How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often.

Other Benefits Of Having Perfect Credit

Outside of the lending industry, there are many benefits you can enjoy from maintaining a great credit score:

What Is A Credit Score

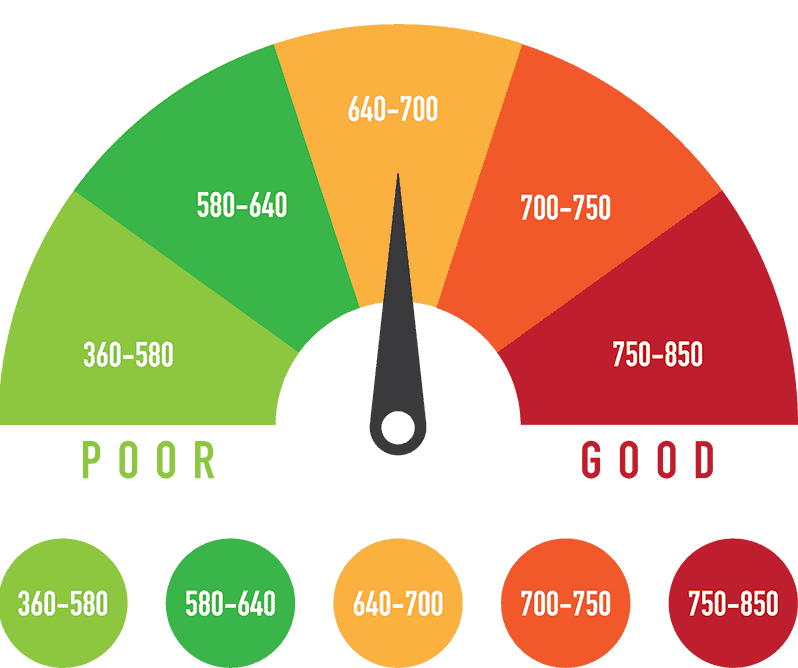

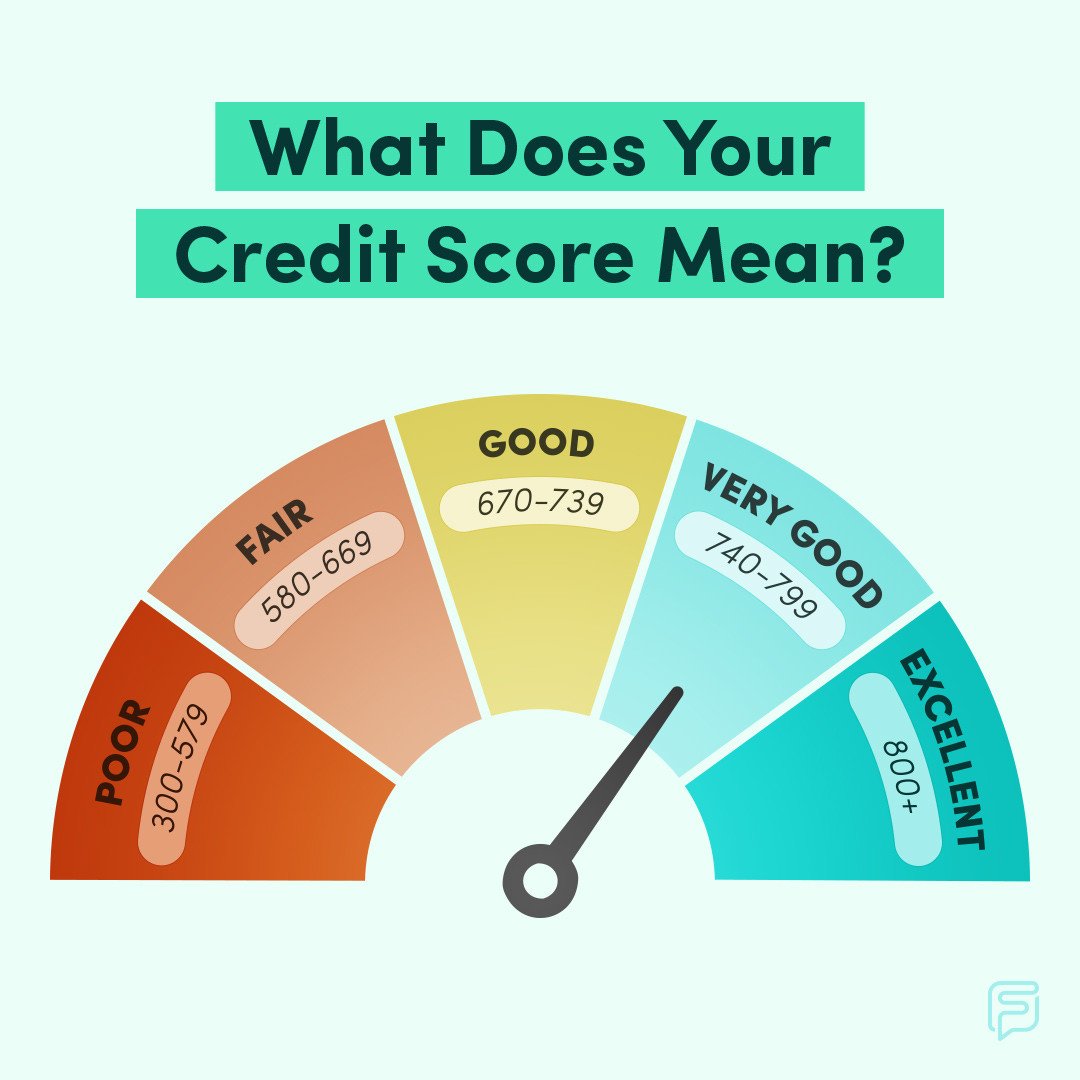

Generally, a credit score ranges from 300 to 850. This three-digit number represents the risk lenders take on when lending money. Overall, a higher score typically indicates a better chance of approval even though many factors are considered when calculating the score. In terms of credit scoring, there are two systems, FICO and VantageScore, with a few key differences between them.

More specifically, credit scores determine your eligibility for loans and your interest rate. The higher your credit score, the better. People with good credit usually qualify for the best loan rates and terms.

You can save a great deal of money in interest by maintaining a good credit score throughout your life. Additionally, it can prevent you from paying some fees. As an example, if you take out a personal loan, a high credit score could help you avoid personal loan origination fees.

On the flip side, those with poor credit scores or minimal credit histories may not meet lenders minimum credit score requirements. In turn, access to cash may be restricted. And, the most likely option is a bad credit personal loan or a loan with a co-signer or co-borrower.

But, thatâs not all. Here are some other perks of having a higher credit score:

Recommended Reading: What Is Considered An Average Credit Score

Benefits Of A Perfect Credit Score

The benefits of a perfect credit score are more or less the same benefits you get from having excellent credit. When you have a perfect credit score, you become eligible for nearly all of todays best credit cards, including premium credit cards like the Chase Sapphire Reserve®, the Citi Prestige® Card and The Platinum Card® from American Express. Your credit card application could still get declined if you fall on the wrong side of something like the Chase 5/24 rule , but in most cases lenders will be eager to loan you money.

Plus, your perfect credit should score you some of the best interest rates on the marketwhether youre applying for a , shopping for a car loan or taking out a mortgage. In fact, if you took out your mortgage before you earned your perfect credit score, you might be able to save a lot of money by refinancing your mortgage and lowering your interest rates.

Having a perfect credit score can also make it easier to rent an apartment since landlords often perform a credit check after you turn in your application. Perfect credit might even help you during a job search if your employer checks your credit history during the interview process.

What People Who Score 800 Or Higher Do

According to FICO, those who achieve ultra-high credit scores pay on time, use credit lightly, have a long credit history and rarely open a new account. Heres what they tend to have in common:

-

A of about 25 years.

-

Owes less than $3,500 on credit cards.

-

Uses only 7% of credit limit.

-

No late payments on credit reports .

You May Like: How To Get Chapter 7 Off Credit Report

What Is The Highest Possible Credit Score

If you live in the United States, you know how important it is to maintain a good credit score. A good FICO credit score is essential for everything from opening a new credit card to buying a home. But what does your credit score mean and whats the highest possible credit score you can have. We will discuss this in much detail below.

Is 804 A Good Credit Score

Your 804 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Recommended Reading: Does Everyone Have A Credit Score

Keep Your Credit Balances Below 30 Percent

Credit reporting agencies look at the ratio of credit used compared to the amount that is available to you. It’s a good idea to keep your credit low, or below 30 percent of your available credit. You may be able to do so by paying off your balances, increasing your credit limit, decreasing spending and opening a new line of credit.

How To Get An 800 Credit Score And Above

You don’t need a perfect credit score, but if you’re looking to achieve an 800 credit score or higher, there are some concrete actions you can start taking now. Keep in mind, though, that it takes a long credit history and no derogatory marks on a credit report to establish and maintain a high credit score.

As you work toward improving your credit, here are some tips to help you get started:

You May Like: Is 641 A Good Credit Score

Which Is Better Transunion Or Experian

TransUnion: The Bottom Line. While both TransUnion and Experian have some similarities, Experian offers a more robust suite of consumer services. It also reveals your FICO Score 8the score most lenders usewhich can give you a better idea of what lenders see than the VantageScore that TransUnion provides.

Have More Housing Options

Many landlords check your credit history when you apply to rent an apartment or house as part of the screening process. A lower score could negatively impact your chances of getting approved. A good score may save you the time and hassle of finding a landlord that will look past the damaged credit. Good credit can also help you get a mortgage on a house.

You May Like: Is 700 A Good Credit Score

What Is The Range Of Credit Scores

Again, in the United States, credit scores range from 300 to 850. Also, there are different ranges of credit scores, here they are:

- Exceptional: 800 to 850

- Fair: 580 to 669

- Poor: Under 580

The higher your credit score, the higher the chance that youll be approved for the credit card or loan that youre applying for. This is so because the higher your score, the less risky lenders and creditor view you because you have a good track record of repaying the money that you borrow. Lenders want to ensure that theyll be able to get their money back. People with low credit scores tend to be more likely to default on their debt. As such, having a good credit score is essential for opening unsecured credit cards, borrowing money to buy or lease a car, and borrowing money to buy a home.

So, as long as you have a good credit score, youre good to go, you do not need the highest credit score possible to qualify for good terms. Although achieving a maximum credit score of 850 is not possible, it is very difficult and you will need decades of credit history to attain this score. Only 1.2% of the U.S population has a perfect credit score of 850.

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Recommended Reading: A Credit Score Is Based In Part On

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

Don’t Miss: Is Noddle Credit Report Any Good

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

Also Check: Does It Hurt To Check Your Credit Score

Pay Your Bills On Time

The frequency of your on-time payments is the factor that influences your scores the most.

Setting up automatic payments on your credit card bills can be a helpful way to avoid forgetting a payment, but make sure you have enough money in your accounts to cover automatic payments. Otherwise, you may have to pay fees.

Keep Your Credit Utilization Low

Maintaining a low credit utilization ratio means you dont want to run up your cards, even if you intend to pay them off at the end of the month. Instead, you might ask the credit issuer to increase your credit limit, or you could apply for a new credit card altogether. Pay attention to how you allocate your monthly spending on a new card to ensure that you are spreading your expenses out evenly.

Youre entitled to receive one free copy of your credit report from Experian, Equifax® and TransUnion® every 12 months. You can order a copy of your report online at AnnualCreditReport.com.

For ongoing monitoring of your credit, you can check your VantageScore® at Rocket Homes.

Don’t Miss: How Long Is A Collection On Your Credit Report

Is The Best Credit Score Possible

The highest possible FICO credit score one can have is 850, and a credit score above 750 is generally regarded as excellent credit. The FICO credit score is the most widely used credit score by lenders to determine creditworthiness. The second most common credit score seen by lenders is the VantageScore 3.0, which also maxes out at 850.

This is the tier we should all strive to reach. Not only do consumers with excellent credit have the highest odds of approval when applying for loans and credit, they also have access to the best terms and rates.

Limit Your Requests For New Credit

Having open accounts is one way to build your credit profile, but you’ll want to limit how many applications you submit. Each application may lead to a hard inquiry, which has the potential to lower your credit score. Inquiries can add up and influence your credit score. Opening new accounts may also decrease your average age of accounts.

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Access To The Best Credit Cards

A good credit score not only gets you the best interest rates on your credit cards, but it also opens you up to some of the best credit cards in the industry. These cards will have superior rewards, great perks and other benefits normal credit card issuers don’t offer.

You can also get access to special offers, including 0% balance transfer credit cards or low-APR introductory offers, like 1.9% for 18 months.

Also Check: Can Experian Boost Hurt Your Credit Score

Verify That Your Credit Report Does Not Contain Any Negative Marks

Its possible that your credit reports contain illegitimate negative marks even if youve never missed a payment. Get your free TransUnion and Equifax credit reports from Credit Karma and make sure they are error-free.

Dispute any inaccurate marks on your report if you find any. In response to a dispute, credit-reporting companies must investigate and fix errors as soon as possible.

Over time, negative marks on your credit reports should have less impact on your scores and eventually disappear.

Does Anyone Have A Perfect Credit Score

There are people in the U.S. who have perfect credit scores, though they’re a fairly small group. According to FICO, just 1.6% of the scorable population has a perfect 850 credit score. “Scorable” means that you have enough credit history to generate a credit score.

So what do people with the highest credit score have in common?

FICO analyzed specific behavioral characteristics of people with perfect credit. The analysis found that people with 850 credit scores:

-

Pay on time. Payment history is the most critical factor in FICO score calculations. People with the highest credit score have no reported history of missed payments, collection accounts, or derogatory information.

-

Have low credit utilization. People who have perfect credit scores don’t avoid using credit entirely. But they do keep their credit utilization very low overall under 10% of their available credit and they dont carry balances.

-

Have an established credit history. Credit age is another important element in FICO score calculations. Someone with the highest credit score typically has an average account age of 30 years.

-

Apply for new credit sparingly. Inquiries for new credit influence 10% of FICO scores, and each one can temporarily knock a few points off your score. Those with perfect credit still apply for credit, though they do so only when it’s necessary.

You May Like: How Long Do Closed Accounts Stay On Your Credit Report