Forgetting To Pay Your Bills On Time

If you think paying your credit card bill late every once in a while isnât a big deal, youâre definitely wrong. Believe it or not, but your payment history is the most important factor that makes up your FICO score, making an impact of 35%. This means a single late payment could cause serious damage to your score, but it also means multiple late payments could harm it even more.

The best thing you can do for your credit is always pay your bills early or at least on time every single month. If you donât take bills seriously and you simply pay them when you get around to it, youâll likely regret it.

What To Know About Credit Karma Including Accuracy

Your credit score is one of the most critical pieces of financial information, especially when buying a home.

For a long time now, creditors and lenders have used your credit score to determine whether they would lend to you and what kind of terms they would offer.

Today, your credit score affects even more aspects of your life, possibly even your ability to get a job or successfully rent or purchase a property.

The company has over 100 million members as of 2021, all of which can get their free information from the Credit Karma site.

When buying a home for the first time, it is essential to get your financial house in order far in advance of ever putting down your earnest money with a real estate agency. Credit Karma helps you do just that.

One of the most substantial mistakes first-time homebuyers make is not preparing themselves well enough financially. Credit Karma can be your financial right-hand man in your home buying journey.

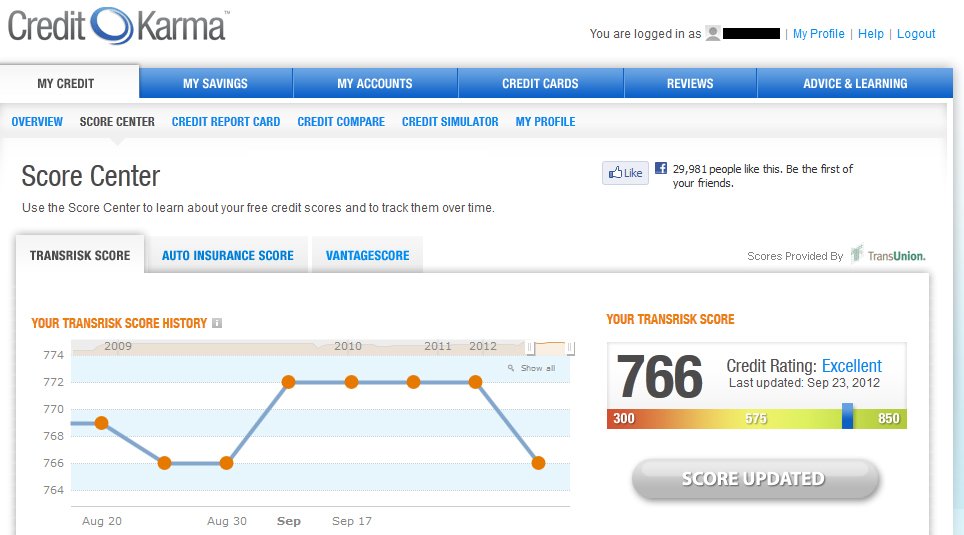

Once you are ready to get started, the Credit Karma sign-in will get you on your way. As you would expect, the Credit Karma login is at the top right of the screen.

Lets take a deep dive into what you need to know about Credit Karma and what it offers:

Why Is My Credit Karma Score Lower Than My Experian Score

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don’t all receive the same information about your credit accounts.

You May Like: Does Capital One Report Authorized Users To Credit Bureaus

Can I Buy A House With A 684 Credit Score

As mentioned above, a 680 credit score is high enough to qualify for most major home loan programs. That gives you some flexibility when choosing a home loan. You can decide which program will work best for you based on your down payment, monthly budget, and longterm goals not just your credit score.

Should I Use Credit Karma

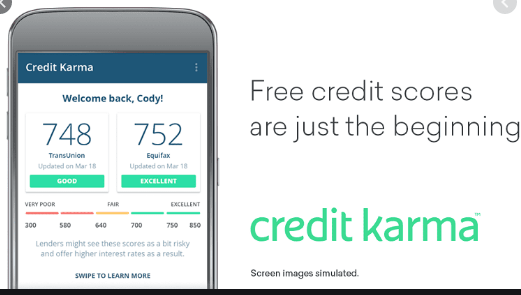

Unlike other services that charge between $15-$20 to view your credit score, Credit Karma allows you to check and track your score for free without needing a free trial or a credit card.

Using Credit Karma doesnt affect your score because it performs a soft inquiry on your credit report, which will not be reflected on the report. However, most services will make a hard inquiry on your credit report, which will likely knock off a few points on your credit score.

Recommended Reading: Can A Closed Account On Credit Report Be Reopened

What Goes Into Your Credit Score

Knowing your score is crucial. Several factors impact your credit score, and not every factor is measured equally. The great feature of Credit Karma is that it allows you to know what actually goes into it.

With Credit Karma, you can easily visualize how each credit factor affects your credit score , so you can take the measurements to improve those areas you consider. Below youll find a breakdown of these factors:

This refers to the percentage of credit used on your credit card.Leaving a balance on your credit card close to your credit limit will harm your credit score.

Typically your credit card balance should never be more than 30% of your credit limit. If you struggle to maintain that, you can try asking your financial institution to raise your credit limit.

-

Payment history

Your credit scores most influential factor is how often you make payments on credit cards or loans on time. It is imperative to make all payments on time, and a failure to do so could have very negative consequences on your credit score.

-

Derogatory marks

These are negative, long-lasting indications that mean you didnt pay back a loan as agreed.

Late payments, collections, and bankruptcy will have a high and negative impact on your credit score. Also, a large number of debts could negatively influence your credit score.

Again, make sure to pay off your debts on time, and consider refinancing to get better rates .

-

Total accounts

-

Hard inquiries

How Many Points Is Credit Karma Off

Many people ask ‘how many points is credit karma off?’ and the answer varies for each individual case. Credit Karma receives information from two of the top three credit reporting agencies. This indicates that Credit Karma is likely off by the number of points as the lack of information they have from Experian, the third provider that does not report to Credit Karma. If you can figure out your Experian credit score you will be able to generate an accurate detailing of how many points Credit Karma is off as it relates to your actual score.

You May Like: How To Establish A Credit Report

Does Using A Credit Score App Lower My Credit Score

You may have heard that anytime someone checks your credit report, it lowers your score. So, itâs easy to believe that using Mint or Credit Karma, which both get your credit scores frequently, will continually lower your score. Thatâs not accurate. The system is a little more complicated. When you use Credit Karma or Mint, those credit reports are considered soft inquiries. Soft inquiries do not affect your credit score or report. When individuals want to check their own credit reports, those are soft inquiries. Other examples of soft inquiries are when a bank pre-approves you for a loan or a credit card. When you actually apply for a new account, thatâs a hard inquiry, which does affect your credit report and score.

I asked Paperno why people sometimes get pre-approved for an account, but then at the point of hard inquiry, theyâre denied. He gave a number of reasons.

Everything I just explained is relevant, because it leads to the question, âDo you need to check your credit score every single week?â which is the frequency that Credit Karma advertises. The answer is⦠it depends. For most people, the answer is no. Paperno confirmed that big changes in your credit score take months or years to attain. But as mentioned, smaller fluctuations can happen daily . There may be cases in which people need to know their credit score more frequently than that, but then they would have to consider whether tracking their FICO score would be a better option.

Whats A Hard Credit Inquiry

As we mentioned above, there are two types of credit inquiries: hard inquiries and soft inquiries.

Hard inquiries are typically triggered when you apply for a loan or credit card and the lender checks your credit when making a decision on your application.

While a new card or loan may follow a hard inquiry, a hard inquiry can also lower your credit scores by a few points. A hard inquiry may remain on your credit reports for up to two years, but the damage may be removed even before then.

Hard inquiries have a much smaller impact than most people think, says Randall Yates, founder and CEO of The Lenders Network. He notes that this may be especially true regarding FICO scores, which only consider inquiries from the past 12 months.

Soft inquiries, on the other hand, typically happen when an employer or company checks your credit as part of a background check, or when you check your own credit. A soft inquiry may occur with or without your permission, but it wont affect your credit scores.

As part of the prequalification process, a lender could perform a soft inquiry, which may give it enough information to predict whether youre likely to be approved.

Also Check: What Is An Exceptional Credit Score

Breaking Down Fico And Vantagescore

When most people think about their credit score, whether they know it or not, they are thinking about FICO. The Fair Isaac Corporation introduced FICO credit scores for consumers back in 1989, and since then the company has worked diligently to keep up with consumer behaviors and how those impact the FICO scoring calculations. Up until a decade ago, FICO was the only consumer credit score used by the three major credit reporting agencies, as well as the only score used by lenders and financial institutions.

In recent years, VantageScore has taken on the challenge of competing with FICO for its place at the top of the consumer credit scoring chain. By partnering with the three credit bureaus, VantageScore is able to use similar information and scoring models as FICO to generate individual credit scores. However, there are differences between FICO and VantageScore that consumers should be aware of.

First, it is important to understand that both the FICO and VantageScore methods draw from the same consumer information: payment history, credit usage, recent inquiries, length of credit, and type of credit. However, these details are gathered in different ways.

Playing The Balance Transfer Game

Transferring high-interest balances to a new credit card that extends 0% APR for a limited time can absolutely help you save money and pay down debt faster, but youâll pay the price if you get stuck in a situation where youâre simply transferring balances from one card to another every year.

Not only will you likely take a hit to your credit score for opening a new credit card, but your utilization could increase if you transfer your balances over and use your old credit card to rack up more debt over time.

Beyond an impact to your credit score, note that most balance transfer credit cards charge a balance transfer fee of 3% or 5% of your balance in order to manage the transaction. So while these offers do let you save on interest along the way, but they are far from âfree.â

You May Like: Is 611 A Good Credit Score

What Is A Hard Pull

When an entity contacts the credit reporting agencies Equifax, Experian or TransUnion and requests a persons credit report with their consent, thats known as a hard pull. This kind of inquiry can have a negative impact on your credit score. But if a potential creditor asks for one, theres no need to panic.

It is unlikely that a single hard inquiry will risk your chances of getting approved for a new credit card or loan, said Ken Lin, Credit Karma founder and CEO. Any damage from a single hard inquiry on your credit score will likely decrease or disappear before the inquiry eventually drops off your credit report.

A hard pull can decrease your credit score by up to 10 points. According to FICO, a major credit scoring service, hard pulls made within the past 12 months can influence your score.

A Response To Criticism About Credit Karma Having An Accurate Credit Score

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® credit score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score and where that number puts you concerning other consumers.

The take-home message here is that when someone asks how accurate Credit Karma is, dont always believe the negative news you see on social media from those attacking the company like Twitter users.

The company uses VantageScore credit scores which are different than FICO credit scoring. They are just different scoring models which does not make them any less accurate.

The VantageScore model is a respected alternative. Just because they provide different credit scores doesnt mean the information isnt useful.

Don’t Miss: How Long Does It Take To Boost Credit Score

How To Minimize The Effect Of Hard Credit Inquiries

When youre buying a home or car, dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans as a single inquiry as long as theyre made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely wont know which scoring model a lender relies on to generate your score.

Which One Is Better Credit Karma Or Experian

If want to see your credit accounts for free then opening a Credit Karma account is your best option. However, if you want to see your FICO ratings with each of the three major credit bureaus sign up for Experian. Credit report information from Experian is also used when applying for a loan, credit card, or other financial services. Checking your own reports does not hurt your credit score.

Both companies have their own pros and cons, but which one is better? Credit Karma is known for being a free credit score checker, while Experian is known for giving people access to their credit reports.

Also Check: Can You Get A Bankruptcy Removed From Your Credit Report

The Hidden Costs Of Credit Karma Credit Sesame And Other Credit Score Apps

Most don’t produce reliable scores, and all have unnecessary charges and pose privacy risks, Consumer Reports finds

Janet Ha Andrews, 33, of Redmond, Wash., started using Credit Karma several years ago as a new U.S. citizen to help build and monitor her credit. But when she went to purchase a car earlier this summer, she says she was dismayed when the dealership said her was significantly lower than the one the app showed her.

New York City resident Alfred Bonnabel, 66, says that because hes had poor credit in the past and is trying to get into a better financial position, he planned to sign up for the free Experian Credit Report app. But somehow he accidentally tapped the wrong button and enrolled in a higher tier of service he had to pay for.

Like most consumers, Ha and Bonnabel understand that their credit score mattersa lot. Having a good one means you can get a loan or open a credit card account with a favorable interest rate. And because the scores can also be used by othersfrom phone and utility companies to car insurers and even prospective landlordsto make decisions about you, these scores have money-in-the-bank value if you can get them high and keep them up.

Very Important: Credit Usage

Credit usage is also an important factor, and its one of the few that you may be able to quickly change to improve your credit health.

The amount you owe on installment loans such as a personal loan, mortgage, auto loan or student loan is part of the equation. But even more important is your current .

Your utilization rate is the ratio between the total balance you owe and your total credit limit on all your revolving accounts . A lower utilization rate is better for your credit scores. Maxing out your credit cards or leaving part of your balance unpaid can hurt your scores by increasing your utilization rate.

Sarah Davies, senior vice president of analytics, research and product management at VantageScore, says that for VantageScore® credit scores, your overall utilization rate is more important than the utilization rate on an individual account.

But utilization rates on individual accounts can also affect your credit scores. This means you should pay attention to not just your overall credit utilization, but also the utilization on individual credit cards. Having a lot of accounts with balances might indicate that youre a riskier bet for a lender.

Don’t Miss: How To Remove A Judgement Off Your Credit Report

More Outstanding Mortgage Advice

- How do home improvement loans work are you planning on remodeling your home? One of the essential decisions youll need to make is how to finance the project. Fortunately, there are now tons of options available. See all of the home renovation loans you can use.

- Mortgage terms buyers and sellers should know see thirty-five different mortgage terms you should at least have a basic understanding of. The more you know about financing, the better off you will be when buying or selling.

- Frequently asked mortgage questions when buying a home, it is vital to ask lots of questions. You must understand the process, especially when it comes to getting a mortgage. See what most people like to ask and the appropriate answers.

Use these additional mortgage resources to get helpful advice before buying your next house.

Also Check: Experian Boost Paypal