative change to your information. Its also possible that differences in your score result from which credit score system FICO or VantageScore is used to calculate your score.

Don’t Miss: Does Boost Mobile Report To The Credit Bureau

Your Credit Scores Can Change Frequently Thats Why Credit Karma Is Now Checking Your Credit Reports Daily For Any Changes From Equifax And Transunion

Now that Credit Karma is checking your TransUnion and Equifax reports every day, youll be able to keep a closer eye on your progress as you build credit. Daily checks mean you can know sooner if your scores have changed and that could help you make more-timely decisions when it comes to applying for new auto loans, credit cards and mortgages.

Does Credit Karma Affect My Credit Score

In short, no.

To calculate your score, Credit Karma uses a soft check to pull your current credit score, giving you the most current information available. Unlike a hard credit check, a soft check does not affect your credit, leaving your credit report unchanged by Credit Karma, no matter how many times you check your score. When you log in to check your score, a soft credit inquiry occurs. Because it is a general inquiry and not specific to one application, it is considered a soft credit check and does not impact your score.

Recommended Reading: What Credit Report Does Capital One Auto Pull

Why Should You Care About Your Credit Score

Because people with a bad credit score usually default, financial institutions wont lend to them.

If you have a poor credit score, you will have a tougher time leasing a car, buying a home, or getting any sort of loan.

Do you want to apply for a loan and do not know where to start? At Camino Financial we evaluate your ability to obtain credit.

Learn here more about the benefits of a good credit score.

Kellogg Federal Credit Union

1. Its Me 247 All products and services available on this website are available at all Kellogg Community CU full-service locations. Equal Housing Lender. We are a member-owned financial institution providing friendly, competent, and competitive financial services. We offer savings, checking, vehicle loans, Log back on to Home Banking. Return

Read Also: What Credit Score Is Needed For A Home Depot Card

Best For Improving Credit: Creditwise

-

Timely notifications about credit report changes

-

Only offers TransUnion report access

-

Sign-up required

You can check your TransUnion credit report and credit score through CreditWise, a credit report and credit score tool from Capital One. Credit Wise is available for free, even for those who arent Capital One customers. Signing up is simple and easy. You wont have to enter any credit card information, theres no trial subscription to cancel, and your credit information is updated weekly. You can access Credit Wise online or use the mobile app to keep up with your credit score.

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users,

Read Also: How Do You Get A Good Credit Score

How To Improve My Credit Score

As a small business owner, you know how important it is to have a healthy credit scoreit can help you get great loans to grow and thrivebut you also know getting there is not that easy.

Or is it?

While improving your credit score is not a quick process, its not that complicated. There are some things you can d0:

- Get a secured credit card

- Purchase electronics with installment payments

- Consolidate credit card debt into an installment loan

- Never exceed 30% of credit capacity

- Pay off credit card balances each month

These are just some easy ideas that can help you on your journey. But the most important thing is that you know that youll get an excellent credit score if you work hard at it. The credit score is not a mythical thing thats hard to understand its quite easy once you get the gist of it. If you want to improve your credit knowledge, why not visit our ?

Does Checking Credit Karma Hurt Your Score

Checking your credit information on Credit Karma will not directly hurt your credit score, so you are free to check your credit information as you wish.

Again, Credit Karma uses Experian and TransUnion to get your credit information. To get this information, they need to pull the information from your account, just like lenders do.

However, anytime a lender does a pull on your credit account, it will likely cause a hard inquiry, and your score will drop as a result. Credit Karma on the other hand, does something called a soft inquiry, which is basically a hard inquiry that does not affect your score at all.

Soft inquiries show up on your credit report but do not affect your credit score. You can freely use Credit Karma knowing your score will not take a hit.

Also Check: Do Loans Affect Your Credit Score