Choose Your Vehicle Or Dealership

The first step to getting a Capital One auto loan is to browse the Auto Navigator site for vehicles and dealers in your area. If you narrow your choices down to a single vehicle, you can get prequalified right on that page for an auto loan. You can also simply view dealership inventory in your area and find out which dealers work with Capital One.

How Can I Improve My Score To Get This Card

If your credit score falls below the 580 score threshold, that would put you in the poor credit tier. The good news is that credit scores change over time, and its in your control to improve your credit score. It will take time and patience, but its totally doable. Here are some strategies you can try:

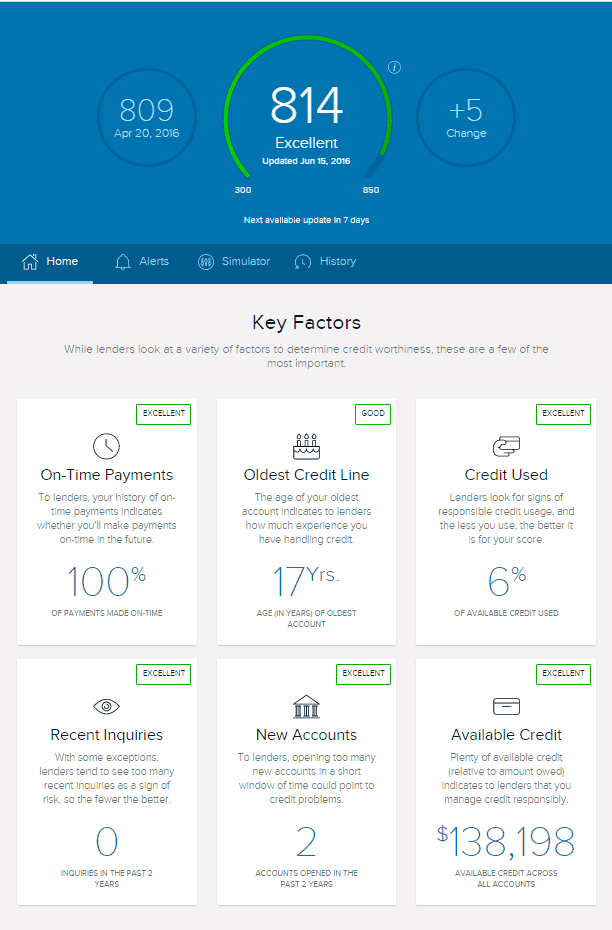

Pay down outstanding debts. If youre maxed out on another card, that could be one of the key factors keeping your score down. , or how much of your credit limit you are using, is the second most important factor in the credit score calculation .

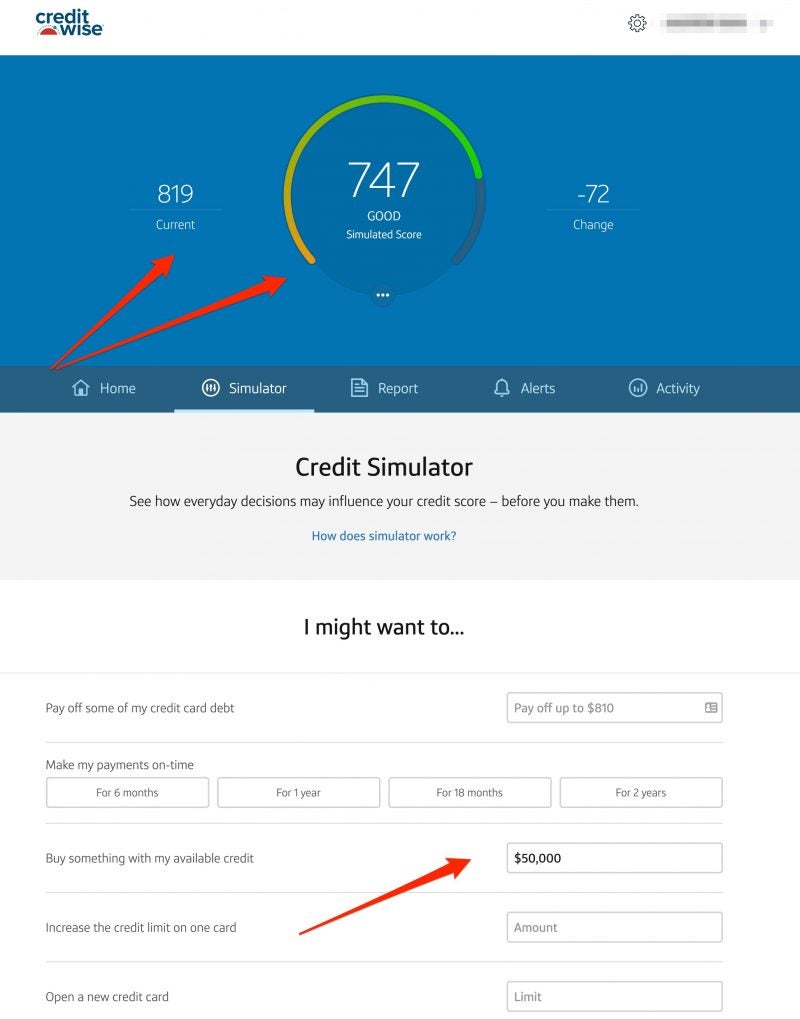

So if you have a $1,000 credit limit on a card and you owe $980, youre using 98% of your available credit. Because of that, the credit score algorithms deem you to be a higher-risk borrower. Therefore, make it a goal to get your utilization down in increments: first below 50%, then 30%, and eventually as close to zero as possible. The lower it goes, the greater the positive impact will be on your credit score.

Check your credit reports for errors. If youre not sure why your score is coming up low, it could be that there are negative items on your credit reports that shouldnt be there. In fact, a recent study by Consumer Reports found that 11% of consumers had an error on their credit reports.

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Don’t Miss: How To Get Repossession Off Credit Report

Amendment To Terms Of Use To Allow Personal Visits

In 2014, Capital One amended its terms of use to allow it to contact you in any manner we choose, including a personal visit . . . at your home and at your place of employment. It also asserted its right to modify or suppress caller ID and similar services and identify ourselves on these services in any manner we choose. The company stated that it would not actually make personal visits to customers except As a last resort, . . . if it becomes necessary to repossess sports vehicle. Capital One also attributed its assertion of a right to spoof as necessary because sometimes the number is displayed differently by some local phone exchanges, something that is beyond our control’.

Read Also: Aargon Collection Agency Reviews

How Often Capital One Reports To Credit Bureaus

According to Capital One, it typically provides your credit information to all three bureaus every 30 to 45 days.

The company doesn’t specify exactly when it does this, but it’s normal for creditors to report your data at the end of every billing cycle.

Capital One also doesn’t specify what exactly it reports, but based on a review of the information that shows up on a credit report, you can reasonably guess that Capital One reports:

- Your payment history for two years

- Your balance

- The amount of your last payment

- The past amount due

- The account status

- The date the account was open

- Who is responsible for the account

Other information may be reported, depending on your individual circumstances. Also, Capital One says that your credit report will show when the issuer provided your data to each bureau.

One key piece of data is your balance. With this information, plus your credit limit, a credit bureau can determine your utilization ratio. More on this all-important ratio in a moment.

Also Check: Credit Score To Qualify For Care Credit

What Is A Good To Excellent Credit Score

Capital One defines good to excellent credit as:

- Never declaring bankruptcy or defaulting on a loan

- Not more than 60 days late on a credit card, loan, or medical bill in the past year

- Had a loan or credit card for 3 years or more with a credit limit above $5,000

How hard is it to get the Capital One Venture credit card? If you meet these three conditions, your Capital One Venture approval odds are very high. Of course, there are no guarantees that you will be approved if you have an excellent credit score. Having good to excellent credit means your credit score is at least 700.

When your credit score is higher than 700, you can apply for the Capital One Venture Rewards Credit Card, one of the best credit cards for excellent credit scores.

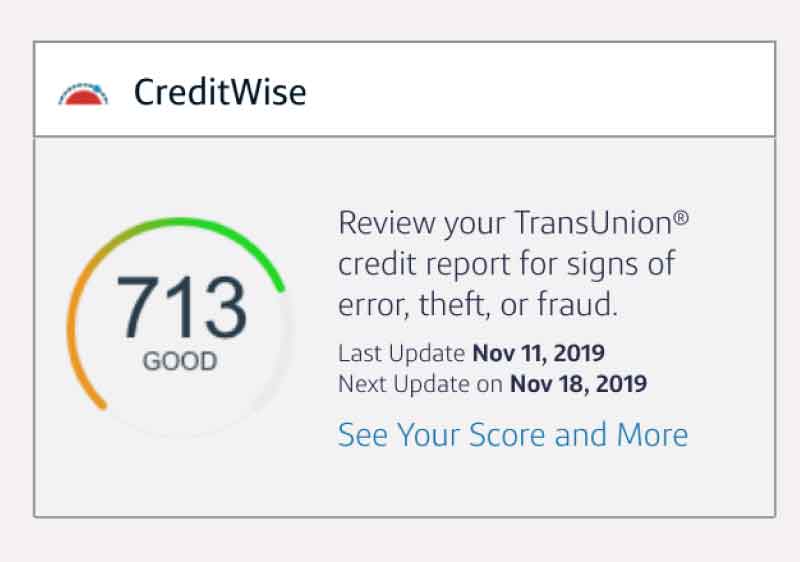

Why Is My Transunion Score Higher Than My Equifax

The credit bureaus may have different information. And a lender may report updates to different bureaus at different times. So, it’s possible that Equifax and TransUnion could have different credit information on your reports, which could lead to your TransUnion score differing from your Equifax score.

Read Also: How To Delete Inquiries

Get Another Credit Card

To get approved for another card, you’ll generally need to show consistent debt management, a good credit utilization ratio, and a timely, consistent payment history.

Keep in mind that applying for a new card will result in a hard inquiry on your credit report. In some cases, applying for a credit limit increase will do the same thing. So either way, apply sparingly. Each hard inquiry has the potential to reduce your credit score by a few points. Too many hard inquiries could make it hard for you to get credit in the future when you need to apply.

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

Recommended Reading: How To Notify Credit Bureau Of Death

Capital One Pulls All Major Credit Bureaus

First, Capital One likes to pull all three major credit bureaus whenever you apply. This means that you will most likely get a hard pull on your credit report for: Experian, Equifax, and TransUnion.

This is one of the drawbacks of applying for a Capital One card because most other banks only pull from one or two bureaus at a time. And some banks such as American Express may not even pull from any bureaus.

This does not mean that you should never apply for a Capital One card but it does mean that you should expect a temporary ding on all of your credit reports if you apply.

Note that this method of pulling all three credit bureaus can actually work in your favor in some cases as I will explain below.

Capital One Venture Credit Score Needed

The Capital One Venture is now one of the best travel rewards credit cards on the market.

Thats because Capital One recently made changes to its rewards program and now allows for one to one transfer ratios to some great travel partners. They also added some new travel partners and will be opening up airport lounges very soon as well.

But what type of credit score is needed to get approved for the Capital One Venture? And what type of starting credit limit can you expect if you are approved?

In this article, I will break down the credit score requirements to help give you a sense of your approval odds and also provide you with some insight into getting approved for Capital One cards.

Don’t Miss: 877-392-2016

Learn Why You May Have More Than One Credit Score And What That Means For You

You may already be familiar with the importance of credit. After all, your credit score can help lenders decide whether to approve your credit application, what interest rate to offer, how to determine your credit limit and more.

But did you know that there are different types of credit scores? Here are some things to know about how credit scores are calculated and why you might have different types.

Removing Capital One Collections From Your Credit Report

Collections can hurt your credit score and remain on your credit report for up to 7 years regardless of whether you pay it or not. Unfortunately, paying the collection could even lower your credit score.

However, it is possible to have it removed before 7 years, and you may not even have to pay it.

Phone number: 383-4802

Read Also: Cbcinnovis On My Credit Report

Recommended Reading: Syncb Zulily Credit Card

Get Your Capital One Collections Removed Today

If youre looking for a reputable company to help you with collection accounts and repair your credit, we HIGHLY recommend Lexington Law.

Call them at for a free credit consultation. They have helped many people in your situation and have paralegals standing by waiting to take your call.

- Top Trending Debt Collection Agencies

-

Heres a list of some of the nations most popular debt collectors that cause damage to your credit.

You May Like:

Capital One Venture Rewards Credit Card Benefits

If you qualify for the Capital One Venture Rewards Credit Card, you will enjoy the following benefits:

- 2x miles on every $1 spent

- 5x miles on hotels and rental cars booked through Capital One Travel, where youll get Capital Ones best prices on thousands of trip options

- Redeem miles for travel statement credits and future award travel

- Receive up to $100 application fee credit for Global Entry or TSA PreCheck

- $95 annual fee

There is no foreign transaction fee with this card, making it one of the best credit cards for international travel.

New Capital One Venture Rewards Credit Card cardholders can earn 60,000 miles after spending $3,000 on purchases in the first 3 months.

Recommended Reading: What Does Syncb Ppc Stand For

Can I Use My Credit Card Before Closing On A Home

Posted:

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience. She has written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times, and she previously served as an adjunct instructor at the University of Florida. Today, she edits all CardRates content for clarity, accuracy, and reader engagement.

Reviewed by: Ashley Dull

With more than a decade of experience as a content manager and marketer, Ashley has specialized in finance coverage since 2015. She has worked closely with the worlds largest banks and financial institutions, up-and-coming fintech companies, and press and news outlets to curate comprehensive content and media campaigns. Her credit card commentary is featured on national media outlets that include CNBC, MarketWatch, Investopedia, and Reader’s Digest, among others.

Homebuyers are well-advised to be mindful of their credit usage when applying for a home loan and waiting for it to close. But does that mean you cant use your credit cards at all during this time?

Not exactly.

While there are some specific card-related activities you should avoid when buying a home, you can continue to use your cards to make everyday purchases as you normally would.

When Does Capital One Report Credit Utilization To Bureaus

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The three biggest consumer national credit bureaus — Experian, TransUnion, and Equifax — don’t calculate your credit score from thin air. To do that, each credit bureau needs data. And one source of that data is your creditors.

If you’re a Capital One credit card holder, you might be wondering when this creditor sends your data to the credit reporting agencies.

To understand when Capital One reports credit utilization to the bureaus, we’ll:

- Discuss what the issuer reports

- Look at the hows, whens, and whys of issuer reporting

- Explore what’s important about your payment history and your credit utilization — and what you can do to improve them

Read Also: How Often Does Usaa Update Credit Score

Where To See Credit Score

Category: Credit 1. Free Credit Report Experian Experian offers free credit reports, credit scores, and daily monitoring. Check your updated credit report and always know where your credit stands. You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®,

What Dtis Do Home Lenders Require

Theres no one specific DTI you must have to qualify for a home loan. Instead, the DTIs youll need will depend on your credit scores, your down payment as a percentage of your new homes purchase price, how much cash youll have after your loan closes, and the type of loan you want, among other factors.

Some lenders and loan programs are more flexible than others. Using your credit cards could be riskier if your DTIs are very close to the margin between qualifying or not qualifying for the loan amount and interest rate you want.

Youre not out of the woods on this issue once youve been prequalified for your loan. Thats because your lender will probably take a last look at your and DTIs a few days before your closing.

If your scores or back-end DTI deteriorated because you ramped up your card use and spiked your minimum monthly payment, your final loan approval could be delayed or even canceled.

The same caution applies to other types of debt, such as a new car loan, personal loan, student loan, store cards, or another home loan. In all cases, its wise to wait until your home loan closes before you apply for additional credit.

As you count down the days until your closing, you may be tempted to make big purchases or apply for new cards because you think they wont affect your credit scores or DTI until after your home loan closes.

Don’t Miss: What Credit Bureau Does Care Credit Use

Is 7 Credit Cards Too Many

As with almost every question about credit reports and credit scores, the answer depends on your unique credit history and the scoring system your lender is using. “Too many” credit cards for someone else might not be too many for you. There is no specific number of credit cards considered right for all consumers.

Should I Increase My Credit Limit If Offered

In the abstract, a higher credit limit should help your credit score because it will lower your credit utilization ratio as long as how much you owe remains constant or goes down, says Rossman. But, if there’s any chance you’ll view a higher credit limit as an excuse to get deeper into debt, you should avoid it.

You May Like: Syncb/ppc Credit Card Login

Capital One Auto Finance Offers Loans To A Variety Of Customers But Is It A Good Choice

Capital One is well-known for its credit card offers, but it also provides a variety of banking services, including auto purchase and refinancing loans. This review can help you decide if a Capital One auto loan is worth considering.

If youre trying to secure a low-interest loan, read our review of the best auto loan providers. We compare interest rates, loan terms, the application process, and customer reputation. Read on to see how Capital One auto loans score in these categories.

How Card Use Affects Your Credit Scores

Its no secret that credit card debt can affect your credit scores. In fact, card debt can affect every aspect of your scores, including your payment history, your utilization ratio, the length of your credit history, the mix of types of credit youve used, and whether youve recently applied for more new credit.

If you have excellent credit, small changes in your credit scores while waiting for your home to close probably wont have a material impact. Its when your credit scores are closer to the danger zone that youll need to be careful.

Your lender should be able to give you some insights into how well youve managed your credit and whether a dip in your scores even if its temporary may adversely affect your home closing.

The details can be complicated and involve a lot of variables. To keep things simple, your lender may advise you not to use your cards at all, even though that drastic step may not be necessary.

Read Also: Serious Delinquency On Credit Report