If You’re Approved But Your Credit Limit Isn’t Enough To Buy A Device With Apple Card Installments

You can apply for Apple Card when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments. If your application is approved with insufficient credit to cover the cost of the device you want to buy, you can choose a different device that’s covered by your credit limit. You can also choose a different payment method or use Apple’s Trade-in program.

Next Steps To Apple Card Approval

Potential applicants who know their credit score and other requirements for Apple Card approval are likely informed enough to decide whether signing up for the card makes financial sense. People considering the Apple credit card can apply quickly and easily by filling out the form on Apples website, receiving a pre-approval decision in as little as a minute.

However, all is not lost for those with low credit scores or poor credit reports. Several steps to improving a credit score include regularly monitoring credit reports and not canceling old cards. By following these steps, among others, applicants who were once denied an Apple Card may find approval later.

Information is accurate as of Sept. 29, 2022.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Our in-house research team and on-site financial experts work together to create content thats accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates processes and standards in our editorial policy.

How Credit Is Reported For Apple Card Account Participants

Participants 18 years or older can opt in to be credit reported and build credit history.6 Participants will be reported to the credit bureaus as Authorized Users, which means they can spend on the account but are not required to make payments.

If you’re added as an Apple Card participant

- If a participant opts in to be credit reported, the Apple Card account will appear on their credit report.

- Participants inherit all positive and negative credit reporting from the account owners Apple Card account.

- The account owners payment history and account age is reported on the participants credit report.

If youre removed as a participant from an Apple Card Family account

- Account owners, the participant themselves, or Goldman Sachs can remove a participant at any time.

- Upon removal, Goldman Sachs will stop reporting the participant on that account to the credit bureaus.

- The participants credit history with Apple Card remains on their credit report unless the account is closed for a specific reason, such as an account owner filing for bankruptcy.

If youre a participant and want to open your own Apple Card account

You May Like: How To Remove Closed Accounts From Credit Report

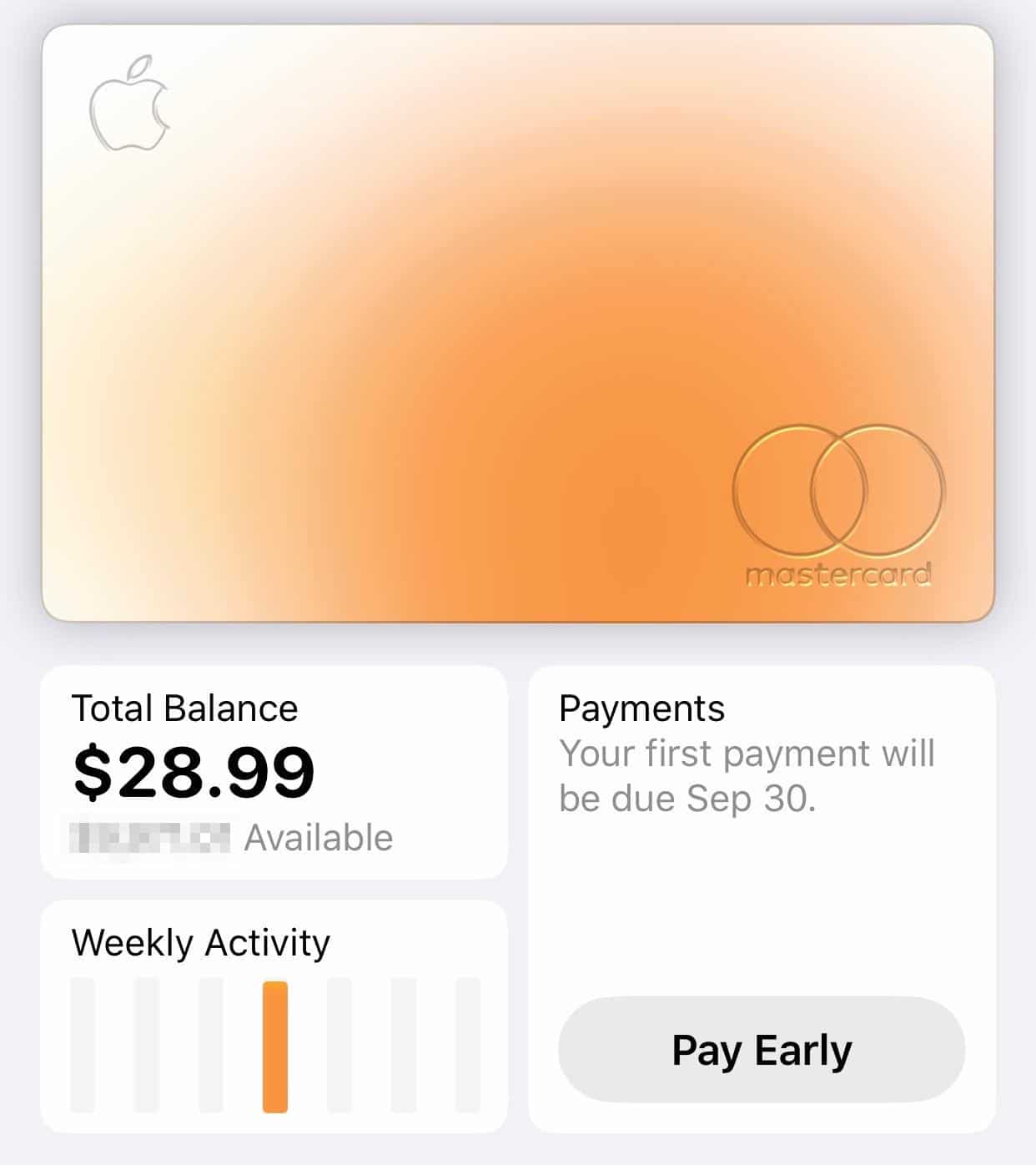

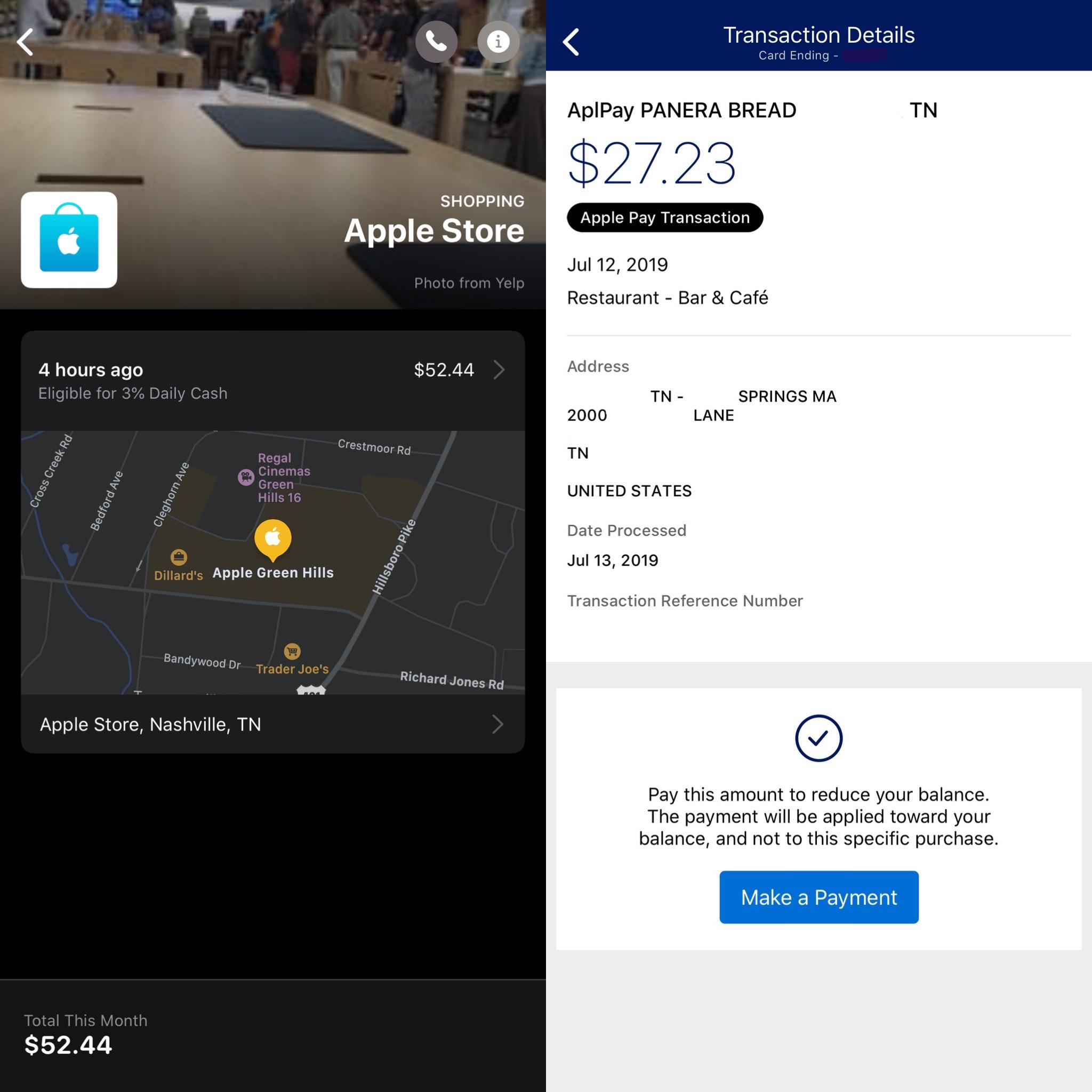

Using Apple Card With Apple Pay

Apple Card is designed to work with any other credit or debit card stored in the Wallet app for use with Apple Pay. You can set it as the default card and use it for in store purchases on iPhone and online purchases on Apple Watch, iPhone, iPad, and Mac.

What Is The Minimum Credit Score Needed For The Apple Card

The Apple Card is a new credit card from Apple and Goldman Sachs. It is available to customers in the United States and is issued by Goldman Sachs. The Apple Card can be used anywhere that accepts Mastercard.

The minimum credit score needed for the Apple Card is 700. This is a good score, but it is not excellent. If you have a score below 700, you may still be able to get the card, but you may not be able to get the best terms.

You May Like: What Is A Good Credit Score To Lease A Car

Virtual Card Numbers For Online Non

There are no credit card numbers or other information on the physical titanium Apple Card. This data is instead available in the app, leaving some questions about online purchases where you often need a number and a CVV.

Apple Card is able to generate virtual card numbers for these kinds of purchases. The Wallet app provides a virtual card number and a virtual confirmation code, with the number being semi-permanent and able to be regenerated whenever you want. This info can be used for non-Apple Pay online purchases, over-the-phone purchases, and other similar situations.

There is not, however, support for single-use numbers or single-merchant numbers for having separate card numbers for different merchants. Purchases are also protected by a one-time use dynamic security code rather than a persistent CVV.

How Does It Work

Apple designed their card for use with Apple pay. The Apple card works similarly to traditional cards, meaning that you can use it with other debit or credit cards in the Wallet app. You can also enjoy other benefits like setting the Apple Card as a default payment method where you can use it for online and in-store purchases.

Recommended Reading: How Do Hard Inquiries Affect Your Credit Score

Who Should Get This Card

The Apple Card is really built for people who use Apple products exclusively. If you use your iPhone for everything, the Apple Card might make a lot of sense.

Though not all of its features are ground-breaking, it consolidates several nice-to-have perks on your phone. One of the biggest draws is the ability to use the card with Apple Pay from your iPhone, earning Daily Cash, and other features exclusive to Apple users.

People looking for a simple rewards program might also have an interest in the Apple Card. As you use your card, youll earn a percentage of your purchase back in Daily Cash. Its called that because its loaded into your account daily. Theres no waiting for a month to gain access to your rewards, nor is there a minimum needed to redeem your cash back.

If youre a fan of metal credit cards, you may also be intrigued by the Apple Card. Although most purchases are meant to happen digitally within Apple Pay, you can opt to order a titanium Apple Card. The physical card is unique because it has no credit card number, expiration date, or code on it this is to help protect your account info.

What Participants Can Do On A Shared Apple Card

- They’re not responsible for payments.

- They can view their own transactions and information.

- They can spend up to the credit limit on the account but might have an optional transaction limit set by an account owner or co-owner.

- They can immediately use their shared Apple Card and get unlimited Daily Cash on all of their own transactions.

- If they’re 18 years or older, they can order their own titanium Apple Card.

- If they’re 18 years or older, they can opt in to build their credit and be reported as an authorized user on the account.3

If a participant is 18 years or older and doesn’t want to be part of Apple Card Family, they can apply for their own Apple Card account.4 If their application is approved and they accept their Apple Card offer, they get their own account and are removed from the shared Apple Card account.

Read Also: Is 685 A Good Credit Score

How Can You Maximize Your Apple Card Rewards

To maximize your Daily Cash rewards, make sure to use Apple Pay for as many purchases as possiblethat way, you automatically earn 2 percent cash back on most purchases. Your rewards get bumped up to 3 percent cash back if you make Apple Pay purchases with Apple, Uber Eats, Walgreens or another participating retailer.

Does The Apple Card Help You Build Credit

If you use your Apple Card responsibly, it can help you build your credit over time. To improve your credit score with the Apple Card, focus on making regular, on-time payments and try to keep your credit card balance as low as possible. The Apple Card reports credit activity to the three major credit bureaus: TransUnion, Experian and Equifax.

Also Check: When Does Chapter 13 Fall Off Credit Report

Is There A Rewards Program

Yup! The primary reward is a daily cash back program that Apple calls Daily Cash. Rather than a complicated points system, it simply pays you cash back for every purchase you make.

Apple Card rewards are tallied each day and delivered via a cash card.

Because the Apple Card is a MasterCard, it also carries many of the other benefits common to MasterCards. This includes free fraud and identity theft protection, two-day shipping from brick-and-mortar stores through ShopRunner, travel booking services, and more. For a complete list, look at this MasterCard page.

What Other Perks Does The Apple Card Offer

In addition to cash back rewards, the Apple Card offers several features designed to help cardholders manage their finances and build their credit. Use the Wallet app to track your purchases by category or identify spending habits and trends. When you make credit card payments, the Wallets payment wheel will offer recommendations to help you avoid interest charges and pay down your balance more quickly. You can even pay for Apple products in interest-free installments.

You can also share your Apple Card account using Apple Card Family. With this feature, you can share your account with up to five people. Everyone on the shared account can use your Apple Card and view their spending. Account owners and co-owners can see group members activity, set transaction limits and more.

You can designate a co-owner for the account, too. Like an authorized user, they will share your credit line and information reported to credit bureaus regarding the account. Your account co-owner must be at least 18 years old, while children over 13 can also be added to the account.

Also Check: When Do Inquiries Fall Off Credit Report

What If My Credit Limit Is Not Enough To Pay For An Apple Product

If the credit limit on your Apple Card is not enough to cover the cost of an Apple product, you may consider paying a portion in cash and financing the rest based on whether you qualify. Bear in mind that the financing will not be linked to your Apple Card. Using the companys trade-in program might be of help, or youll need to think about using a different payment method.

How Will I Apply For Apple Card

Apple is making the application process incredibly simple. You’re able to apply for Apple Card right through the Wallet app. Once approved, your titanium card will be shipped to you through the mail and your digital card will be immediately available to use with Apple Pay. If you want to apply, you can get a direct link right through the Apple Card website .

Don’t Miss: What Can You Get With A 700 Credit Score

Make All Of Your Required Payments On Time

To complete this step, regularly make on-time payments on your loans and lines of credit to keep your accounts in good standing. This excludes medical debt. It also excludes any payment where you’ve agreed with the lender to suspend all payments for a period of time due to hardship. Your required payments must be reported as paid on your credit report until the date that you complete the program.

To help ensure that you make all of your required payments on time, you can set up autopay. When you don’t make timely minimum payments on credit cards or loans, it can be reported as a negative event to credit bureaus. This puts your account in delinquency and lowers your credit rating.

If you’re a few days late on a required payment, contact your lender immediately to see if making a payment will avoid past due or late credit reporting to the credit bureaus.

How To Request A Credit Increase With Your Apple Card

You may request a credit limit increase on your Apple Card online or over the phone. If you plan to call, the number to use is 877-255-5923. Submitting an online request is possible by using your iPhone or iPad.

iPhone

In the Wallet app, select Apple Card.

Select the More button, followed by the Message button.

Request a higher credit limit by typing a message.

In the Settings app, select Wallet & Apple Pay.

Select Apple Card, followed by the Info tab.

Request a higher credit limit by typing a message.

> > MORE: HOW TO GET A HIGHER CREDIT LIMIT

Read Also: How To Analyze A Credit Report

How Apple Cards Credit Score Requirements Compare To Other Cards

If youre considering applying for the new Apple Card, you might be wondering what credit score you need. After all, one of the selling points of the Apple Card is that its designed for people with good credit. So what is a good credit score? And how does the Apple Cards credit score requirements compare to other cards?

How Credit Scores Are Determined

Information found in your credit report is used to determine your credit scores, which might include the following:

- Your history of debt payments

- Hard inquiries6 on your credit score from new credit applications

- The amount of debt you currently have on your credit accounts

- The age of your credit accounts

- The amount and type of loan accounts you have open

- The percentage of available credit you’ve utilized

- If and when you had a foreclosure, declared bankruptcy, or had debt sent to collections

It’s common to see varying credit scores when you look at different sources. Credit Karma and other services might display different credit scores, like TransUnion VantageScore, which is different from the TransUnion FICO score that’s used for your Apple Card application. Your credit report and the timing of when your credit score is updated can affect your credit score.

For information about credit scores from TransUnion, please click here.

Also Check: When Do Late Payments Drop Off Credit Report

Whats The Daily Cash Rewards Rate

The Apple Card will pay you 3 percent back on Apple Store purchases and Apple Music downloads, and 2 percent back on all other purchases made using Apple Pay. When you use the physical Apple Card, however, youll only get 1 percent back.

Apple is also offering 3 percent back for some third-party businesses, including:

- Exxon and Mobil gas stations

Apple Card: All The Details On Apple’s Credit Card

Apple in August 2019 released the Apple Card, a credit card that’s linked to Apple Pay and built right into the Wallet app. Apple is partnering with Goldman Sachs for the card, which is optimized for Apple Pay but will still works like a traditional credit card for all of your transactions.

There’s a lot of fine print associated with the Apple Card, so we’ve created this guide to provide details on what you can expect when signing up for the card. Apple Card has been available since 2019, and Apple is continuing to add new features. You’ll find everything that you need to know about Apple Card below.

Also Check: How To Send Credit Report From Experian

You Live In Or Travel To Cities With Widespread Apple Pay Acceptance

Apple claimed in announcing the Apple Card that 70% of U.S. retailers accept Apple Pay. Certainly, as of this writing, several major merchants do accept it , including Target, McDonald’s, CVS and Best Buy. It’s also worth noting that the Apple Card has no foreign transaction fees, and Mastercards are widely accepted around the world, so in general it will make a decent travel buddy.

» MORE:NerdWallet’s best credit cards for digital wallets

Why You Might Want The Apple Card

The $0-annual-fee Apple Card earns 3% cash back on Apple purchases, as well as at select merchants and through select apps, and 2% back on everything else but only if you make your purchases via Apple Pay on your iPhone. If you use the physical version of the card, which is an option at retailers that dont accept Apple Pay, youll earn only 1% cash back.

It’s unclear what kind of credit scores you’ll need to qualify for the Apple Card, but assuming you are creditworthy, you might benefit from this card. Here’s how.

» MORE: How to apply for the Apple Card in 3 steps

Read Also: How Often Is Credit Report Updated

Is Credit Karma A Reliable Credit Score

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Apple Card Review : The Cashback Card For Apple Lovers

Last updated Oct. 17, 2022| By Kevin Payne

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Leave it to Apple to create the most anticipated credit card release in years. The long-awaited Apple Card was released nationwide in late August 2019, touting an integrated experience for users that allows access to everything right from your iPhone.

The cards unique cashback structure may be beneficial for passionate Apple customers, but casual followers could find better deals elsewhere. Heres everything you need to know about the card everyones talking about.

Mobile-first rewards card

Earn up to 3% cash back on eligible purchases

Annual Fee

Rewards Rate

3% cash back on Apple purchases and when you use Apple Pay for purchases from select partners, 2% on other purchases made with Apple Pay, and 1% cash back on everything else

Benefits and Drawbacks

- Can spend your cash back almost immediately

- Integrates with Wallet app

- No over-the-limit, late, or annual fees

Drawbacks

- Low rewards rate for non-Apple Pay purchases

- Need an iPhone to maximize this card

Card Details

Read Also: When Do Banks Report To Credit Bureaus