What Can You Do If You Are Wrongly Reported To A Credit Bureau

If you see an error on a credit report, you should immediately address the issue to correct the problem. Errors on credit reports can lead to a lower credit score which can impact your ability to open a new credit account or get a loan. If you are in this situation, you should first dispute the inaccuracy with the credit bureau, which you can do electronically. Then you should contact the company or organization that that provided the information to the credit bureau. Both the credit bureau and the organization are responsible for fixing the issue under the Fair Credit Reporting Act. Next, wait up to after 30 days for the credit bureau and/or organization to investigate and respond to the dispute. After you receive the results of the investigation, you may have to provide copies of the documents supporting your position.

EPGD Business Law is located in beautiful Coral Gables, West Palm Beach and historic Washington D.C. Call us at , or contact us through the website to schedule a consultation.

*Disclaimer: this blog post is not intended to be legal advice. We highly recommend speaking to an attorney if you have any legal concerns. Contacting us through our website does not establish an attorney-client relationship.*

How Often Is My Credit Report Updated

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

How Often Do Creditors Report To The Credit Bureaus

By | Submitted On October 11, 2007

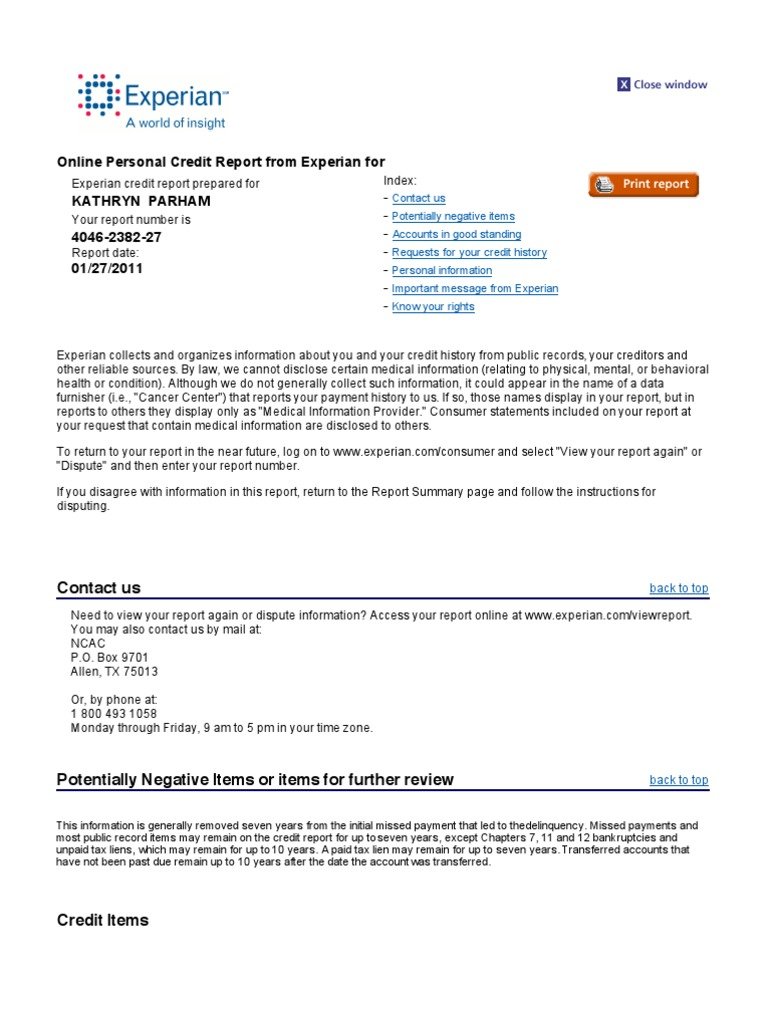

Above all it gives details about a person’s credit history. These include all the creditors with balances and accounts that are closed or in collections. It will also indicate if there are any late payments, and any other irregularity. In addition it will also list the requests for that credit report by creditors during the past year and requests for credit reports including those by employers for the past two years.

These reports are maintained by three nationwide credit bureaus which use slightly different sources to compile the information. Based on the information they have credit bureaus calculate a figure called the credit score. The three credit bureaus Equifax, Transunion, Experian use different formulas to arrive at their score. The credit score can be considered a mathematical way of determining the likelihood of the borrower paying back a loan.

This information can be accessed by creditors, insurers, employers, and others who have been legitimately allowed access subject to conditions through The Fair Credit Reporting Act . It is clear that accurate information in the credit report is important to everyone concerned not only for the person about whom it is concerned but to anyone else who may want to rely on it for decision making. As such it is important to understand how the credit report is compiled and the accuracy of the information and sources on which that compilation is made.

You May Like: Carmax Credit Requirements

Contact The Agencies By Phone

Before submitting a formal written request, contact the agency by phone. Why do this when you already are sending a written notice? The main reason is that criminals work quickly.

It only takes a day or so for them to start their own fraud scam. Calling is the fastest way to take action in the meantime. Note you only need to call one agency. They notify the others of the updates.

You can contact each credit bureau at the numbers below:

- Experian – 888-397-3742

- Equifax – 888-548-7878

- TransUnion – 800-888-4213

Contact one of the above agencies by phone and let them know your relative passed away. Theyll make a note on the account. Theyll also give you specific instructions about how to go about filing a written claim. Otherwise, follow the steps below.

What Is A Credit Bureau

Credit bureaus, also called “credit reporting agencies” , are companies that collect and maintain consumer credit information. The three major CRAs in the U.S. are Equifax, Experian, and TransUnion. Each is a publicly traded, for-profit company. While there are other smaller agencies, creditors and lenders are most likely to check your credit with one of the major CRAs.

The major CRAs receive credit-related information from the companies and lenders that you do business with. Lenders regularly report whether you’re paying your bills on time, whether you’ve ever defaulted entirely, and how much debt you owe to them. The credit bureaus also pull relevant public records, like tax liens or bankruptcy information, from state and local courts. This information is included in your credit report as well.

CRAs can sell your information to companies that want to prescreen you for their products and services and to businesses that have a legally valid reason for reviewing it. For example, a company with whom you’ve applied for credit would have a valid reason to look at your credit history.

Recommended Reading: Does Paypal Credit Report To Credit Agencies

Social Security Fraud After Death

A report from the Office of the Inspector General revealed that there are over 6.4 million U.S. Social Security numbers active for people above the age of 112+. Because its not likely that this many people in this age group are alive, this is actually a sign of Social Security fraud.

Criminals often steal Social Security numbers of the recently deceased to do a number of fraudulent activities. They often:

- Steal the individuals Social Security benefits after death

- Open new lines of credit, like credit cards and loans

- Create new utility or service accounts in the deceaseds name

- Provide this information in a criminal situation

Basically, these criminals charge up several debts to your loved ones credit. From there, these debts go unpaid. Since many families dont monitor this credit report, you may not notice the criminal activity until its too late. Eventually, these lenders seek payment for these debts, and your loved ones estate is at risk.

Where do these criminals find this information? Theyre skilled in searching for the most vulnerable. They browse social media and obituary websites searching for those who recently passed.

These websites often reveal personal information, like a local address. From there, criminals find valuable data from sources like mail, family, and even online. Stealing the identity of a deceased person is known as ghosting since the persons identity lingers on like a phantom.

» MORE:

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Remove Credit Inquiries In 24 Hours

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, you’ll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didn’t initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Can A Creditor Report The Same Debt Twice

Consumers may have multiple debts owing to the same debt collector or creditor . Each report will only contain one debt from that company. By Duplicating account information like this, creditors may be violating regulations such as the Fair Debt Collection Practices Act and Fair Credit Reporting Act.

You May Like: Credit Report Serious Delinquency

How Do You Dispute Late Payments On Your Credit Report

You can dispute your information with the three credit bureaus online, over the phone, or by mail. Check your report with each bureau, because you’ll need to file a dispute with each one that has inaccurate information. You can start a dispute with TransUnion, Equifax, or Experian by visiting their respective dispute pages.

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

You May Like: Affirm Approval Credit Score

Who Can Report You To The Credit Bureaus

- 10:22 pm

Youve probably heard of Equifax, Experian, and TransUnion, which are different credit bureau agencies that keep credit reports on file for every person with a social security number. Credit report files contain information about a persons financial debt, including account numbers for current and past debts, loan types and terms and payment history. When a person defaults on loan payments, the creditor may decide to send a report of the late payment to the credit bureaus so that it will be reflected in the customers credit file.

What Is A Credit Report

A credit report is nothing but the history of an individuals credit behaviour that contains all credit and loan related information. All your loan transactions with credit card companies, banks and other lenders for the past 7 to 10 years are recorded on the credit report.

Experian, CIBIL and Equifax are the three agencies responsible for the compilations of all your credit reports. These credit report agencies collect all the information from various creditors such as car finance companies, retailers, mortgage lenders, credit card issuers, financial institutions, student loan lenders, etc. Thus, you get 3 credit reports which vary from one another depending on the reports and information provided by the lenders to the agencies. The accuracy of your credit scores completely depend on the credit reports which, again, depends on the information received from the lenders. Hence, it is highly significant that you keep checking your credit reports. You would essentially file a dispute with the particular credit report agency which generated wrong credit reports for you. Make sure that none of your credit reports prepared by the agencies have any error on them, whatsoever.

There are several ways to improve your credit scores. The following points might help you to understand this in a better way:

Also Check: Does Affirm Show Up On Credit Karma

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

What Do Creditors Have To Report To Credit Bureaus

Creditors and lenders are not required by law to report anything to . However, many businesses choose to report on-time payments, late payments, purchases, loan terms, credit limits, and balances owed. Credit bureaus collect this data, and it helps create a person’s credit report, and often this information can impact credit scores.

Businesses usually also report significant events such as account closures or charge-offs. For example, if a mortgage is paid off, this information is reported.

Governmental organizations that maintain public records don’t report to the credit bureaus, but the bureaus usually obtain the documents on their own. For this reason, bankruptcy filings also typically show up on credit reports.

Another example, if a person owes the IRS money, chances are, a public record of a tax lien may find its way onto their credit report, and that can impact your .

Also Check: Can A Closed Account On Credit Report Be Reopened

Can Small Businesses Report A Debt To A Credit Bureau

Its definitely frustrating when you do not receive payment for services rendered or products sold. Small business owners may reach out to one of the credit bureau agencies and report their clients actions. First, you need to be a apply to be a member of the proper credit agency. You must also pay any fees the agency requires. Additionally, you will be required to have the appropriate software necessary to electronically submit the data to the bureaus and follow its credit-reporting guidelines. Each agency has its own set of guidelines, but generally only significant debt that has been past due for at least 90 days should be reported. It is important to note that reporting a small debt may not be worth it if you spend more money than what you would ultimately collect.

When And What Do Credit Card Companies Report To Credit Bureaus

Whether you use your credit card frequently or sparingly, your monthly balance activity is tabulated and reported to the three nationwide credit bureaus Equifax, Experian and TransUnion. These consumer reporting agencies collect information relevant to your credit card usage and financial history, so understanding what facts credit card companies report to the bureaus can help you strategize how to build or maintain good credit. Read on to learn more about when credit cards report and what exactly might end up in your credit card report.

What Do Credit Card Companies Report to Credit Bureaus?

- The number of accounts you have open

- Any credit card balances you have

- Any late payments you may have on your account

- Your revolving credit utilization rate

How Often Do Credit Cards Report?

When Do Credit Card Companies Report Late Payments to Credit Bureaus?

When Do Credit Card Companies Report a Canceled Credit Card?

What Credit Bureaus Do Credit Card Companies Report to?

Equifax, Experian and TransUnion are the three nationwide credit bureaus that credit card companies report to voluntarily. Creditors dont necessarily have to report to every credit reporting agency though.

TransUnion in its 2020 annual report said that its customer base includes many of the largest companies in the industries we serve, including credit card issuers. Based on information published on TransUnions website as of November 2021, card issuers that report to TransUnion include:

The Takeaway

Don’t Miss: Raise Credit Score 50 Points

How Are Your Credit Reports Used

The information in your credit reports is used to calculate your credit scores. Credit-scoring models can weigh the same information from the same credit report differently. But the main scoring models, FICO and VantageScore, look at information in five key areas to determine your scores: payment history, credit usage, credit history, credit mix and recent credit.

Your credit reports can also be used by creditors, such as credit card issuers, when theyre considering whether theyll open a line of credit for you. The credit bureau may also use the information on your reports to calculate a credit score for you.

Negative Hits On Credit Reports

Negative information, such as late or missed payments, remains on an individual’s report for seven years, after which the credit bureaus automatically remove the data.

Debtors who find inaccurate information on their credit reports can file a dispute with the credit bureau or with the creditor who provided the incorrect data. Most claims must be investigated within 30 days, and if the claim is substantiated, all three bureaus must remove the negative report.

Recommended Reading: Dispute Verizon On Credit Report