Checking Your Credit Report

Now that youre aware of what can happen if theres than an inaccuracy on your credit report, lets talk about what kinds of common errors you may see on it:

- Inaccurate Personal Details Simple mistakes such as the wrong name, birthdate, or mailing address can spell disaster because you could end up with someone elses credit information .

- Wrong Account Information Its also possible that your lender didnt report your payment or account activity correctly. For instance, if you paid your debt on time but it was accidentally labeled as late or defaulted.

- Falsified or Stolen Accounts Identity theft and fraud are two of the worst things that can happen to your finances and credit report, not to mention complicated and time consuming to deal with afterward.

- Uncorrected Negative Information Missed payments and other negative credit actions stay on your report for several years . If so, a bureau may forget to remove the information after the allotted time period.

What Happens If You Pay Off A Judgement

If you settle your case properly, you can enjoy long-term financial benefits. If they are a creditor, at least some payments will be received, unless they are a lump sum. Pay less money to avoid a wage garnishment while still paying a fair amount. In a satisfaction of judgment document, creditors will certify they have fulfilled their obligations.

How To Check Your Credit Report For Collections

Checking your credit reports regularly can help you determine whether you have any collection accounts that might be hurting your score. You can request a free copy of your Canadian credit report from Equifax Canada and TransUnion Canada in writing. If you dont have time to wait for your credit reports to be mailed out, you can purchase a copy of your credit reports from either bureau online.

Keep in mind that your credit reports and credit scores are two different things. The information in your Canada credit report is used to calculate your credit scores. If youd also like to see your scores, you can request them separately from each credit bureau for a fee.

Once you have copies of your Equifax and TransUnion credit reports, review them carefully. Look for any collection accounts and if you find them, make a note of:

- Who the debt is owed to

- The name of the collection agency, if there is one

- How much is owed

- How many payments the account is behind

Also, make sure you have the right contact information for debt collectors, which youll need for the next step. Again, some creditors will route past due accounts to their in-house collections department while others will assign or sell past due accounts to a collection agency. You need to know who to contact if you want to remove collections from your credit report in Canada.

You May Like: Carmax Finance Rate

Pay The Debt If You Owe It

A simple way if you can possibly afford it would be to pay off the debt, assuming its accurate and yours and cant be removed through the validation process.

Pay the debt only if its yours and the court case was handled properly, meaning you cant likely lodge a successful appeal. Paying the debt wont always result in the credit bureaus removing the civil judgment from your credit report.

If possible, make your payment to the creditor contingent upon the creditor helping you remove the debt from your credit report.

Get this agreement in writing, and dont give a creditor or collection agency your bank account information or credit card number. Stick with old-fashioned check writing.

Your agreement doesnt have to pay off the entire balance. You could negotiate down. If the money is going to a collection agency this strategy is particularly helpful.

So How Do I Get Rid Of Negative Public Records

Unfortunately, its not that easy.

The three major credit bureaus wont accept certain poorly sourced public records, and theyre proactively removing some tax liens and civil judgments if they cant verify whos responsible for repayment, along with some recent medical debts.

But theres no legal recourse for you to remove other, accurate public records from your credit reports.

If you spot an error on your TransUnion® credit report, Credit Karmas Direct Dispute tool may be able to help you challenge it. Since 2015, weve helped members remove more than $7.9 billion in erroneous debts.

You may also dispute errors on your Experian® and Equifax® credit reports directly through their websites.

Also Check: Aargon Com

Paid Or Not Paid Collections

A common assumption people often make is assuming that paying off a collection will instantly remove collections from your credit bureau.

Its important to remember that a collection entry wont disappear from your credit bureau even if you settle it and pay it off.

That means when a lender, whether its a credit card company or the bank, sees a collection entry on your credit bureau, it will likely impact their decision of whether to lend to you or not.

Even if your credit account application is approved, your interest rate will likely be higher than someone without a collection entry on their credit report. That being said, its certainly worthwhile to take the necessary steps to get rid of a collection entry on your credit report.

When theres a collection entry on your credit report, chances are pretty good that there are some late payments associated with it. This is likely due to the fact that you were late on your payments.

There is often a separate entry for this debt, apart from the collection entry. There are steps you can take to remove the late payments from your credit report too.

What Is Satisfaction And Release

Satisfaction and release is a document stating that a consumer has paid the full amount of debt that was owed to a creditor under a court judgment. A satisfaction and release prevents from attempting to recover more money from the borrower or consumer.

A satisfaction and release document states the name of the creditor that has been paid, the date the full or final payment was received, and the name of the debtor who has fulfilled its obligation to the creditor. A satisfaction and release is important because it can help a borrower prove that the debt was paid off, which might help in getting approved for credit in the future. However, a judgmentwhether satisfied or unsatisfiedcan negatively impact a person’s credit report.

Also Check: Ccb Mprcc

Moving From Red To Green

Defaults and judgments, if paid up, can be removed with the help of a credit bureau like TransUnion. Generally once paid up, these may be automatically removed. However, if you wish to expedite this process you can log a dispute with the credit bureau. You will need to submit the relevant documentation including the paid up letter, from the credit provider that listed you originally. This dispute is then logged with the credit provider who made the negative listing, for verification. This process is legislated and takes 20 working days. Consumers are cautioned not to take chances with this process, as in the case where the dispute is found to be invalid, this is recorded on their credit report for a period of 12 months.

*Credit Bureau Monitor: 2nd Quarter, June and 3rd quarter, September 2018.

Consumers may visit TransUnion at www.transunion.co.za or call 0861 482 482 in order to obtain their credit report as well as log a dispute.

Invest In Your Financial Health

When dealing with judgments on your credit report, the important thing to remember it that it pays to be proactive. I chose to hire a even when I didnt think I had much of a chance of getting the negative item removed. It was one of the best decisions I ever made.

I look back on my experience hiring a credit repair company as a worthwhile investment, not an expense. That is because I really did get a return on the money I invested in them. Just a few hundred dollars over six months yielded a much lower interest rate when I obtained my auto loan. That certainly saved me several hundred if not thousands of dollars over the life the loan.

My biggest takeaway from the whole experience was learning that something as important as your credit report is worth fighting for and protecting. In my case, it paid off in a big way. That was because the credit repair company found something that I simply would not have found on my own.

I hope you found my experience helpful. I can assure you that a brighter financial future is possible for those who seek to attain it.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

Also Check: Report A Death To Credit Agencies

Negotiate With Debt Collectors

If a debt collector refuses to remove a collection entry in exchange for payment or you cant afford to pay off the amount owing in full, you might look into a debt settlement. A debt settlement means that youre able to settle your debts by paying a lesser amount than is owed. This wont always get rid of the collection entry from your credit report, but it will show that the debt is paid, improving your credit score.

Remember, if youre doing a debt settlement, make sure to get everything in writing. Youll want something in writing to prove the account is current with the debt collector.

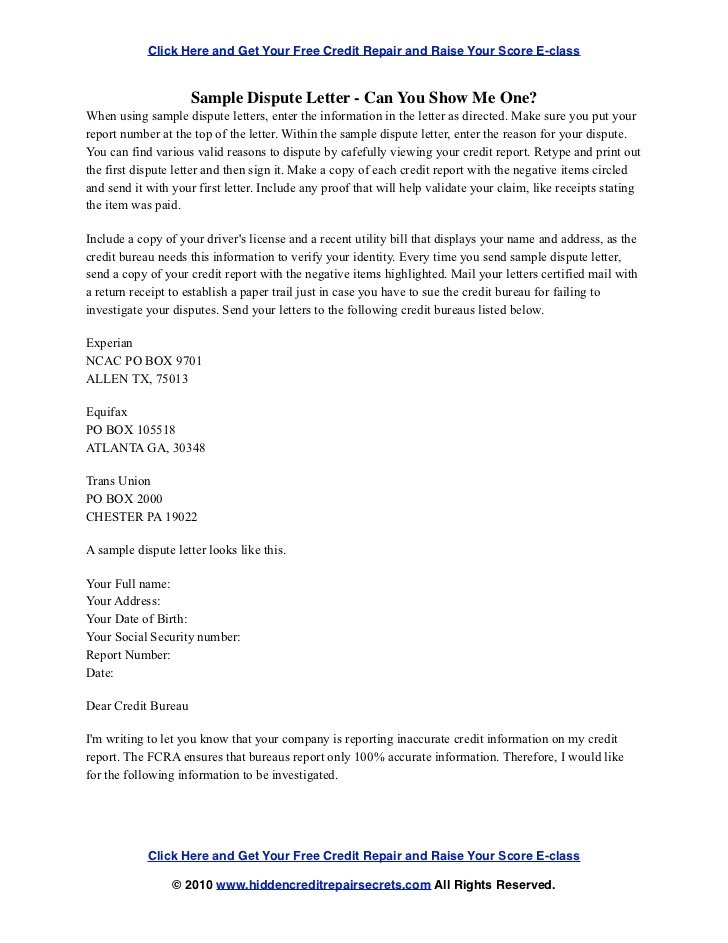

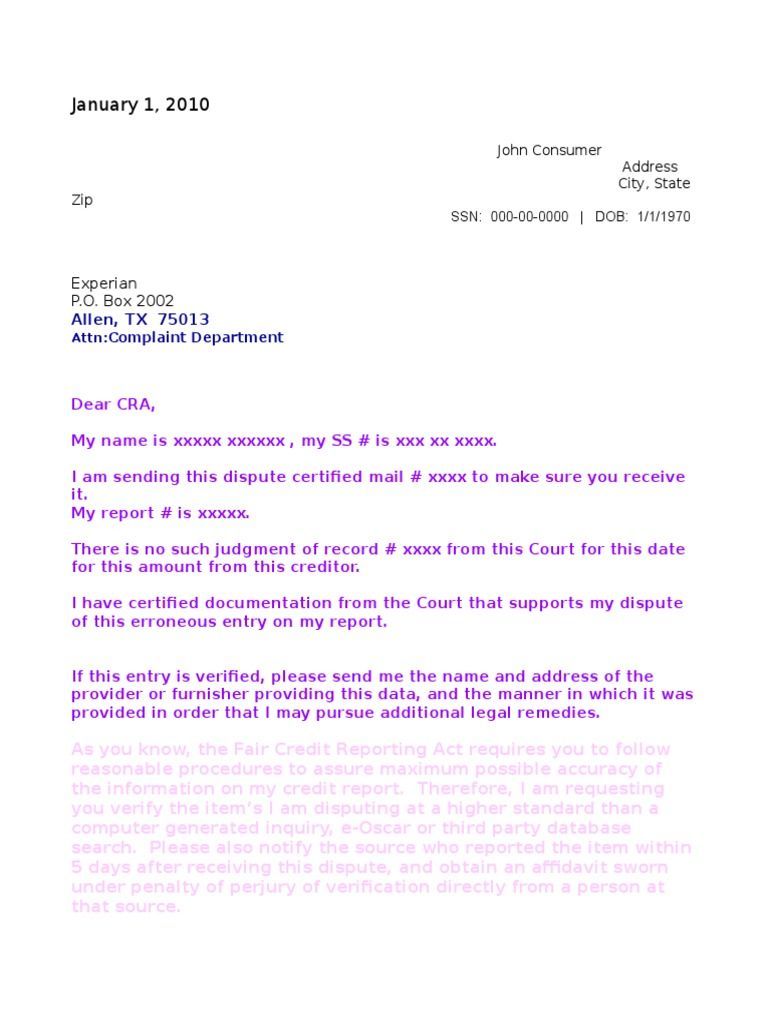

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Also Check: Credit Score Serious Delinquency

Seek Professional Help Removing Judgments

Removing judgments from your credit report is not easy. It may be wise to hire a to do the work for you. This is most important if you are disputing a judgment, as the company will write dispute letters to Transunion, Equifax, and Experian for you, and handle any follow-ups as necessary.

For more information on credit scores and how to raise them, visit our . Learn more about disputing errors on your credit report at our letter template resource center.

What Should I Do If A Creditor Tries To Sue Me

When a creditor tries to sue you, you’ll receive a court summons. Many people ignore the summons and don’t show up to court. If you’re not there to defend yourself, the judge usually issues a default judgment against you.

The judge may even order that your wages are garnished or place a lien on your property. If you show up, you can try to defend yourself. If you’re not sure what to do, then you can seek out an attorney for legal advice on how to handle the summons.

Read Also: Tri Merge Credit Report Mortgage

Removing A Judgment From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

Having a judgment on your credit report will lower your credit score, sometimes significantly. In some instances, though, you can get this negative information removed from your credit history. As with any item on your credit report, you have the right to dispute any judgment on your report that you feel has been made in error or has already been resolved. If a creditor has entered a judgment against you, hereâs what youâll need to do to get it removed from your credit report.

Written bythe Upsolve Team. Legally reviewed byAttorney Andrea Wimmer

If you have one or more unpaid debts that have been turned over to a debt collector or debt collections agency, then you can expect your creditor to sue you for the unpaid debt at some point. This will usually mean bad news for your credit report and your credit score, but in some instances, you can get this negative information removed from your credit history. If a creditor has entered a judgment against you, hereâs what youâll need to do to get it removed from your credit report.

Does Your Credit Reset After 7 Years In Canada

From the time a late payment is reported on a credit card, the late payment persists on a credit report for up to 6 years. Known as previous high rate as well as high rate in Canada due to the way payments are arranged. If you filed for bankruptcy seven years from a date that is no longer valid, youd have to update your Equifax credit report six years after.

Don’t Miss: Care Credit Hard Inquiry

Remove An Entry In The Register Of Judgments Orders And Fines

If your CCJ is over 6 years old it will no longer appear on the Register of Judgments, Orders and Fines, even if it hasnt been paid.

You might be able to apply to have your entry in the Register removed if you can prove to the court that you dont owe the debt, or if you paid the debt off within a month of getting the CCJ.

How To Clear Judgment From Your Credit Record

Update: In April 2014 a second National Consumer Amnesty regulation ruled that all Paid Up Judgments will be removed from consumer’s credit record on the basis of submitting a Settlement Confirmation Letter for the judgment account.

The Settlement Confirmation Letter should be issued by the Credit Provider or Attorneys upon receipt of the settlement fees. This new rule will continue to apply on all future judgments.

In short…A Judgment can only be removed from your Credit Profile once the account related to the judgment is settled in full. The need to rescind the judgment is optional.

A judgement on your credit record is not something to be taken lightly as by law it is supposed to stay on your records for 5years and no major financial institution will even glance at your application for credit if you have a judgment listing on your credit record. The good news is that it can be rescinded and removed before the 5 years retention period.

SACPA can assist you with the Judgment Removal process and ensure that all Credit Bureaus update your credit bureau profile in accordance with the NCA regulation.

Select a Package from the below table

Removal of Judgment Guaranteed within 7 Days

|

Default |

You May Like: Credit Score Needed For Les Schwab Account

Tips To Manage Credit Going Forward

If youre successful in removing collection accounts from your Canada credit report, the next step is working on improving your credit. You can do that by:

- Paying all of your bills on time each month.

- Keeping your balances on credit cards low, relative to your card limit.

- Leaving older credit accounts open.

- Using a mix of different types of credit.

- Only applying for new credit when you truly need it.

Raising your credit score after having a collections account removed can take time. But with patience and the adoption of good credit habits like these, you can begin to see your score grow. That can pay off down the road when youre ready to borrow for your next major purchase.

At Birchwood Credit, we understand that perfect credit can sometimes be difficult to achieve when you have a past collections history. We work with buyers from virtually every credit background to help find financing solutions to fit your needs and budget. Browse our extensive inventory online today to find your next vehicle. If youre ready to learn more about what types of financing you qualify for, you can start by completing our online loan application.

How To Have A Judgment Removed From Your Credit Report

If a judgment is issued against your name, you will soon notice its impact on your credit score.

We have a look at what a judgment is, and we consider the steps you should take to have this officially removed from your credit report.

Tip: Get ahead of your debt before things get messy. Start debt consolidation today.

How do judgments work?

According to Annelene Dippenaar, chief legal and compliance officer at Experian South Africa, a judgment is a decision made by the court.

This gives a credit provider the right to collect outstanding debt, and it might even include repossessing your home or household goods.

If you have not responded to a Section 129 letter of demand, the credit provider may decide to take legal action, in which case the sheriff of the court will serve you with a summons, says Dippenaar.

READ MORE: Everything you need to know about a Section 129 notice

Once you receive a summons, you need to respond within 10 business days, either by indicating your intention to defend the matter if you believe the monies are not due and payable by you or by acknowledging the debt and settling the claim amount, she explains.

Dippenaar says that if you fail to respond during the given period, the credit provider can still get a judgment against you in your absence this is called a default judgment.

This judgment notes that the claim of the credit provider is upheld and taken in your absence. It is therefore important to never ignore a summons, says Dippenaar.

Also Check: How Do I Notify Credit Bureaus Of A Death