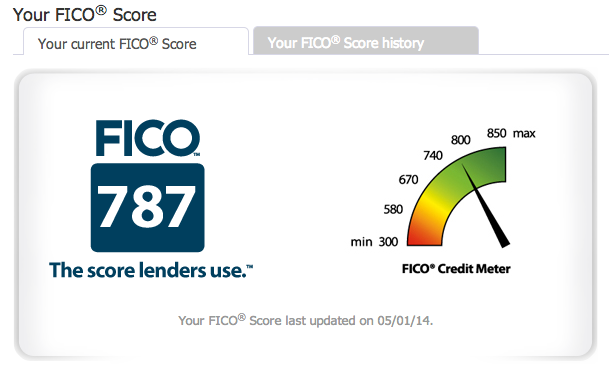

S To Improve Your 787 Credit Score

Improving your 787 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

What Does A 750 Credit Score Mean For Your Wallet

A 787 credit score is well above the national average of 679, according to the latest data from TransUnion. As a result, such a score generally gives you access to some of the best loans and lines of credit. The very best rates, rewards and fees may still be out of reach, though, as youll see in the table below.

Explore Your Refinancing Options

Now may be a good time to refinance your car loan or your mortgage. Doing so can save you money in the long term and potentially help your credit by making it easier to keep on top of future payments.

Although it is possible to refinance when you have bad credit, youll reap much greater rewards with a 787 credit score. For example, youll get better interest rates, which will save you money and may allow you to pay off the loan quicker.

You May Like: How Remove Hard Inquiries From Credit Report

What Is A Good Credit Score In Canada

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though good technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

How To Improve Your 787 Credit Score

Knowing how to improve your credit score is a big deal. You want to ensure that your credit is the best out there so that you do not have a problem applying and being granted loans and lines of credit.

Here are some tips to help you maintain or even grow your 787 credit score a bit more than it currently is:

- Always make sure that youre making all of your monthly payments on time, every time.

- You should always pay off your debt as quickly as you can to ensure that you have a boost in your credit.

- Keep your credit utilization to 30% of the available credit that you have overall. This will ensure that you have the best credit utilization and that you are not using too much all at once.

- Dont move the debt around that you have, pay it off and it will move quicker and benefit the score even more.

- Dont keep opening up new accounts every month since this can negatively impact the score and having hard checks done can also bring the score down.

- Never open up new accounts just to increase the amount of available credit, always just use the ones you have.

- Dont own too many credit cards all at once, or other loans since this can become overwhelming and actually harm your credit more than do it any good.

- Keep a comfortable income coming in and budget for expenses going out so that your credit score can benefit from bills being paid.

Recommended Reading: Carmax Lenders

Length Of Credit History 15%

While length of credit history is a less significant credit scoring factor, its still quite important. As the age of your oldest account and your average age of accounts grows older, your scores may improve. You may need a year or more of credit history to be considered for some premium rewards cards.

Your length of credit history should naturally increase over time. If you have a loved one willing to add you as an authorized user to an older credit card account, this might help you in the length of credit history category too.

Finally, its wise to maintain some activity on all of your credit cards. Doing so may help you avoid the risk of having your account closed due to inactivity. A closed credit card will fall off your credit report after 7-10 years . Once the account falls off your report, it will no longer count in your average age of credit.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

Don’t Miss: How To Check My Credit Score Without Ssn

How To Improve A 787 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 7 million negative items for their clients in 2020 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

What Can I Do About A Bad Credit Score

Think you have a bad score? Do not fret theres excellent news: credit report arent static! Your score will change when the details in your credit report changes. That means you can take control of your financial health now by making changes that will favorably impact your credit score over time. Heres a few things anybody can quickly do to start:

Also Check: Affirm Approval Credit Score

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

What Are The Benefits Of A Good Credit Score

Making timely repayments of loans and credit card bills can fetch you a good credit score. This has numerous benefits. Here, we have listed some of the major benefits of a good credit score:

1. Low-Interest Rates on All Types of Loans

This is a major benefit when it comes to having a good credit score. Everyone aims to maintain good credit so that loans can be availed at low-interest rates. This can further help in paying off loans faster and reduces a significant amount of financial burden. Even a slight reduction in big-ticket loans such as home loan, loan against property, etc., can save you a lot of money in the long run.

2. Improved Approval Chances for Loans and Credit Card

Every lender first goes through your credit score and reports as soon as you apply for a loan or credit card. This is called a hard enquiry and it can also impact your credit score. The impact can hurt your credit score in case the application gets rejected. However, with a good credit score, the credit approval chances are higher since lenders will not have a strong reason to reject your application.

3. Higher Credit Limits

4. More Negotiating Power

Don’t Miss: How To Get Inquiries Off Your Credit

What Is A Bad Credit Score

As you can see in the table above, credit scores between 0 and 624 are considered bad. If you’re applying for a credit card in Australia, you’ll usually need a good or better credit score to receive approval. If you do have a low credit score, there are steps you can take to increase it and improve your financial history.

Can I Get A Car / Auto Loan W/ A 787 Credit Score

Trying to qualify for an auto loan with a 787 credit score is cheap. There is little to no risk for a car lender .

Taking out an auto loan out with a 787 credit score, should be easy.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Also Check: Does Titlemax Report To Credit Agencies

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

How To Get Your Free Credit Report

If you want to see your most up-to-date credit score for free, you can now get a free credit report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly reports will be available through April of 2021 in response to the coronavirus pandemic. After April of 2021, youll still be eligible for one free credit report from all three major credit bureaus every year.

You can also track your credit through free credit monitoring services like Credit Karma or Credit Sesame. These wont show your actual credit score, but theyll give you a good approximation based on your payment history, credit utilization rate, and mix of accounts.

One of your credit card accounts may offer free FICO scores or free Vantagescore. Check on the app or website to find out.

| 500 |

Don’t Miss: Does Verizon Report To Credit Bureau

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.

Maintain Your Good Credit

The first thing you need to think about when you have a very high credit score is how to make sure that you dont lose all the progress that youve made.

To keep your credit score high, follow these tips:

- Pay all of your bills on time.

- Avoid opening any new credit accounts .

- Avoid closing old accounts.

- Send a debt validation letter demanding proof of any future debts that anyone tries to collect from youthis is one of your rights under the Fair Debt Collection Practices Act .

Don’t Miss: Removing Hard Inquiries From Your Credit Report

Mistakes Guaranteed To Wreck Your Credit Score

Every day, responsible consumers who think theyâre doing everything right unwittingly put their financial reputations at risk.

We pulled together a list of eight sure-fire ways to hurt your credit score. Here are two that you might not have thought of:

Not paying when a charge is in dispute: Even if a transaction is challenged, the account holder is expected to pay each month. The disputed charge will be designated as pending, but the cardholder is responsible for payment until the matter is resolved and a refund is issued.

Cosigning for friends or relatives: This could, and often does, have terrible repercussions down the road. Most people think of a cosigned loan as a shared responsibility, but in fact, the entire burden shifts to the cosigner if a friend or relative falls behind. Cosigning is potentially disastrous for credit scores and relationships alike.

LendingPoint is a personal loan provider specializing in NearPrime consumers. Typically, NearPrime consumers are people with credit scores in the 600s. If this is you, weâd love to talk to you about how we might be able to help you meet your financial goals. We offer loans from $2,000 to $25,000, all with fixed payments and simple interest.

Heres How To Get A 787 Credit Score:

Don’t Miss: Comenity Shopping Cart Trick

A Good Credit Score Is Always Useful

As we said, a good credit score is one of the best things you can use in your day-to-day life, no matter what age group you fall into. Not only can a high score help you get the credit products you need, it also helps you save money in interest, money that can come in handy later in life. So, for the sake of your financial well being, its best to start building healthy credit early on and maintain it throughout the years.

Rating of 3/5 based on 74 votes.

What Does Not Count Towards Your 787 Credit Score

There are many things that people assume go into their 787 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Recommended Reading: How To Remove A Repo From Your Credit