Have A Long Credit History

Its a little confusing to learn that you dont begin your credit journey with a perfect score. Credit scores, however, are about building a credit reputation over time. Its simply impossible to prove how youll respond to paying down debt until you do so over several years. If youve only just begun to build credit or have minimal accounts, your score will improve as you continue to follow your set payment schedule.

If You Close A Credit Card Or Pay Off A Personal Loan Will That Automatically Improve Your Score

The total amount of credit you have is one factor affecting your credit score. The more credit you have, the more it will affect your credit score but this could be offset by good repayment behaviour. Reducing the amount of credit, you have may be good for your credit score but again this is only one factor taken into consideration.

Your current credit report and the way you have managed your credit obligations to date will affect how a particular action may impact your score.

If You Mess Up Fess Up

Most people aren’t perfect when it comes to their credit history, and we mess up from time to time. My suggestion, should you ever be late on a payment: fess up.

About eight years ago I was late by a matter of hours in getting my often-used credit card bill paid, and I was hit with a late charge and a ding on my credit report. Most people would probably pay the late charge and chalk up the error as a lessoned learned. However, what you may not realize is that most creditors have some leniency if a mistake is more of the “once in a blue moon” variety. Previous to this late payment, I had never been late with a payment. When all was said and done, the creditor reversed the late charge and removed the black mark on my credit report.

The next time you run into a credit snafu, ask your lender if they’d be willing to remove the late fee and accompanying black mark against your credit score. If you’ve made your previous payments on time, you may be pleasantly surprised by their answer.

Image source: Getty Images.

Read Also: Is 658 A Good Credit Score

What Is A Perfect Credit Score 2020

A perfect credit score of 850 is hard to get, but an excellent credit score is more achievable. If you want to get the best credit cards, mortgages and competitive loan rates which can save you money over time excellent credit can help you qualify. Excellent is the highest tier of credit scores you can have.

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

Recommended Reading: What Is A Good Credit Score In Texas

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Keep Your Credit Utilization Low

Aim to get your credit utilization ratio as low as possible. According to The Washington Post, FICO data indicates that people with 850 credit scores have an average credit utilization of just 4.1 percent. That means that if you have $10,000 in available credit, youll want to keep your revolving balances below $410. Anything else needs to be paid off in full before your billing cycle closes.

Recommended Reading: How To Contest Items On Credit Report

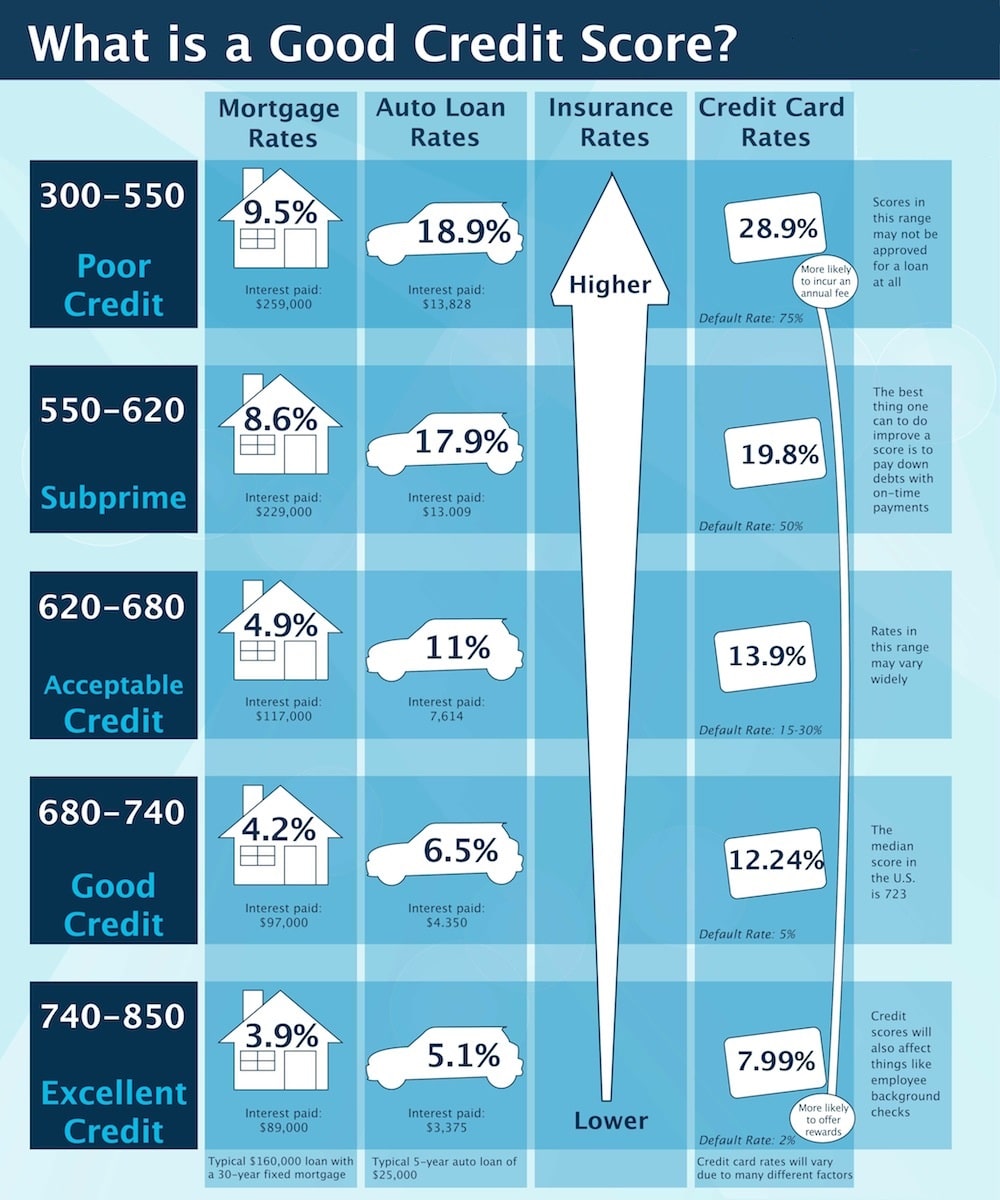

Having A High Credit Score Could Give You Access To More Favorable Loans Credit Cards And More

Good credit. You mayâve heard the term more times than you can count. Thereâs a reason for that.

Itâs because credit can touch many parts of your life. For example, it may impact where you live, how much money you can borrow and how certain employers may view your job application. Read on to take a closer look at the benefits of good credit and how you could work on improving your own.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: What Credit Score Do You Need For Chase Freedom

The Real Perfect Score

When youre working to improve your credit score, its important to identify why you want to earn a higher score in the first place. For example, are you aiming for a score that will make it easier to qualify for loans? Do you want a credit score thats high enough to help you qualify for the best rates and terms from lenders and credit card issuers? If so, you can achieve both of those goals with a score much lower than 850.

To qualify for the best treatment from lenders, you typically only need a credit score of 760 or above. In the eyes of a lender, you could say that 760 is the real perfect credit score.

Some people have a hard time believing that a score of 760 90 points shy of the highest credit score possible could be just as good as a score of 850. Heres proof.

FICO offers a loan savings calculator that can help you estimate how much interest you might be charged on various types of loans based on your FICO score. Its a great way to figure out how much money earning a better credit score might save you. Guess what score you need to move into the highest category on FICOs loan-saving chart? Yup, 760.

More Credit Card Options

Some of the best credit cards pay generous signup bonuses and rewards, but they’re only available to consumers who have the best credit scores.

With an excellent credit score, you have a much better chance of getting approved for some of the best credit cards on the market. On the other hand, having a low credit score limits your credit card options tremendously.

Being able to qualify for better credit cards can allow you to earn rewards, such as cash back, gift cards, merchandise, and travel.

Having more credit options available to you also means you can avoid predatory lending like payday loans, title loans, and pawnshop loans. These types of short-term lending options have the highest interest rates and often keep borrowers trapped in an impossible cycle of debt.

Recommended Reading: What Does Filing For Bankruptcy Do To Your Credit Score

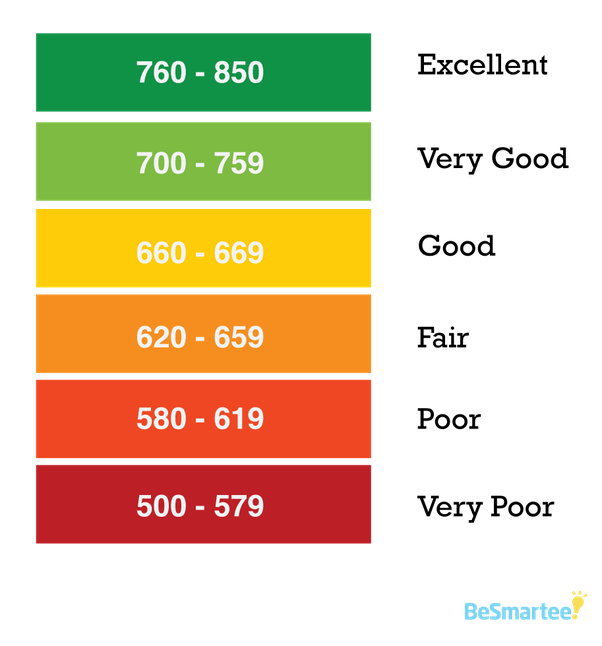

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

Dont Carry A Balance If You Dont Have To

If you can, pay your credit cards off each and every month. One of the greatest misconceptions is that you need to carry a balance on your credit cards to improve your credit score, which just isnt true. As long as youre paying your bill on time each month, even if that bill is paid off in its entirety every month, then youre going to see a long-term positive benefit in your credit score.

Ive been paying my credit cards off in full for the past 12 years, which has helped reduce the overall cost of the goods and services Ive bought since theres no interest to be paid. It also helps keep your aggregate credit utilization down, which comprises about 30% of your FICO credit score.

Don’t Miss: How To Remove Public Records From Credit Report

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Why Do I Need A High Credit Score

Each credit bureau has its own scoring range from low to high. The higher your score, the better your credit. The better the credit, the lower the financial risk.

If you ever plan on borrowing money to buy a house, a new car, go on vacation, consolidate debt, open a credit card, or whatever the case may be, youre credit will be pulled to determine the financial risk of lending to you.

Credit scores arent just for loans. Credit is also used to determine the risk of renting a home or apartment. Potential employers may even pull your credit information. Although they dont see your score, they can see some of the factors that contribute to it, so if you have a high score, its likely that the information that is pulled from potential employers will be positive .

Don’t Miss: How Do You Get A Credit Score

What Do People With Perfect Credit Scores And The Loch Ness Monster Have In Common Most People Cant Decide If They Actually Exist

While we dont know about the elusive aquatic creature in Scotland, we do know there are humans out there who have reached credit-score nirvana.

For most credit-scoring models, including VantageScore 3.0 and FICO, the highest credit score possible is 850.

We were able to speak to two Americans who belong to the exclusive FICO 850 Club: Brad Stevens of Austin, Texas, and John Ulzheimer of Atlanta. Both proudly showed off computer screenshots proving theyve reached the pinnacle of credit scoring.

Many people are skeptical that 850 is attainable. But it certainly is, says Ulzheimer, who is president of The Ulzheimer Group and a nationally recognized credit expert.

Develop A Good Credit Mix

Among these commonalities is the existence of debt. According to an article from Business Insider, those with excellent credit scores have an average of $126,306 in outstanding mortgage debt, $11,162 in auto-loan debt, $4,261 in student loan debt, $2,579 in personal loans, and $392 in unspecified debt

Most people with excellent credit have debt, and thats because you cant prove that you can manage debt without ever incurring any. You may notice another similarly in this information, and its called the credit mix. Obtaining different kinds of debt, or having a good credit mix, shows that you can manage different kinds of credit.

Recommended Reading: Is 699 A Good Credit Score

What Is A Good Credit Score In Canada

Your credit score is used by lenders to determine what kind of borrower you are. It can affect your eligibility for certain loans or credit cards as well as the interest rate you get.

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, thats excellent. If your score is between 700 and 780, thats considered a strong score and you shouldnt have too much trouble getting approved with a great rate. When you start hitting 625 and below, your score is getting low and youll start finding it more and more difficult to qualify for a loan.

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

Don’t Miss: Do Payday Loans Ruin Your Credit Rating

How Do You Improve Your Credit Score

Start early. The sooner you establish a reliable repayment history, the better so if you plan to apply for a mortgage in the next few years, or take out a major loan, you should manage your credit health now by ensuring there are no negative information such as a default listed against you for not making your debt obligations and by ensuring that you pay your bills on time.

The way in which you manage your repayments on your credit and loan accounts is one of the top factors in most credit scoring models. If you have been making repayments on your existing accounts on time, this is factored into your score and it will impact your credit score positively.

Your credit score will change over time as your credit behaviour changes e.g. if you apply for and/or take on more debt, default on your account or if your repayment behaviour changes by skipping your monthly account payments.

Lenders subscribe to one or more of the credit reporting bodies, sharing their customers comprehensive credit reporting information for inclusion in your credit report. So, not all credit reporting bodies have the exact same information, it all depends on which credit reporting body your lender shares your credit reporting information with.

Review Your Credit Reports

Dont forget to review your credit reports regularly and dispute any errors you find. Many Americans dont realize that their credit reports contain inaccurate informationyour credit report might list a credit account that actually belongs to someone with a similar name, for exampleand those kinds of errors can drag down your score.

Also Check: Does Walmart Credit Card Report Authorized Users

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

How Long Does It Take To Get To An 850 Credit Score

The No. 1 factor that separates people with an 850 score from those in the high 700s or low 800s is typically the length of their credit history, according to Logan Allec, a certified public accountant who runs the personal finance site Money Done Right.

So, even if, for all practical purposes, you are doing everything perfectly credit-wise … the fact that you simply havent had credit history long enough could prevent you from achieving the elusive 850, Allec said.

Theres no hard evidence that points to exactly how long of a credit history is long enough to achieve an 850 credit score. One 2011 study by SubscriberWise, a company that provides risk management services to a major credit reporting agency, found that among the quarter of a million credit reports from its national database of U.S. member operators, the shortest length of credit history for those who achieved a score of 850 was 17 years. The average length was 30 years. So, if youre hoping for a credit score of 850, patience is the name of the game.

Don’t Miss: Is 702 A Good Credit Score