Ratings Use In Structured Finance

Credit rating agencies play a key role in structured financial transactions such as asset-backed securities , residential mortgage-backed securities , commercial mortgage-backed securities , collateralized debt obligations , “synthetic CDOs“, or derivatives.

Credit ratings for structured finance instruments may be distinguished from ratings for other debt securities in several important ways.

Aside from investors mentioned abovewho are subject to ratings-based constraints in buying securitiessome investors simply prefer that a structured finance product be rated by a credit rating agency. And not all structured finance products receive a credit rating agency rating. Ratings for complicated or risky CDOs are unusual and some issuers create structured products relying solely on internal analytics to assess credit risk.

Subprime mortgage boom and crisis

The Financial Crisis Inquiry Commission has described the Big Three rating agencies as “key players in the process” of mortgage securitization, providing reassurance of the soundness of the securities to money manager investors with “no history in the mortgage business”.

From 2000 to 2007, Moody’s rated nearly 45,000 mortgage-related securities as triple-A. In contrast only six companies in the United States were given that top rating.

Conflict of interest

How Credit Rating Agencies Work

Debtors want investors to have a good idea of how creditworthy their securities are, because most wont buy unrated bonds. This means if it wants to borrow money, a bond issuer pays a credit rating agency to rate their debt.

After the company solicits a bid, the credit rating agency will evaluate the institution as carefully as possible. However, there is no magic formula to determine an institutions credit rating the agency must instead conduct research and subjectively decide whether repayment of the debt is likely or if the bond issuer is more likely to default.

When conducting their assessment, the credit rating agencies look at a number of factors, including the institutions existing level of debt, its character, its financial liquidity, a historical demonstration of its ability and willingness to repay loans, and its financial ability to repay its debt.

Although many of these factors are based on information found on the institutions balance sheet and income statements, others such as an attitude toward repaying debt need to be scrutinized more carefully.

For example, in the 2011 national debt ceiling debacle, S& P downgraded the U.S. sovereign debt rating because it felt the political brinkmanship of the federal government was not consistent with the behavior of a AAA institution.

When they assess an institutions credit rating, the bond rating agencies classify the debt as one of the following:

A Brief History Of Credit Rating Agencies

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

provide retail and institutional investors with information that assists them in determining whether issuers of bonds and other debt instruments and fixed-income securities will be able to meet their obligations.

When they issue letter grades, provide objective analyses and independent assessments of companies and countries that issue such securities. Here is a basic history of how the ratings and the agencies developed in the U.S. and grew to aid investors all over the globe.

Recommended Reading: Is Discover Credit Score Accurate

What Do Credit Reporting Agencies Do

Credit reporting agencies keep track of peoples debt and how well they manage that debt. Each agency compiles its own score, based on data they have collected on the way people use credit. That can include their payment history, current available credit and current amount of credit usage. In summary, their job is to track if someone pays their debts on time and if they borrow responsibly. Typically, the more financially responsible you are high credit limit, low credit utilization and a history of timely payments the better your credit score.

When you want to take out a loan, apply for a credit card or buy a house, lenders will request your credit report from one of the major credit bureaus to assess your creditworthiness. This helps banks and other lenders limit risk. Its also supposed to help you not to borrow more than you can take on.

How Did Credit Reporting Agencies Get Started

The big three credit bureaus, TransUnion, Equifax, and Experian, all trace their ancestry to small, local investigative companies. These early credit bureaus would collect every bit of seemingly relevant information they could about a person, including employment history, marital status, age, race, religion, and testimonials.

They then provided this information to creditors, who used it to determine whether a person was worthy of a loan and how much interest they would be required to pay.

Over time, they grew and merged until the credit reporting system moved from one with many local bureaus to the current system of three major nationwide credit bureaus.

As this happened, the three largest bureaus became so powerful that it became necessary to regulate them. This resulted in the Fair Credit Reporting Act being passed to protect you from their growing power.

Also Check: How To Dispute A Judgment On Credit Report

How Do Credit Reporting Agencies Work

Every month, banks and other creditors send millions of records to the credit reporting agencies, updating them about their borrowers. These reports include whether the borrowers paid the money they owed that month, if they were late making a payment, or if they defaulted on their balance.

They accumulate all the data given to them by the banks and list it on each individuals credit report.

While most information is updated monthly, they usually have a processing time of several weeks before everything is completely up-to-date.

Users Of Credit Ratings

Credit ratings are used by investors, intermediaries such as investment banks, issuers of debt, and businesses and corporations.

- Both institutional and individual investors use credit ratings to assess the risk related to investing in a specific issuance, ideally in the context of their entire portfolio.

- Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk and further derive pricing of debt issues.

- Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as an independent evaluation of their creditworthiness and credit risk associated with their debt issuance. The ratings can, to some extent, provide prospective investors with an idea of the quality of the instrument and what kind of interest rate they should be expecting from it.

- Businesses and corporations that are looking to evaluate the risk involved with a certain counterparty transaction also use credit ratings. They can help entities that are looking to participate in partnerships or ventures with other businesses evaluate the viability of the proposition.

You May Like: What Is A Charge Off On Your Credit Report

There Can Be Conflict Of Interest

The credit rating agencies usually provide ratings at the request of the institutions themselves. Although they sometimes conduct unsolicited evaluations on companies and sell the ratings to investors, the agencies usually are paid by the very companies they are rating.

Obviously, this system can lead to potential conflicts of interest. Because the company pays the rating agency to determine its rating, that agency might be inclined to give the company a more favorable rating to retain its business.

The Department of Justice has investigated the credit rating agencies for their role in the 2008 financial crisis and made regulatory changes to try to reduce these conflicts of interest and prevent another collapse of the financial system like there was during the subprime mortgage crisis.

Congress passed the 2010 Dodd-Frank Act in response to these investigations, which among other financial system rule changes gave regulators more power to oversee credit rating agencies and their activities.

Types Of Credit Ratings

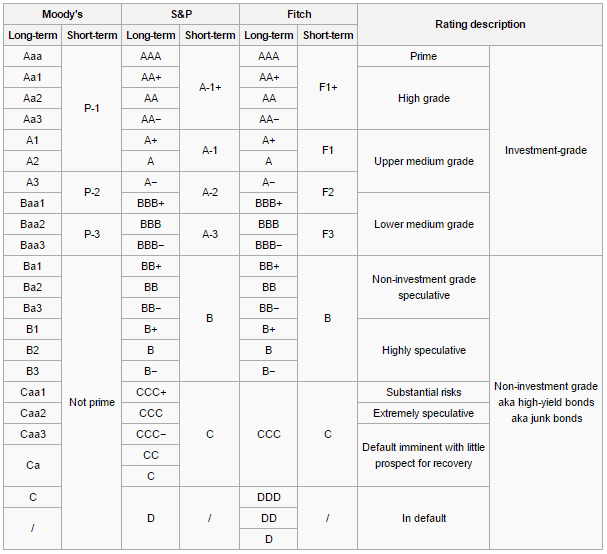

Each credit agency uses its own terminology to determine credit ratings. That said, the notations are strikingly similar among the three credit agencies. Ratings are bracketed into two groups: investment grade and speculative grade.

Recommended Reading: How To Get Creditors To Update Credit Report

Criticism Of Bond Rating Agencies

Since the 2008 , rating agencies have been criticized for not identifying all of the risks that could impact a security’s creditworthiness. In particular, they were blamed for giving high credit ratings to mortgage-backed securities that turned out to be high-risk investments. Investors continue to be concerned about possible conflicts of interest. Bond issuers pay the agencies for the service of providing ratings, and no one wants to pay for a low rating. Because of these and other shortcomings, ratings should not be the only factor investors rely on when assessing the risk of a particular bond investment.

The bond rating agencies are private companies with their own agendas, not independent nonprofit organizations working for investors.

On the other hand, bond rating agencies have also been criticized for causing financial losses by making dubious rating downgrades. Most famously, S& P downgraded the U.S. federal government’s credit rating from AAA to AA+ during the 2011 debt ceiling crisis. In point of fact, the Federal Reserve can always print more money to pay interest. Furthermore, the U.S. government showed no signs of defaulting during the following decade. Nonetheless, stock prices experienced a significant correction in 2011. Some innocent companies ended up paying higher interest on their debts. However, the market showed its lack of confidence in S& P’s downgrade by sending U.S. Treasury bond prices higher.

Issuers Should Evaluate The Need For Obtaining One Or More Credit Ratings And Develop Appropriate Policies And Procedures For Selecting And Managing Credit Rating Agencies

State and local governments often engage one or more credit rating agencies with respect to the issuance of debt. A rating reflects the independent opinion of a particular agency on the credit worthiness of the issuer to make timely payments of principal and interest on the debt. If engaged, a credit rating agency will assign its rating to a particular debt issue and also to all the outstanding debt issued under the same security or credit pledge. In addition, institutional investors are often restricted from purchasing unrated debt or debt below a certain rating threshold. Accordingly, obtaining one or more credit ratings may provide a material benefit to an issuers cost of borrowing.

The Government Finance Officers Association recommends that issuers evaluate the need for obtaining one or more credit ratings and develop appropriate policies and procedures for selecting and managing credit rating agencies.

Evaluating the Need for a Credit Rating

If an issuers outstanding debt already has one or more credit ratings, it is common practice to request a new rating on any subsequent debt issued under the same security or credit pledge. However, some issuers have elected not to have their subsequent debt issues rated. Issuers should consider the following factors in evaluating the need for a credit rating:

Selecting and Managing Credit Rating Agencies

References:

Don’t Miss: Does Opening A New Credit Card Hurt Your Credit Score

The Role Of Credit Ratingagencies In The Financialsystem

Rating agencies are key players in the markets. Indeed, ratings are widely used in the regulatory framework and also contribute to the strategies of many investors.

At the regulatory level, the so-called “standard” approach for applying the solvency ratio is based entirely on the ratings of credit agencies.

To be eligible for central bank refinancing operations, securities must have a minimum rating.

Similarly, the management objectives of many investors are based on ratings: for example, a UCITS may have as one of its objectives to hold 80% of assets issued by issuers rated at least “BBB”. Credit risk monitoring indicators in corporate and investment banks are also based on ratings.

Lastly, ratings determine the risk premium that an issuer seeking to finance itself on the markets will have to pay. This risk premium reflects how much the rate it will have to pay to investors must exceed the rate of issuers rated “triple A” for its securities to be subscribed.

Information Flow In The Credit Rating Process

. Standard & Poor’s rating analysis relies principally on the public information provided by the issuer, including audited financial and other information contained in the issuer’s annual, quarterly and current reports mandated by the U.S. federal securities laws and stock exchange and Nasdaq requirements, as well as press releases and other public disclosures published by the issuer. Meetings with corporate management are typically part of the credit rating process. The purpose of such meetings is to review the company’s key operating and financial plans, management policies and other credit factors that may have an impact on the credit rating issued.

In addition to information provided by the company, Standard & Poor’s makes extensive use of primary and third party databases as a source of additional information. Third party data providers are a source of timely financial information on the domestic insurance and banking industries, the corporate sector and the asset-backed and residential mortgage sectors. Other sources of information include the Federal Deposit Insurance Corporation, the National Association of Insurance Commisioners, the United States Census Bureau, the Institute for Real Estate Management and the Mortgage Bankers’ Association, among others.

Don’t Miss: Does Having A Mortgage Help Credit Score

Conflict Of Interest Between Rating Agencies And Companies

You may wonder if there exists a conflict of interest between rating agencies and the companies paying them for the ratings.

It may seem so, given that Teva is a source of revenue from Moodys. After all, rating agencies earn only from companies they so closely and critically evaluate!

However, for a rating agency, its credibility is of utmost importance.

If Moodys did not downgrade Teva based on the significant increase in debt post the acquisition of the generics business of Allergan, it would have lost the creditors trust. It would not have valued Moodys opinion as we advanced.

Who Evaluates Credit Ratings

A credit agency evaluates the credit rating of a debtor by analyzing the qualitative and quantitative attributes of the entity in question. The information may be sourced from internal information provided by the entity, such as audited financial statements, annual reports, as well as external information such as analyst reports, published news articles, overall industry analysis, and projections.

A credit agency is not involved in the transaction of the deal and, therefore, is deemed to provide an independent and impartial opinion of the credit risk carried by a particular entity seeking to raise money through loans or bond issuance.

Presently, there are three prominent credit agencies that control 85% of the overall ratings market: Moodys Investor Services, Standard and Poors , and Fitch Group. Each agency uses unique, but strikingly similar, rating styles to indicate credit ratings.

Read Also: Does Applying For Credit Card Hurt Credit Score

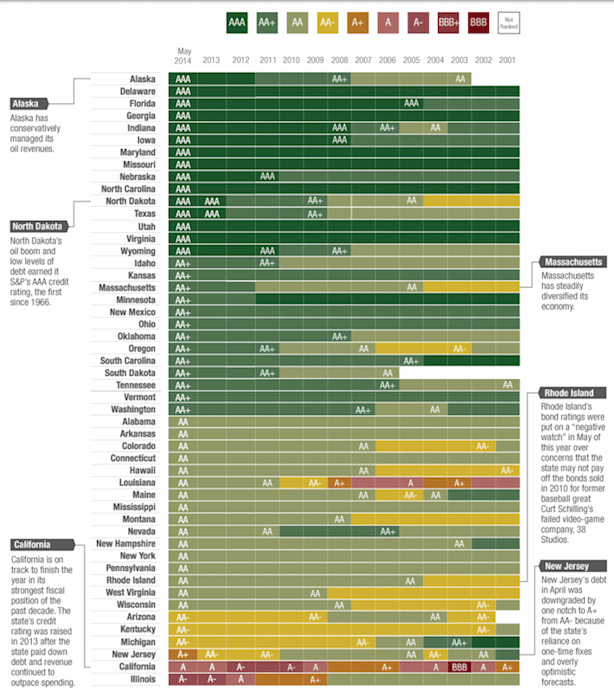

Ratings Use In Sovereign Debt

Credit rating agencies also issue credit ratings for sovereign borrowers, including national governments, states, municipalities, and sovereign-supported international entities. Sovereign borrowers are the largest debt borrowers in many financial markets. Governments from both advanced economies and emerging markets borrow money by issuing government bonds and selling them to private investors, either overseas or domestically. Governments from emerging and developing markets may also choose to borrow from other government and international organizations, such as the World Bank and the International Monetary Fund.

Sovereign credit ratings represent an assessment by a rating agency of a sovereign’s ability and willingness to repay its debt. The rating methodologies used to assess sovereign credit ratings are broadly similar to those used for corporate credit ratings, although the borrower’s willingness to repay receives extra emphasis since national governments may be eligible for debt immunity under international law, thus complicating repayment obligations. In addition, credit assessments reflect not only the long-term perceived default risk, but also short- or immediate-term political and economic developments. Differences in sovereign ratings between agencies may reflect varying qualitative evaluations of the investment environment.

Conflict of interest in assigning sovereign ratings

Importance Of Credit Ratings

Credit rating represents an objectively analyzed assessment of the creditworthiness of the borrower. So, the scorecard affects the amount that companies or governments are charged to borrow money. A downgrade, in other words, pushes down the value of the bonds and raises interest rates. These, in turn, influence the overall investor sentiment concerning the Borrower Company or Country.

If a company perceives to have undergone a downturn in fortunes and its rating is lowered, investors might ask for higher returns to lend to it, thereby judging it to be a riskier bet. Similarly, if the economic and political policies of a country look gloomy, its ratings are downgraded by global credit agencies thereby influencing the flow of investments in that country. On a macroscopic level, these changes affect economic policies of a nation.

An endorsement from a convincing rating agency makes life easier for countries and financial institutions issuing bonds. It basically tells investors a firm has a track record and indicates how likely it is to be able to pay back the money.

Don’t Miss: How To Get Your Real Credit Score

Who Oversees The Credit Reporting Agencies

Since 2012, the Consumer Financial Protection Bureau has been tasked with supervising the largest agencies at a federal level. The CFPB conducts exams to monitor how the credit reporting agencies screen for accuracy, investigate consumer complaints, and other procedures.

If you have a complaint with one of them, you can contact the CFPB, the FTC, and your state attorney general. It may seem like many steps, but its best to cover your bases and get as many regulators involved as possible if theres any potential wrongdoing.