Why Do Canadians Want To Know How Often Their Credit Report And Scores Are Updated

There are a number of different reasons why Canadians want to know how often their credit report and scores are updated. One of the more common reasons is that they are expecting significant changes to their credit reports which in turn may affect their credit scores.

For example, if someone with bad credit has been paying their bills on time, reducing their debt levels, and has overall been actively using credit responsibility, theres a possibility that it will positively impact their credit scores. Understanding how often their credit is updated will allow them to better track the changes in their report and scores. Moreover, if they plan on applying for a loan, they might be interested in finding out when their credit report updates, so they can apply for the loan after their report has been updated.

Your Credit Scores Can Update Whenever The Information In Your Credit Reports Changes

Your credit scores are based on the information in your credit reports. And your credit scoresâlike your reportsâcan change over time. But how often do they change?

The short answer: It depends. Read on to learn about when your credit scores might change and to get tips for improving your scores and monitoring your credit.

Monitor Your Credit For Free With Creditwise From Capital One

Whether youâre trying to maintain your credit or improve your credit scores, itâs important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standâand how much progress youâve made.

is one way you can monitor your credit. With CreditWise, you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwithout hurting your score. And with the CreditWise Simulator, you can explore the potential impact of your financial decisions before you even make them.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Don’t Miss: How To Raise My Credit Score Fast

How To Get A Rapid Rescore

A rapid rescore gives lenders the most up-to-date version of your credit report. Mortgage lenders often request rapid rescores if youre trying to raise your credit score a few points to get approved for a loan or to qualify for a better interest rate.

Rapid rescore works when you have proof of a credit report error or youre able to pay off an account right away and need the deleted error or paid-off balance to change your credit report and score immediately.

How Often Do Credit Reports Update

Most creditors report to credit bureaus monthly. However, they report data at different times throughout the month, and they may report to only one or two credit bureaus instead of all three.

The credit bureaus add new information once its reported to them, according to TransUnion. That means your reports are continually evolving.

Once your credit report updates, the new data will be reflected in your credit score next time it’s calculated.

Recommended Reading: How Does A Credit Rating Relate To Shopping For Insurance

How Do Credit Card Balances Affect Me

High credit card balances can negatively impact credit scores because lenders view them as a sign of risk.

Your utilization rate, which is calculated by taking the total of all your and dividing that number by the total of all your credit card limits, is the second most important factor in your FICO® Scores. Most credit experts recommend keeping your utilization rate, or balance-to-limit ratio, below 30%. Individuals with the best scores tend to have utilization rates below 10%.

When Do Credit Card Issuers And Banks Report Data To The Credit Bureaus

Some small loan providers do not report your credit score to the top three credit bureaus.

Its not the obligation of a credit provider to send your reports to the credit bureaus. Rather, they do it since they use the existing credit scores to check whether you qualify for credit.

Most credit providers send your credit information to the bureaus. Its not the question of do they? But when?

- While some send it after every 30 days other lenders take up to 45 days to send your report.

- Since the credit bureaus dont give the creditors a time frame for providing the credit reports, each company sends the updated information on there own schedule.

Therefore, you dont have a specific day of which your credit score can change as it will depend on different schedules of lenders. It can change in the next hour, day, week or month since the bureau will be receiving information about you in no distinct times.

Also, note that the lenders rarely report to the three credit bureaus at the same time. That is, they may send your information to TransUnion in this week than in the following week, then theyll report to Experian and vice versa. And the new information will affect your credit score either lowering it, raising it or making it remain constant.

Also Check: How To Remove Something Off My Credit Report

How Often Does Your Credit Score Update

At a glance

Your credit score may update on a weekly or even daily basis. It depends on several factors.

Instantly access your report and discover your credit score from all three credit bureaus.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

If youre trying to build your credit, you probably already know that it takes time and patience. Still, it can be frustrating to do everything right, check your credit score, and see that it hasnt changed at all.

In general, how frequently your score is updated depends on your creditors. However, in certain circumstances, there are things you can do to get your score updated more quickly.

How Often Is My Credit Report Updated

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Read Also: Does Cancelling A Credit Card Affect Your Credit Rating

What Is The Credit Score Update Process

Each month, your creditors provide new information to credit bureaus about your credit usage and financial activities. The credit bureaus take that information and update your credit report, which causes your credit score to update. The information that creditors share with credit bureaus includes:

-

Whether you made on-time payments towards your credit accounts

-

Your current credit balances compared to your credit limits

-

How long your credit accounts have been open

-

Whether youâve opened any new types of credit accounts

-

Whether you applied for any new loans or credit accounts

Whenever information is added to your credit report, it can impact your credit score. This is because the main factors that are used to calculate your credit score are:

How Often Does Your Credit Report Get Updated

Your is a record of your payment history of your financial accounts.

Banks, credit card companies, auto lenders and mortgage companies that you do business with report your payment history monthly to one of more of the three main credit reporting companies, Experian, Equifax and TransUnion. However, all these companies may not report data at the same time in the month.

Recommended Reading: What’s The Difference Between Fico And Credit Score

Problems With Credit Reporting

Heres where it gets complicated. Some businesses only provide information to the CRAs when an account is past due or has been written off and/or turned over to a collection agency. Creditors will write off a debt when it is deemed uncollectible.

Some of these creditors include:

- Utility companies

- Doctors and hospitals

- Lawyers and other professionals.

The three reporting agencies are making increasing efforts to gather monthly information from utility companies, phone companies and local retailers. That increases the amount of data in an individuals credit profile, which cuts down on the guesswork.

So What Does That Mean

What that means is that your credit report can be constantly changing, especially if you have a lot of accounts. And since your credit report can change often, so can your since scores are based off the data from your credit report.

Let’s put this into a real world example. Let’s say you had a really rough month with your kitchen appliances and they all broke beyond repair at the same time.

You decide to buy new appliances for $7,000, and pay with an existing credit card account with a $10,000 limit. Also hypothetically, say this particular credit card company reports data to the credit reporting companies immediately after you make your purchase. For a period of time, your account will have a high credit utilization ratio, meaning that your spending is close to the credit limit.

Of course, once you start paying down the balance on the account, your will decrease, and your credit scores will reflect that positively.

Does Having Your Credit Card Declined Hurt Your Credit?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Resources

Recommended Reading: Is Using Your Overdraft Bad For Credit Rating

Why Is Wells Fargo Providing Access To A Fico Score 9 Version

Wells Fargo is providing you with access to your FICO® Score 9, which is one of the newest versions available. This score is for educational purposes and provided to you as a benefit to help support your understanding of FICO® Credit Scores and how theyre calculated. It may or may not be the score Wells Fargo uses to make credit decisions.

Why Does Transunion Update Slower Than Equifax

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, its possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

Recommended Reading: Do School Loans Affect Credit Score

Also Check: Is 816 A Good Credit Score

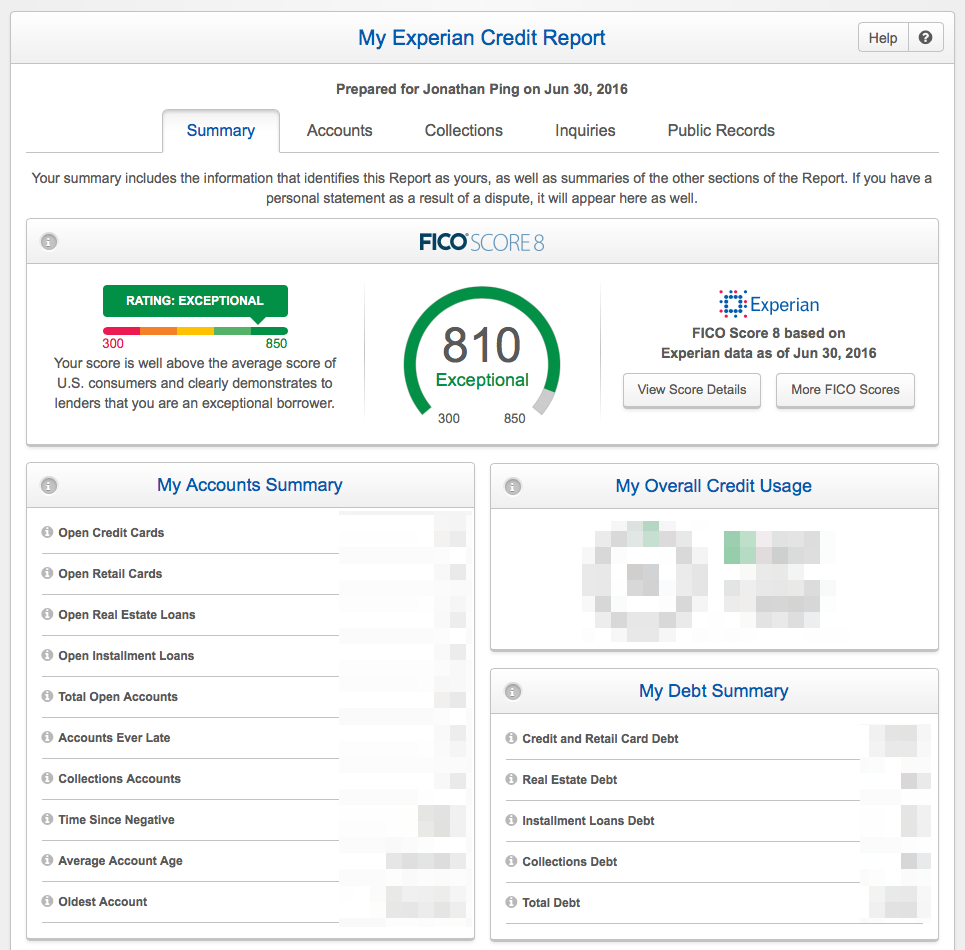

Check Your Credit Report Frequently

Checking your credit scores and credit reports frequently can help you stay on top of your accounts and ensure that the information reported is up to date.

Ordinarily, you are entitled to a free credit report annually from each of the three major credit reporting companies. Through April 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

You can also request a free and free credit report directly from Experian at any time. When you receive your credit score from Experian, you will also receive a list of the top risk factors currently impacting your score. These factors can help give insight into changes you can make to help improve your credit score going forward.

Thanks for asking.

Jennifer White, Consumer Education Specialist

Join our live video chat every Tuesday and Thursday at 2:30 p.m. ET on Periscope. Rod Griffin, Director of Public Education at Experian, is available to answer your questions live.

If Your Score Isnt Increasing It Could Actually Be Costing You Money

How? Your credit score directly affects the interest rates youre eligible for. Yet another perk of having great credit, is that when you apply for a credit card, youll be offered a much better interest rate than someone with poor credit. This can have a huge impact on your financial stability, lowering your overall cost of borrowing significantly.

Also Check: Why Credit Rating Is Required

How Long You’ve Been Trying To Improve Your Credit Score

Although time is of the essence to improve payment history, there are some very powerful moves you can make to see noticeable signs of improvement within weeks:

- Checking your credit report for errors and disputing them

- Paying down a balance on a credit card to zero

- Improving your utilization ratio by paying all balances down to less than 30% of credit limit

How Often Does My Credit Score Change

Your credit score is calculated by algorithms that analyse the information documented on your credit report. Therefore, you can expect your credit score to change when an update has been made to your credit report.

As mentioned previously, you should expect your credit report to update at least once a month, which means your credit score will automatically adjust depending on the new information received.

You May Like: What Is Syncb Ntwk On Credit Report

What Should I Do If My Name Has Changed

There can be multiple reasons you might want to change your name. Your name might change after a marriage or a divorce or there might be a spelling mistake in your documents that you wish to get corrected or there might be some other personal reason. Whatever the reason, it is very important to inform your banking partners about the change in your name.

While in most cases, once the name is updated in the records of your lenders, the same is also reflected in your CIBIL report automatically, it is always a good idea to also inform CIBIL about the name change.

Changes To Your Credit Mix

Lenders like to see that you can handle different types of credit.

If you were recently approved for a new revolving account or personal loan, you might notice a positive impact on your credit.

Balancing your credit card bills with a mortgage or car payment can help you demonstrate a healthy credit mix. But remember: We dont recommend opening a new account only to improve your credit mix.

Read Also: What Is Rentgrow On My Credit Report

Check Your Credit Report

The bottom line to it all is information. To pick up on problems and learn whats going well, you must see your credit report. Every consumer can do that annually at no cost make your request at www.AnnualCreditReport.com but Griffin said fewer than half of the eligible people take advantage of that.

Thats a huge concern, Griffin said. We want people to be educated and know their course. You cant do anything about your credit report unless you know whats in it. Its all part of the education process. Information is powerful and people need to know how to get the right information.

6 Minute Read

How To Check A Credit Score

The free annual credit reports do not include your credit score, or more accurately, scoresyour credit score from each of the credit bureaus will vary based on the information each has. Lenders also use slightly different credit scores for different kinds of loans.

How to get your credit scores then? Here are a few ways:

Buy a score directly from the credit reporting companies or from myfico.com. Look at a loan statement or a credit card statement. Some financial companies provide credit scores for customers as a perk. Use a credit score checker. Some services give consumers access to their credit scores but charge for premium services like checking a score daily. Other sites may require that you sign up for a credit monitoring service with a monthly subscription fee in order to get your free score. Sign up for an app like SoFi Relay, which provides free weekly updates on your credit score and tracks all of your money in one place.

When signing up for credit score checking websites, its important for consumers to look at the terms of service and ensure theyre not being charged for premium services they do not want.

Also, its best to avoid an educational credit score vs. a score that a lender would use. For some, there will be a meaningful difference, the Consumer Financial Protection Bureau says.

Recommended: Does Checking Your Credit Score Lower Your Rating?

Read Also: What Is A Business Credit Score