How Do I Get My Free Annual Credit Report

By law, under the Fair Credit Reporting Act, you are entitled to a free copy of your credit report every 12 months from each of the three major credit bureaus . In addition, several states offer an additional free credit report per year, including:

- Colorado

- New Jersey

- Vermont

Your free annual credit reports contain the same information that is found on a paid credit report: your open and closed financial accounts, and your payment history for each. Youll generally find payment history for loans, credit cards, and revolving lines of credit. You may also see rental payments if you rent an apartment.

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

Be Wary Of Certain Offers

Beware of sites that offer a free or discounted credit report, but request that you enter your credit card number to sign up for a free trial. These sites typically enroll you in a trial subscription to a and begin charging you monthly if you don’t cancel the subscription before the trial period ends.

Don’t Miss: How Long Does Repossession Stay On Credit Report

Free Credit Report In Spanish

Additionally, Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail. There are two ways to request your Spanish credit report, online or by phone.

To receive your credit report in Spanish, you can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish. Our Customer Care is available between 9:00 AM and 9:00 PM ET, Mon-Fri 9:00 AM and 6:00 PM ET, Sat-Sun. When you request your Equifax credit report in Spanish by phone you will receive it in the mail.

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

Read Also: Does Opensky Report To Credit Bureaus

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

I Got My Free Credit Reports But They Do Not Include My Credit Scores Can I Get My Credit Score For Free Too

Free credit reports provided by the nationwide credit reporting agencies currently do not include free credit scores. However, your credit card company may provide a free score. Be wary of programs offering free scores if you enroll they are generally not really free.

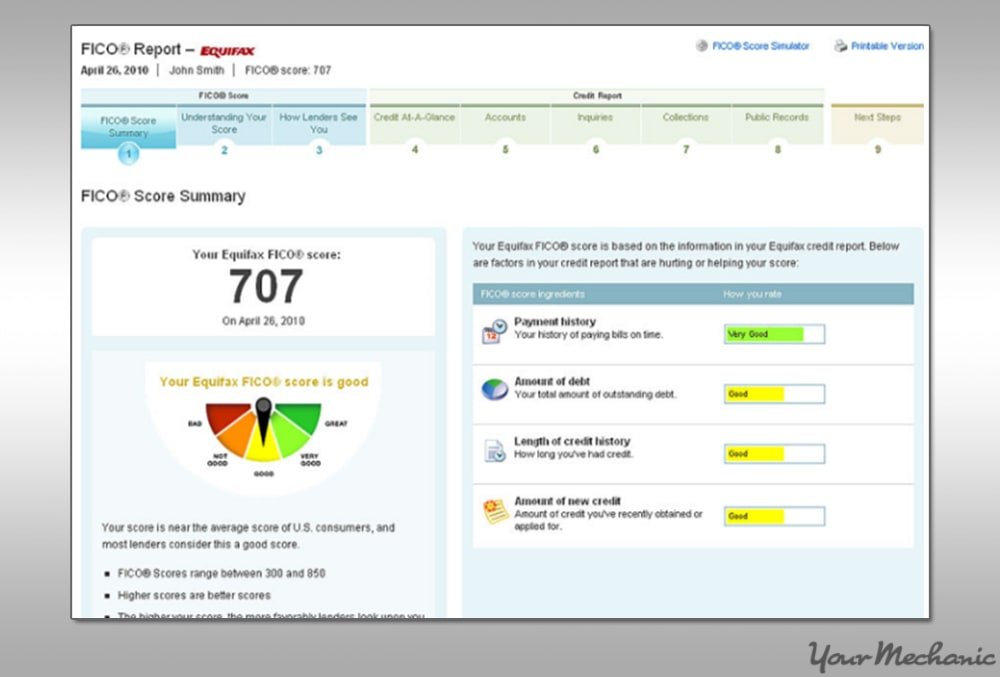

You can purchase your score directly from the credit reporting agencies and scoring companies. However, its important to check your credit report to make sure the information is accurate because your credit score is based on the information in your credit report. Its also important to note that the score you purchase may not be the same as the one lenders use to decide whether to give credit.

Your credit card company may share a credit score with you for free. Some companies include credit scores on your monthly statements.

- deny your application,

- increase the cost of your credit, or

- offer you a higher rate than other consumers get from that creditor.

Mortgage lenders also have to disclose your score when they check your score to approve a mortgage loan.

There are other third parties that claim to offer free credit scores. However, you should consider the following:

You may need to enroll in a program with a fee or purchase a product to get this free credit score. That means it is not really free. Sometimes there is period of time during which you can cancel without paying a fee. These programs are not free unless you remember to cancel within the allowed period of time.

You May Like: Zzounds Paypal

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

Free And $1 Credit Reports

Prior to the Fair and Accurate Credit Transactions Act of 2003, there were dozens of impostor websites on the internet promising to give you a free annual credit report. These sites would request your credit card information and enroll you in a trial membership to a .

If you didn’t remember to cancel the trial, your credit card would be charged for a full period of the credit monitoring service. These gimmicks still exist, although now most of them offer your credit report for $1, rather than for free. The legitimate website for ordering your free annual credit report doesn’t require a credit card and doesn’t ask you to sign up for any trial subscription.

Also Check: Cbna Bby Inquiry

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Why Its Important To Check Your Credit Report

Checking your credit report should be done periodically to screen for reporting errors and unrecognized activity. The first signs of identity theft usually appear on your credit report, and the earlier you spot them, the easier it is to stop the theft. Even if all the information you find is accurate, seeing your credit activity at a glance can give insight into how to manage debt more efficiently and raise your credit score.

Requesting a free credit report should also be an early step in any upcoming plans involving applying for a loan, such as buying a home or car. Pull a copy at least six months before a major purchase because if you do need to work on your credit, dispute errors, etc., it can take several months or longer to address these issues, says Bringle.

As long as youre entitled to a free report, theres no harm in requesting one. A common myth is that getting your own report will hurt your credit scores, says Rod Griffin, senior director of public education and advocacy at Experian. It wont. This is because there are two types of credit checks: hard inquiries and soft inquiries. While the former can temporarily ding your score, the latter which includes requesting your personal credit report will not. Soft inquiries do not affect credit scores or lending decisions, says Griffin.

Also Check: Does Les Schwab Report To Credit Bureaus

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

How To Get Your Free Credit Report

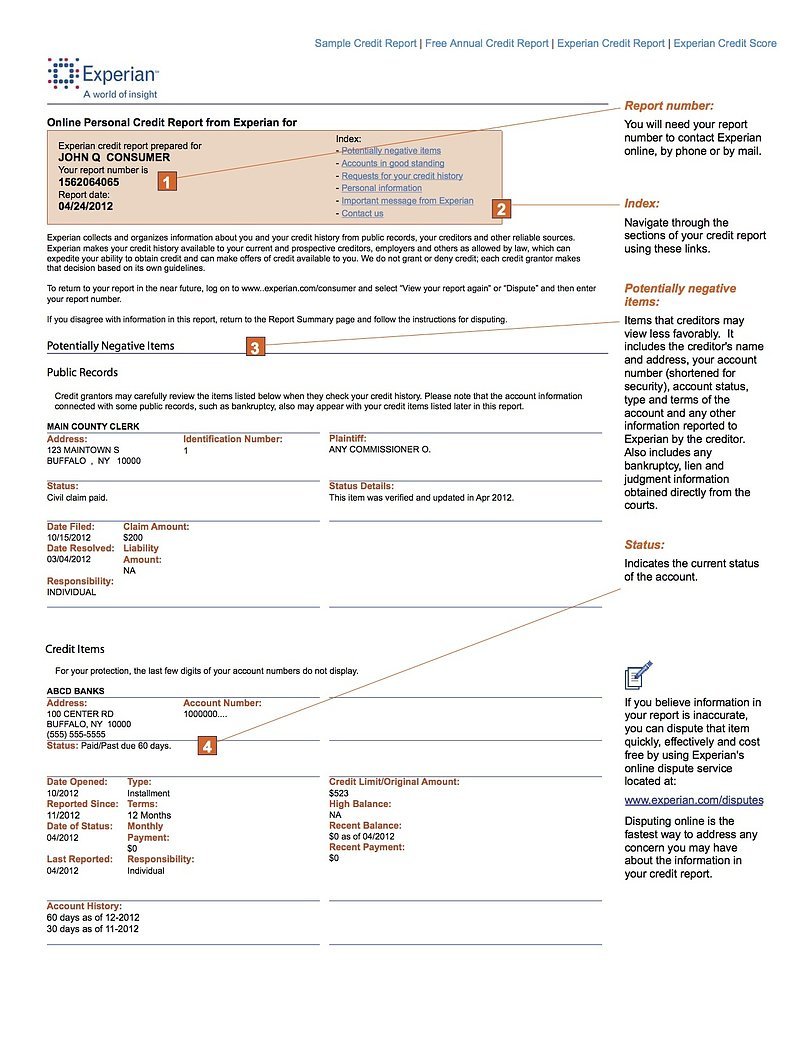

Your is one of the most important factors of your financial life. It contains a detailed history of your credit accounts, including the date you opened the account, the current balance, and the payment history for the account.

Because so many businesses use your credit report to make decisions about you, it’s important that you check your credit report at least once a year to be sure the information in your credit report is accurate. Each of the major credit bureausthe companies who compile your credit reportoffers your credit report for sale, but there are instances that you can get a free credit report from each bureau.

Read Also: Does Walmart Take Klarna

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Don’t Miss: Sywmc On Credit Report

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Online at annualcreditreport.com.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: How To Get A Repo Off Your Credit

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Can I Get More Than One Free Credit Report Per Year

If youve already ordered your legally-mandated free credit reports for the year and you dont live in a state where you are entitled to an additional free report, there are still several situations which qualify you for an additional free credit report:

Negative actions as a result of your credit report such as:

- Being denied for credit or a loan

- Being denied for insurance

- Being passed over for employment

- Being denied a government license or benefit, or having an adverse action for either of these

- Being denied or having an unfavorable action happening on another account

Hardships that make it difficult to maintain positive credit such as:

- You are currently unemployed and are planning to seek employment within the next 60 days

- You are receiving or have recently received public welfare assistance

- You believe that your credit file may be inaccurate due to fraud or identity theft

You May Like: What Credit Bureau Does Carmax Use

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

What Is Identity Theft

Identity theft is when someone uses your personal information without your permission. They may open a credit card account, get a loan, or rent apartments in your name using your personal information. They also might access your bank or retirement accounts. You may not know that identity theft has happened until you see your credit report, are notified when trying to apply for credit, or get called by a debt collector.

For more information about identity theft, visit the Federal Trade Commission’s website or the Consumer Financial Protection Bureau’s website.

Recommended Reading: Does Carmax Do Credit Checks

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Don’t Miss: Does Zzounds Do A Credit Check

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.