Can You Remove Hard Inquiries From Your Credit Report

It would be nice if you could simply wipe all those inquiries off your credit report with the sweep of a magic wand. Unfortunately, things arent quite so simple.

That said, theres an exception: inquiries that are the product of identity theft.

One reason its a good idea to check your own credit report is that its fairly common for them to contain errors or false information. In some cases, you might receive entries that should belong to another person with the same name or, worse, someone who has stolen your social security number to make credit applications. All of this can harm your credit score.

You can identify these entries by checking your credit report and looking for inquiries related to company names you dont recognize. However, some companies might use a different doing business as name or abbreviation so, even if youre unfamiliar at first, you might be looking at a legitimate inquiry.

If you find a mistake, its possible to request an amendment. Just contact the credit bureau in question to dispute the inquiry. Then, the credit bureau will contact you and determine whether the dispute was legitimate. With any luck, theyll decide to remove it.

How Many Points Will A Hard Inquiry Impact Your Credit Score

A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably wont be that significant. As FICO explains: For most people, one additional credit inquiry will take less than five points off their FICO Scores.

FICO also reports that hard credit inquiries can remain on your credit report for up to two yearsbut when FICO calculates your credit score, it only considers credit inquiries made in the past 12 months. This means that if your credit inquiry is over a year old, it will no longer affect your FICO credit score.

Why Dont Hard Inquiries Stay On Your Credit Report For More Than 2 Years

The reason hard inquiries dont stay on your credit history for very long is that they mainly predict your financial behavior in the short term. They dont necessarily suggest anything about your long-term borrowing habits.

The way the credit bureaus see it, applying for new credit might be a sign that youre financially struggling . However, the longer you manage your new account responsibly, the less likely this is to be the case, so it doesnt make sense to penalize you for hard inquiries for a long time.

Read Also: Do Insurance Quotes Affect Your Credit Score

Is Amone Good For Loans

Overall Rating: 4.8 / 5 AmOne is a loan marketplace that assesses consumers individual financial needs and matches them with the best lender for them. AmOne matches consumers with financial products in minutes, does not require a minimum credit score, and has an excellent rating from Trustpilot.

Is AmOne a direct lender?

AmOne is not a direct lender. The platform connects borrowers with lending companies. The application process involves filling out a short form, after which AmOne reviews your information and quickly searches through its network of partners for a loan that fits your needs.

Do loans ruin your credit?

The amount and age of a loan can affect your credit scores. But its not only the loan itself that affects your credit scores. And the better your payment history, the better your credit scores might be. But if youre late or miss payments, that could hurt your credit scores.

Closed Accounts In Good Standing

Even if you do have to close one of your revolving credit accounts, all is not lost. Closed accounts in good standing will also typically stay in your credit report for ten years. That gives you plenty of extra benefit after youre done with that credit card or line of credit. These closed accounts can help counteract any other blemishes on your report too.

Even though these accounts stay on your credit report for a decade, they will eventually drop off. This is why many financial experts recommend you never cancel that old credit card. Even if you upgrade to one with better rewards, a lower interest rate, or high credit limit, it usually helps your credit score to simply leave the account open. It positively adds to your credit history and your .

Don’t Miss: What Is A Remark On A Credit Report

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

You May Like: How To Remove Timeshare Foreclosure From Credit Report

Stay On Top Of Your Payments

Your payment history and the age of your credit accounts are two major factors used to determine your credit score.

As such, one of the easiest ways to improve your credit score over time is to consistently make on-time payments towards your debts. It may take some time, but making on-time payments will surely help mitigate the effects of hard inquiries on your credit report.

Remember that not all lenders report payments to credit bureaus.

Don’t Miss: What Number Is Considered A Good Credit Score

Keep An Eye On Your Credit Inquiries

Remember: Checking your own credit scores is an example of a soft inquiry. And soft inquiries donât impact your credit scores.

Hard inquiries, on the other hand, happen when a lender checks your credit report after you apply for credit. And since hard inquiries do affect your scores, youâll want to control how many âhardâ hits your credit takes.

Monitoring your credit can help you keep an eye on where you stand.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

A Hard Inquirys Impact May Decrease Over Time

Like other negative marks on your credit, a hard inquiry may have the greatest negative impact when it first shows up on your credit report. As long as you practice other good credit behaviors, such as paying your bills on time and only using a small portion of your available credit limits, a negative impact from a hard inquiry could decrease over time.

VantageScore shows the impact of an inquiry could drop to zero within just three months. In some cases, the inquiry could remain on your report and have no impact on your scores. For example, FICOs credit scores dont consider credit inquiries that are over 12 months old.

Don’t Miss: How To Get Inquiries Off Credit Report

Understanding Hard Inquiries On Your Credit Report

When a lender requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry. What does a hard inquiry mean for your credit scores? And how long does a hard inquiry remain on your credit report?

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit report for two years, although they typically only affect your credit scores for one year. Depending on your unique credit history, hard inquiries could indicate different things to different lenders.

Exceptions to the impact on your credit score

When Should You File A Dispute

There are a few circumstances when you may want to dispute a hard inquiry and have a good chance of getting it removed.

- If the hard inquiry is from over 24 months ago, it may no longer be timely and should possibly be removed from your credit reports.

- If a creditor checked your credit but you never gave it your verbal or written permission to do so, it may have violated the FCRA and the hard inquiry could be removed.

- If someone else applied for credit in your name, you can dispute the fraudulent hard inquiry as you didnt authorize the credit check. Also, look for an associated account, dispute that account and contact the creditor to let it know that youve been the victim of fraud.

You can file a dispute with each of the credit bureaus online, by mail or over the phone. The dispute process with data furnishers can vary depending on the organization.

You May Like: Which Credit Score Is Used For Car Loans

Can Inquiries On My Credit Report Be Disputed

Legitimate inquiries can’t be disputed or removed from your credit report until the two-year time period is up.

A hard inquiry from a company you don’t recognize doesn’t necessarily indicate a case of identity theft. When you shop around for a mortgage or car loan, websites, brokers or dealerships may send your information to multiple lenders, who will each check your credit. If you don’t recognize the name of the company that performed the hard inquiry, you can often find contact information for the company listed in the entry on your credit report or online, so you can call to verify.

If it turns out that a company pulled your credit report in error, you can ask the company to contact the credit bureau to have the inquiry removed. If someone is fraudulently applying for credit in your name, you can contact the credit bureau to dispute the inquiry and ask to have it taken off your credit report.

If Youve Applied For Financing Or Other Credit And The Lender Checked Your Credit Scores As Part Of The Process Youve Probably Experienced Whats Called A Hard Credit Inquiry

When lenders check your credit with a hard inquiry , they often make a note of their official review in your . They use that information to assess how youve handled credit in the past, how often youve paid your debts and bills on time, and whether you have any derogatory marks on your credit reports.

They also want to know how much credit youre juggling and how long youve been managing your credit. All of these factors help creditors decide whether to extend new credit to you or give you additional credit.

You can help yourself prepare for a hard credit pull by monitoring your credit reports and making sure there arent any unpleasant surprises. Checking your own credit reports often involves whats known as a soft credit inquiry, or soft pull.

Lets take a deeper look at the differences between hard credit inquiries and soft credit inquiries.

Also Check: What Is Ic Systems On My Credit Report

Understanding The Difference Between Hard Pull & Soft Pull

Before getting an in-depth answer to the question how long do hard inquiries stay on your credit report? its important to understand the difference between hard pulls and soft pulls.

Unlike hard inquiries, soft inquiries do not affect your credit score, and companies dont need your permission to perform them. In most cases, you wont even know when a soft inquiry has occurred. For example, have you ever received an offer from a credit card company in the mail?

Chances are that the company performed a soft pull to see if you qualify for the offer.

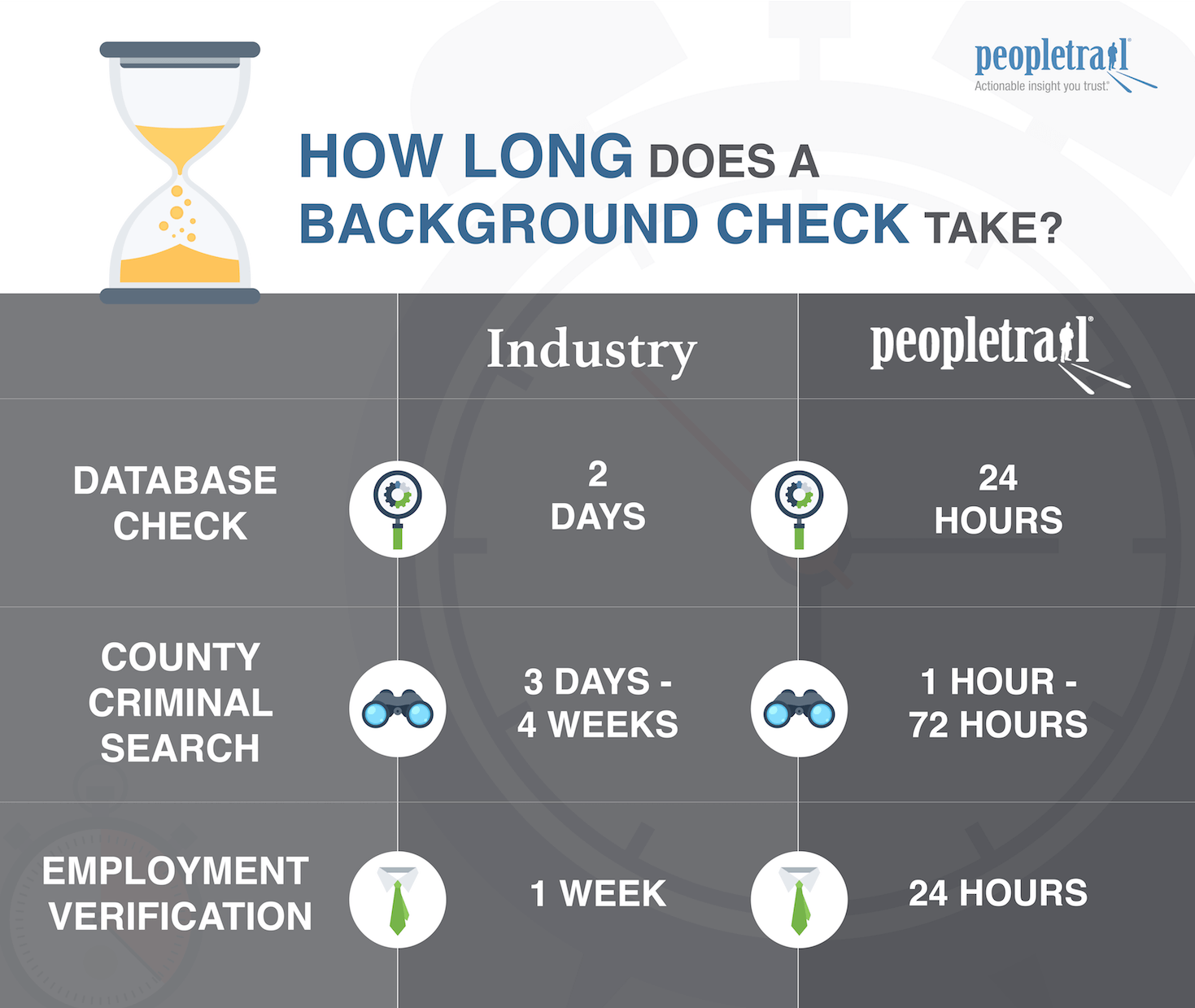

Employers may also perform soft pulls as part of a background check before hiring you to ensure that you are responsible. You also perform a soft pull every time you check your credit score.

Hard inquiries, on the other hand, do impact your credit score. Hard pulls occur when you apply for credit, and they can only be performed if youve given consent.

Hard pulls are recorded on your credit report and can make your credit score drop by around five points, so its important to avoid having too many of these inquiries on your credit report at once.

To get a more in-depth understanding of hard pulls vs. soft pulls reading: .

What Are Hard Inquiries

A hard inquiry is when a lender pulls your credit report after youve applied for a line of credit, such as for an auto loan, a new mortgage, or a new credit card. A hard credit inquiry may impact your credit score, but you dont necessarily have to worry. In most cases, a hard inquiry wont cause a significant change to your and may not stay on your credit history for very long.

Read Also: What Is Considered A Very Good Credit Score

Do Credit Card Inquiries Hurt My Credit Score

Often, if you apply for a new credit card, the application will lead to a hard inquiry when the credit card issuer will check your credit. A hard inquiry from a credit card application could hurt your credit and remain on your report, even if the card issuer denies your application, just like a hard inquiry from a different type of loan or credit line application.

Whats more, FICO does not dedupe or buffer out hard inquiries from credit card applications. Knowing this, you may want to hold off on applying for multiple credit cards at once.

Camino Financial: Apply For A Business Loan Without Affecting Your Credit

One of the easiest ways to avoid hard inquiries is to apply for loans from lenders that dont perform hard pulls before approving your loan.

At Camino Financial, we understand that people may want to avoid adding another hard inquiry to their credit report. Thats why we only perform soft pulls on our applicants. When you apply for a business loan at Camino Financial, your credit score will not be impacted.

Additionally, we dont require a minimum credit score or credit history as we know that some of our applicants are immigrant business owners who havent remained in the US long enough to build a credit history.

Ready to take the next step towards improving your business without sacrificing your credit?

Request a loan quote today and discover instantly if you are prequalified without impacting your credit.

Read Also: What Credit Score Do You Need For Capital One

How Long Do Inquiries Stay On Your Credit Report

Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries wonât affect your credit scores.

Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

For example, if youâre shopping around for a mortgage or car loan, it makes sense that you might be comparing rates with different lenders. For that reason, rate shopping within a certain time frameâgenerally 14 to 45 days, depending on the credit-scoring modelâcould be treated as just a single hard inquiry.

You could keep up with your credit status by pulling your free credit reports from the three major credit bureaus: TransUnion®, Experian® and Equifax®. You can retrieve free copies of your credit reports by visiting AnnualCreditReport.com.

can also help you access your TransUnion credit reports and your weekly VantageScore® 3.0 credit score. Using CreditWise wonât hurt your credit scores, and itâs free for everyone, whether or not you have a Capital One product.

Why Do Credit Inquiries Matter

When you apply for a credit card, begin shopping for a loan or prepare to take on a new financial responsibility, like renting an apartment, the lenders and companies involved want to know whether youre likely to be a financial risk. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on the rent.

There are two different types of credit inquiries: hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which dont affect your score at all.

Read Also: How To Remove Prescribed Debt From Credit Report