Examine And Correct Your Credit Reports

Checking your reports is important to keep unnecessary errors from harming your score. For example, there could be incorrect accounts, incorrect payment statuses, among other common errors. You must get rid of these errors once you notice them.

File a dispute with the credit reporting bureau if you discover an inaccuracy. You will not be charged anything if you submit a dispute with the credit reporting bureau.

Filling out a dispute form isnt difficult simply draft a letter outlining the specifics of each of the faults you found. Include any copies of evidence you have to back up your claim.

It may take up to 30 days for the bureau to review your claims and respond. If there was a mistake, it will be corrected.

As a result, consider sending a copy of your report to your previous creditors to keep it up to date.

How Do I Qualify For A House In Hawaii

In Hawaiian society, it is considered acceptable to be a native Hawaiian when one or more half of your blood lines coincide with the last tribe to inhabit the Hawaiian Islands before 1778, also referred to as a descendant. There must be a blood quantum of at least 50 percent Hawaii in your case. Since 1921, there has been an unchanged requirement.

What Is Considered A Good Credit Score

Since different credit agencies use different rating systems, a good score will vary from one agency to the next. For Experian, a score of 881-960 is considered good, and a score of 961-999 is considered excellent. For Equifax, a score of 420-465 is considered good, and a score of 466-700 is considered excellent. For TransUnion , a credit score of 604-627 is considered good, and a score of 628-710 is considered excellent.

Don’t Miss: What Credit Score Does Comenity Bank Use

Buying A Home With Poor Credit

A credit score in the 500s will likely narrow your options down to a bad credit loan. These loans normally come with higher interest rates and added fees since lenders see you as a high credit risk.

Keep in mind that lenders may take other factors into account when considering you for a loan. For example, it may help your chances of buying a home if a lender is aware of a past financial hardship you have since recovered from. Lenders also look at factors besides your credit score to determine if theyll approve you for a loan. Some of these things include:

- Low loan-to-value ratio

- Length of credit history

- Employment history and income

Positive marks in these areas may impact a lenders decision if your score is low. However, improving your credit score will give you a better chance of securing the loan you want.

Prequalify Online And Compare Interest Rates

Prequalification for a loan can assist you in assessing your creditworthiness based on your credit, debt, income, and assets.

The prequalification calculator will tell you how much money you can borrow, your monthly mortgage payment, and the highest monthly mortgage payment you can acquire.

You can use the estimations to negotiate better conditions and decide whether you want to make a bigger down payment in exchange for a lower interest rate.

Also Check: Can Repossession Be Removed From Credit Report

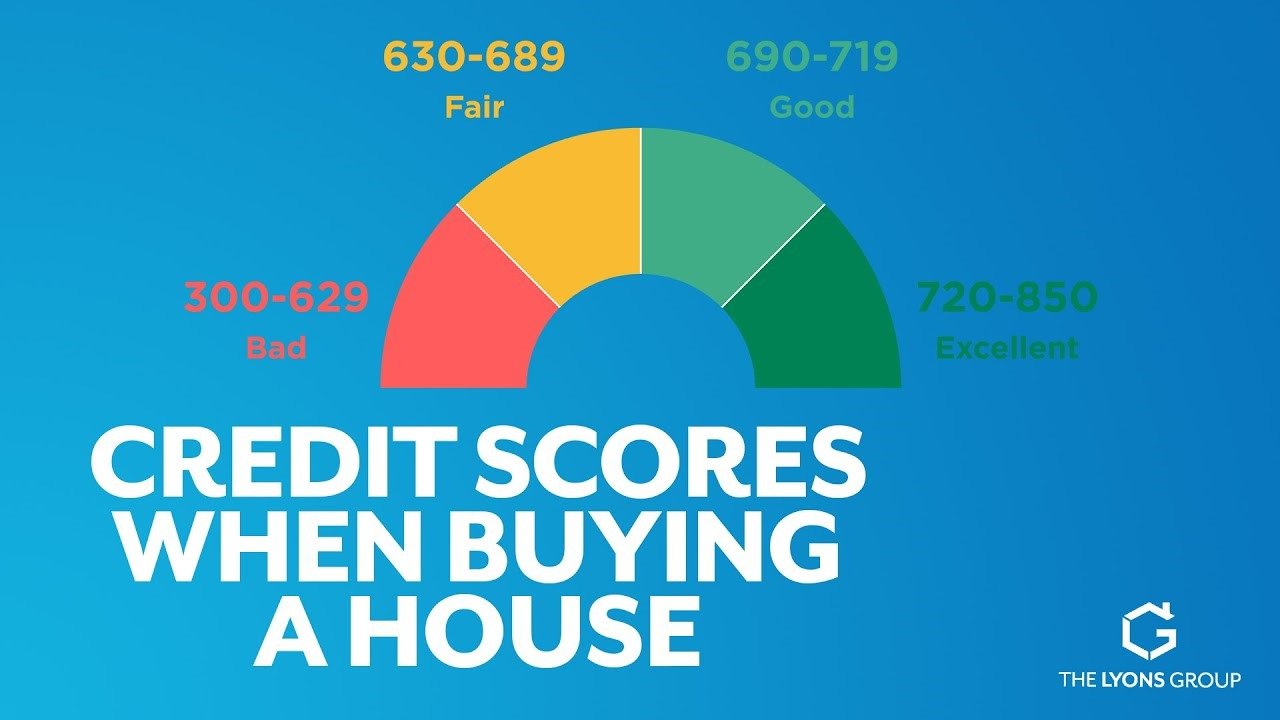

Whats A Good Credit Score To Buy A House

Generally speaking, youll need a credit score of at least 620 in order to secure a loan to buy a house. Thats the minimum credit score requirement most lenders have for a conventional loan. With that said, its still possible to get a loan with a lower credit score, including a score in the 500s. How?

Different Types Of Home Loans

Generally, there are four different types of loans most people obtain in order to buy a house. These loans are:

Unlike the other loans, the FHA loan actually does have a minimum credit score in order to be eligible for the program. Because its connected to a federally funded program, there are strict guidelines that you must meet in order to qualify for this loan.

If you are able to provide 10% of the mortgage price as a down payment in cash, you must have a minimum credit score of 500.

If you are only able to put 3.5% down as a down payment, your credit score must be a bit higher at 580.

Due to the lower down payments needed for FHA loans, they are primarily designed for borrowers who fall into the low or lower-income tiers.

If you are a veteran, there is more leniency given for VA loans in regards to credit scores. The minimum credit scores are dependent on each individual lender that is part of this program. Credit score minimums will vary by lender. Due to this, there is no minimum credit score for the overall program.

While there are no official minimums, there are a few guidelines for borrowers looking for a home loan. Most of the lenders in the VA program require borrowers to have a minimum credit score of 620. While this a general norm, a few other lenders will lend to borrowers with a credit score of 580 or above.

You May Like: How To Get Repo Off Credit

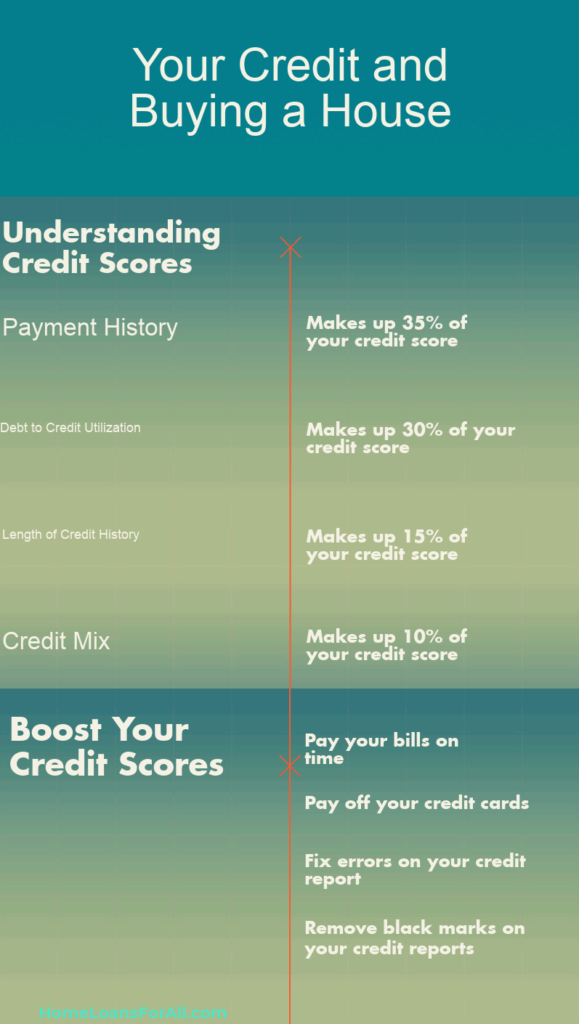

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

- New credit

How Much An Hour Do You Need To Make To Live In Hawaii

An adult working without keiki and without 21 hours of benefits earns $19.6 per hour. It costs $85 per hour, or $23 per hour. Its estimated that the state of Hawaii will have an unemployment rate of 82 percent in 2020. In order to cover the $25 they would need under benefits, this individual would need $25. The hourly wage is $22. The amount is $27. It will take 48 years to achieve economic security. Each state is estimated as having a housing wage, which is calculated by the National Low Income Housing Coalition.

Read Also: Hard Inquiry Fall Off

How To Improve Your Credit Score

If you have bad credit, or no credit, you probably can’t get a mortgage without a co-signer. You can take steps to improve your score with some simple strategies, though, experts say.

“If your credit score is low due to high card balances, then the best way to quickly improve the score is to pay down those balances until they’re less than 35% of your credit limit,” says Melissa Cohn, executive mortgage banker at William Raveis Mortgage. “If your score is low due to a late payment, or you have an account in collections, then the only way to improve it would be to get in touch with the company that reported it, and ask that they remove it.”

Tips On How To Get A Good Credit Score

Dont lose hope if you do have an application rejected by your bank, as South Africas leading home loan comparison service, ooba Home Loans, can apply to multiple banks on your behalf, and have been successful in securing home loan financing for two in every three applications that are initially turned down by their bank.

ooba Home Loans also offer a range of home loan calculators to help make the home-buying process easier. Start with their Bond Calculator, then use their Bond Indicator to find out what you can realistically afford. Then, when youre ready, you can apply for a home loan with ooba Home Loans.

Do you know your credit score?

Check your credit score for free in minutes.

Read Also: Debt Recovery Solutions Verizon

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Minimum Credit Score To Buy A House By Loan Type

Conventional loans are the most common home loan and have a hard minimum credit score of 620. Conventional loans are issued through mortgage lenders, mortgage brokers, and credit unions. Conventional loans are the default option for home buyers because of their low rates and simple approvals.

Conventional loan approval requires:

- Current credit score

FHA mortgages are the original mortgage loan, developed by the Federal Housing Administration in the 1930s to keep homeownership attainable. FHA loans are more inclusive than other loan options because of their relaxed down payment requirements, and because the FHA doesnt change your interest rate based on your credit score.

In fact, FHA loans dont require home buyers to have a credit score at all, although many lenders want to see a minimum score of 580.

FHA loan approval requires:

- Loan lengths must be 15 years or longer

VA loans are backed by the Department of Veterans Affairs. VA loans are affordable home loans for active-duty servicemembers and veterans.

Because the VA guarantees its loans against losses, mortgage lenders make VA loans at very low interest rates and, historically, VA mortgage rates are often the lowest of all available mortgage loans. VA loans dont require a downpayment.

VA loans:

- Are available as 100% mortgage loans

- Have lower interest rates as compared to conventional loans

- Require a Certificate of Eligibility

USDA loans:

Jumbo loans can be used for a variety of property types.

Jumbo loans:

Don’t Miss: What Is Syncb Ppc On My Credit Report

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

Check Your Credit Report For Errors

The FTC found in 2012 that one in five credit reports contained errors. This is why you should periodically review your credit reports for any erroneous items. These mistakes can add up and drastically impact your score if theyre not removed. And thanks to the Fair Credit Reporting Act , you have every right to dispute your credit report whenever you find inaccurate information.

Buying a home can be more complicated when you have below-average credit. This is why its important to work on repairing your credit errors long before it comes time to buy property. Itll take some time, but its doable with the right resources. Follow our tips above to raise your score and open the door to a better home loan.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Reviewed by Brittany Sifontes, an Associate Attorney at Lexington Law Firm. by Lexington Law.

Brittany is an attorney practicing in the area of consumer advocacy with Lexington Law Firm. At Lexington, Brittany assists clients with credit repair. Brittany attended the University of Colorado at Boulder for her undergraduate degree and attended Arizona Summit Law School for her law degree. At Arizona Summit Law school, Brittany graduated Summa Cum Laude and ranked 11th in her graduating class.

Don’t Miss: What Is A Serious Delinquency On Credit Report

How To Find Out Your Credit Score

You can use ooba Home Loans Bond Indicator to access your credit score. This is a 100% secure, online tool that is available free of charge and without any obligations. Based on the information you provide, the tool will give you an indication of your credit rating, and how much you can realistically afford. The Bond Indicator tool will issue you with a Bond Indicator Certificate that will enable you to house hunt with confidence.

General Rule Of Thumb For Credit Scores And Home Loans

While credit score minimums vary by lender, the majority of lenders require a FICO score of at least 620, while a credit score of 580 appears to be the absolute lowest under most circumstances.

It is obvious that the higher your credit score, the better chance you have at securing a home loan with a lender.

Keep in mind that your credit score is also tied to the interest rate that will be attached to your loan. Generally, the lower your credit score, the higher the interest rate you will be offered. Interest rates can vary greatly and a percent or two can result in you paying tens of thousands of dollars to the lender over the life of the loan.

You May Like: What Is Thd Cbna On My Credit Report

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

What Do Mortgage Lenders Look For On Your Credit Report Uk

Here are a few key notes: Personal information, including any information associated with your personal identification number , where your address is located, and what was your birthdate. It would appear that past employer information is already available on a credit application, as it was previously listed. You can find detailed information about loans, revolving credit accounts, late payment dates, and current payment status on these websites.

Read Also: How To Raise Your Credit Score By 50 Points

How Does Credit Score Affect Your Interest Rate

The interest rate you receive on a home loan is largely tied to your credit score. Generally, borrowers with higher scores qualify for lower mortgage rates, which can save them thousands of dollars over the life of a mortgage. Its a good idea to compare how varying .

Every lender will have a different formula for setting your interest rate, but even a small difference on your credit score can help you save substantially. For example, bumping your score from 660 to 700 may help you shave $61 off your monthly payment on a $300,000 mortgage. Thats a difference of $21,960 over a 30-year mortgage term.

What If You Dont Have Any Credit At All

Building credit from scratch is challenging, but it can be done. Adding a cosigner to the mortgage loan application works for people with no credit as well as for those with poor credit. Another option is to start using a credit card responsibly.

Start off with a secured card and make your monthly payment in full each month to build credit. Or ask a close relative if you can be added as an authorized user on one of their credit cards.

You can agree not to spend anything . This simple step will add that credit cards entire length of use to your own credit report.

You can also show your lender that youve regularly paid other bills on time, like your cell phone, utilities, or rent. Another method is to make a bigger down payment to compensate for your lack of credit. Talk to your lender to see what else you can provide to make the loan work.

Read Also: Is A 524 Credit Score Bad

Pay More Than Monthly Minimums

If youve maxed out your credit card in the past, now is the time to take control of the situation. Make more than the minimum payment due each month, says Lisa Torelli-Sauer, editor at Sensible Digs, a website specializing in budgeting home investments. Even if its only a few dollars more than the minimum payment, it will show the credit reporting agencies you are making a greater effort to pay down your debt and will improve your score.

Lower Your Credit Utilization

Try to re-work your budget to pay off your credit card balances and other debt. This will lower your and ultimately increase your credit score.

Is your available line of credit really small? Ask an existing creditor to extend your maximum amount on one of your current credit cards. This will also lower your credit utilization.

Read Also: How Often Does Usaa Update Credit Score