Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

The Impact Of New Scoring Programs Today

Experian isnt the only company experimenting with nontraditional credit scoring methods.

TransUnion uses a product called eCredable Lift to similarly add 24 months of utility payment history to your credit report by accessing your utility accounts directly instead of your bank account. This program works with your TransUnion FICO Score 8 and VantageScore 3.0, even if you have no credit history at all and costs $19.95 annually.

Beyond the credit bureaus, FICO also recently introduced a new credit scoring model to help pad thin credit profiles. The UltraFICO Score goes beyond just utility payments, accessing banking history such as savings balances, length of account history, frequency of transactions, and more to supplement your credit information. Even if you dont have enough credit history to generate a traditional FICO Score, you can receive an UltraFICO Score.

Ultimately, its a positive trend for these institutions to begin assisting people with little access to traditional credit, says Cristina Livadary, CFP, of Mana Financial Life Design, a financial planning firm in Marina Del Rey, California.

Its one of the things that kids are never taught in school, she says. Having good credit really determines your access to some of the things that are important to acquire when becoming an adult.

How Exactly Can Experian Boost Help You

Regardless of your current credit rating, Experian Boost can help you improve your credit score with minimal effort. If you have little to no credit, the payment history will add positive history to your profile to strengthen your credit health right away. But if you have less than perfect credit, you could also benefit as positive payment history can help offset the negative marks in your credit report.

Also Check: How Do Hard Inquiries Affect Your Credit Score

How Does Experian Boost Increase Your Credit Score

Have you been attempting to enhance your credit rating? Do you desire a promising FICO 8 credit rating? If so, you should have stumble across Experian Boost.

In this article, we will certainly discuss all the crucial things you should learn about Experian Boost exactly how this outstanding function can help to enhance your credit score without spending a lot. Additionally, we will talk about How Does Experian Boost Increase Your Credit Score.

Make sure to continue reading till the end to discover just how you can benefit from the use of Experian Boost.

Experian Boost is a cost-free feature that permits consumers to include extra data to their credit report data with the goal of boosting their FICO rating. Users can use this feature by attaching the savings account they utilize for qualifying utility, cellular phone, and video streaming solution settlements.

Users might select which positive payment histories from these solutions should be included in the Experian Credit Report. If applicable, you might see results of Experian Boost promptly after finishing all steps in connecting accounts on your credit history record via the app or website portal.

This is a complimentary tool provided by Experian that helps improve your FICO rating without influencing any type of other info regarding your credit report. It is fasts and also simple to add accounts as well as it enhances your credit rating with Experian Boost.

Can Experian Boost Hurt Your Credit Score

Banks Editorial Team

Banks Editorial Team

Does your credit score need a boost? Experian, the largest credit bureau in the U.S., offers a free service worth considering if youre looking for a fast and easy way to improve your credit health. Its called Experian Boost, and many U.S. consumers have used the service to start getting results.

Read on to learn more about Experian Boost, how it works, the impact it could have on your credit score, and how to sign up.

Also Check: What Is Removed Collections On Credit Report

Consider Keeping Old Accounts Open

If you have older accounts that have been managed well, it could be worth holding onto them.

CRAs will consider how long you’ve held accounts for, and look more favourably on those who doesnt frequently open and close them. That said, having too much unused available credit can make some lenders nervous, so its worth being judicious in how many accounts you keep open.

Fastest Ways To Improve Your Credit

Its unlikely youll be able to get your credit score to where you want it in just 30 days, but there are some actions you can take that can improve your score more quickly than others:

Again, improving your credit can be a long process, but taking these steps can give you a head start and give you the chance to see improvements early on in the process.

Also Check: How To Remove Delinquency From Credit Report

Read Also: What Is Elan Financial Services On My Credit Report

Can You Raise Your Credit Score By 100 Points In 30 Days

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Your credit score affects everything from the interest rate youll pay on an auto loan to whether youll be hired for certain jobs, so its understandable if youre wondering how to raise your credit score quickly.

While there are no shortcuts for building up a solid credit history and score, there are some steps you can take that can provide you with a quick boost in a short amount of time. In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days.

Learn more:

Is Experian Boost Worth It

Experian Boost is a free feature that can help you raise your FICO® Score in a matter of minutes. For anyone who has worked to improve their credit scores over months or even years, seeing those credit scores go up instantly can be extremely rewarding.

Having a good credit score not only makes you feel good, but it can also help you save money and expose you to new financial opportunities. Your improved FICO® Score may help you get a favorable interest rate on a new loan, which could save you hundreds or even thousands of dollars over the life of the loan. Your improved credit score may also make you eligible for a new type of credit. These positive outcomes make Experian Boost worth it for many consumers.

Also Check: How To Get Free Credit Report In Georgia

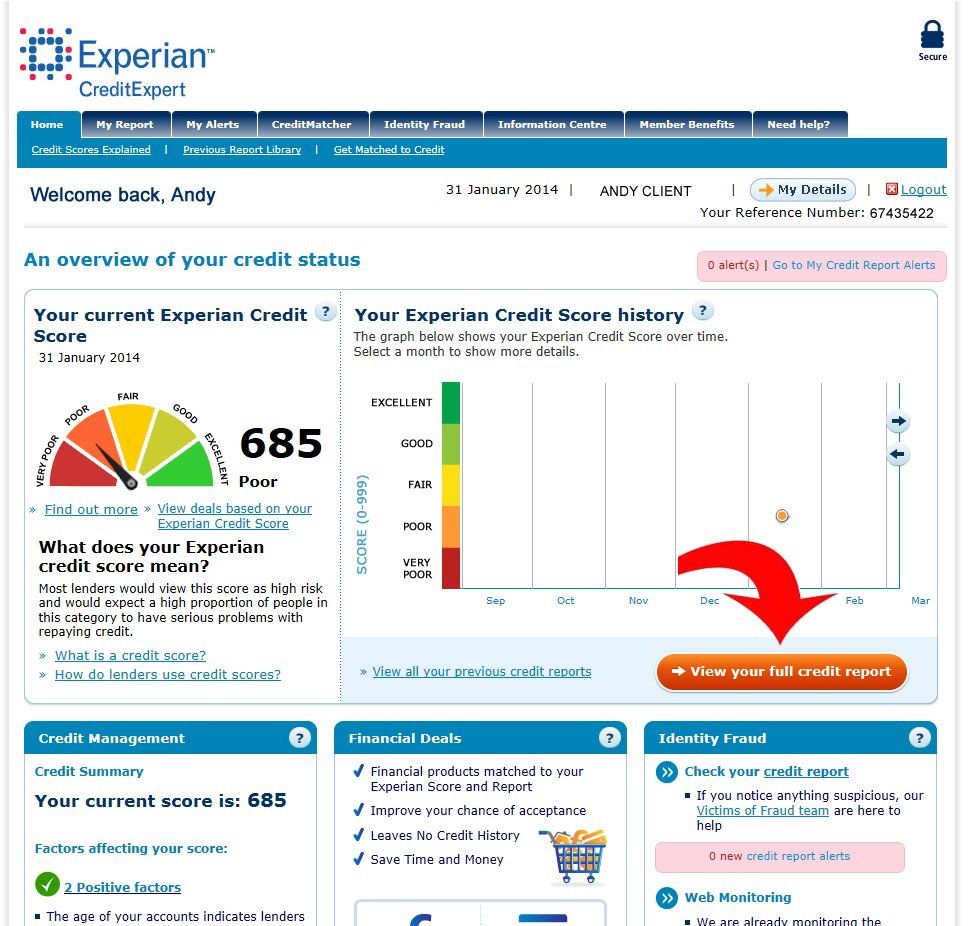

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you do so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Improve Your Credit Score Quickly With These Tips

At first glance, your credit score might seem confusing. The financial factors that contribute to them arent always clear, and its far easier to damage your score than it is to improve it. Because of that, raising your credit score can seem like a daunting task. However, there are a handful of ways to improve your scores, and therefore turn you into an appealing borrower in the eyes of lenders.

Also Check: What Credit Score Is Needed To Rent An Apartment 2020

Read Also: How Does Marriage Affect Credit Score

Can Experian Boost Hurt My Credit Score

Connecting to Boost will never be the cause of your credit score going down…

Connecting to Boost will never be the cause of your credit score going down â but while connected, your score could go down for the common reasons a credit score can drop.

Boost is dynamic and will be updated regularly. That means your boost can also go up or down while connected. For example, things that could cause your boost to decrease can include stopping regular payments to a savings account, ending digital entertainment subscription payments for the likes of Netflix, and any change in the amount of money coming in or going out of your account.

Another reason why your boost might change is from time to time we fine-tune the way a boostâs calculated to give you the most up-to-to date indication of the difference it makes to how lenders view you.

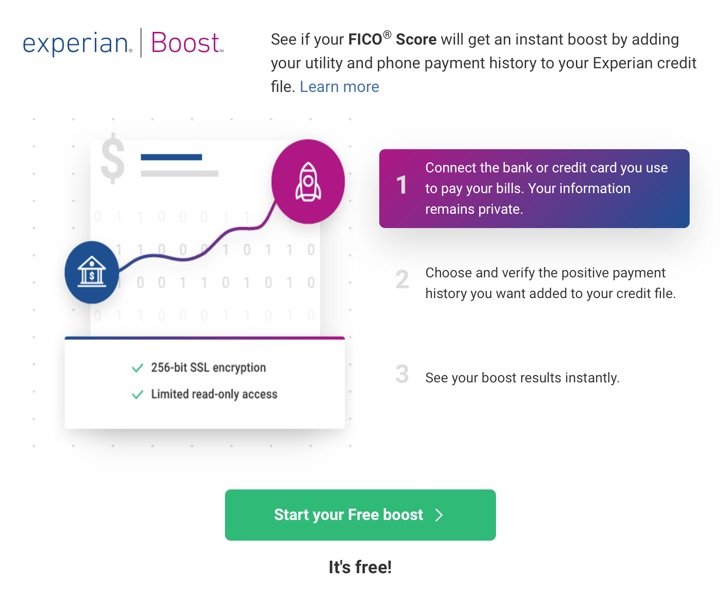

How Do I Sign Up For Experian Boost

Signing up for Experian Boost is easy. When you go to the Experian Boost page, you’ll be asked to create a free Experian account to start the process. You’ll then connect your online bank and credit card accounts so Experian can search for any qualifying on-time payments. Once you verify that you want to add the accounts to your credit file, your credit scores will be calculated using the newly added payment information. The process is simple, and if you receive a boost, you’ll see your FICO® Score increase in just a few minutes.

If you pay your rent or utility, telecom or streaming bills using your bank account or a credit card, consider trying Experian Boost to see if you can instantly raise your FICO® Score and get credit for your past on-time payments. You can always get your FICO® Score for free from Experian to stay on top of your credit and see how you may be able to improve your credit scores.

Recommended Reading: Will Paying Off My Student Loans Increase My Credit Score

If You Sign Up For Experian Boost Your Rent Payments Could Help Improve Your Credit Score But Should You Use This Service

In most cases, lenders won’t give you a loan or credit card if you don’t have a credit history. So, those just starting out, like younger people, sometimes find it difficult to get an auto loan or take out a mortgage, for example.

In early 2019, Experianone of the three major introduced “Experian Boost.” This online platform allows people with thin credit files to potentially raise their .

When first introduced, Experian Boost looked only at utility and telecommunications payments. Experian recently announced that Boost will also consider monthly rent payments when building consumers’ credit scores. But before you sign up for this service, consider the downsides.

Improve Your Credit Score

According to Experian, the average Experian Boost user improved their FICO score by 13 points. This can be a major benefit when it comes to your personal finances.

With even a small credit score boost, you could unlock better financing terms to save yourself thousands on major purchases. This is especially true if the boost gets your Experian credit score over the threshold from fair to good.

Experian Boost is a useful option for those with a thin credit file. It will add information to your account that will expand your credit report.

Read Also: What Is S Good Credit Score

How Do You Sign Up For Experian Boost

Its easy to sign up for Experian Boost. You can get started online or via the mobile app by enrolling in the Experian CreditWorks Basic membership program. Theres no cost to create an account, and youll need to provide your first and last name, current address, email address, and password youd like to use to access the dashboard.

Once your account is open, youll be asked to connect your bank account. Experian will analyze transactions to identify qualifying payments you can use. You will be asked to confirm these accounts before moving forward and can disconnect your account at any time if you want to stop using Experian Boost.

Increase Your Credit Score Instantly: A Guide To Experian Boost

Experian is best known as one of the three major credit bureaus alongside Equifax and TransUnion. Each of these three agencies collects your financial information and compiles that into a report for lenders, like credit card companies, to determine your creditworthiness.

However, you might not be as familiar with the various credit tools that are offered to help consumers better manage and understand your credit. After all, what good is a report if you cant parse out what it means?

Today, well take a look at Experian Boost, a relatively new tool from Experian that has the potential to increase your credit score instantly — and for free. Too good to be true? Lets take a look at how Boost works and if its right for you.

New to The Points Guy? Sign up for our daily newsletter and check out our updated beginner’s guide.

You May Like: How Does A Mortgage Affect Your Credit Score

Use A Credit Builder Credit Card

If you’ve never borrowed money before, you might assume this means you have a good credit score. In fact, this is unlikely to be true.

That’s because when assessing your application, lenders look for evidence that you’ll be able to pay back what you borrow, so having no record of successful repayments can count against you.

Experian estimates 5.8m people have a thin’ or non-existent credit file in the UK. This means that CRAs hold little or even no information on you, which makes you invisible to the financial system. This can lead to not being able to access products such as a mortgage, loan or credit card, or facing higher costs than others.

Consequently, you may find that you’re turned down for a credit card or loan especially one at the cheapest rate even if you could comfortably afford to pay them back.

One solution is to take out a credit card specifically designed to help you build or rebuild your credit history.

Because these ‘credit builder’ cards are aimed at higher-risk customers, APRs tend to be very high, so you should never use them to borrow.

How long will this take to boost my score?

It takes six to 12 months of paying on time for someone whos never officially borrowed before to improve their credit score.

The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

You May Like: Which Credit Score Is Used For Auto Loans

How To Improve Your Credit Score In A Year

If you have a year to improve your credit score, first follow all the strategies we recommended for increasing your credit score in 30 to 60 days.

Heres what else you can do to increase your credit score in a year:

- With a year to plan, you can open two new credit cards in the first 6 months of the year to increase your total available credit.

- Diversify your credit mix. Try to have at least one revolving line of credit, like a credit card, and one installment loan, like an auto loan, student loan, or credit builder loan.

- Finally, near the end of the year, after paying on time and decreasing debt throughout the year, you can request an increased credit limit again.

Be sure to make all payments on time!

You May Like: What Is Experian Credit Score

What Do We Mean By Lender

A lender is an organisation who provides either money, goods or a service to you with the expectation that you will pay them back in the future.

Some of the lenders we work with will be familiar to you . We also work with companies who provide you with goods and services on credit. Some examples of this include:

- Mobile phone companies who include the price of your phone in your monthly bill

- Your energy company, who charges you after youâve used their services

- Retail companies who might ask you to pay in instalments for something like a new TV

Also Check: Does Moneylion Report To Credit

Use Experian Boost To Report Council Tax Netflix Subscriptions And Savings

In November 2020, Experian launched a new tool to help people quickly improve their credit scores.

Experian Boost uses open banking, by which you grant Experian access to your current account information.

The tool allows them to unlock previously hidden information on your salary, council tax payments, savings habits and even your subscription payment information.

Experian says that 17m people could boost their credit scores by up to 66 points by using the tool.

Find out more:Experian Boost explained