When Does Your Credit Score Start

Banks Editorial Team

Banks Editorial Team

You may have wondered in the past: when does your credit score start? The subject is often unclear does it start as soon as you obtain a line of credit, or before? Does everyone start with the same score, or is every score unique from the get-go? Maybe you thought that everybody starts at 300 the lowest possible score or maybe everybody starts with a perfect 850, the highest possible score. In fact, neither is the case. It is important to realize that your credit score starts only after you obtain credit, and, from the start, is tethered to your reliability in paying back debts.

Getting Married Will Merge My Credit Score With My Spouse

False. When you get married, your credit report stays unique to you and only you. “Credit reports are always individual at the consumer level,” Ulzheimer says.

When it comes to applying for new credit with your partner, such as filling out a joint application for a mortgage, each partner’s credit score is taken into consideration by the lenders. Once a joint loan is opened, the positive and negative actions both you and your spouse take are reflected on both of your reports.

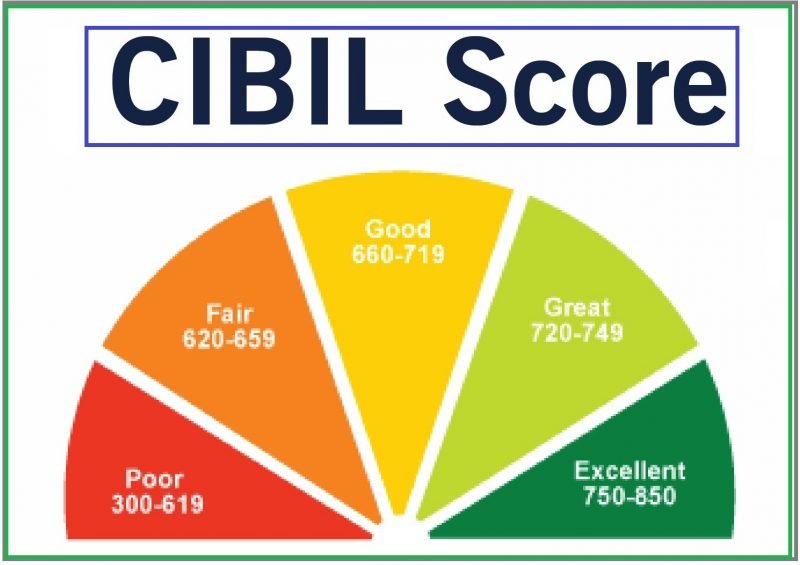

What Is The Difference Between A Good And Excellent Credit Score

“Excellent” is the highest tier of credit scores you can have. For FICO, it falls between the range of 800 to 850, and for VantageScore, it’s between 781 to 850. A perfect credit score of 850 is hard to get, but an excellent credit score is more achievable.

Many of the best credit cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets . But you’ll need good or excellent credit to be approved for the Amex Gold, which Select named the best rewards card of 2020. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Even if your credit score falls within the excellent range, that is not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

See rates and fees, terms apply.

Recommended Reading: What Does Transferred Closed Mean On Credit Report

The 0% May Not Apply To Everything

The offer may say “0% APR” in big, bold letters but that could be referring to the rate on purchases, balance transfers or both. To find out what youll pay in each situation, read the Schumer box, a table of rates and fees typically included in credit card offers. A single credit card can charge different interest rates:

-

Purchase APR: This is the interest rate charged on things you buy. If you want to use a 0% card to finance a big purchase, make sure the 0% offer applies to purchases and not just balance transfers. Keep in mind that if a card offers 0% APR on both purchases and balance transfers, the length of the 0% period might be different for one versus the other.

-

Balance transfer APR: This is the rate charged on debt you move from one card to another. Double-check that the 0% offer applies to balance transfers before moving your debt. Otherwise, you could end up paying interest on top of any applicable balance transfer fees.

-

Cash advance APR: You’ll often have to pay a higher APR for cash advances than for other types of transactions, and there may be a fee involved, too. Cash advances on a credit card rarely qualify for 0%.

-

Penalty APR: Issuers may slap a sky-high penalty rate on your account under certain conditions, and a 0% offer won’t save you. Actions that might trigger a penalty APR include:

-

Failing to make your minimum payment within 60 days.

-

Exceeding your credit limit.

-

Making a payment that doesnt go through.

Get Credit For Rent And Utility Payments

Rent and utility payments are not automatically factored into your credit score calculations, but there are services that can help you get them included, allowing you to build credit more quickly. Experian Boost, for example, is a free service that can help you raise your credit score by reporting payments for utilities, phone, and streaming services. According to Experian, the average user saw an increase in their FICO 8 credit score of 13 points as a result.

Experian Boost also includes free credit score monitoring, which can help you track credit score changes over time.

This service may be worth looking into if you dont have any credit cards or loans in your name for the time being. Just keep in mind that any credit score changes associated with Experian Boost would only be reflected in the FICO 8 version of your score. As there are multiple FICO versions lenders can use to evaluate credit, if a lender is checking something other than FICO 8 when you apply for a loan, you may not see much benefit from having these payments reported on your credit history.

Also Check: Does Bankruptcy Stay On Your Credit Report

How Long Does It Take Your Credit Score To Improve

Your is a sensitive numberthree digits that can move up or down on any given day depending on how the information in your credit report changes. If youve been working to improve your credit scoreby paying off past-due accounts, correcting errors, making timely payments, or having negative items deleted from your credit report you undoubtedly want to see the results of your efforts as quickly as possible. And if you need your credit score to increase a few points so you can qualify for a loan or better interest rate, you’re probably eager to see improvement soon.

Try A Store Credit Card

Most store credit cards offer charging privileges only at the issuing store and its brands or partners and work the same as other credit cards, though they may be easier to get approved for compared with traditional credit cards. Some may even offer rewards on purchases.

What you have to watch out for, however, are the annual percentage rate and the credit limit. Because store credit cards may have lower credit requirements for approval, they may charge a higher APR, which means that carrying a balance on one of these cards month to month could cost you more money. And a low credit limit means that you could max your card out quickly, leading to a higher , which can lower your credit score.

Recommended Reading: How To Raise Your Credit Score Fast

Improving Your Credit Score

For many, the sheer number of credit scores floating around makes it difficult to determine the condition of their credit. At the end of the day, it doesnt really matter which model is used to calculate your score. Just keep in mind that higher numbers are better and that the key to healthy credit is to maintain healthy financial habits.

Always paying bills by the due date, keeping credit utilization rates low, and avoiding opening unnecessary credit accounts are all good ways to maintain a good or better credit rating.

In the event that your score falls into the fair category or below, the first step to improving your credit will be to get a copy of your credit report from each bureau to determine which accounts are bringing your score down. Once youve identified the sources of the problem, you can begin to improve your credit behavior.

Be sure to address any mistakes or discrepancies on your report, as well, to make sure your score accurately reflects your actual credit history. You may also want to think about using the services of a reputable credit repair company to look for disputable items that may be negatively affecting your score.

Understanding Your Credit Scores

First off, you have more than one credit score, and there are a few reasons for that.

There are different scores for specific products. For example, there are special auto and home insurance credit scores. There are also different credit-scoring models, like FICO and VantageScore, which means you could have scores according to each model. Even the same model could give a different score depending on whether it uses data from your Equifax, Experian or TransUnion credit report.

Lastly, there are multiple consumer credit bureaus that provide on which scores are based. So depending on what information each bureau gets from individual lenders and that can differ the data used to compile your reports and build your scores could vary from bureau to bureau.

When you put it all together, that means that each individual could have multiple scores, and sometimes they dont match. Its difficult to pinpoint exactly how many scores you may have, but it could be hundreds.

Even though there are many different credit scores out there, its worth knowing the general range that your scores fall into especially since they can determine your access to certain financial products and the terms youll get.

FICO and VantageScore Solutions create the most widely used consumer credit scores, and these companies update their scoring models from time to time.

Recommended Reading: What’s The Highest Credit Score You Can Get

Next Steps: Build Excellent Credit

Once creditors start reporting information to the credit bureaus, the credit bureaus can use that information to create credit reports. Scoring companies can then analyze your credit reports to create credit scores.

Dont worry if you cant get a FICO® credit score immediately, because you need to have an account thats been opened for at least six months on your credit report before youre eligible for a FICO score. In contrast, VantageScore can provide you with a score after just one month. You can access your free VantageScore 3.0 credit scores from Equifax and TransUnion on Credit Karma anytime from any device.

As you start building credit, your financial goals may go beyond simply getting a credit score. Good or excellent scores can help you qualify for the best offers and not get held back by a lack of credit. Here are some steps you can take as you work toward building excellent credit.

While there are many intricacies to credit, you dont need to know all the ins and outs to build excellent credit. Start by opening accounts with creditors that report to the main consumer credit bureaus, paying your bills on time and limiting your credit card usage and, over time, you can get there.

Open A Secured Credit Card

A secured credit card is designed to help consumers build credit. Unlike a traditional card, this type of credit card is easier to qualify for because it requires a security deposit. The amount of money you put down acts as collateralsomething of value a provider can seize if you fail to meet repayment obligationsif youre unable to pay your balance and helps establish your credit limit.

When searching for a secured credit card, make sure the issuer reports to the three major credit bureaus: Experian, Equifax and TransUnion. To add positive payment history to your credit file and avoid late fees and interest, pay your credit card bill in full on or before the due date.

Related:Best Secured Credit Cards 2021

Read Also: How To Get Official Credit Report

Why You Dont Have A Credit Score

No one has a credit score of zero, no matter how badly they have mishandled credit in the past.

The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850. As of April 2021, only 3% of consumers had a FICO 8 score below 500. Tommy Lee, principal scientist at FICO, said scores of 300 are “extremely rare.”

Reasons you might not have a score are:

-

Youve never been listed on a credit account.

-

You havent used credit in at least six months.

-

You have only recently applied for credit or been added to an account.

How Long Does It Take To Get A Good Credit Score

To build a credit score from scratch, you first need to use credit, such as by opening and using a credit card or paying back a loan. It will take about six months of credit activity to establish enough history for a FICO credit score, which is used in 90% of lending decisions. FICO credit scores range from 300 to 850, and a score of over 700 is considered a good credit score. Scores over 800 are considered excellent.

Dont expect a spectacular number right off the bat. While you can build up enough credit history in less than a year to generate a score, it takes years of smart credit use to get a good or excellent credit score.

VantageScore, another type of credit score, can be generated sooner than your FICO scores. Your FICO credit score is the one to watch over the long term. However, to make sure you are on the right track when starting, your VantageScore can indicate how your actions reflect on your new credit history.

Recommended Reading: How To Print Credit Report From Credit Karma

How To Build And Maintain A Good Credit Score

Once you have a credit score, how can you help maintain or improve it? First, you need to understand what is considered a good credit score. Both the FICO® Score and VantageScore models range from 300 to 850. Using the FICO scoring model, a score 670 or higher is considered good and a score of 800 or above is considered exceptional. A VantageScore 661 or above is considered good while a score 781 or above is considered excellent.

The higher your credit score, the more likely you are to be approved for loans or credit at the best rates and most favorable terms. The lower your credit score, the more difficult it will be to get a credit card, obtain favorable terms on a loan or even rent an apartment.

Whether you want to improve your credit score from good to excellent or you’re trying to raise your poor credit score to the fair range, there are plenty of things you can do right away to build credit history and improve your credit score.

Fico Score Scale: 800

Under the FICO model, the most exceptional credit scores are 800 or better, up to the highest credit score possible, 850. Though the industry-specific models score on a different scale, it is probably safe to assume a FICO Score 8 in the excellent range will equal a respectable score under the Auto or Bankcard Score models, as well.

Attaining an excellent FICO Score requires consistently meeting credit obligations, in full and on time, as well as keeping total debt levels low.

Recommended Reading: How Often Should You Check Your Credit Score

Paying Off Debt Increases Your Credit Score

True and false. This is true for , but not so true for installment debt, such as a mortgage or student loan. While it is good for your overall financial life to be totally debt free, you won’t see a bump in your credit score if you pay off your car loan, for example. It can actually ding your score because it means having fewer credit accounts. That doesn’t mean you shouldn’t pay off the loan, though you don’t want to pay unnecessary interest over time just to save a few credit score points.

Because credit cards usually have higher interest rates than installment loans, paying off credit card debt first can help you while also improving your score .

Where Does My Score Come From

ViDI Studio / Shutterstock

For the majority of Canadians, it starts with credit cards. As soon as you swipe your credit card for the first time, your credit card provider, utility companies and any other creditors will begin reporting your behaviour to the big credit bureaus. Within about six months, these bureaus will have enough data on you to fill out a credit report and calculate your first credit scores.

Read Also: How To Check Credit Report

What Is Your Credit Score If You Have No Credit

If you have no credit history, you are credit invisible. That means none of the three major credit bureaus have a credit history on you. That might be because youve never applied for credit or youve paid for everything in cash. If youve never used credit or applied for a loan, youre credit unscorable. That means that you may have a credit file at the major credit bureaus, but theres not enough history to calculate a credit history.

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

You May Like: Does Refinancing Hurt Credit Score