Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

How To Remove Paid Collections From Credit Report

To remove late payments from a credit report, you will have to settle the debt by repaying. First, contact the credit directly. You may be able to negotiate and pay only a reduced amount for the debt to be cleared. In exchange for your payment, ask for them to contact reporting agencies so your annual credit report can be updated.

Before you sign or agree to anything, have them supply you with a letter or written confirmation of the conditions agreed upon. Its important that you do not admit fault or take responsibility for a bill until you have something in writing.

If the about method does not work for you, it may not be possible to remove a late payment from your credit report. A dispute will not work unless the information on your credit report is inaccurate. Negative information stays on your credit report for 7 years.

Get A Free Credit Report

There are 3 credit reporting agencies. Equifax, Experian and TransUnion

Each is required to give YOU a FREE copy of your credit report every 12 months. Check your credit report every four months alternating among these 3 agencies and your reports will be free!

Go to the free official web site to request your report:

You May Like: How Good Is My Credit Score

Is Credit Repair Legal

With all the worry about scams, its often questioned if credit repair is legal. In the US, credit repair is not only legal but also a federally protected right. The problem lies with untrustworthy companies and scammers. Sometimes they sell credit services that dont really. Or as youll read below, there can be hidden costs.

How Do I Get My Free Credit Report

Reading time: 3 minutes

- You can receive Equifax credit reports with a free myEquifax account.

- You can access free credit reports from each of the nationwide credit bureaus at annualcreditreport.com.

- You can request these free annual credit reports online, by phone, or by mail.

- In addition to receiving a free credit report, you can now also receive your credit report in Spanish from Equifax.com or by calling Equifax Customer Care.

If you want to check your credit reports there are several ways that we’ll discuss below.

Recommended Reading: How Many Years Collection On Credit Report

How Long Do Credit Disputes Take

On average, credit disputes take at least 30 days. Dont expect your credit report to be fixed overnight. Also, how often credit disputes are successful depends directly on the reasons for the dispute. If there is an obvious discrepancy on who the credit belongs to, this can be an easy win. If the negative mark is being disputed only to improve your credit score, the success rate would be very low. In that case, there would be a 7-year wait until the negative information comes off your annual credit report.

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

You May Like: How To Pull My Credit Report

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

Which Annual Credit Report Is Best

There are many benefits to checking your annual credit report. Its important to stay ahead of any discrepancies that arise to avoid problems later. Becoming aware of any issues allows you to address them. These issues with your annual credit report will affect your credit score. Financial institutions use your score to decide whether to give you a loan. There are many places advertising access to your credit report. But they are not all created equal. This article compares the top three and will tell you which annual credit report is best.

Equifax is the best annual credit report. It consistently uses the most updated FICO score making it more relevant. All three of the major reporting agencies are important. You can obtain your credit report from all three for free. Use all of them over the course of the year to maximize their benefit.

You May Like: Does Klarna Report To Credit Bureaus

Capital One Spark 1% Classic

Who’s this for? The Capital One Spark 1% Classic is a solid choice for business owners looking to improve their credit scores.

The card doesn’t come with a welcome bonus, but users can earn an unlimited 1% cash back on every purchase for their business, and 5% cash back on hotels and rental cars booked through Capital One Travel.

The card has few benefits, so if you apply for this card, your goal should be to build your credit score and move on to a new card. It charges a steep 26.99% variable APR so you’ll want to pay your balance off in full each month.

Determine How You Want To Request Your Report

You are entitled to a free credit report every 12 months from each of the three major consumer credit reporting companies: Equifax, Experian, and TransUnion. You can request and review your credit report in one of the following ways:

- Online: Complete the online application process on AnnualCreditReport.com, the official government website for requesting a credit report.

- Phone: Call 322-8228

- Mail: Download and complete the Annual Credit Report Request form. The completed form should then be mailed to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281

Image courtesy AnnualCreditReport.com.

Be on the lookout for suspicious websites that offer free credit reports, especially those mimicking the name and design of AnnualCreditReport.com. Some websites will only give you a free report if you buy their products or services, while others will give you a free report and then bill you for services you have to cancel. To ensure you’re going to the correct site, you can type www.AnnualCreditReport.com into your web browser address line or visit the Consumer Financial Protection Bureau ‘s website. If you find a link to AnnualCreditReport.com on a site you don’t trust or in an email, play it safe and don’t click on it.

You are also eligible for additional free credit reports if any of the following applies to you:

Read Also: How To Order Your Free Credit Report

Banks Are Not The Only Ones Who Care About Your Credit History

Financial institutions are not the only ones who use your credit report to figure out how trustworthy you are when it comes to paying your dues. Insurance, utility, cellphone, internet companies, and even government agencies, may also want to check it out.

Your credit history helps these companies determine how reliable you will be with payments, if they should ask for a security deposit, how much to charge you for an insurance policy, or if you are eligible for government welfare.

If you have poor credit or no credit at all you may have to pay a deposit for those types of services that somebody with good credit or excellent credit wouldnt have to pay, mentioned Lass.

Its also likely that a landlord or property manager will ask for a credit report before renting out a property. Many landlords look at credit history as one of their factors in terms of acceptance an applicant, confirmed Lass. A survey from SmartMove, a tenant background screening service offered by Transunion, found that 90% of landlords run credit checks on prospective tenants.

Employers might also be interested in taking a look. A survey by the National Association of Professional Background Screeners, in partnership with HR.com’s Research Institute, found that 16% of employers check every candidates credit report, while 31% check at least some candidates.

Sylvia Montez Is The Third Owner Of Apex Home Health A Home Care Business Located In San Antonio Tx When She First Entered The Space She Saw That Most Of The Agencies Around Her Were Run By Business Owners From Different Backgrounds Than Hers

As a Latina, many doors wouldnt open and Ive missed out on many opportunities. But I was able to overcome it with companies like Biz2Credit. Even after the pandemic, the financial assistance I received brought the company to the next level and opened a lot of doors. It helped with marketing, not only door to door, but also with accessing web-based technology to grow my business.

Also Check: What Is The Fico Credit Score Range

Watch Out For Credit Report Scams

While AnnualCreditReport.com is a safe way to get a copy of your credit report, scammers may try to trick you into entering your personal information on look-alike websites. They can then collect your personal information and possibly sell it or use it to steal your identity.

The look-alike sites may have a nearly identical URL, and the scammers may even copy the exact images and wording from the authentic website. You might wind up on one of these phishing sites after clicking on a link from another website. Or, you might receive an email that looks like it’s coming from the website with a link to the scammer’s website.

Be similarly suspicious of other websites that ask for your personal information and claim they’ll give you a free copy of your credit report. While there are legitimate companies that offer these services, some are scams.

Also, beware that scammers can get SSL certifications for their websites, so the certification isn’t always an indication of safety. While your connection is encrypted, you could still be sending your encrypted personal information to a criminal.

If you want to use the website to request your credit reports, the safest option is to enter https://www.AnnualCreditReport.com directly into your browser.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

You May Like: How To Improve Mortgage Credit Score

Free Annual Credit Report

Review your credit report often to make sure the information is accurate. If you see something on your report that you didnt do, it could mean youre the victim of identity theft.

You can get one free credit report each year from each of the three nationwide credit bureaus. The website annualcreditreport.com is your portal to your free reports.

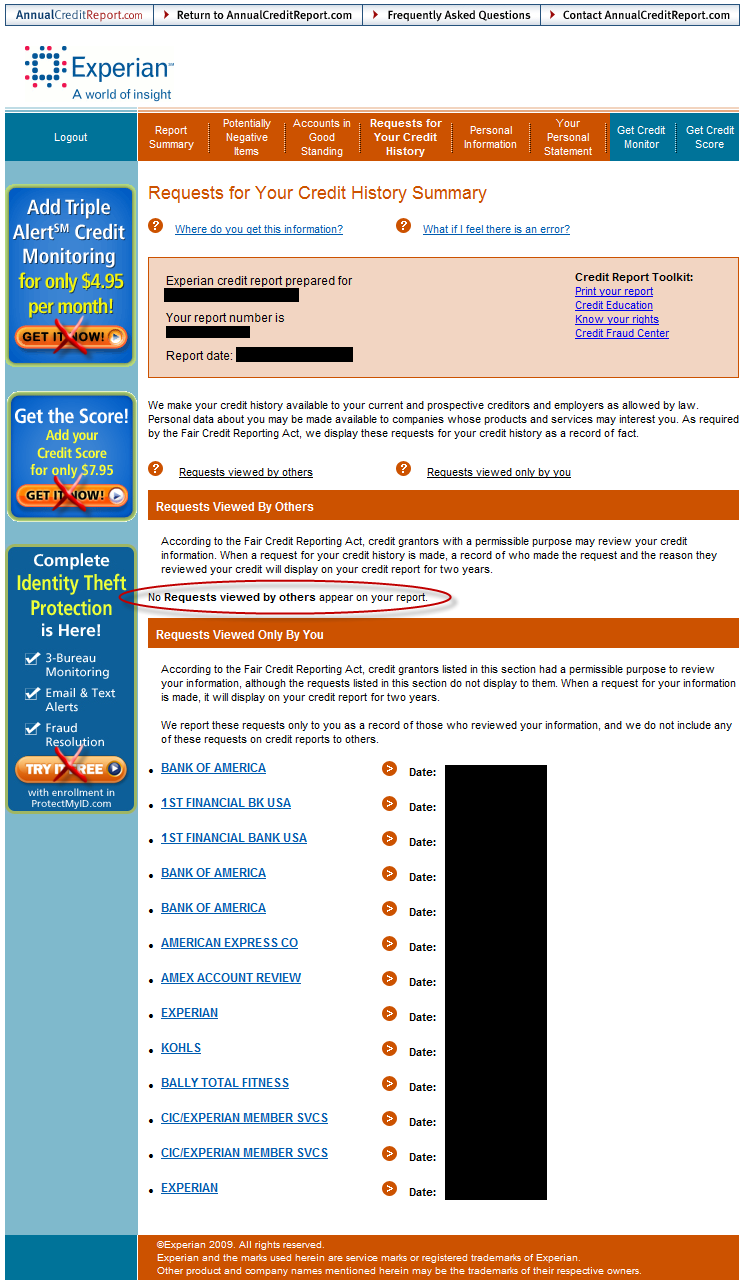

Note: when you leave that website and move to the company website to get your free report, the company will probably try to get you to sign up for costly and unnecessary credit monitoring services.

You can also get your credit reports by phone by calling 1-877-322-8228. Under North Carolina law, credit monitoring services are required to tell you how you can get credit reports for free.

To keep track of your credit during the year, request a free report from a different credit bureau every four months. You can also pay for additional copies of your credit report at any time.

Important Things To Note

It has been reported that every consumer is entitled to a free credit report from all three credit bureaus annually. AnnualCreditReport.com is the official website that allows you to obtain your free credit report from all three credit bureaus Equifax, Experian, and TransUnion without charge.

The Consumer Financial Protection Bureau verifies that AnnualCreditReport.com is the official website that allows you to receive your credit report from all three credit bureaus. Its free of charge and you dont need to sign up, create an account, or enter your credit card information. Visit AnnualCreditReport.com to order your free credit report. Alternatively, you may call 1-877-322-8228 to order your free credit report.

With Annual Credit Report, an encrypted connection is made between your device and the sites servers using SSL, which is indicated by the s in https in your browsers address bar. Keeping people from spying on the data you send may be aided by encrypting it before AnnualCreditReport.com sends it to the credit bureau.

Also Check: What Credit Score Do You Need To Lease A Car

How To Dispute Credit Report

In order to dispute a credit report, the information would have to be inaccurate. This is true in a case of mistaken identity or fraud. You will not have success if disputing a missed or late payment for which you are responsible.

The first course of action is to contact the lender directly. This would be the bank or company that originally reported the negative information to the credit agency. Sometimes you go down that road and it seems like they are running you in circles. In that case, I would then reach out to the Consumer Financial Protection Bureau through the link in the Resource section of this article.

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

Also Check: Can Employers Pull Your Credit Report

Check Your Credit Report From Each Bureau

Free credit reporting services provide information from a single credit bureau. Remember that there are still two other reports you absolutely have to check out. Its possible the information across all three reports could be slightly different.

Most importantly, the credit report youre seeing could be squeaky clean while the one from the other bureaus includes inaccurate or outdated information. These errors could potentially affect your credit health. Its of utmost importance to compare the information across all three reports. Anything that shouldn’t be there can and must be removed.

Keep in mind, though, that information won’t be removed if you can’t provide enough evidence to the bureaus of its inaccuracy.

Check Your Credit Report With Experian

While AnnualCreditReport.com is legitimate and safe, you can get free copies of your credit reports from other trusted sources. For example, rather than using AnnualCreditReport.com to request a copy of your Experian credit report, you can go directly to Experian’s website. There, you can get your free Experian credit report, a free credit score based on the report and free credit monitoring.

Don’t Miss: What Factors Affect A Credit Score

Why Your Report Is Important

The information on your report is used to calculate your score. Banks consider your credit history when deciding whether to approve you for a credit card, mortgage, auto loan, or other type of loan.

Thats not all though.

Many landlords will look at your credit when deciding to rent to you.

This means that your credit can have a big impact on many areas of your life.

If your credit isnt good enough, it can stop you from getting a credit card or a mortgage for example.

Have Your Personal Information Ready

In order to request a credit report, you will have to provide several pieces of personal information, specifically your full name, date of birth, mailing address, Social Security number , and your previous mailing address. Additional information may be required to process your request, in which case the consumer credit reporting company you requested your credit report from will contact you by mail. As this information is used to identify you for the request process, omission of any information when filing by mail may delay your request.

Although most of this information should be known to you, some details may be harder to recall. While you can simply pause when filling out a mailing request form or an online application, failing to have all of this information on hand while making a request by phone could result in a slower application process or having to start over at a later time.

When requesting your credit report online, you will be asked several security questions about your finances that only you should be capable of answering . As these questions will vary from person to person, it can be difficult to adequately prepare for them. Note that, should you request your credit report by mail or phone, you may not be required to answer any security questions.

Read Also: A Credit Report Is Particularly Sensitive Information Because