Do Banks Pull Your Credit Report Before Opening An Account

Most banks only pull your ChexSystems or Early Warning Services report. Its pretty rare for a bank to pull your credit reports from the three major credit bureaus to open a checking account.

Before you apply for a checking account, you can ask the bank or check their website. Most are transparent with what they require for you to open a bank account. If you come across a bank that checks your credit and you dont think youll qualify, there are many other banks to choose from.

See also:Banks That Dont Use ChexSystems

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Recommended Reading: How To Remove Credit Inquiries From Credit Report

Why Is My Experian Score Lower

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

What Is A Good Credit Score

If youâre just looking for a quick answer, itâs probably best to start with popular credit-scoring companies FICO® and VantageScore®, which issue two of the many different types of credit scores.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them, and what you can do to monitor and improve yours.

Key Takeaways

- People have more than one credit score, and scores can vary based on how theyâre calculated, when theyâre calculated and what information is used to calculate them.

- FICO and VantageScore are two popular credit-scoring companies.

- Scores from FICO and VantageScore typically range from 300 to 850.

- FICO says good credit scores fall between 670 and 739 VantageScore says good scores fall between 661 and 780.

You May Like: Does Apple Card Show Up On Credit Report

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

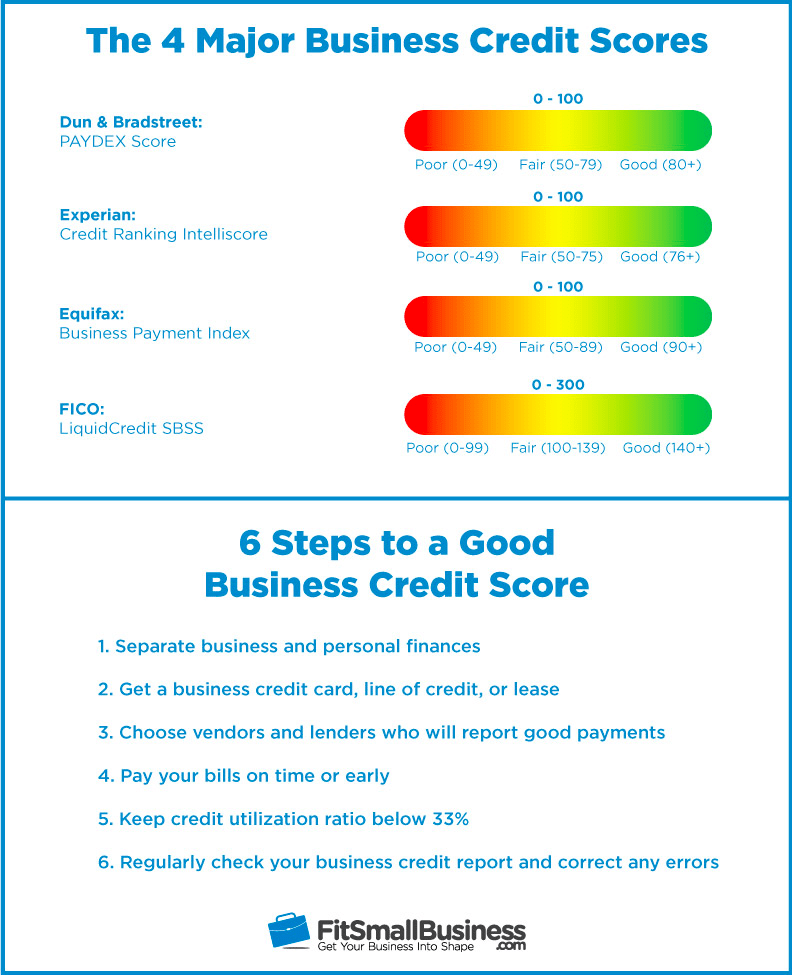

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

Strengthen Your Credit Score

Improve your payment history by paying all your bills consistently and on time. Carefully consider any offers from creditors to “reduce” or “skip” payments before accepting

Get current on delinquent accounts to reduce your outstanding debt and to avoid having delinquencies reported. Keep balances low on credit cards

Build on your credit history. The longer you’ve had credit, particularly if it’s with the same credit issuers, the better for your credit score

Think twice before applying for too much new credit. Don’t open accounts you don’t need, as inquiries made on your credit report could lower your score

Diversify your credit. A large number of revolving credit accounts with open balances, for example, can result in a lower score than a combination of mortgage, installment and revolving credit balances

Recommended Reading: How Can You Build Your Credit Score

Which Is Better Experian Or Cibil

However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL. In short, if you own a business in India, then the CIBIL score can do more for your business when you need to get a loan from a bank, than Experian.

Get A Cosigner For A Credit Card Or Loan Or Become An Authorised User

If you cant get a credit builder loan, credit builder card or secured credit card then your next bet to help you improve your credit score will be to get yourself a cosigner on a credit card or loan.

You should really only do this if you are likely to repay your credit cards or loans on time and in full every month.

If you fail to make your credit card repayments on time then this may affect your co signers credit score too. If you make these repayments on time your credit score will rise and the payments will be registered on your credit file for at least 6 years.

Getting a cosigner on a credit card or loan creates a financial relationship between yourselves. This means any negative behaviour from them might affect your credit score negatively and vice versa.

A cosigner essentially allows you to qualify for credit and in some cases cheaper credit. A cosigner will also be legally responsible for any debt owed on the account if you default.

Another way to help improve your credit score is by becoming an authorised user on someone elses credit card.

The difference between authorised users and cosigners isnt that much. Becoming an authorised user on someone elses credit card will help you improve your credit score if the main card holder makes all their repayments in full and on time each month as well as keeping their credit balance low.

some credit card companies might not take you into account and may not collect this data and hence report it on your credit report.

Read Also: What Is Considered A Poor Credit Score

Why Your Credit Score Matters To Lenders

Your credit score helps lenders determine your ability or inability to repay the mortgage. As part of your scores, they examine your debt-to-income ratio. It is the percentage of monthly debt obligations relative to how much you make.

To illustrate, if you earn $4,000 per month, and have $1,250 in credit card, loans, housing, and other payments, your ratio would be 31 percent. The ideal ratio is less than 36 percent, though some lenders will accept more with a higher down payment.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

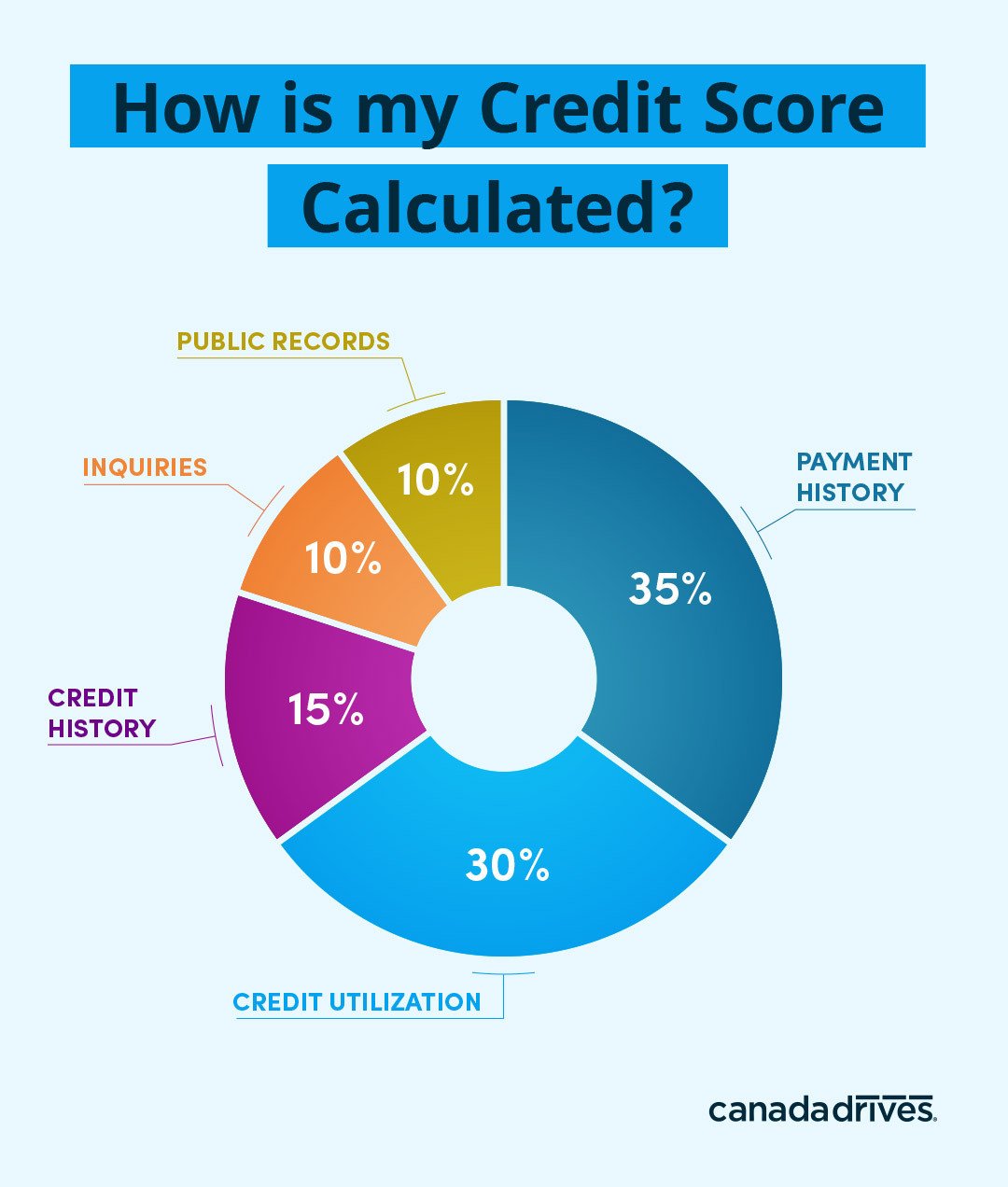

Which Credit Scores Do Banks Use

Many banks provide your FICO® Score, which is commonly used to make lending decisions, but banks can show you whatever credit score they prefer to use. Quite a few versions of the FICO® Score exist. If this is the score your bank provides, it will most likely show you your FICO® Score 8 or 9 because they’re used by the widest variety of lenders.

Another commonly used credit score is VantageScore®, which was created cooperatively by the three major credit reporting bureaus . It, too, comes in several versions.

FICO® Scores and VantageScores are just two types of credit scores that can appear on your app, though, so check with your bank to find out which it uses. There are many dozens of credit scoring models, including those used for only for educational purposes. Your bank may opt for any of them, including the one it produces and uses for its lending decisions.

Don’t Miss: How To Make Your Credit Score Go Up Fast

What Affects Your Credit Score

The FICO Score and VantageScore credit models take the same general factors into account when calculating your credit score, although they weigh them slightly differently.

- Payment history: Paying your bills on time is the single biggest factor in your credit score. In the FICO Score model, this comprises up to 35% of your credit score.

- The amount of credit you use as a percentage of your available credit is another important factor. To maintain a good credit score, you shouldnt use more than 30% of your credit limits. If you have a credit card with a limit of $3,000, that means your maximum balance should be $1,000. Credit utilization accounts for 30% of your FICO Score.

- Length of credit history: The longer youve had credit, the more time youve had to prove you can make your payments on time. The length of your credit history accounts for 15% of your FICO Score.

- This refers to the different types of credit you have. A mix of both installment credit and revolving credit will help boost your FICO Score this accounts for 10% of the FICO Score.

- Every time you apply for credit, the lender checks your credit report this process is known as a hard inquiry. Because a hard credit inquiry typically lowers your credit score slightly for a few months, you should avoid applying for too much credit in a short time. Having a lot of hard inquiries accounts for 10% of your FICO Score.

Is Your Fico Score The Most Important Score

Some 90% of lenders use the FICO Score when making credit decisions, making this the most important credit score to monitor. Although there are dozens of credit score variations, you dont need to worry about checking every single one of them. Since every type of credit score takes the same basic information into account, your scores shouldnt vary dramatically from one credit score version or credit bureau to another.

Most lenders use a FICO Score based on data from just one of the three credit bureaus. However, mortgage lenders typically use data from all three: a FICO® Score 2 based on Experian data, a FICO® Score 5 based on Equifax data, and a FICO® Score 4 based on TransUnion data.

You May Like: Does Navy Federal Report To Credit Bureaus

Does Wells Fargo Use Fico 9 For Mortgage

While Wells Fargo uses the FICO® Score 9 for some credit decisions, there are many different credit scores available to consumers and lenders. FICO® Scores are credit scores used by most lenders, but different lenders may use different versions of the FICO® Score.

Why do mortgage lenders use FICO 9? The versions of the FICO® Score that are used on mortgage loans and the more recently released versions, such as the FICO® Score 9 and 10, have the same range of 300 to 850. VantageScore, a rival manufacturer of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 credit score models. Pay down credit card balances.

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

Read Also: What To Pay Off On Credit Report First

Which Credit Scores Lenders Most Look At

Banks Editorial Team

Banks Editorial Team

How many different credit scores do you have, and what is the most important credit score when you apply for a loan or other type of credit? There are three major consumer credit bureaus whose data is used to generate credit scores. However, because there are many different credit scoring models, you may have dozens of credit scores. Which credit score is most important for a particular lender will vary depending on the type of credit for which youre applying. Heres what you should know about your credit scores.

What Is A Credit Scoring Model

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. A weight is assigned to each factor considered in the models formula, and a credit score is assigned based on the evaluation.

Scores generally range from 300 to 850 .

Lenders use credit scores to help determine the risk involved in making a loan, the terms of the loan and the interest rate. The higher your score, the better the terms of a loan will be for you. There are different credit score models, which emphasize varying factors.

You May Like: Do Closed Accounts Affect Your Credit Score

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Why Your Credit Score Might Soon Get A Boost

Worried about your credit score? Well, good news is on the way. Fair Isaac, which is in charge of tabulating the popular FICO credit scores, is about to recalibrate the way it calculates credit scores. That may mean its easier for millions of Americans to get loans.

The company said Thursday it plans to dismiss late bill payments as a negative… Continue Reading

Read Also: What Uses Credit History To Determine Credit Score

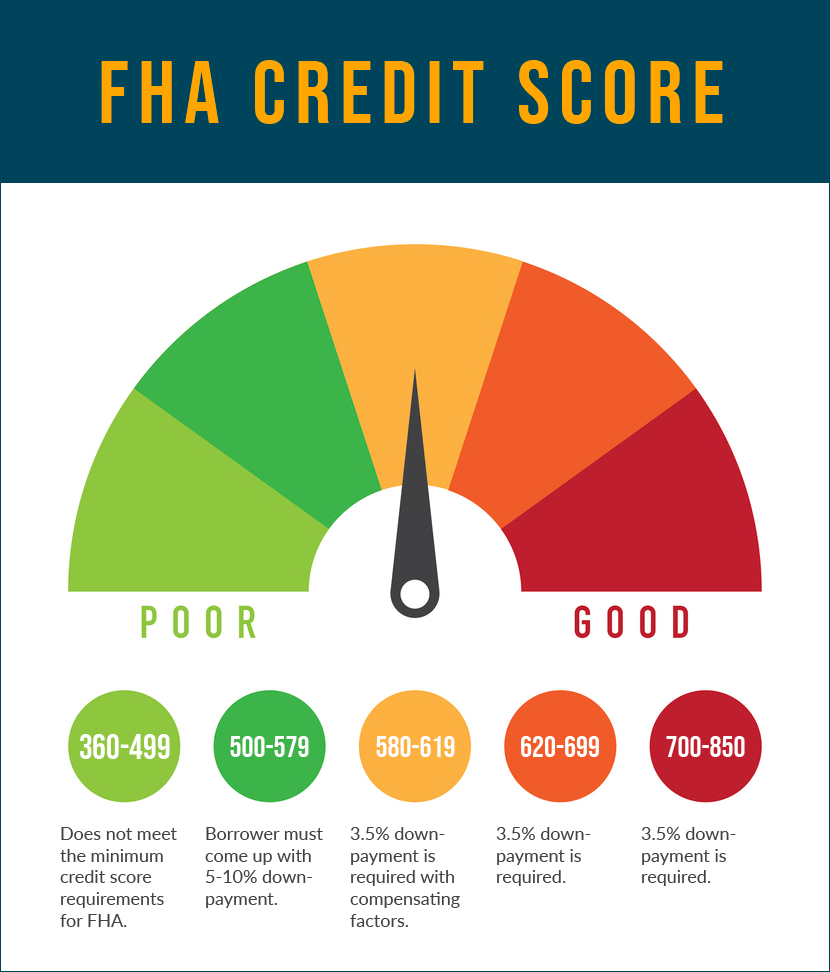

One Mortgage Application = Either Three Or Six Credit Reports And Fico Scores

If youre like most people, a home is likely the largest purchase you will ever make. Because youre asking to borrow such a large amount when taking out a mortgage loan, the lender will be very thorough when it reviews your creditworthiness.

A credit card issuer or an auto lender will generally only check one of your credit reports and scores when you apply for financing. A mortgage lender, on the other hand, will review your credit information from all three of the primary credit reporting agencies: Experian, TransUnion, and Equifax.

And, if you have a co-applicant, the lender is going to review all three of their credit reports as well.

That means one home loan application can equal as many as six credit reports and scores. In mortgage lending, because of the Federal Housing Finance Agency mandate, the only scores that can be used currently are three of FICOs older scoring models, although that may eventually change.

And, in a process that only exists in mortgage lending, the lender bases its decision not on your highest credit score, not on your lowest score, but rather on the middle numeric score. If your three FICO scores were 700, 709, and 730, the lender would use the 709 as the basis for its decision.

Reviewing this large collection of credit reports and credit scores gives the mortgage lender a more comprehensive picture of your credit risk. Your three credit reports likely arent identical, and its equally unlikely your scores will be the same.

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Recommended Reading: What Credit Score Do You Need To Buy A House

What If No Score Is Available

In some situations, an applicant may not have a usable FICO score from one of the three credit bureaus. In that case, the mortgage lender will simply use the lower of the two scores that are available. And if two scores are not usable, they will use the one remaining score.

And since you may be wondering, if a mortgage applicant has no usable FICO scores, generally they won’t qualify for a mortgage. I say generally because there are exceptions. If you fall into this category, contact a mortgage broker to see what options you have.

What Is A Vantagescore

A VantageScore® was jointly developed by three credit bureaus Equifax®, Experian, and TransUnion® as a more consumer-friendly credit scoring system. It essentially offers credit applicants more approachable and actionable reporting information that explains how an individual can improve their credit score based on data provided in their credit report. Your VantageScore® can be used in tandem with your FICO® Score by lenders to determine if your mortgage application will be approved, and at which interest rate.

Six factors play into the formula through which your VantageScore® is calculated. Although actual weighting is unspecified, credit bureaus have noted how impactful each factor can be with regards to overall level of influence. These categories include:

Recent versions of the VantageScore® formula tend to adopt a 300 850 scoring range, as with ones FICO® Score.

Recommended Reading: Is 718 A Good Credit Score