Re: Affirm 0% Offershould I Take It

NOOOO

My EX score is low due to using AFFIRM!

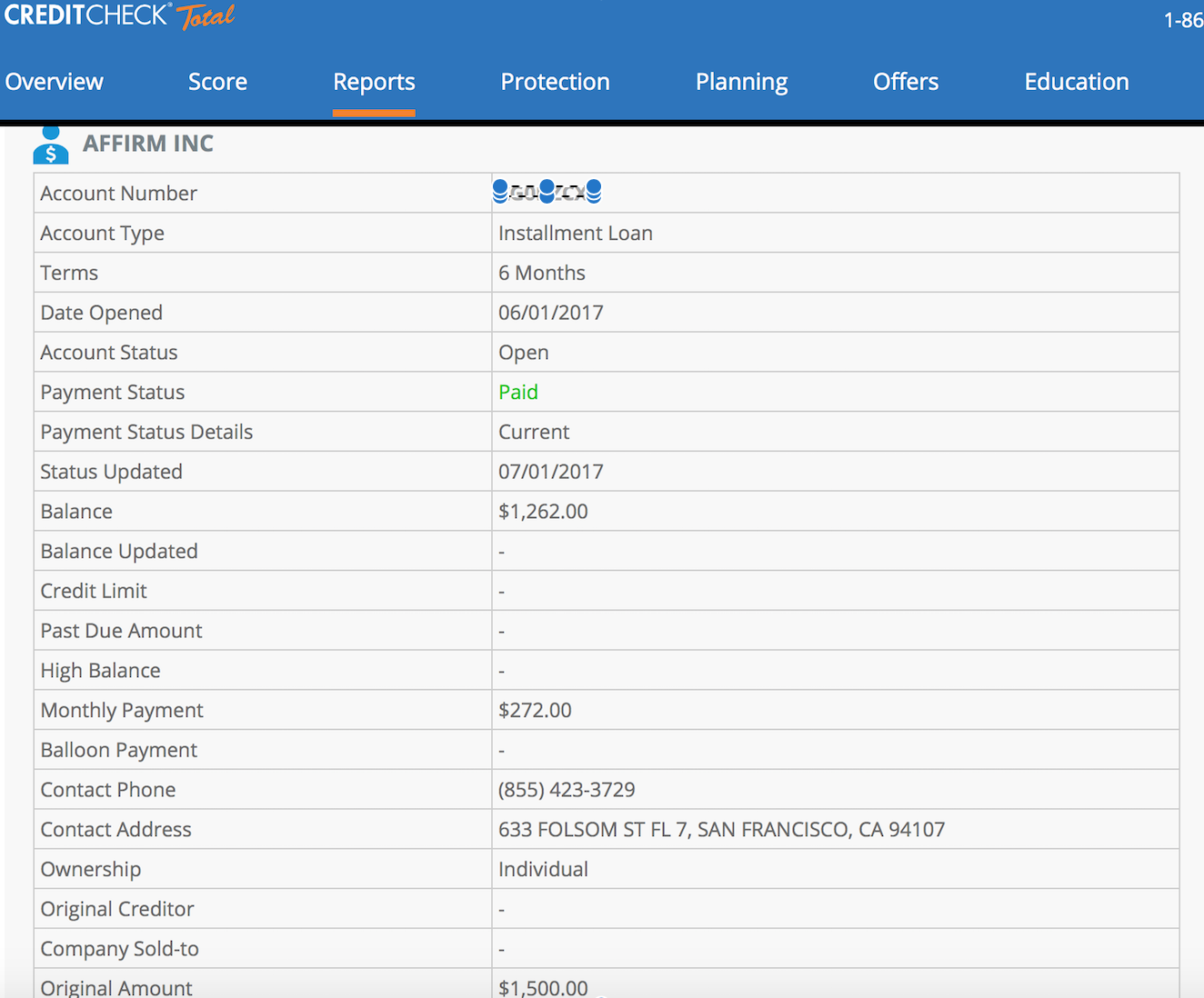

Originally they were a hidden tradeline and I used them not knowing they were a type of “loan” bad for the score.

I always paid early and that’s recorded on my CR but Affirm began reporting & reported all my paid off financing . Those a a big negative impact on my score..

Trying To Build Credit Dont Count On Some Silicon Valley Lenders For Help

Like many of her peers, 20-year-old Vanessa Montes de Oca doesnt have a credit card. In her case, its not for lack of interest or even lack of trying.

Shes already been rejected for several credit cards, which she chalks up to her lack of credit history. Shes also part of the under 21 pack, which makes it much tougher for her to get a card in her own name thanks to a 2009 federal law.

Still, the fashion design student likes to shop. And companies like Affirm, PayPal and Klarna are happy to help her do so, positioning themselves as a sort-of digital alternative to credit cards for the Millennial crowd.

What these Silicon Valley financiers dont advertise, however, is that they wont help you build conventional credit. When you make on-time payments on a regular credit card, its beneficial to your credit score. Its like the sun rising in the East and setting in the West, says credit expert John Ulzheimer. Thats not the case with these companies, whose policies are all over the lot and arent made sufficiently clear.

When Montes de Oca first learned about Affirm, she was checking out at her favorite online clothing retailer UNIF and it appeared as a payment option. She never used to be able to buy too much at once. Its a little more on the expensive side, she says of the store.

Part of whats incentivized her to do so: She thought it would help her credit score.

Affirm Vs Credit Card

The benefit of using Affirm for credit purchases instead of a credit card is that Affirm does not charge late fees, hidden fees or compound interest. They do charge an interest rate, but a user will know exactly how much theyâll be paying from the start. With a credit card repayment, late fees are charged for missed payments and unexpected interest payments can increase the price of the loan. Late fees, hidden fees and interest are also common contributors to credit card debt.

Affirm also reports on time payments to Experian, while other service providers do not do this. This gives you the opportunity to improve your credit score, as long as you do not make a late payment.

Don’t Miss: Does Carmax Have Good Financing

Affirm Vs Afterpay: Terms

Buy now, pay later financing is available from both Affirm and Afterpay. Affirm offers a variety of repayment terms and options, while Afterpay focuses only on “pay-in-four” lending to consumers, wherein the purchase price is divided into four equal payments.

With Affirm, you will be offered multiple payment terms to choose from at checkout. This gives you the ability to select the payment amount, interest rate, and term that works best for your budget. Some of these payment options are the pay-in-four that is common with BNPL apps, while others are longer terms up to 36 months. While credit limits vary by customer, the maximum loan amount is $17,500. Depending on which retailer you are shopping with, you may be required to pay a down payment.

Afterpay splits customer purchases into four smaller payments with its pay-in-four financing. The company does not have a minimum purchase requirement, but certain retailers may require you to spend a certain amount before this financing option is available. Your spending limit is determined by your personal profile, but it does not guarantee that your transaction will be approved at checkout. Like many pay-in-four programs, each transaction is individually underwritten for an instant credit decision.

Klarna Vs Affirm: Interest And Fees

Klarna does not charge any interest or fees as long as your payments are on time. When you miss a payment, Klarna will try one more time to collect the payment. If the payment is not made on the second attempt, the missed amount will be added to the next payment with a $7 fee added on top.

There are no hidden fees with Affirm. It does not charge late fees on its loans, even if you pay late. Affirm has funded over 17 million transactions to date and has yet to charge a late fee. The company makes money by charging a commission to businesses for handling the financing and some customers pay interest on their loans.

Read Also: The Higher Your Credit Score The Brainly

What Happens If I Fail To Pay My Affirm Loan

Yes, if you are unable to pay your loan, Affirm may share this information with Experian, which could negatively affect your creditworthiness. What about the confirmation? If you receive a zero price offer and pay on time, there is no catch. However, terms vary by seller and some approved loans have an interest rate of 30%, which is a high rate.

Do Affirm Loans Help Your Credit

In theory, Affirm loans could help your credit when you make timely payments. That said, one important factor for your credit sore is your credit utilization ratio. What makes your credit score happy is when you have a lot of credit available to you, but you havent used a lot of it. For example, having a couple of credit cards with over $10k in available credit, but a low balance that you regularly pay off each month. That would give you a good credit utilization ratio. On the other hand, if you have a lot of credit extended to you and you have high balances on that credit, that can actually harm your score. On top of that, when you actually pay off your loan with Affirm, you are essentially closing off a line of credit extended to you, which could in theory harm your score.

Don’t Miss: Does Speedy Cash Check Your Credit

How Do Returns Work When Using Affirm

If you have an issue with a purchase or need to return an item, Affirm advises customers to contact the merchant directly. You’d then have to follow the store’s policies for returns.

In terms of what happens to your Affirm loan after making a return, there are a few possibilities. For instance, Affirm can cancel your loan completely if the merchant has finalized the return. If the amount that’s returned to you is more than the loan, then Affirm can return this overpayment to you.

But the result may be different if the merchant only issues a partial refund or issues store credit in lieu of a refund. In that case, you would still be responsible for paying any remaining balance due on your Affirm loan, even if you’ve returned the item you purchased.

If you’re not able to resolve a return or refund issue with a merchant, you can initiate a dispute with Affirm. If you win the dispute with the merchant, Affirm will refund the full amount of the purchase along with any interest paid. But if the dispute goes in favor of the merchant, you’d still be responsible for paying your Affirm loan in full.

Can You Have 2 Afterpays At Once

Yes you can, Afterpay will monitor your account. If you are up to date with your payments you have the option to have multiple orders running simultaneously. In the case that you have overdue payments or too many scheduled payments Afterpay will decline your application and provide you with the reason.

You May Like: Does Marriage Affect Credit

Does Affirm Hurt Credit Score To Close Accounts

Having a verified account does not affect your creditworthiness. However, if you’ve paid for your purchases and still want to close your account, let them know below. They will contact you and close your account without affecting your balance. Once you close your account, you will no longer be able to login or view your rental history.

Do You Have To Have Good Credit To Get An Affirm Loan

If it is. Each confirmed loan you receive will appear as a separate loan on your credit report. Are you confirming an incorrect credit history? The confirmation approves your loan if your loan is 640 or more. credit test? Affirm carries out a careful credit check on candidates. This will not affect your credit score.

Recommended Reading: Getting Public Records Removed Credit Report

Experts Are Cautious About Buy Now Pay Later And Its Impact On Credit Scores

TransUnion does plan to use BNPL loans to calculate consumers’ credit scores in the future, but it will likely take credit bureaus and reporting models a few years to adjust, Liz Pagel, Senior Vice President at TransUnion, told CNBC last week, and Experian’s Chief Product Officer, Greg Wright, said the same thing.

For now, BNPL information will be separate from credit information in those two bureaus so that it doesn’t negatively impact credit scores but they won’t be improving them either. Other than storing the data, Experian and TransUnion have not said what else they plan to do with it.

Equifax, in contrast, is encouraging BNPL providers to report data on a biweekly basis, to align with the platform’s payment frequencies. It will be up to providers, however, to decide whether or not they report data to Equifax and how frequently.

The bureau will also account for BNPL lines of credit, and give the firms that generate scores the opportunity to view and decide how to incorporate the BNPL data, Equifax said in a press release.

Susan Sterne, president and chief economist at Economic Analysis Associates, told Insider’s Ben Winck in January that the credit bureaus should have investigated the impact of BNPL sooner, due to the risk of a possible credit bubble. Credit bubbles describe a surge in forms of credit, such as loans.

Let Affirm Take Care Of Financing While You Take Care Of Your Home

Buy new Whirlpool® appliances and pay later with Affirm. To get your loan decision in real time, choose Affirm at checkout.

Your rate will be 0% or 1030% APR based on credit, and is subject to an eligibility check. Payment options depend on your purchase amount, and a down payment may be required. Payment options through Affirm are provided by these lending partners: affirm.com/lenders.

Recommended Reading: Affirm Credit Score For Approval

What Credit Score Do You Need For Affirm

Affirm reports that youre more likely to be approved for their financing with a score of 640 or higher. There are user reports of being approved with a score as low as 600. Ensuring your revolving balances are low and that you have less than six inquiries will help.

Subsequently, Can I use Afterpay on Expedia?

No, Expedia does not accept Afterpay financing.

Keeping this in consideration, Can you get approved for Affirm with bad credit?

There is no minimum credit score to use Affirm. Loan approval depends on your credit score, your payment history with Affirm, how long youve had an Affirm account and the merchants available interest rate. If you receive a zero-interest offer and make payments on time, there is no catch.

Beside above What credit score do you need for Klarna? Klarna doesnt set a minimum credit score to qualify for financing. Actually, its possible to get credit with no prior history. If you choose to four interest-free installment payments, the company may conduct a soft credit pull. This does not hurt your credit score.

Does Afterpay build credit?

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Read Also: When Does Self Lender Report To Credit Bureaus

Affirm 0% Offershould I Take It

Was going to upgrade my espresso machine…have always wanted a La Marzocco, just never wanted to spend the money. Was at their site, and saw it mentioned 0% with Affirm. I “pre-qualified” and it is offering me 3 and 6 months at 0% .

The 0% is nice. But, I’ve heard conflicting things about Affirm. Whats the scoop?

I don’t have any “consumer loans” on my CRs.

Are Payments Automatically Split Into Four Installments With Affirm

With some point of sale loans, your payments are automatically divided into four installments. Specifically, that means an initial down payment at the time of purchase, followed by three additional installments.

Affirm, on the other hand, allows you to choose your payment option. So, for example, you may be able to split purchases up into three payments, six payments, or 12 payments.

You May Like: Does Paypal Credit Report To Credit Bureaus

Don’t Miss: Does Paypal Credit Report To Bureaus

Affirm Personal Loan Rates Terms And Fees

Affirm provides personal loans with interest rates from 10.00% 30.00% with no other fees. Depending on the retailer, some Affirm loans offer a 0% APR, which could be a good option for consumers who need time to pay off the loan. Generally, loan terms are 3, 6 or 12 months but select merchants may offer different terms, such as a 30-day payment option for purchases under $50. If a retailer allows you to use Affirm for purchases between $50 and $99.99, you must choose between a loan term of 0.25 months or 0.25 months.

| Loan Amount Range |

|---|

| Yes |

Affirm Vs Afterpay: Mobile App

Both Affirm and Afterpay offer mobile apps for Apple and Android so customers can access their accounts, browse and shop at participating merchants, and pay their bills anywhere, anytime. Each app offers a personalized experience based on a user’s favorite merchants, spending limit, and purchase history.

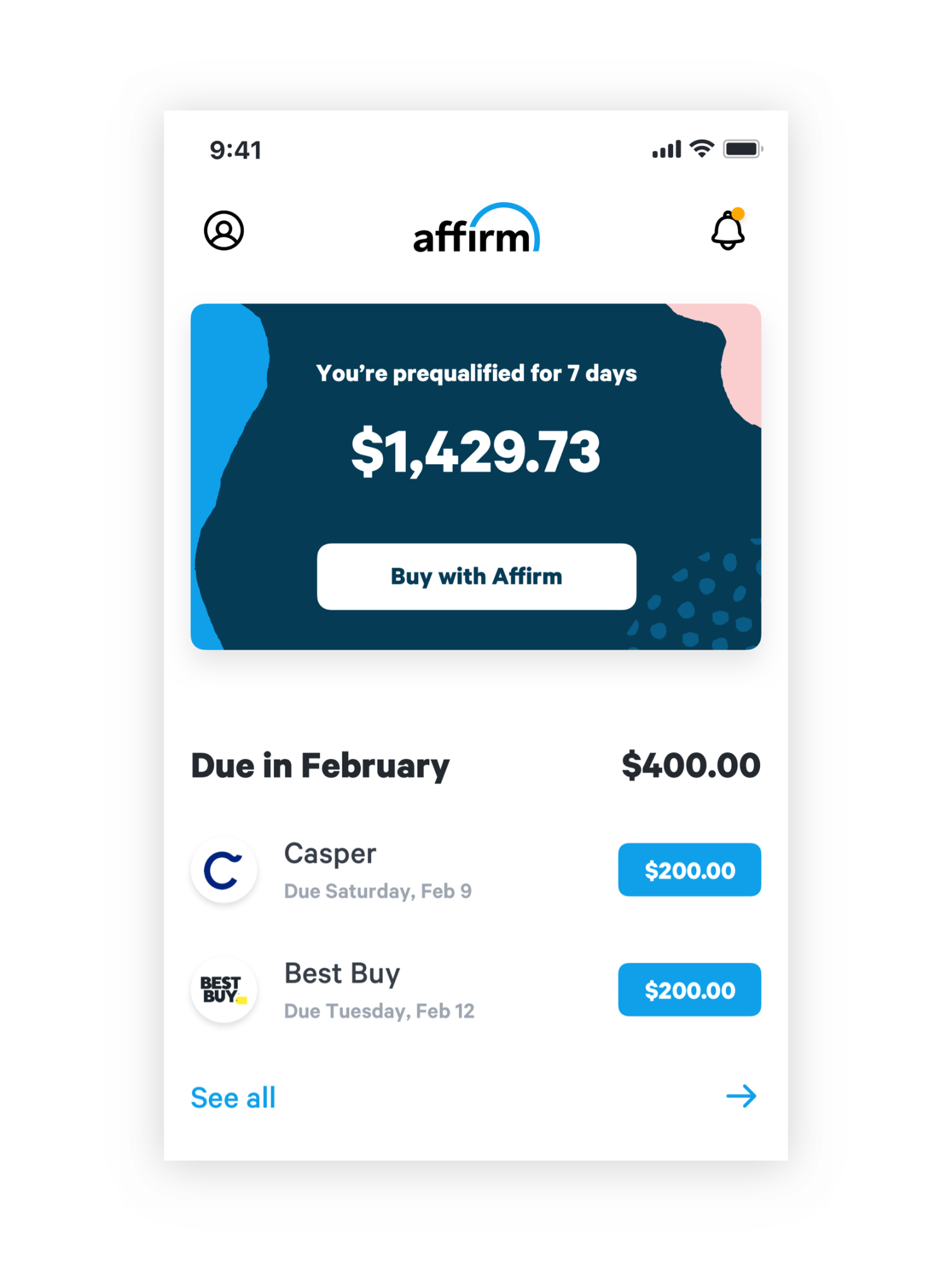

Affirm’s mobile app gives customers the ability to finance their purchases at over 11,500 merchants. Customers can make purchases online or in person with the mobile app at participating stores. The app offers exclusive offers from its merchants and special financing rates as low as 0%. Customers can also open a high-yield savings account through the app, which features no monthly fees or minimum balance requirements.

Customers can browse and shop at over 85,000 retailers with the Afterpay mobile app . The app also allows you to make in-person purchases at participating retailers. Inside the app, you can view your purchase history, payment schedule, and shipping status of your purchases. Your payment method can be changed through the app and you can prepay upcoming payments as well.

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

What Are The Requirements To Be Approved For Affirm

How does Affirm approve borrowers for loans? Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number. Affirm verifies your identity with this information and makes an instant loan decision.

Is It Safe To Use Affirm Or Paybright Credit

Affirm is a legitimate company that consumers can use to help fund their purchases over time.

Whether or not Affirm or PayBright is safe or a good idea will depend a lot on you. Like any loan, there is risk involved. An Affirm loan can be a convenient way to break up your purchase into smaller payments. If you ensure all of your payments are paid in full and on time then, you likely wonât have any issues.

An Affirm plan can also be a good alternative to using a credit card because the Pay in 4 plans offer 0% interest, as do some of the Pay Monthly plans. However, many of the Pay Monthly plans do charge interest which can reach as high as 29.95%. This is higher than most credit cards.

A BNPL option is probably not a good idea for you if you are someone who makes late payments or misses payments. If you do this, your credit can suffer. A better choice is to save up to make a purchase in advance and pay for it in full — which is easier said than done. However, when you save up and pay in full, at least there is no chance of a late payment or a hit to your credit score.

Before you use any BNPL service, itâs important that you read and understand the terms of your agreement. This includes having a solid grasp of how the loan can potentially impact your credit score. The main risks involved with using a BNPL product include borrowing more than you can pay back and the impact this can have on your personal finances and ultimately your credit.

Don’t Miss: 819 Fico Score

Interest Rates & Fees

What are Affirm’s fees?

Affirm discloses the interest amount upfront before you make a purchase, so you know exactly what you will pay for your financing. Affirm does not charge any hidden fees, including annual fees.

Why is my Affirm interest rate so high?

When Affirm determines your annual percentage rate , it evaluates a number of factors, including your credit score and other data about you. If you finance future purchases with Affirm, you may be eligible for a lower APR depending on your financial situation at the time of purchase.

This APR calculator will give you an idea of how much interest you actually pay:

When you consider Affirm financing, carefully evaluate the loan terms that Affirm offers you and determine whether the monthly payments fit your budget.

How is interest on an Affirm loan calculated?

Affirm calculates the annual percentage rate of a loan using simple interest.

This model differs from compound interest, in which the interest expense is calculated on the loan amount and the accumulated interest on the loan from previous periods. Think about compound interest as “interest on interest,” which can increase the loan amount. Credit cards, for example, use compound interest to calculate the interest expense on outstanding credit card debt.