How Can I Stop Someone Using My Address Without My Permission

If someone is using your address without your permission, and you’re receiving post addressed to someone else, simply write ‘not at this address’ on the envelopes and post them back to the senders. You donât need to put new stamps on them. The senders should soon stop sending correspondence to your address.

How To Increase Credit Score To 800

Generally speaking, lenders typically like to see a credit score of at least 650 before they qualify a borrower for a loan. However, a score of 650 might not afford borrowers with the best interest rates, making their loans more expensive to pay down.

When it comes to getting approved for loans and securing the lowest interest rate possible, a higher credit score is best. If you can get your credit score to 800, youll likely be able to take advantage of the best rates and should have no problem getting approved for a loan, as long as all of your finances are in order and there are no other red flags that might worry your lender.

In addition to the above-mentioned tactics, consider the following measures to get your credit score to 800:

- Pay down the balance of your credit cards that are currently at or near their limit.

- Pay down higher-interest debt first .

- Consolidate your debt to pay it off more quickly and transfer the balance of a higher interest-rate card to a lower interest rate card.

- Have a mix of debt which can increase your credit score.

For more ways of improving your credit, .

Final Thoughts

Depending on your particular situation, it may take just a matter of a couple of months to inch your credit score back up. Regardless of where you fall on this spectrum, its important to take steps right now to improve your credit score so you can enjoy better rates and an easier time getting approved for a loan.

Rating of 4/5 based on 23 votes.

How Many Credit Cards Is Too Many

The number of cards you should have depends on your needs, financial circumstances, and how you use them. Remember that different cards suit different purposes, such as repaying debts, spreading purchases, reward schemes or overseas spending.

However, the more credit cards you have:

- the higher the temptation to spend beyond your means

- the harder it is to keep track of repayments and account management

- the higher the risk of fraudulent use

- the higher the risk of losing them or forgetting password or PIN details

Don’t Miss: Removing Repossession From Credit Report

How Does Having No Fixed Address Or Living In Temporary Accommodation Affect My Credit Score

Lenders typically like to see that you live at some sort of permanent residence, and are registered on the electoral roll. Since they often use the electoral roll to confirm your name and address, itâs wise to register using a family memberâs permanent UK address if youâre in student housing or other temporary accommodation, such as army barracks. Just remember to use the same address when you apply for credit â and make sure the family member will be happy to forward your mail to you.

Doing this may not only improve your credit score and your chances of securing credit, but can also protect you from identity fraud too.

If you have no fixed address, or are homeless, then you can get support through Citizens Advice. Weâll work with them to provide your credit report information, so you can see where you stand. They can also help with other support, including temporary accommodation.

Sign Up To Mse’s Credit Club Which Includes Your Experian Credit Report

Our totally free MoneySavingExpert.com Credit Club helps you keep a track of your credit record. You can here’s what it does:

You can get your full Experian Credit Report for FREE through Credit Club. See our full details on how this will work.

You’ll get a free Experian Credit Score. This will give you an indicator of how lenders see you when assessing you for credit applications.

Our unique affordability score. This clever tool will help you work out how much you can afford to borrow, using calculations based on your income and estimated spending.

Our unique Credit Hit Rate this will show you your chances of success, expressed as a percentage, of grabbing our top cards and loans.

Eligibility tool to show your best credit deals. It reveals the likelihood of you getting top credit cards or loans.

Wallet workout tool to check if youre on the best credit products for YOU.

Your credit profile explained. It shows the key factors affecting your score and how to improve them.

You May Like: Thd Cbna Bank

Cancel Unused Credit And Store Cards

These can kill your application. Access to too much available credit, even if it isn’t used, can be a problem. If you have a range of unused credit cards and lots of available credit, it could be a good idea to cancel some of them. This lowers your available credit and should help.

However, just to complicate things, long-standing accounts with good credit histories can be a benefit to your credit score, so they’re often best left open. There’s no definitive answer as to whether you should close down your old cards, because all lenders are different. But, look to strike a happy medium if you’ve lots and lots of unused credit, close some cards down, but don’t close ’em all. And above all, don’t max out.

If you need to cut credit card debt costs, first check if the old cards will let you shift debt from other cards to them cheaply, as you then won’t need to apply for new credit. This helps your credit file, and means you’re using your existing credit more efficiently. See Balance Transfers for full info.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

You May Like: Coaf Credit

Can You Close A Credit Card Account With A Balance

If you still owe the card provider, you won’t be able to formally cancel a credit card. You can let the provider know you want to cancel it, but they will keep it open until it is paid off.

You can however move your credit balance to a balance transfer credit card with another provider. In some cases you may be able to get a balance transfer offer on an existing unused card. To apply for a new card, youâll have to get a credit check, which will appear as a hard search on your . We’re a credit broker, not a lenderâ

Close Any Account That Isn’t Needed

Lenders are paying increasingly close attention to the amount of credit available to an individual, and if it seems you’ve already got access to a lot, they might be reluctant to offer you any more. That means any accounts you don’t use or need should be closed as soon as possible by, for example, cancelling a credit card that you’ve paid off and will no longer be using . This applies to things like unused mobile contracts and store cards too, so be prepared to go through your finances to check for anything youve overlooked.

Recommended Reading: Chase Sapphire Preferred Card Credit Score Needed

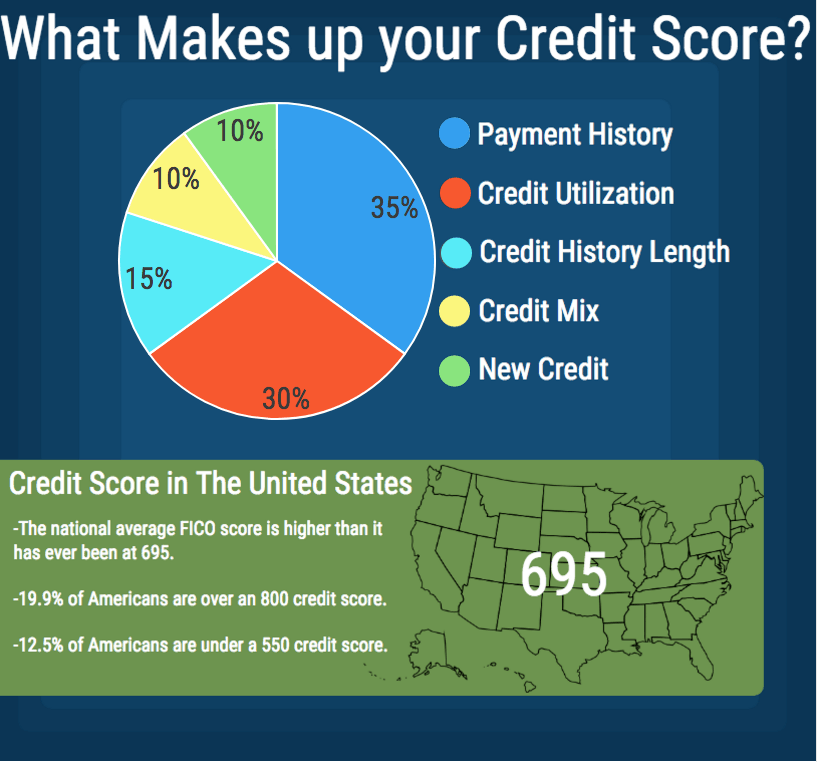

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

How To Improve Your Credit Rating Before Getting A Mortgage

Your credit rating not only affects whether your mortgage application is successful – it influences how much your monthly repayments will be, too. Thats why its essential to improve your credit score before you apply for a mortgage.

Improving your credit rating is one of the most effective things you can do to prepare for a mortgage application but it takes time, so you need to be prepared to chip away at this slowly.

Recommended Reading: Remove Evictions From Credit Report

How Do You Cancel An Unused Credit Card

The most important things to remember is to tell the card company, by calling them or putting it in writing, and make sure youâve paid off your most recent statement or transferred it to another card first. You canât cancel a card simply by cutting it up into several pieces, cancelling direct debits, or just not using it any more â this could lead to missed payments, which can put you at risk of getting a default or even a CCJ .

Quite often, if you donât use your card for a long time, your provider might send you a letter saying theyâll close it unless you say otherwise.

Once youâve confirmed you want to cancel your card, the provider may try to keep you as a customer by offering incentives to stay, such as benefits or a different card. Some people may even phone up to deliberately try and get a better deal! By all means consider the incentives â but if youâre certain you want to cancel your card, go ahead and do it.

How Long Does It Take Your Credit Score To Improve

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Read Also: Ollo Optimum Mastercard

How Long Does It Take To Improve Credit Score

How fast youre able to increase your credit score depends on why its the number that it currently is. For instance, if youre just starting to build credit after not having any at all, you can raise your credit score rather quickly by just using credit and making payments on time and in full every month. As you add more credit cards and dont use them or only make small charges with them your total debt compared to the amount of available credit lowers, thereby increasing your credit score.

Will paying off your credit card help raises your credit score? Find out here.

Also, if you currently have a lot of debt on the books, you can increase your credit score more quickly if you pay down that debt because your debt-to-credit ratio improves.

However, if your score is low as a result of a history of missed payments, bankruptcy, or another financial misstep, it will take longer to increase your credit score. In this case, it can take many months and sometimes even years depending on how badly you damaged your score.

Check out this infographic for a visual look at how your credit score is calculated.

Don’t Miss Or Make Late Repayments

Missed and late payments can stay on your credit file for up to six years. If you’ve made a late payment due to circumstances beyond your control , so long as you made the payment promptly when you noticed, talk to your credit provider and see if you can get this black mark removed. This also applies to late payments for utility bills like gas or electricity.

You May Like: Verizon Credit Collections

Use A Secured Credit Card

Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit you pay it upfront and the deposit amount is usually the same as your credit limit. You use it like a normal credit card, and your on-time payments help build your credit.

Impact: Varies. This is likeliest to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Time commitment: Medium. Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don’t require a security deposit.

How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit. Rather, your aim is to build a record of keeping balances low and paying on time.

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

Don’t Miss: What Does Leasing Desk Score Mean

How Long Does It Take For Your Credit Score To Improve When You Start Paying Student Loans

Your credit score could start improving immediately once you start making payments on your student loans, but most people should keep their initial expectations low. Like with any major loan, early student loan payments go more toward paying down interest rather than reducing the principal loan amount. Your overall credit utilization rate will remain high until your payments significantly reduce your principal.

Why Do You Need A Credit Score

Your credit score is one of the most important things that banks will consider when you apply for a mortgage, and it will determine how generous they’re likely to be with the repayment terms. As such, anything you can do now to improve your score is worth doing.

However, as valuable as a good credit score is, it’s not the only factor that a lender will consider when you apply for credit.

Among other things, they’ll also look at the affordability of the debt in other words, can somebody on your salary, and with the other financial commitments you have, afford to make the monthly payments required?

And despite what you might’ve been told in the past, the idea that there’s some sort of credit score ‘blacklist’ that prevents people from taking out loans isn’t true, so don’t worry! Just remember that if your credit score is low, it’ll make being accepted for financial products more unlikely.

Also, if you think that you can try to minimise your credit history in an effort to avoid a bad credit score, think again.

Having no credit history is just as bad as having a poor credit history, as lenders are keen to see evidence of you having successfully and reliably repaid credit in the past. In other words, you can’t game the system. Sorry.

You May Like: Leasingdesk Hard Inquiry

How Long Does It Take To Fix A Bad Credit Score

The bad news about low credit scores is that they take a while to fix. If you have negative items on your credit report that are impacting your score, there is not much you can do beyond paying your bills and waiting it out. Delinquencies can stay on your credit report for up to seven years, car repossessions stay for up to seven years, and inquiries can stay on your report for up to two years.

You cant do much of anything to make those disappear faster. In the short-term, self-reporting and score-boosting tools may also help bring you up a few points. In the case of delinquencies, you can try to get them removed faster by paying off the debt and getting the collections agency to agree to remove it from your report. Most collections agencies will allow you to set up payment plans and may even allow you to pay a lower amount than what you actually owe if you can pay it off all at once. Inquiries that you didnt authorize can be disputed.

Any mistakes you see on your credit reports can be disputed and getting those knocked off can bring your score up a couple of points in just a few weeks. Credit reporting agencies have to investigate disputes within 30 days of them being filed.

Overall, the amount of time it is going to take for you to see the improvement youre looking for is going to depend on how many negative items are on your report and, just as importantly, how many positive ones you can start putting on there by taking the right steps.