Personal Information Only What You Provide Is Reported

Your credit report will list your full name, address, and date of birth its vital that you check that this information is correct, especially if you have a common name. Sometimes your account details could be mixed up with another person with similar identifying points. In worst case scenarios, you could be a victim of identity theft.

Your credit report could contain employment information as well, which you provide when you apply for credit and are asked for your employment and salary details.

Your credit report wont, however, list your gender, race, religion, citizenship, political affiliation, medical history, or criminal records . It could list marital status if you applied for joint credit with your your spouse.

Personal information reported on your credit report will be information you provided to a lender at some point. The information can become outdated very quickly, e.g. if you move, get divorced, or switch employers.

Building Up Your Credit Score Takes Time

Your credit score is something which builds up steadily over time. You may not always get to see a satisfying boost month on month.

Lenders tend to prefer to see a long-term pattern of dependable behaviour. All the changes to your report help to build up an overall picture of what kind of borrower you are. You need to consistently show the behaviour to prove itâs not simply a one-off.

So taking steps to improve your score will help to improve the overall health of your credit report and add to your standing with lenders. Lenders will look at your whole report, and not just your score when they are deciding whether or not to lend to you. This means all the positive information on your report can still be worthwhile, even if it doesnât change your score.

Adding Information Showing Stability

Creditors like to see evidence of stability in your file. If any of the items listed below are missing from your file, consider sending a letter to the credit reporting agencies asking the agency to add that the information. You can use Nolo’s Letter to Request Addition of Information Showing Stability. You can also make your request online.

Include any documentation that verifies the information you’re providing, such as copies of your driver’s license, a canceled check, a bill addressed to you, or a pay stub showing your employer’s name and address. Remember to keep copies of all correspondence.

You May Like: Which Credit Score Matters The Most

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Frequency Of Opening Accounts

When applying for a new credit card account, an inquiry will present itself on your credit report. Due to this, the inquiry will present itself as potential new debt and could cause your credit score to somewhat decrease.

This slight impact is due to the lender not being clear on how the borrower is going to manage and utilize this newly available credit. Which could, in turn, affect a borrowers overall credit utilization rate.

However, this slight decrease is resolved once the borrower shows they are making payments on time and keeping their balance low. It is important to note that if a borrower opens new accounts often, this could have a long lasting negative impact on their credit score.

Recommended Reading: How To Contact Free Credit Report Com

Most Of Your Everyday Bills Are Not Reported

While your credit card accounts and lines of credit are pulled into your credit report, your day-to-day bills, such as your rent and utility payments like Internet, water, and electricity arent roped in.

If you fall behind on payments and these accounts go into default or end up with a collection agency, its at this point, however, that they could show up on your credit report.

Become An Authorized User

If a spouse or family member can add you as an authorized user on a card, you have an opportunity to start building credit. Keep in mind that as an authorized user you wonât be solely responsible for paying the bill, so make sure to coordinate accordingly.

Also, others may be reluctant to add you if you have a history of questionable money mistakes. In that case, see if you can be added as an authorized user but not actually get the physical card to spend on. This move can also affect your score negatively if the person fails to pay a bill, so partner up with someone who is money smart.

Read Also: What Credit Report Does Synchrony Bank Use

What To Do If You Dont Have A Credit Score

If it turns out your score isnt showing up because you dont have one, dont panic. You wont be penalized for not having a score.

However, having one can certainly make your life easier. For instance, if you dont have a credit score, you may need a cosigner to take out a loan or get an apartment, and utility, cable, or phone companies may ask you to pay a deposit before they offer you their products and services.

Moreover, having good credit comes with various benefits. For example, youll have more options when applying for different types of credit and get lower interest rates because lenders will be able to see that youre a trustworthy borrower.

If you decide you want a credit score, then youll need to start building credit. There are thatll allow you to obtain your score more quickly, but at its core, credit-building is really very simple. You just have to:

Follow those steps and in six months or less, your credit score should finally appear and youll be able to enjoy all of the benefits of having good credit.

Article Sources

The Account Was Too Old To Be Reported

The account you’re looking for may have dropped off your credit report. This could happen either because the passed, or the credit bureaus internal reporting time limit for that type of account expired.

Accounts closed in poor standingfor example, if you were delinquent when the account was closedwill fall off your credit report after seven years. That’s based on the credit reporting time limit outlined by the Fair Credit Reporting Act.

Other closed accounts will fall off your credit report after 10 years or so, depending on how long the credit bureau decides to report these types of accounts. There is no law defining the amount of time in which accounts that have been closed in good standing must fall off your credit report.

Read Also: Does Increasing Your Credit Limit Affect Your Credit Score

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Faqs About Removing Collections From A Credit Report

Collections can stay on credit reports for up to seven years from the date of default on the original account. So, if you have a bill that was 180 days past due, it could stay on your credit report for up to seven years after its six-month past due mark.

Thats seven and a half years after you got the original bill, and a long time for an old bill to be haunting your credit report. Here are some answers to common questions about removing collections from a credit report.

Read Also: Is 680 A Good Credit Score

Also Check: How To Get Your Credit Report Mailed

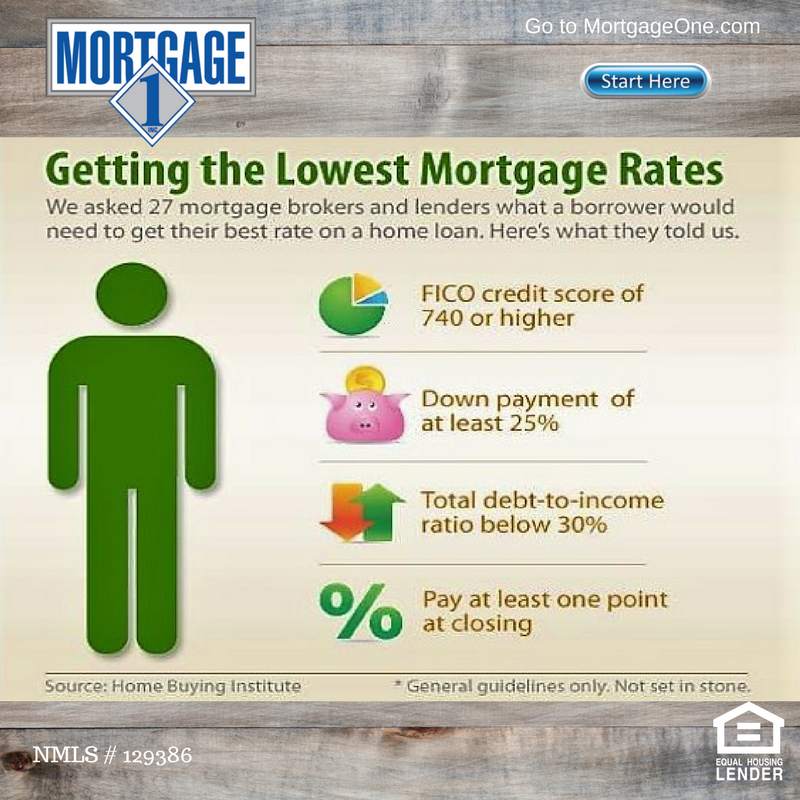

Why Do You Want A Credit Score

Credit scores are an important aspect of your financial health, and having a good score can mean improved access to loans and better interest rates and borrowing terms. Obtaining new credit is often dependent on a credit check, where a lender evaluates your borrowing history and decides whether to approve you for the loan. Having a good credit score in this process can help you get approved and also can help you get better terms and interest rates that will save you money over the life of the loan.

People with higher credit scores can shop around with multiple lenders to find the loan with the best terms and the lowest rate. Lower interest rates can save you a lot of money over time: Reducing a mortgage loan’s interest by just one percentage point can result in tens of thousands of dollars in savings.

If One Credit Bureau Removes Information From Your Credit Report Do The Others Have To As Well

No, a credit bureau does not automatically have to remove information just because another one did. However, if one bureau removed information because it’s outdated or otherwise inaccurate, then other bureaus will likely want to do so if they haven’t already. It may be an oversight that the bureau hasn’t deleted the information. Disputing the information with each bureau individually is the best way to ensure that your credit reports are accurate and complete.

Don’t Miss: What Credit Score Is Needed For A Conventional Loan

How Long Do Collections Stay On Your Credit Report

Collections can remain on your credit report for up to seven years. Even if you pay it in full, its still considered a negative account and will stay on your credit report as a paid collection account for seven years.

A collection account is separate from a charge off placed by the original creditor, which will likely also show up on your credit history for seven years.

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Read Also: Do Collections Drop Off Credit Report

The Big Question Is The Hassle Worth It

We see many people on an almost daily basis who hope to qualify for a new mortgage or wonder how long it will be before they get a clean bill of health after a consumer proposal. One of the first things we do is ask their permission to review their credit history to inspect it for mistakes.

We also offer a Credit Renovation service, which many opt to use, especially if they need a quick boost to their score to qualify for a home loan or get the best rates possible for a mortgage renewal. Here is a sampling from just the last couple of months of what types of improvements theyve seen and the results achieved with a more accurate credit history.

| 689 | These score increases achieved within two days of submission! | Score bumps of 122 and 155 points mean they are already well positioned for a great mortgage with a ‘B’ lender. |

The results speak for themselves and are pretty black and white. A better credit score not only means you will pay less for many things, but it can also be the difference between a yes and a no when it comes to getting a mortgage, having a rental application accepted, or being able to buy a new car.

I Dont See My Credit Score On My Credit Report

Credit reports and scores are so closely related, you might think that where you find one, youll find the other. But that isnt always the case: You wont find a credit score on your free annual credit reports. If you pulled your reports looking for a score but dont see one, youre still on the right track. Reviewing your credit report gives you valuable insight into your credit standing. This can help you make sense of your three-digit credit score.

Recommended Reading: How Does Credit Score Go Up

What’s A Credit Report

Unlike a score, your credit report is just that, a report. It lists your entire credit profile for creditors to examine and then evaluate your creditworthiness both independent of credit scores and in conjunction with them.

The information comes from creditors and public records. Reports are voluntary, and some creditors send data to only one or two bureaus, while others report to all three.

The reports cover a lot: open and closed accounts , amounts owed, credit limits, late payments, collections actions, public records and more.

You’re entitled to a free credit report from each of the three big credit bureaus weekly through the end of December. Use Annualcreditreport.com to get them.

You can and should dispute errors on your credit reports and get them corrected. Mistakes on your reports could affect your access to credit, cost you a job opportunity or make it harder to rent a home.

Your Hard Credit Inquiries May Be Too High

When a lender, creditor, or other third party checks your credit report, it is considered a hard credit inquiry. Hard inquiries take down your credit score a few points each time they are conducted. And so, having too many credit applications in a short time can really bring down a credit score that you may have just improved on.

Also Check: What Affects Your Credit Score

Your Lender Does Not Report To All Credit Bureaus

While many lenders report loan activity to all three credit bureaus, some only report to one or two. In fact, some lenders don’t report to credit bureaus at all. If your loan doesn’t appear on one of your credit reports, try checking the other two.

Ultimately, lenders are not required to report their accounts. But be aware: Just because a lender doesn’t report your loan and successful payment history, it doesn’t mean they can’t or won’t report negative information if your car is repossessed or you default on your loan.

Some Lenders May Like To See Diversity In Your Credit Report

This is all about the types of credit products and accounts that you have and is one reason why your score may stay the same for long periods of time.

If the credit accounts you have and the way you use credit has pretty much stayed the same, then your score can also stay relatively stable. Now thatâs not necessarily a bad thing â but itâs good to be aware of it.

If youâve only got one credit card that youâve had for years, and nothing else changes on your report, then your score may not change that often. This is because nothing is really changing that significantly month to month.

Read Also: What Credit Report Does Chase Pull

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Why You Dont Have A Credit Score

Thereâs no such thing as a zero score. Having âno scoreâ simply means you donât have any number tied to your credit profile. You can be absent from the scoring model if youâve never had a credit card or loan, or if you havenât used credit in a long time. Itâs also possible that your new line of credit hasnât been reported yet.

Recommended Reading: What Credit Score For Walmart Card

Willow Tree Credit Partners

Category: Credit 1. Willow Tree Credit Partners Company Profile PitchBook Willow Tree Credit Partners General Information. Description. Operator of a middle-market private investment firm. The companys platform is focused on Track the AUM, funds, and holdings for Willow Tree Credit Partners LP over time. View the latest funds and

You Should Add Information Showing Stability And Unreported Positive Accounts To Your Credit Report Here’s How

Get Free Credit Reports Weekly During the Coronavirus Crisis

During the coronavirus national emergency, the three major credit reporting bureaus are offering free weekly credit reports to consumers.

In addition to disputing incorrect or incomplete information and adding explanations for negative information the won’t remove, you might want to ask the credit reporting agency to add information to your report that makes you look more creditworthy. This information usually includes:

- information demonstrating your stability, and

- positive account histories that are missing from your report.

Also Check: When Does Credit Karma Update Score