Next Steps For Cleaning Up Your Credit Report If You Can’t Do It Yourself

While cleaning up your credit report by yourself is possible, the process can be quite tedious. This is where DoNotPay can help you fix your credit report and improve your credit score without a hassle. You only need to provide a few details, including the debt amount, collection agency name, and default date, and leave the rest to us.

DoNotPay will fill out a goodwill removal request letter, send a for inaccurate records, submit a debt validation letter, and mail a pay-to-delete negotiation letter on your behalf to the ERC.

Who Is Enhanced Recovery Company Llc

Enhanced Recovery Company, LLC, also known as ERC, is a large third party collection agency, headquartered in Jacksonville, Florida. The company was founded in 1999 and is a Limited Liability Company, according to their website. The company has been the subject of many consumer complaints and has been known to mislead consumers when collecting on debt, call repeatedly, and illegally threaten legal action. ERC collects on various types of debts including, bank cards, cell phone bills, bank overdrafts, utility accounts, cable television accounts, and much more.

When Negative Information Comes Off Your Credit Reports

Delinquent accounts may be reported for seven years after the date of the last scheduled payment before the account became delinquent. Accounts sent to collection , accounts charged off, or any other similar action may be reported from the date of the last activity on the account for up to seven years plus 180 days after the delinquency that led to the collection activity or charge-off.

What Is a Tradeline?

You May Like: What Is A 524 Credit Score

How To Stop Enhanced Recovery Company From Calling You

Enhanced Recovery Company will call, email, or mail you if they believe you have an unsettled debt. The reason debt collectors like these are calling you is simplethey want to pressure you into paying up.

Unfortunately, Enhanced Recovery Company representatives will keep trying to contact you unless you pay the debt, prove that it doesnt belong to you, or reach an agreement with them .

Dont ignore debt collectors like Enhanced Recovery Companyin the end, you may get sued, and you may even have your wages garnished. Its smarter to engage with them tactically to ensure you dont have to pay, or that you get the best deal you can.

To begin, you can get Enhanced Recovery Company to stop calling youat least temporarilyby sending them something called a debt verification letter.

Ner With A Reputable Credit Repair Company

Are you a full-time employee? What about a parent or student?

Most people do not have time to worry about this issue and push it off to a later date. As you learned, pushing this off is not smart. It will only put your credit score in jeopardy.

Fortunately, we reviewed the best credit repair companies for you, so you can make a simple decision. Plain and simple, will make sure Enhanced Recovery Company is removed from your credit report immediately. And the best part is that they are affordable compared to other options.

> > More:

You May Like: How To Remove Serious Delinquency On Credit Report

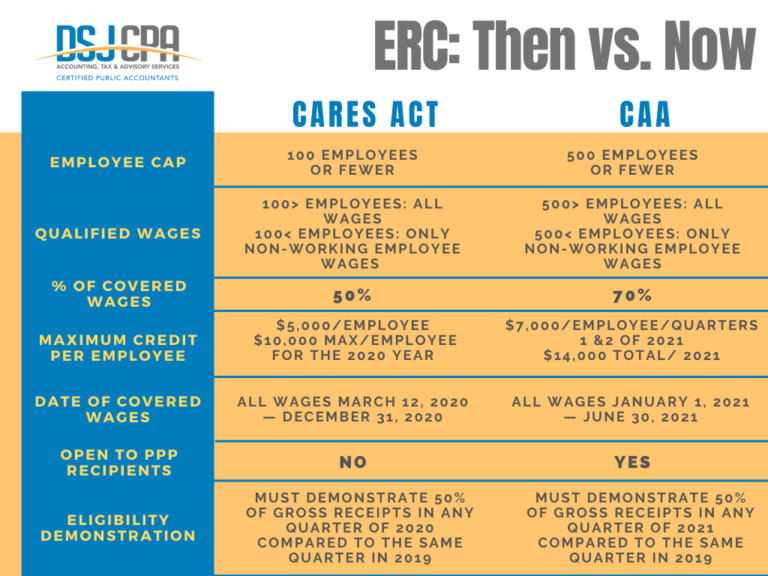

Eligibility Criteria For The Employee Retention Tax Credit

Many employers, including nonprofits, qualify for an ERC. Eligibility is determined quarterly.

To be eligible, the employer must demonstrate any of the following

- They either suspended operations partially or entirely due to an official COVID-19-related shutdown order.

- They encountered a notable decline in gross receipts applicable to the same quarter of the year 2019 .

What Is The Employee Retention Credit And Why Is It Important For Business Owners

The Employee Retention Credit is a refundable tax credit intended to encourage business owners to keep their employees on the payroll and minimize the number of workers filing for unemployment benefits. The credit is computed differently for 2020 and 2021:

- For 2020, the tax credit is equal to 50% of qualified wages that eligible employers pay their employees in a calendar quarter, and qualified employers can receive a maximum credit of $5,000 per employee.

- For 2021, the tax credit is equal to 70% of qualified wages that eligible employers pay their employees, and qualified employers can earn a maximum credit of $7,000 per employee per quarter .

Unlike Paycheck Protection Program loans and other small business relief options, businesses of all sizes are eligible to receive the ERC. And because the ERC is not a loan, recipients will never need to repay or seek forgiveness for ERC funds.

Calculating your ERC amount can get a little complicated. Dont worry, well walk you through it. Use our Tax Credit Estimator to calculate your potential ERC amount.

Also Check: Does Renting A Storage Unit Build Credit

Should You Pay Enhanced Recovery Company

You should only pay a collection agency like Enhanced Recovery Company if youre certain the debt is yours and you owe it. If youre struggling financially and cant afford to pay this debt collector, you can get help from a non-profit credit counselor.

Takeaway: Enhanced Recovery Company is a legitimate debt collection agency

- Enhanced Recovery Company is a debt collection agency, which means they collect severely delinquent debts that lenders have charged off and transferred or sold.

- Enhanced Recovery Company probably isnt a scam, but you should make sure to avoid scammers by verifying your debts and only making payments once you’re sure they’re legitimate.

- You have rights under the Fair Debt Collection Practices Act that prohibit debt collectors from harassing you. You can sue for harassment, and you wont need to pay the legal fees if you win.

- There are several ways of removing Enhanced Recovery Company debt from your credit report, but if these approaches fail, then you should consider seeking advice from a credit repair professional.

Other Collection Agencies

How Do You Claim The Employee Retention Credit

Employers reported total qualified wages and the related COVID-19 employee retention credit on Form 941 for the quarter in which the qualified wages were paid. Wages paid during the period March 13-31, 2020, that qualified for the employee retention credit were reported on the second quarter Form 941 to determine the employer’s credit for the quarter ending June 30, 2020. The credit was allowed against the employer portion of social security taxes and railroad retirement tax on all wages and compensation paid to all employees for the quarter. Although it should be noted that different rules apply for 2021. If the amount of the credit exceeded the employer portion of those federal employment taxes, then the excess was treated as an overpayment and refunded to the employer.

An eligible employer could reduce its employment tax deposits during the quarter by the anticipated credit amount for the quarter. The employer could retain federal income tax withheld from employees, the employees’ share of social security and Medicare taxes, and the employer’s share of social security and Medicare taxes with respect to all employees. If the employment tax deposits retained were not enough to cover the anticipated credit amount the employer could file Form 7200 to request advance payment of the remaining credit amount.

Additional limitations exist for 2021 the credit is now available to small employers only.

You May Like: How To Remove Repossession From Credit Report

Always Dispute The Debt

If you do not dispute the debt within 30 days, it is presumed valid. Always dispute debts held by collection companies.

If you are using a dispute or debt validation letter template, be sure that the template is designed for notices received after the implementation of Regulation F on Nov. 20, 2021. Much of the information that debtors used to ask for is now required in the Notice of Debt.

Send the debt collector a certified letter addressing these issues.

- Ask for documentation that verifies that you owe the debt, such as a copy of the original contract.

- Ask whether the statute of limitations on the debt has expired. The collector doesnt have to tell you, but they cant lie. If they wont say, the statute of limitations may have expired.

- Ask whether the agency is licensed to collect debt in your state. Again, the collector is not allowed to lie. You can ask for the date of the license, license number, and the state agancy that issued the license as well.

- A copy of the last billing statement sent by the original creditor.

Send the letter to ERC Collections by certified mail.

Once you receive the debt validation letter you have 30 days to send your debt dispute letter.

Remember that even if you know the debt is yours, the more important issue is whether they know its yours.

Because guess what?

If they cant prove its yours, they cant collect it or report it to the credit bureaus.

Who knows what was lost in the shuffle?

Remember the Statute of Limitations

The Debt Is Then Charged Off Or Sold To Collections

Then, the creditor is likely to charge off the debt. Its status will be changed to “charged off” and “sold to collections.” “Charged off” and “sold to collections” are both considered a final status. Although the account is no longer active, it stays on your credit report.

When the debt is sold or transferred to a debt collector, a new collection account is added to your credit history. It appears as an active account, showing that the debt collector bought the debt from the original creditor. If the debt is sold again to another collection agency, the status of the first collection account is changed to show that it was sold or transferred. Once again, the final status shows that the first collection account is no longer active, but that status continues to appear as part of the account’s history.

Read Also: Chase Sapphire Preferred Card Credit Score Needed

How To Get The Erc For Wages Paid In Q1

The process for obtaining the ERC for 2021 is similar to that outlined for 2020 above. Be sure to take into account changes enacted by the CAA and outlined above, including the fact.

Just like in 2020, you could obtain your ERC for Q1 through Q3 of 2021 by reducing your employment tax deposits. If you qualified as a small employer , you may request advance payment of the credit using Form 7200, Advance of Employer Credits Due to COVID-19.

In 2021, advances were not available for employers with more than 500 employees.

Why Use Donotpay To Clean Your Credit Report

DoNotPay offers several advantages, including:

| Fast | No need to spend many hours trying to clean your credit report. Clean your report within a few minutes. |

| Easy | We’ve eliminated the tedious process of filling boring forms and searching for information. Just fill in a few blanks, and our system will take over. |

| Successful | With a vast customer base, rest assured that you will have a clean credit report within no time. |

Read Also: R9 Credit Score

What Is The Tax Credit Amount

For 2020, you can get a credit equal to 50 percent of the first $10,000 of qualified wages paid per employee in the aggregate of each eligible quarter. Thus, the maximum ERC for the whole of 2020 is $5,000 per employee.

For 2021, you can get 70% of the first $10,000 of qualified wages paid per employee each quarter.

The maximum ERC for each quarter is $7,000 per employee. Thus, the maximum ERC for 2021 is $28,000 per employee.

Can Erc Debt Collectors Threaten To Serve You

Debt collection calls can add to the stress of having financial difficulties. When harassing, threatening, or intimidating calls are made, the situation can quickly escalate â especially if you are unaware of your rights.

Government officials enacted the Fair Debt Collection Practices Act to protect customers from illegal, unfair, or abusive debt collection methods. On June 23, 2014, the FTC and the State of New York filed a joint complaint against National Check Registry for allegedly violating the Fair Debt Collection Practices Act by allegedly using outrageous and intimidating tactics to get people to pay debts immediately â often debts that were in dispute.

National Check Registry is accused of accusing individuals of check fraud or other crimes and threatening them with lawsuits, garnishments, arrest, or jail if they don’t pay. According to the FTC and the State of New York, National Check Registry allegedly informed customers they had to pay within 12 – 24 hours to avoid being pursued by a local court system or law enforcement agency. The company would frequently educate a client’s family, friends, and coworkers that the individual had committed a crime or was facing legal action.

These were, in reality, hollow threats. According to the lawsuit, National Check Registry has no jurisdiction to initiate arrests or seek any criminal penalties for failing to pay these debts.

â falsely claim to be law enforcement officers

You May Like: Will Paypal Credit Report To Credit Bureaus

If Erc Wont Cooperate: Hire A Professional

If in spite of your best efforts, Enhanced Recovery Company refuses to cooperate with you, youll need to get professional help.

You may need to work with a good credit repair company. They work with collection agencies all the time and will know the best ways to make them more agreeable.

If the debt obligation is large, or if ERC is being particularly hostile, you may need to engage the services of a credit law firm.

If so, we recommend Sky Blue. Theyre one of the best-known credit law firms in the country.

Often, just having a collection agency contracted by a credit law firm will be enough to get them to be more willing to negotiate.

How Do I Remove Enhanced Recovery Company From My Credit Report

Removing Enhanced Recovery Company from your credit report may be possible if any information on the account is incorrect, error’d, or fraudulent, and is not fixed in an appropriate amount of time. According to a study by the U.S. PIRGs, 79% of credit reports contain mistakes or serious errors. We specialize in going after these types of accounts for our clients.

Recommended Reading: What Credit Score Do You Need For Chase Sapphire Reserve

Restrictions On Enhanced Recovery Company

When attempting to collect payments from you, Enhanced Recovery Company must adhere to the regulations specified in the Fair Debt Collection Practices Act. This is a federal law that prevents debt collectors from engaging in harassment or predatory behavior, such as lying to you or calling you incessantly or at unreasonable hours.

Enhanced Recovery Company representatives also need to follow the rules set out in the Telephone Consumer Protection Act. Its a good idea to familiarize yourself with these laws so that you can take action against Enhanced Recovery Company if they do something illegal.

Keep records of letters and phone calls

If you think that Enhanced Recovery Company may be violating your rights, then its a good idea to record your phone calls, save any letters they send you, and keep records of when theyve contacted you. This will make things much easier if you need to take legal action against them in the future.

Impact Of Other Credit And Relief Provisions

An eligible employer’s ability to claim the Employee Retention Credit is impacted by other credit and relief provisions as follows:

- If an employer receives a Small Business Interruption Loan under the Paycheck Protection Program, authorized under the CARES Act, then the employer is not eligible for the Employee Retention Credit.

- Wages for this credit do not include wages for which the employer received a tax credit for paid sick and family leave under the Families First Coronavirus Response Act.

- Wages counted for this credit can’t be counted for the credit for paid family and medical leave under section 45S of the Internal Revenue Code.

- Employees are not counted for this credit if the employer is allowed a Work Opportunity Tax Credit under section 51 of the Internal Revenue Code for the employee.

Read Also: Leasingdesk Hard Inquiry

What Is Employee Retention Tax Credit

The Employee Retention Tax Credit is a CARES Act relief measure available to businesses that paid employees during times of economic hardship due to COVID-19. The refund credit can be used in any way that the business pleases, as there are no limitations on what expenses the refund can be used for.

ERC is not a loan and therefore does not need to be repaid. All business structures are eligible to apply for ERC, including non-profits and startups.

In 2020, employers can receive a credit of 50% of qualified payroll expenses for a maximum of $5,000 per employee for the year. In 2021 employers can receive a credit of 70% of qualified payroll expenses for a maximum of $7,000 per employee per quarter.

Get A Copy Of Your Credit Report

First, get a copy of your credit report from each of the three major credit bureaus.

You dont have one credit report, but three. Thats because there are three major credit bureaus Experian, Equifax, and TransUnion.

Youll need a copy of all three to determine exactly where ERC is reporting the debt.

You can do that, free of charge, through an online service provider known as AnnualCreditReport.com. Theyre the only source officially authorized to provide you with a copy of your credit report from all three bureaus.

Once you receive a copy of the credit reports, check to see if ERC is reporting on all three, and exactly what information shows up on each. Youll need this in future negotiations.

You May Like: How Long Does It Take For Opensky To Report