How Long Does Negative Information Stay On Your Credit Report

Most negative information will remain on your credit report for 7 years and some items will remain on your credit report for 10 years. 1 You can limit the damage of derogatory information, even if it’s still on your credit report. Removing a negative entry from your credit report does not mean you are out of debt. Exam period: two years.

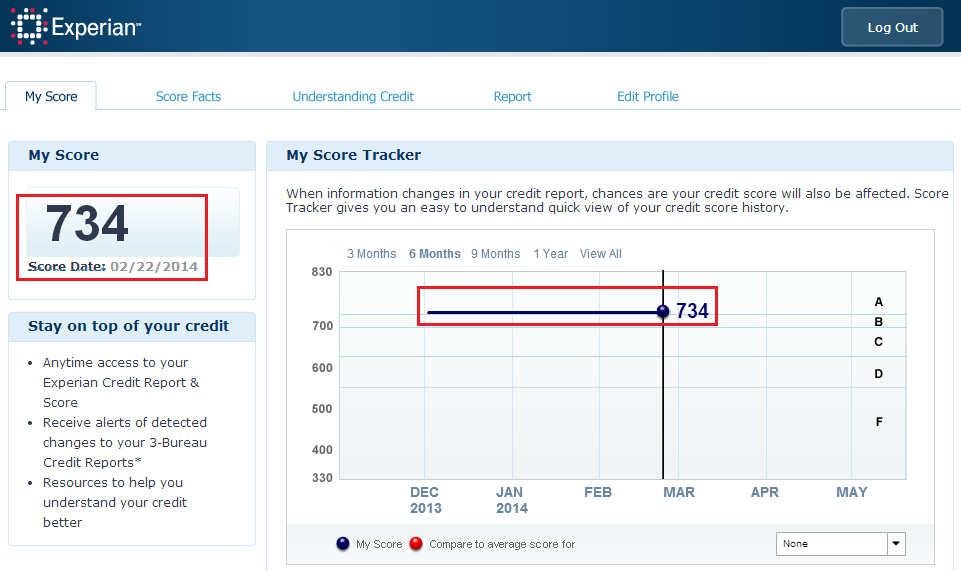

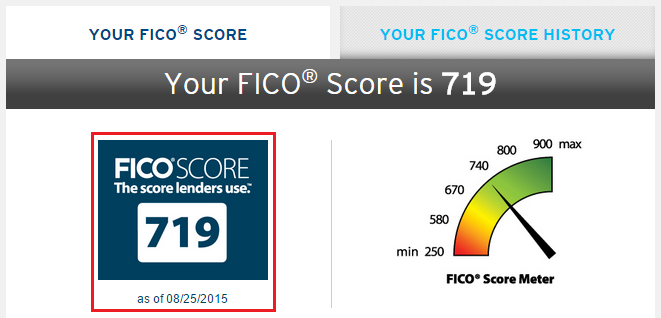

Fico Is The Most Widely

Since there are so many free credit score options out there, you should know that FICO is the most widely used credit score among lenders. In fact, 90% of lenders check FICO Scores rather than any other types of credit scores. So if youre looking to take out a loan anytime soon, we recommend checking your FICO Score.

FICO actually has multiple scoring models, such as FICO Auto Score and FICO Bankcard Score, used in different lending industries. The most popular score across industries is the FICO Score 8, while the FICO Score 9 is the most recently released FICO scoring model.

You can purchase your FICO credit score and report from each credit bureau individually for $19.95 or all three credit bureaus scores and reports for $59.85. Purchasing your credit score through FICO will include your FICO Score 8, as well as other important industry-specific scores.

Why Is There A Difference: Different Algorithms

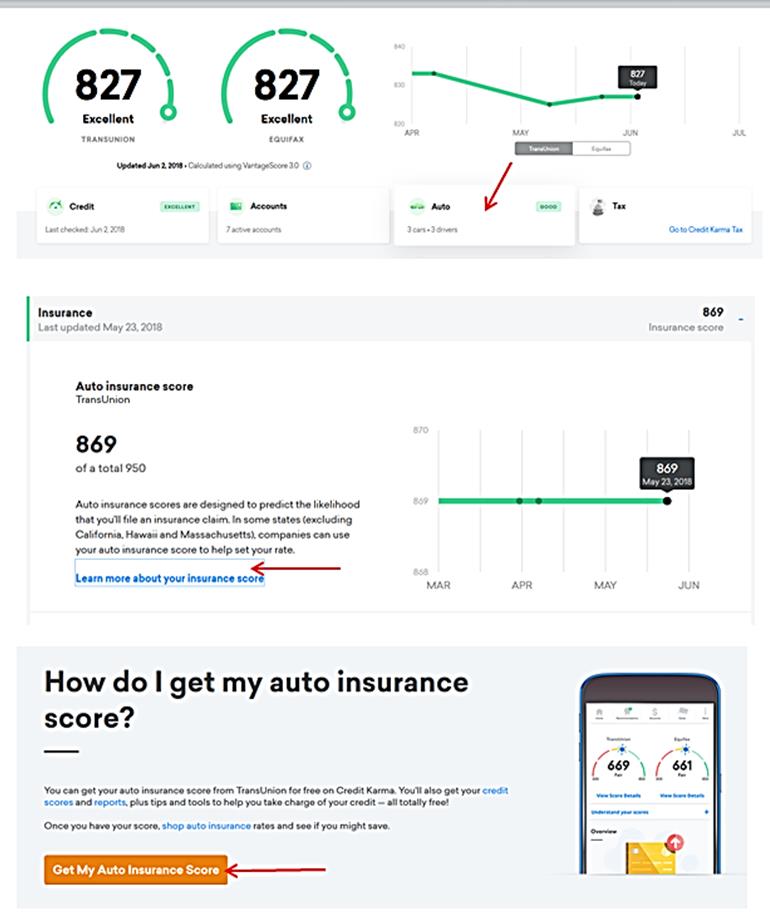

So why is there a big difference between the Transunion vs Equifax scores?

Once you get over the shock factor comparing the two different credit scores, you may wonder why there is such a big difference between the Equifax and Transunion numbers. There are many reasons why the numbers between Equifax and Transunion may differ so much.

One of which is that they use different algorithms to calculate your credit score. Even then with the different algorithms, the variance between the two scores should be between 7-10% or even less. Therefore, there are other reasons why the numbers between Equifax and Transunion are different.

According to Pocket Sense, Equifax separates your credit inquiries to open and closed referrals. The closed inquiries will be less important and therefore they will affect the algorithm less so than the open inquiries. The results will be weighted. Equifax also uses an 81-month history instead 7 years to calculate the score. These are some of the reasons why there is such a big difference between Transunion vs Equifax scores.

Also Check: Paypal Working Capital Log In

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Understanding Your Credit Profile

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process takes a tremendous amount of information into consideration, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use more than one scoring method. For some agencies, the amount owed may have a larger impact on your score than payment history.

You May Like: What Credit Score Does Carmax Use

What Is A Credit Report

Your credit report is a record of your credit activity and history. It includes the names of companies that have extended you credit and/or loans, as well as the credit limits, loan amounts and your payment history. You can think of it as your financial resume it tells the story of your financial health to potential lenders.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Also Check: Paypal Credit Credit Bureau

People You Are Financially Linked To

People whom you have a financial connection with can affect your credit rating, as their financial circumstances could affect your ability to make repayments.

Just living with someone doesnt create a financial connection you need to have a joint loan, mortgage or bank account to create financial links. If youre a guarantor for someone elses loan, their credit rating or score will also affect yours as you are promising to pay their debt if they cannot.

What Is Cibil Transunion Score

Get answers to commonly asked questions related to credit bureaus

CIBIL Limited) has formed a collaboration with Transunion an American company and is known as TransUnion CIBIL Limited. CIBIL TransUnion score relates to the 3-digit credit score provided by TransUnion CIBIL Limited, one of the leading credit bureaus of India. The credit score helps in monitoring and tracking the credit repayment history of an individual.

Additional Reading: What is the meaning of the CIBIL Score

Recommended Reading: Is 626 A Good Credit Score

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

How Your Credit Report Relates To Your Credit Score

As companies that you do business with report payments and other information such as account openings and closings to TransUnion, your score will likely fluctuate. Much of the information in your report is used to calculate your credit score. Your score can change when information in your report changes. Keep in mind there are many scoring models. Each one varies, and lenders may use a score that is different from the one that you get from TransUnion or from another source. Youll likely find that the score you see in one place is different from another.

Small credit score changes may not be cause for concern, but you’ll want to look into an unexpected change. If your score drops, its a good idea to pull your credit reports to identify the reason.

Also Check: When Does Usaa Report To Credit Bureaus

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Also Check: Does Klarna Report To Credit

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Whats The Purpose Of My Credit Report

Your credit report shows your credit history and tells a story of your financial health and responsibility to potential lenders like credit card companies, banks, and often even landlords and cell phone companies. Credit reporting empowers you to participate in the credit economy and have potential offers of credit extended to you.

Recommended Reading: Does Zzounds Report To Credit Bureau

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

How Many Credit Reference Agencies Are There

In the UK there are three main Credit Reference Agencies TransUnion, Equifax and Experian.

They work with building societies, banks, mobile phone companies and other major retailers to help those businesses make a quick and informed decision about whether the person applying for credit is likely to pay it back.

Also Check: 672 Credit Score

Does Checking Your Credit Score Lower It

When I recently applied for another credit card to replace my MBNA World Elite Mastercard, my credit score went down by about 20 points. This is called a hard inquiry. If I applied for multiple credit cards within a short duration, my credit score would have likely gone down lower.

When I check my credit score , it does not affect my credit score. This is called a soft inquiry. Another example of a soft pull is when you get the you are pre-authorized for a so-and-so credit card, apply now!

To me, it is a vanity metric and doesnt matter too much to me since I am not borrowing money any time soon . It was down to about the 700s last year at the end of 2017, but I had just applied for another credit card. It doesnt mean anything though unless you are trying to borrow money. You could have a ton of student loans and a mortgage, and a HELOC and still have an excellent credit score. As long as you are paying off your debt and paying off your credit cards, you will have a good credit score.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Don’t Miss: Les Schwab Credit Score Requirements

What Personal Details Do Not Affect My Credit Score

Now that you have an idea of what goes into your score, it’s good to know what doesn’t factor into your score. A recent survey from the Consumer Federation of America found that out of 1022 adult respondents, 40% believed marriage status influenced credit scores, while 43% thought age also played a part.

Your score is a representation of how you manage financial responsibility, not a testament to you as an individual. Things like age, ethnicity, religion and marital status are excluded in the calculation of your score. Your employer, salary and occupation are likewise not included in the equation.

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Recommended Reading: Will Paypal Credit Report To Credit Bureaus

How To Improve On Your Cibil Transunion Score

Clear all outstanding loans/credit card dues

Avoid any late payment fees on your loan or credit card by paying all outstanding debt on time. This will certainly help you to improve your CIBIL TransUnion score.

Low credit utilization

Always ensure that you do not exceed your credit utilization by more than 30% of the sanctioned credit card limit. Lenders do not prefer borrowers who have a disposition towards high debt, as they consider them a risky option who could default on their credit amount.

Avoid too many debts at one time

Multiple loans or credit cards are a strict no as these hampers your chances of improving your CIBIL TransUnion score. You should always keep a gap between different debt so as to have a good credit score.

Regular checking of CIBIL TransUnion score

Keep regularly checking your credit report and CIBIL TransUnion to ensure that the information is accurate. Any errors should be immediately applied to be rectified.

The Difference Between Fico & Educational Credit Scores

Credit scoring has gotten unnecessarily complicated over the years, but there are many companies in existence today whose entire foundations are based on demystifying credit for regular people who dont write about finances all day .

These companies such as Mint, Credit Sesame, and Quizzle can show you your credit score as well as recommendations for improving your credit, all in easy-to-read laymens terms.

In the finance industry, however, anything that isnt a FICO credit score is generally regarded as an educational credit score. This means their purpose is to help you get a ballpark estimate of where your credit stands and its also why theyre free.

Recommended Reading: Does Opensky Report To Credit Bureaus

Get To Know What Is Credit Score In 1 Minute

Special news: A woman sits in the middle of the road, causing serious traffic congestion. Our special correspondent Snow Suen is reporting live.

TransUnion Smart Tips: Will credit inquiries affect your credit score?When you apply for a mortgage, car loan, tax loan, personal loan or credit card, financial institutions will request your credit report from TransUnion to help determine if you qualify for the loan. Since hard inquiry indicates your application for credit, it may hurt your credit score, while soft inquiry such as checking your own credit report doesnt affect your credit score at all.

Wait, what about my credit? I want my TransUnion Report & Score

Transunion Score Report & Monitoring

A paid subscription to TransUnion Credit Monitoring can help you improve your credit health, manage your data identity and approach credit with confidence.

A paid subscription to TransUnion Credit Monitoring includes key information and tools you can use, all in one place.

Get key information and empowering tools in one place, including:

- VantageScore® 3.0 credit score & TransUnion credit report free refreshes available daily

- Alerts to critical changes to any of your 3-bureau reports

- Educational resources to help you understand your credit report and steps you can take to reach your score goals

- Identity protection, including 1-touch TransUnion & Equifax credit locks, ID theft insurance and instant inquiry alerts

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

Subscription price is $24.95 per month .

You May Like: Removing Repossession From Credit Report

Your Annual Credit Report Is Now Available Weekly And Its Still Free

The three national credit reporting agenciesTransUnion, Experian and Equifaxare required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

In response to the COVID-19 health crisis, TransUnion is pleased to offer you one free weekly credit report online through April 20, 2022 at AnnualCreditReport.com. Reviewing your credit reports regularly helps you ensure the information reported is accurate. It also gives you an opportunity to monitor your account history to combat identity theft.