Should I Dispute The Inquiry

Returning to the example of our commenter, we should verify that she is seeing a hard inquiry affect her score and not just the report of a soft inquiry. When checking your credit reports, you will see them in different columns. Someone pulling a credit report without authorization happens more often that you may think. If it is a confirmed hard inquiry, and if our commenter does decide to dispute the inquiry, she has a few options. Disputing errors on your credit report is something you can do on your own, or you can turn to a professional credit repair agency for help. Either way, these are the four steps a dispute requires:

Recommended Reading: When Do Companies Report To Credit Bureau

How To Remove Hard Inquiries From Report

When you apply for new credit, the hard inquiry associated with your application stays on your personal credit report for 24 months. Federal law requires hard inquiries to stay on your report for a specific period of time so you know who has had access to your credit file.

You cant force a credit bureau to remove a legitimate hard inquiry from your report early. But you can dispute any item on your credit report thats incorrect or that you want a credit bureau to verify.

The credit bureaus have incentives to correct inaccurate information when you dispute italthough you shouldnt expect mistakes to be fixed overnight. First, the Fair Credit Reporting Act requires the credit bureaus to investigate information you dispute and correct inaccuracies. The credit reporting agencies want to follow the FCRA so they dont face potential consequences of non compliance, like lawsuits or fines.

Next, the credit bureaus are also motivated to correct credit reporting errors, like unauthorized hard inquiries, because having accurate information makes for a better product. The credit bureaus sell credit reports to lenders. The more accurate the reports, the more valuable they are to the people who buy them.

Do you have unauthorized inquiries on your credit report? You may be able to get a credit bureau to remove them by following these steps.

Warning About Credit Disputes

Credit disputes dont always work . When our co-founder, Mark Huntley, filed an Equifax dispute, they lowered his score by 72 points that same day! .

But the point is, you may want professional help when dealing with the credit bureaus. Or perhaps youve tried removing the inaccurate hard inquiries yourself but havent had success, then its time to call the professionals. If youve ever searched for a credit repair company, then youll quickly realize there are a lot of choices and some really horrible sounding reviews of many of them.

We like to recommend The Credit Pros. Not only are they super helpful in removing inquiries, but they also offer the lowest monthly credit repair plan cost in the industry, and have a 90-day money-back guarantee.

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit

How To Escalate Matters

File An Identity Theft Complaint With The FTC: You can file a formal identity theft complaint with the Federal Trade Commission through its online complaint form. Once you have submitted your complaint, the FTC will generate an Identity Theft Affidavit. It is very important that you save and print this document, as it can only be viewed once through the online system. The FTC Identity Theft Affidavit is a critical supporting document for investigations into suspected identity theft.

File A Report With Your Local Police Department: Bring a copy of your FTC Identity Theft Affidavit to your local police department, along with a government-issued ID, proof of your address and any additional documentation you have concerning the unauthorized inquiry. This will enable you to file an official police report, which, together with your FTC affidavit, will comprise your “Identity Theft Report.” People often are hesitant to report a seemingly minor sign of identity theft to the police, but its important to remember that taking this step which may be as simple as filling out and submitting a form at the station is more of a procedural milestone than the beginning of an active investigation by law enforcement.

Either way, an unauthorized inquiry should raise suspicions about the security of your personal and financial information, so you may want to consider taking additional steps to ensure this case of suspected identity theft does not spread.

Search For Unauthorized Hard Inquiries

Once you have copies of your credit reports, review them for mistakes, errors, and fraud. Search for credit accounts you dont recognize, incorrect credit reporting on valid accounts , and other mistakes. Finally, check your credit reports for unauthorized inquiries.

If you discover inquiries you dont recognize on your credit report, it could be a sign of identity theft. Make a list of any suspicious inquiries you find. Youll need this information to complete the next step.

Also Check: Can Student Loans Be Removed From Credit Report

What Is A Credit Dispute Letter

A credit dispute letter is a written document that a borrower sends to their lender or to a credit bureau/agency. Typically, the term credit dispute letter refers to letters sent to correct errors in a credit report.

Best penny cryptocurrency to invest in 2020What is the best cryptocurrency for beginners?Bitcoin. Bitcoin is the most widely used cryptocurrency to date.and one of the hottest cryptocurrencies of the decade.Ethereum.Binance Coin A unit of currency consumed in the process does.Basic Attention Token A unit of currency consumed in the process does.Which cryptocurrency do you buy?Coinbase site seâ¦

Hard Vs Soft Credit Inquiries

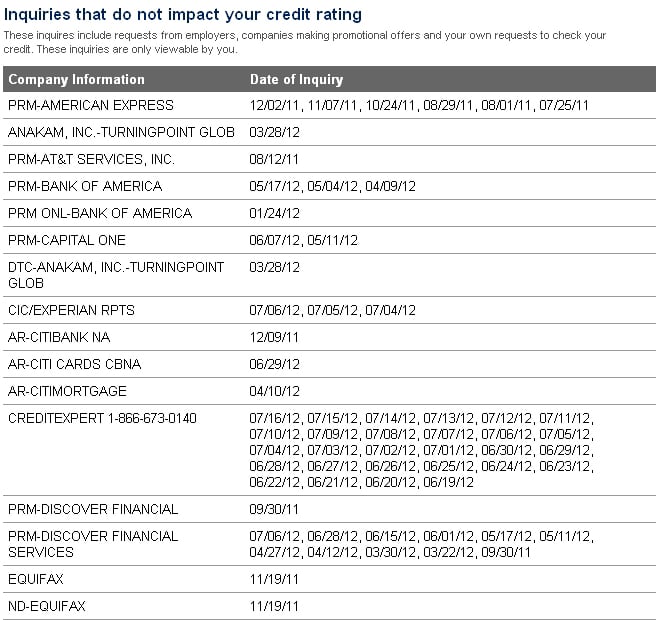

Hard inquiries are the only type of credit pull that can affect your credit score, and they’re the only ones that businesses will see on your credit report. Credit inquiries that don’t affect your score and don’t appear on your report are called soft pulls. Examples of soft inquiries include you checking your own report and a potential employer accessing it during a background check. And credit card issuers may do soft inquiries when they are preparing promotional card offers.

Credit inquiries carried out by insurance companies when you’re seeking quotes for various kinds of policies are considered soft inquiries and do not show up on your credit report.

Don’t Miss: How Long Does Bad Credit Stay On Report

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Checks From An Authorized Lender

Any authorized lender that reports information to the credit reporting agencies is also known as a data furnisher.

Consequently, you’ll have to give permission for the lender to access a copy of your credit report. For example, a credit check will be essential before you can pursue an auto loan application.

Read Also: What Is Credit Score Based On

A Credit Inquiry Is A Record Of When A Lender Or Creditor Requests Your Credit File

While a single hard inquiry, also known as a hard pull, is unlikely to impact your eligibility for new credit products such as a new credit card, it can affect your credit scores for up to two years.

When reviewing hard inquiries on your credit reports, you want to make sure that they are legitimate. What does that mean? For each hard inquiry line item you see, did you authorize the creditor or lender to pull your credit? If you did, you dont need to take any action.

But its possible that when youre monitoring your credit reports that youll flag instances of unauthorized hard inquiries. If you find one of these, youll want to file a dispute with the credit bureau that generated the report and ask the bureau to remove the unauthorized inquiry.

Heres how to dispute inaccurate hard inquiries from your credit reports.

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

You May Like: Do Cell Phone Companies Report To Credit Bureaus

How To Remove A Hard Inquiry

Last updated Aug. 25, 2022| By Larissa Runkle

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Your credit score is affected by a number of factors, and credit inquiries are one of them. If youve recently found a hard inquiry on your credit report, you might be wondering why it happened and if youre worried about your score how to get that hard inquiry removed.

But credit inquiries happen for a variety of reasons and not necessarily bad ones. They make it possible for you to get approved for new loans or credit cards and also to check your own .

The main thing to keep in mind is that not all credit inquiries are the same, and they wont all negatively affect your credit score. In this article, well go over the different types of inquiries that exist and how you can manage them to protect your credit score.

Obtain Free Copies Of Your Credit Report

You can order free credit reports once a year from each bureau. The three bureaus often record the same information. But sometimes, there are differences so it’s essential to check all three reports carefully for signs of identity theft.

What to do:

- Get into the habit of checking your credit every few months to safeguard against fraud.

- Visit AnnualCreditReport.com to order your free credit report.

- Order a credit report from all three bureaus every year â each bureau version includes your credit score.

Read Also: How Do You Get Your Credit Score Up

Check Your Credit Reports For Free

The first step is to get your credit reports from each of the three credit bureausEquifax, Experian and TransUnion. Often, the same information is recorded on all three, but not always, and thats why its important to check all three.

You can typically pull your credit reports for free once per year on AnnualCreditReport.com. However, due to Covid-19, you can order free weekly credit reports until April 20, 2022.

Can You Remove Inquiries From Your Report

While most credit inquiries are nothing to worry about, you should act immediately if you suspect fraud or suspicious activity. Only hard credit inquiries conducted without your consent can be disputed.

The first way to request that inquiries be removed from your file is by sending a letter to the creditor via certified mail. The letter should be specific about which inquiries were unauthorized and that you would like them to be removed.

As previously mentioned, you can also contact the three credit bureaus to dispute an inquiry.

You May Like: Does Getting Rejected Affect Credit Score

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your credit report for two years. Each time a hard inquiry is made, it is recorded by each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. And each time a hard inquiry is logged, it can potentially impact your credit score.

What Exactly Is A Hard Inquiry

In the credit world, when you apply for credit, the lender will pull your credit, which is referred to as a hard inquiry. Its simply an evaluation of your credit by a potential lender. A lender reviews your credit anytime you apply for a mortgage or auto loan. Basically, if youve requested a business to review your credit for lending, then its going to be referred to as a hard inquiry.

You May Like: How Many Years Does Collections Stay On Credit Report

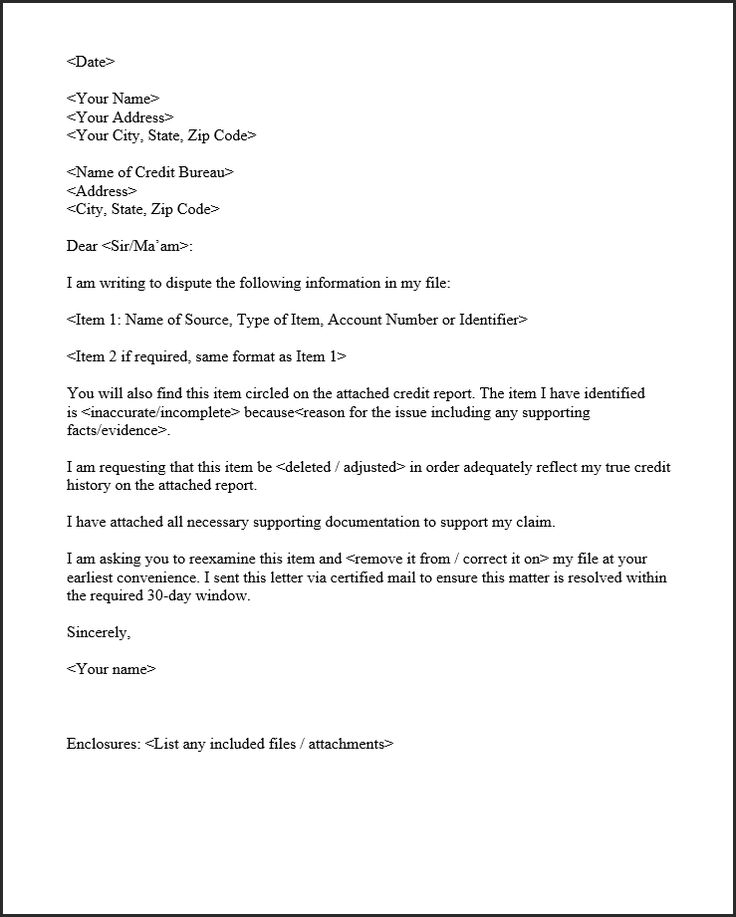

Sample Letter To Get Hard Inquiries Removed From Your Credit Report

If youâre going to dispute an error on your credit report, itâs best to write a letter to the credit reporting agencies. Though many bureaus have online forms, they often include forced arbitration forms, which will prevent you from filing a lawsuit over the dispute, something you may ultimately need to do.

Writing a letter may feel overwhelming. However, the Consumer Financial Protection Bureau and the Federal Trade Commission both provide a sample cover letter and a template of the information that the dispute letter needs to include. Your letter should contain the following info:

Information that identifies you:

-

The number from the account

-

You should number each item that you want corrected

-

The dates that the dispute occurred

-

Explain each inaccuracy

-

The company that has the information in dispute

Finally, make sure you include a summary or list of the documents you submitted to support your claim.

The Type Of Credit Inquiry That Matters Most

There are two different types of inquiries, with differing effects on a consumers : hard inquiries and soft inquiries.

If someone authorizes a hard inquiry of your credit report, then your credit score will drop anywhere from 5 to 10 points for a year for each hard inquiry. A soft inquiry wont impact your credit score at all. Well go into how these two inquiries differ.

Don’t Miss: How Often Should A Person Check Their Credit Report

S To Take If You Do Not Get The Results You Want

If the investigation resulting from the dispute process does not go your way, you have several options:

- You can dispute directly with the creditor that reported the inaccurate information, including getting documentation or written verification.

- You can submit additional documents to the credit reporting company.

- You can request a brief statement related to your dispute to get added to your credit report.

- You can file a complaint with the Consumer Financial Protection Bureau or reach out to your states Attorney Generals office.

Do Disputed Errors Always Go Away

If your disputed error is legitimate and gets corrected, your report will be updated with the correct information, and your credit score will likely go up. Once your report is entirely corrected, the information will be removed, and it will be as though it was never there! However, this is only if the disputed error is investigated and found to be legitimate.

Read Also: How Often Can You Review Your Credit Report For Free

Remove Old And Outdated Addresses

When you remove your old addresses the credit bureaus electronic verification system will sometimes automate deletions when the address on your credit report cannot match up with the account information stored at the creditor.

Sometimes old charge-offs or collection accounts can be tied directly to the old addresses so removing them can help your credit report if they are removed.

What Would Be Considered A Hard Inquiry

Hard inquiries usually happen when you make loan applications or apply for a mortgage or any credit cards. To ensure you are creditworthy, potential lenders will check your credit score and your credit file. Because it can cause a drop in your credit score by a few points, you will usually have to give permission to a financial institution to perform a hard credit check.

Hard credit inquiries are one of the factors that make up your overall credit score. However, credit inquiries only account for about 10% of your score and arenât nearly as important as things like payment history and credit utilization, which account for 35% and 30% respectively. Credit history and credit mix account for the rest of your score.

Because it accounts for only 10% of your rating, a single hard inquiry generally has a negligible effect on your credit score, decreasing it by not much more than five or so points. If numerous hard pulls show up on your credit report in a condensed period of time, however, your score would take more of a serious hit and significantly impact your credit worthiness.

You May Like: How To View Credit Score