How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you .

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users, this is a healthy revenue model for Credit Karma.

If Youre Trying To Improve Bad Credit

If you want to improve your credit score and avoid having it fall into one of the lower ranges, there are a few steps you can take.

- Pay off delinquent bills or accounts: accounts that have gone to collections stay on your credit for years. Thats why youll want to take care of them as soon as youre able.

- Negotiate a payment plan with your creditors: if youre unable to pay off delinquent accounts, reach out to your creditors and explain your situation.

- Get a secured credit card to rebuild your credit: as stated above, a secured credit card can help demonstrate you can responsibly handle credit.

- Make sure there are no errors on your credit report: if there are any errors, learn how to dispute credit report errors ASAP so you can get them off your report.

Who Should Use Credit Karma

There are a lot of people who are too scared to use Credit Karma because they do not want to give their personal information. One of the pieces of information you need when signing up on Credit Karma is the Social Security Number. Not everyone is comfortable with giving these details.

However, its a necessary piece of information if you want to track your credit history and score. If you wish to find out your credit score and monitor it in order to know when you can buy a house or a car, then Credit Karma is the way to go.

Even if you dont give your information to Credit Karma, when you want to buy a new home, you will have to give the mortgage lender your Social Security Number. This will allow him/her to check your credit score. But when that happens, there will be a hard inquiry on your credit report, which will bring down your credit score by a bit.

On the other hand, Credit Karma doesnt end up in a hard inquiry on your report. It is only there to gather information and let you monitor your credit.

So, Credit Karma is a good alternative for first-time homebuyers or just anyone who wants to keep an eye on their credit before they borrow a loan or make a great purchase. You should consider this service and sign up in order to monitor your credit score. On top of allowing you to check your score, Credit Karma also lets you learn more about credit scores, what impacts them and how to improve them.

Also Check: What Credit Score Does Navy Federal Use For Auto Loans

Why Is Credit Karma Not Accurate

Asked by: Cordell Toy

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus but they may not match other reports and scores out there.

How To Use Credit Karma To Check Your Credit

Like most commercials, you probably fast forward through it without a second thought. But these commercials may be a bit more important than the latest flash sale at a clothing store.

The truth is that your credit score is critical to many aspects of your life, and checking up on it regularly should be routine for any business owner. Well show you how to use Credit Karma and how to make the best out of this tool.

Read Also: What Is A Serious Delinquency On Credit Report

Comparing Nates Credit Scores On Credit Karma Vs Wells Fargo

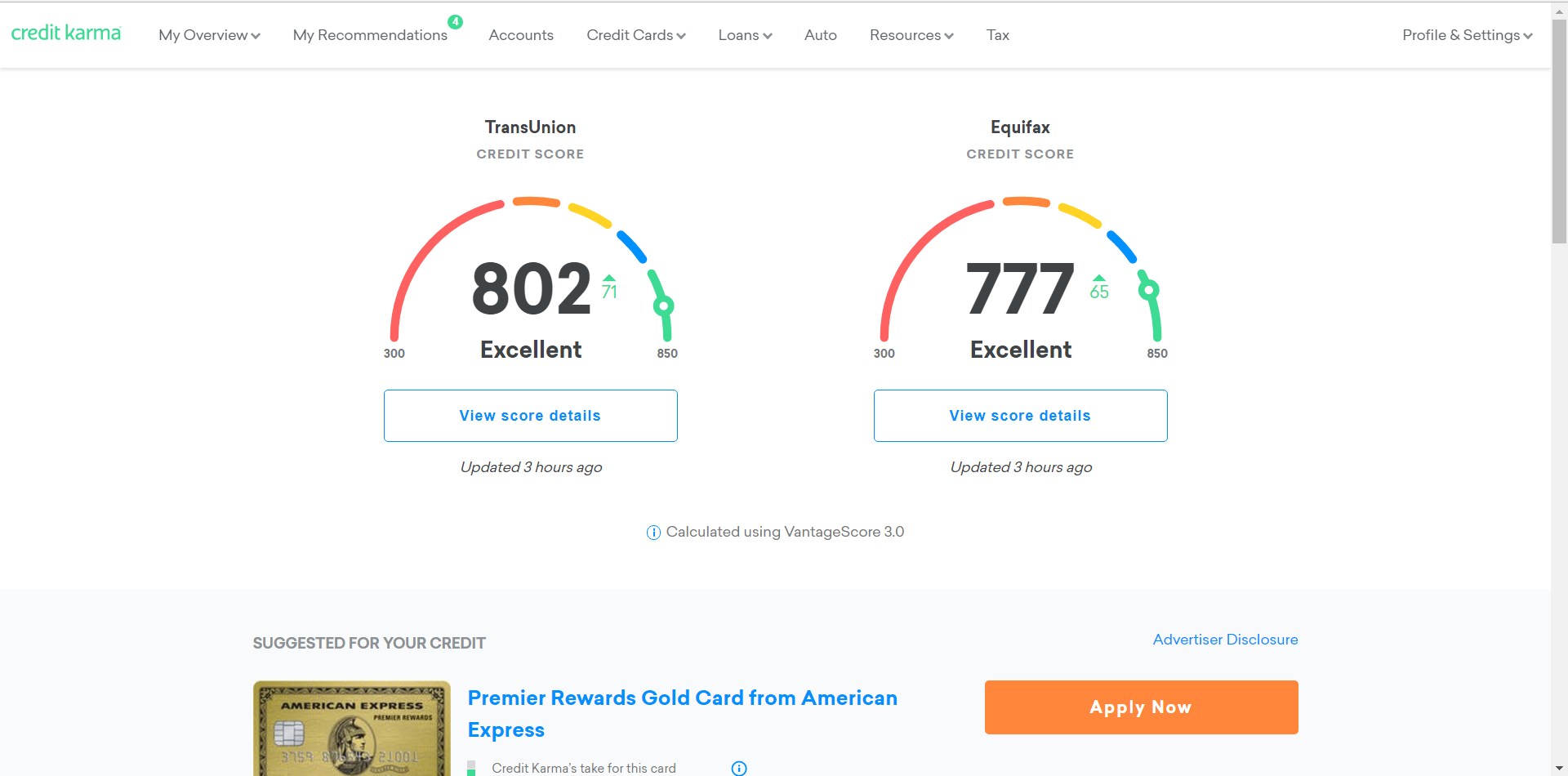

As an example, we experimented to see how accurate Credit Karmas scores were for our Co-founder, Nate Matherson. Here is a screenshot from Nates Credit Karma account:

Also on July 9th, 2019, Nate applied for a personal line of credit from Wells Fargo. Here is a screenshot from Nates Wells Fargo loan application:

As you can see in the examples above, Nates Experian FICO Score 9 was 25 points higher than his VantageScore from Transunion and 20 points higher than his VantageScore from Equifax.

In Nates case, Credit Karma was accurate enough to say that he had an excellent credit score, but wasnt perfect.

Interested in viewing your free credit score with Credit Karma?

- Receive alerts when changes to your reports occur

- View a breakdown of factors that are currently affecting your score

- Make better decisions with personalized recommendations

What Is A Good Credit Score For A Home Loan

In general, mortgage lenders look for a score of at least 670-739 to extend you a favorable loan. And, a credit score above 740 will get you the best interest rates and a higher loan amount.

However, some lenders will make exceptions or differ slightly on what is a good credit score for a homer loan. An FHA loan, for example, can go to someone with a score as low as 500. Keep in mind that the loan amount and interest rate will not be anywhere near as favorable with a credit score that low.

Read Also: What Happens If You Don’t Pay Speedy Cash

How Can Credit Karma Help Me

If youre trying to make ends meet by purchasing a new car or a new home, Credit Karma can assist you in various ways. The following are the most common ways in which people seek assistance from the site:

It assists people in determining whether they can afford a home or qualify for the loan they desire. People concerned about finding a lender with whom they can collaborate usually appreciate the fact that loans are pre-screened to determine whether or not you meet the typical qualifications.

If you are prone to identity theft, Credit Karma can assist you in determining whether or not someone has opened an account in your name without your knowledge.

People who discover inaccurate or false information on their credit reports can file a dispute through the sites dispute function, resulting in the information being removed. It, in turn, has the potential to raise your credit score.

What Is The Way Credit Karma Makes Money

The business model of Credit Karma is not entirely charitable. Its a business for profit which earns money by offering you a credit score for free in exchange for information about your spending habits , and charging businesses to deliver you targeted ads.

Credit Karma places advertisements in front of its users hoping they will respond in a positive way by clicking the ads. Many of the advertisers are lenders in addition, Credit Karma may earn a charge if you submit an application using one of its hyperlinks.

Your personal information is important data for advertisers, and they will pay more to advertise to the data. With over 100 million customers its a sustainable model of revenue to support Credit Karma.

Don’t Miss: How To Remove Hard Inquiries In 24 Hours

Why Is My Credit Score Important

Your credit score will play a large role in determining the answer to three crucial questions regarding your mortgage.

- Will the lender approve my mortgage?

- How much will they lend me?

- What will my interest rate be?

If your credit score is low, you might not be able to qualify for a loan large enough to purchase the home you want. Or, you might get the loan but at a rate so high that you will be wasting hundreds or even thousands of dollars each year just on interest payments.

What Scores Are Needed To Qualify For The Best Refinancing Or Loan Rates

FICO credit scores are often divided into five categories from worst to best as follows:

- Very poor : It is essentially impossible to get credit with these scores.

- Fair : These are subprime borrowers and generally qualify for the worst rates.

- Good : These applicants qualify for better rates, and it is assumed only about 8% of them are likely to be delinquent.

- Very good : These applicants usually qualify for better-than-average rates.

- Exceptional : Anyone with a score in this range should have no problem qualifying for the best rates.

The VantageScore scale runs as follows:

- Very poor : Applicants are unlikely to be approved for any credit.

- Poor : Applicants may qualify for some of the worst rates and may have larger down payments.

- Fair : These applicants are usually approved for credit but dont get the best rates.

- Good : These applicants stand a good chance of getting more competitive rates.

- Excellent : Those in the top range qualify for the best rates and offers.

Recommended Reading: 809 Fico Score

The Credit Score Of Your Karma Could Be Unsatisfactory

It is possible that your credit scores fluctuate daily according to Credit Karma. Its mostly dependent on when your lenders submit with the credit bureaus. Check every day your TransUnion credit score through Credit Karma.

While VantageScores method is accurate however its not an industry standard. Credit Karma is perfect for consumers on the average, but the businesses that will either decide whether or not to approve your application will likely take a look at your FICO score.

What Are Credit Karma Approval Odds

![How Accurate Are Credit Karma Credit Scores? [2020]](https://www.knowyourcreditscore.net/wp-content/uploads/how-accurate-are-credit-karma-credit-scores-2020-uponarriving.png)

When youre logged into Credit Karma and searching for a new credit card, you might see notes about your approval odds near a cards image.

Like the example shows, Approval Odds can include Excellent, Very Good, Good, Fair and Poor. But what, exactly, do they mean?

Approval Odds serve as guidelines regarding the likelihood youll be approved for a specific credit card. Everyones credit situation is different, so your odds might be different from those of other Credit Karma members.

Scroll over the Approval Odds tab, and youll see a pop-up message that explains how Credit Karma determines your unique Approval Odds.

Credit Karma looks at how your credit profile compares to other Credit Karma members who were approved for this product. Of course, theres no such thing as a sure thing, but knowing whether your Approval Odds are Excellent, Very Good, Good, Fair or Poor may help you narrow down your choices.

If youre looking for a new credit card, these Approval Odds can certainly help you when youre evaluating which one is the best fit for you.

Also Check: What Credit Score Is Needed For Chase Sapphire

Is Credit Karma Score Accurate Online Video Tutorial

For our Beautiful reader, we offer a useful video clip to give you a simple tutorial how to write down a very good is credit karma score accurate. The sample down below may a basically guideline if you are free of charge to alter it depending on your troubles. So, delight in viewing!

Very well, it is focused on is credit karma score accurate. We hope it might be practical for just about any business enterprise functions youve. Thanks for reading and see you shortly!

Recommended Reading: Which Business Credit Cards Do Not Report Personal Credit

Using The Credit Karma App

If you love to access your financial information on your phone, you can use the Credit Karma App. The mobile app is free to download for iOS and Android users. The app has tools and features that allow you to stay on top of your finances and check your credit score for free.

You can also file your state and federal tax returns with Credit Karma tax and put away cash with Credit Karma Savings.

With the app installed on your phone, you will have the ability to receive credit alerts if the company gets a crucial change to your credit reports from either Equifax or Transunion.

For example, if your credit card bill got paid off. Their free credit monitoring tool helps you keep up to speed on your finances and any unwelcome surprises.

Also Check: How To Remove Repo From Credit Report

How Do I Get My Credit Report From Credit Karma

Fortunately, you do not need to spend hours trying to figure out how to use Credit Karma.

Just visit their website: all you will need to sign up is a valid email address and some personal information, including:

- your full name

- address

- the last four digits of your social security number

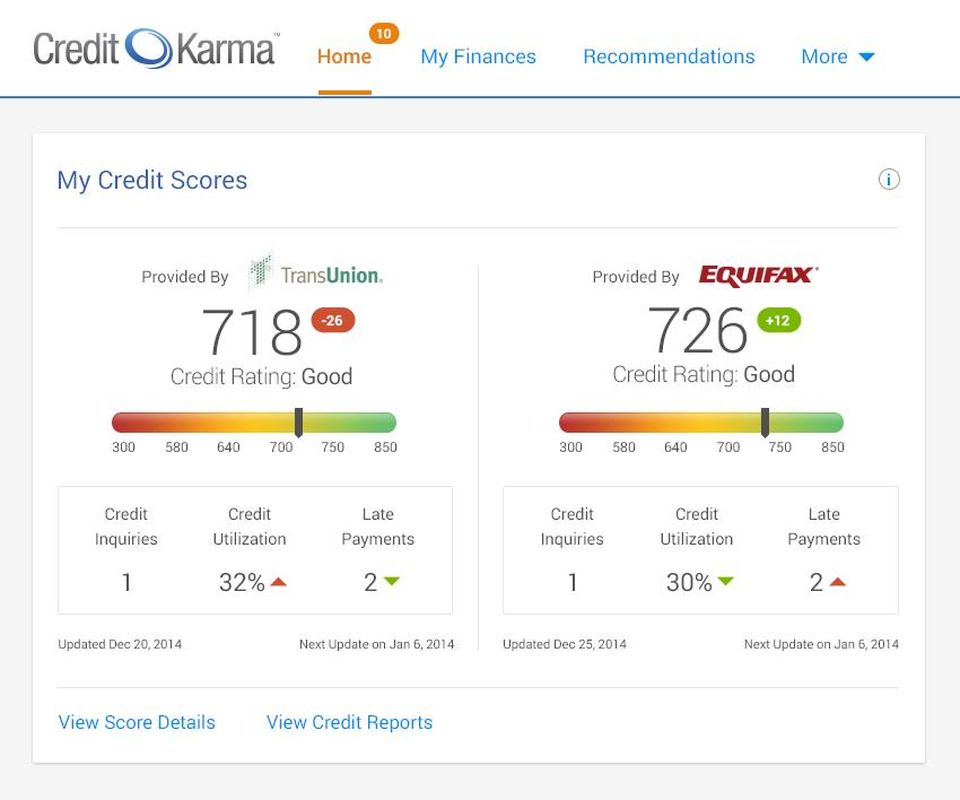

Once you create your account, Credit Karma will quickly pull credit reports from TransUnion and Equifax and will pull up a screen that looks like this:

Did you discover your credit score is sub-par? Learn how to build your credit

From here, you can take a look at your account balances, including:

- all of your credit cards

- business loans

- student loans

- and more

You can also see recommendations for credit cards and other loans you are most likely to be approved for based on your credit score.

You can also click either score to see the factors impacting it, which you should undoubtedly do if you want to maintain or increase your credit score.

As you can see, thankfully, its not hard to learn how to use Credit Karma. Be sure to check your credit score every week or so to see any changes.

#CaminoTipCredit Karma will typically email you frequently notifying you that your new score is available, so make sure those emails dont go into your spam folder!

What Are Credit Karma Limitations

The first question to ask yourself is whether you require Credit Karmas free services or not. And how urgently you need detailed information about your credit standing may determine how much time you have available. Remember:

1- Your legal right to a copy of your credit score and credit report from each of the three credit bureaus once every 12 months is protected by the Fair Credit Reporting Act .

2- Customers of many banks and lenders can obtain access to their credit scores on demand. For example, suppose you have an American Express card. In that case, you can access your FICO score and FICO history by selecting Account Services from the menu bar.

Most of the time that is sufficient for the majority of us. Having access to your credit report and the related services Credit Karma provides may be beneficial if you are about to apply for a mortgage, are working to improve your credit rating, or simply want to take advantage of the other services that Credit Karma provides, among other things.

Recommended Reading: Paypal Credit Report

Faq About Credit Karma

Still have questions about Credit Karma? Keep reading.

Is Credit Karma really free?Does Credit Karma hurt your credit?

Checking your own credit score and credit report on Credit Karma will not hurt your credit. Your credit score may see a temporary dip when you apply for credit and the lender checks your credit report . Checking your own credit score is known as a soft inquiry, which does not affect your credit score.Credit Karma could boost your credit if its educational tools and credit monitoring services help you improve your credit score. On the other hand, if the site inspires you to take on excessive debt and you fall behind on the payments, your credit could suffer.

Can you get my FICO score from Credit Karma?

Credit Karma does not provide a FICO Score it provides your VantageScore 3.0. You can get a free FICO Score and free credit report from Experian. You may also be able to get your credit score from your bank or credit card company, but youll need to clarify whether it is the FICO Score or the VantageScore.

Is Credit Karma score lower than FICO?Is FICO the most accurate credit score?

How Does Credit Karma Make Money

The cost of maintaining a website that provides soft scores for free is not insignificant, but the site itself is pretty profitable. However, even though the site is best known for its free credit reports, most of its revenue is generated through referrals.

Once Credit Karma has run your credit report, it makes an effort to match you with credit cards, mortgages, and loans that are deemed to be appropriate for someone with your credit history.

You are under no obligation to accept any of the credit card offers or other similar offers that may be made to you. Nonetheless, Credit Karma receives a commission if you do.

Don’t Miss: How Long Does Repo Stay On Credit Report

Which Should You Check Regularly

Hardeman recommended picking one and sticking with it. It can be surprising to know that there are potentially hundreds of credit scores, she said. However, credit scores are highly correlative. That means if you rated good in one scoring model, you most likely have a good credit rating in all other models. Whether youre building your credit from scratch, working on bouncing back after a hardship, or just in maintenance mode, I recommend tracking one score for changes over time.

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

You May Like: Ccb Credit Report