Which Credit Bureau Report Or Score Is Most Accurate

If youve ever applied for a loan, apartment rental or even a job, you might have seen the 3-digit number that is your credit score. And if that number changes from day to day, or application to application, chances are youre wondering why.

What many people dont realize, however, is that there are multiple credit scores. So, if youre wondering which credit bureau, report or score is the most accurate, heres what you need to know.

How Often Should You Check Your Credit Score

You should check your score least once a month. Your credit score changes when information on your gets updated, which can vary from person to person. Generally, however, you can expect a score update at least once a month and even more often if you have multiple credit products in your name. One way to be proactive about changes in your credit score is to sign up for a service that will alert you in real time if there is any unusual activity with your credit.

Should I Use Credit Karma

Many folks are afraid to use Credit Karma because it requires things like a social security number to sign up. This is totally personal preference if someone is comfortable with giving out personal information in exchange for a convenient way to track their credit score. Without a social security number, it would be impossible for anyone to know what your credit history is like.

Many folks who are considering a home purchase will be giving their social security number to their mortgage lender to run their credit score. When the mortgage lender runs the credit score it will count as a hard inquiry on your credit report. When you give Credit Karma your social security it will not count as a hard inquiry as you are only using the Credit Karma service to gather information.

For all home buyers monitoring your credit is essential to your ability to buy a home. First-time homebuyers especially since they likely have not had the opportunity to build up as much of credit history as someone who is older.

At the end of the day, if you’re looking to monitor your credit score you should sign up for Credit Karma.

You May Like: How Can You Improve Your Credit Score

Is Fico Score Higher Than Transunion

It’s considered to be one of the more balanced bureaus since it assigns weight fairly evenly across the standard risk categories. TransUnion ranges from a low of 300 to a high of 850. … FICO scoring is more holistic, which allows more Americans to qualify for loans and mortgages than most traditional bureaus’ scores.

Why Is My Experian Score So Much Lower Than Credit Karma

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don’t all receive the same information about your credit accounts.

Don’t Miss: How To Close Accounts On Credit Report

Keep An Eye On Your Credit

Your real FICO® Score can be had for free in several ways, but if you want to check multiple FICO® Scores, you’ll generally need to opt for a paid service. You can look for services that come with more than just your credit scores, such as Experian CreditWorks Premium. Experian’s service also includes free credit report and score monitoring with notifications if there are any suspicious changes. Additionally, you get a wide-range of identity theft monitoring and protection services, including dark web surveillance and up to $1 million in identity theft insurance.

You can also match your score checking or monitoring with your current needs. A free score tracking service can help you keep an eye on one of your FICO® Scores and give you a sense of if your credit is improving. But a paid service may make more sense if you want identity theft protection, or if you’re planning to buy a home and want to check the FICO® Scores that mortgage lenders commonly use.

Does Credit Karma Use Fico

No. However, the credit score Credit Karma provides will be similar to your FICO score. The scores and credit report information on Credit Karma come from TransUnion and Equifax, two of the three major credit bureaus. Your scores can be refreshed as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time.

Recommended Reading: Does Healthcare Finance Direct Report To Credit Bureaus

Which Credit Score Is More Accurate Equifax Or Transunion

Neither score is more or less accurate than the other they’re only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a fair score from TransUnion is typically fair across the board.

Great If Looking For A House

We are in process of buying a home and this app gave us the exact info we needed across all three bureaus. Was able to clean up some negative stuff and they updated any changed info along the way. One of my scores does not reflect the actual since changes on my end and I think the subscription only checks for an update once a month, but for the most part if something major changes the bureaus usually report it an its takes effect almost immediately. Happy with this app an service and yes I do recommend if your serious about fixing your credit or buying a house or car

Also Check: How Long To Raise Credit Score 100 Points

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Theres Far More Than Just One Credit Score

There are dozens of different credit scores used today. Not only are there three major credit bureaus , but each one has a database of consumer information and a scoring system. In the United States, every consumer has at least 60 different credit scores, though most never use nearly that many.

One of the most common scoring systems, FICO, has several credit scores of its own, including:

- General-purpose score

- NextGen risk score

- Small Business Scoring Service

The VantageScore, introduced by the credit bureaus in 2006, is another popular credit score. Along with this, certain lenders rely on other credit scores for additional insight into peoples financial habits and creditworthiness. Non-VantageScore and non-FICO scores include:

- PRBC alternative credit score

- ChexSystems Consumer Score

A persons credit score plays a major role in many facets of society. It can determine whether a lender or creditor will lend to them. Plus, it can help a prospective landlord decide whether to lease to them and what deposit to demand. It can even come into play in certain employers hiring decisions.

Some people view certain credit scores as more or less accurate than others. However, this primarily depends on what its used for and the information included. Overall, credit scores serve one purpose, and that is to determine a persons credit risk and track their credit history.

Also Check: When Will Chapter 7 Be Removed From Credit Report

Similarities Between Fico And Vantage Score

Both FICO and VantageScore have the same straightforward goal: To predict the likelihood that a consumer will default on a debt sometime in the next 24 months.

And that’s why you shouldn’t get too worried about the differences. Every one of your credit scores should be in the same general range, but they’ll never be identical.

Different lenders use different scores. Because you cant predict which score they will choose, it may not matter which score you rely onFICO or VantageScore. There are many other scoring models and no practical way for you to keep track of or access all of them.

You don’t have just one credit score. You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as “good” or “very good.”

Key Differences Between Fico And Vantage Score

The differences between the FICO score and Vantage Score are relatively minor:

- VantageScore is designed to keep track of new or infrequent credit users. This can be an advantage for young adults, or to anyone who for any reason has dropped off the consumer radar for a time.

- When you apply for a new loan, the lender checks your credit rating. Consumer protection law requires that multiple applications are treated as one query so that you don’t get dinged multiple times for comparison shopping. Because the two rivals handle these queries a little differently, VantageScore may ding you a little more than FICO will.

- Both compile a credit score at the moment it is requested. The FICO system relies on current information as it is reported to the credit bureaus. The VantageScore system incorporates information on your spending behavior over the past two years.

You May Like: What Credit Score Do Banks Use

Which Credit Score Should You Check

When you check your credit, you’ll likely receive either a FICO® or VantageScore credit score. Your score will depend on which scoring model is being used and which credit report is being analyzed .

The type of score might not matter if you’re looking for an estimate of where you stand or want to track whether your score is going up or down. Fortunately, credit scores tend to move in a similar direction as they all analyze your credit reports with the same general goal in mind.

Knowing at least one of your general-use FICO® Scores, such as FICO® Score 8, could be helpful as creditors often use a FICO® Score when evaluating new credit applications. Also, many mortgage lenders use the earlier FICO® models mentioned above to comply with federal regulations. Knowing those three FICO® Scores could be helpful if you’re shopping for a mortgage.

Why Is My Credit Score Different From My Fico Score

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference. … So, make sure the credit scores you are comparing are actual FICO Scores. The FICO scores should be accessed at the same time.

Don’t Miss: How To Access Credit Report Again

Which Credit Score Will A Lender Check When You Apply For A Loan

Although VantageScore credit scores have been around for about 15 years, the FICO Score is still the preferred choice of most lenders. In the U.S., lenders use FICO Scores in 90% of lending decisions. If you apply for a loan, credit card or some other type of financing, the lender will probably check your FICO Score when it reviews your application.

But that doesnt mean you should ignore VantageScore brand credit scores. It doesnt mean VantageScore credit scores are fake either, as some may claim.

Nine out of the 10 biggest banks in the U.S use VantageScore credit scores for some purpose. Plus, lenders and consumers used some 12.3 billion VantageScore credit scores in a 12 month period between 2018 and 2019.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: What Is The Top Credit Score

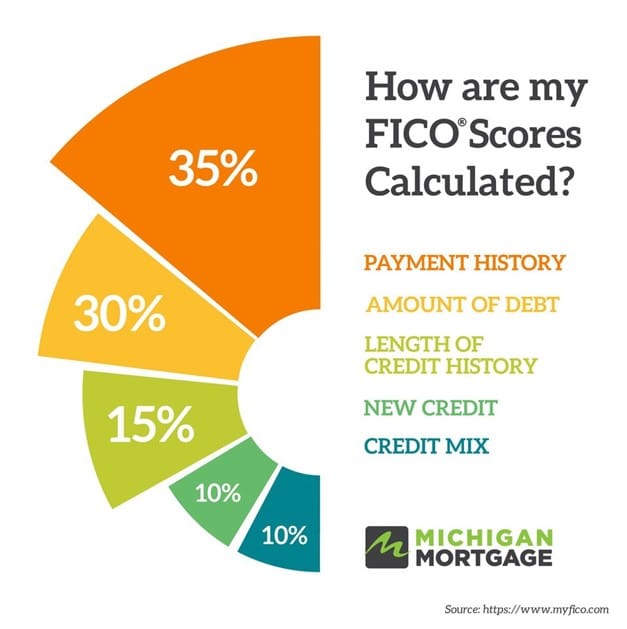

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Recommended Reading: How To Report Positive Credit To Credit Bureau

Why Is Credit Karma Score Higher Than Experian

Why your Credit Karma credit score differs This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. … Your VantageScore® 3.0 on Credit Karma will likely be different from your FICO Score that lenders often use.

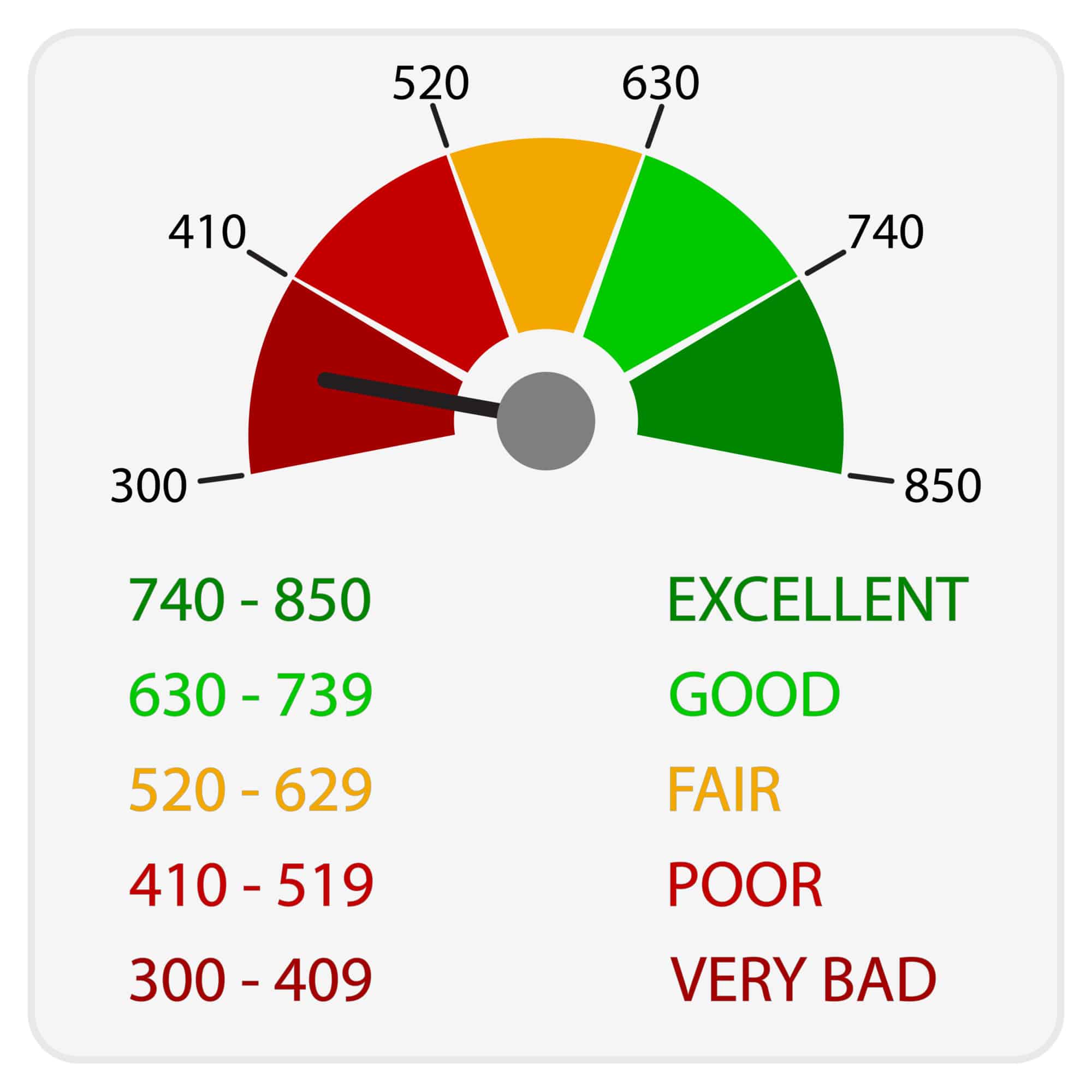

Is 650 Good Enough To Buy A House

Any score between 700 and 749 is typically deemed “good,” while scores from 650 to 700 are “fair.” Excellent scores are usually those over 750. While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates and loan options.

Don’t Miss: Does Carvana Report To Credit Bureaus

Bias In Credit Scoring

Over the past months, the use of certain alternative data in credit scoring has sparked pushback from policy leaders. These events sparked the introduction of a recent bill in the House that calls for the Consumer Financial Protection Bureau to assess the use of educational data by consumer lenders in their underwriting processes, publicize that assessment, and report its findings and recommendations for addressing potential disparities to Congress.

In contrast to some fintech AI models, the FICO Score has complied with fair-lending requirements for decades. Fair-lending regulators have found that the FICO Score shows no prediction bias against protected classes. In comparing persons with the same likelihood of repayment or default, the model did not score individuals in these protected groups lower than individuals in the general population. In an environment where racial equity concerns carry a high focus, credit ratings that prove fair over across decades ought to be the gold standard.

How Many Credit Scores Are There

There are many. And knowing which credit score is the most accurate can make a big difference when you’re applying for credit. On its face, a credit score is merely a numerical representation of the data in your credit reports held by the three major credit bureaus, TransUnion, Experian, and Equifax. So, that’s at least three potential credit scores right there.

Plus, there are two main credit scoring models that those credit bureaus use FICO and VantageScore. Not to mention the credit scores that are available for educational purposes only.

Different creditors might report your activity to one or all three of these bureaus. This is another reason your credit score could vary among different providers.

Further, each company provides a credit score using its own formulas to calculate scores using the data in your credit reports.

It gets worse:

Each score can emphasize different aspects of your credit behavior.

For example:

One credit scoring company might give more weight to late payments, while another might focus more on your auto loan history or a mixture of credit.

Essentially, this means that your score can not only be confusing but also that there is no such thing as an “accurate” credit score.

Each formula uses factual information from your credit history. However, each weighs and calculates that information differently.

Now what?

Also Check: Can You Remove Closed Accounts From Credit Report

Is 722 A Good Fico Score

A 722 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

What Are The Fico Score Ranges

The FICO scores run as follows:

- 800 to 850: Exceptional

- 580 to 669: Fair

- 300 to 579: Poor

The higher your score, the more likely you are to be approved for higher loan values, lower interest rates, and more premium credit cards.

But thats not to say you need to be in the 800s! You can still qualify for many loans and rewarding credit cards with a score thats very good or even just good.

And some lenders are starting to consider factors other than your FICO score, such as rent payment history and steady employment. Thats because the credit score process can be discriminatory against those who are new graduates, recent immigrants, or who havent been able to build a credit history for some other reason.

Read more:Best personal loans for bad credit

Don’t Miss: Is 724 A Good Credit Score