Best Student Credit Card

The academic year tends to be front-loaded with expenses: Text books, lab supplies and, if youre living off-residence, housewares and the cost of setting up utilities. This is where a rewards card comes in handy, especially with a great welcome bonus of 5% cash back on purchases on your first three statements. After the bonus period, youll still earn 3% cash back on groceries, 1% on recurring bill payments, and 0.5% on everything else. Fortunately for busy students, this straightforward card doesnt have a complicated points system or tiered earn ratesit just provides simple cash back.

- Annual fee: $0

- Welcome offer: Get up to 5% cash back for the first 3 months; introductory 1.99% interest rate on balance transfers for 9 months with 1% transfer fee; plus apply now to get a $50 cash back bonus when you spend over $6,000 in the first year .

- Earn rate: 3% cash back on groceries; 1% on recurring bill payments; 0.5% on everything else

- Additional benefits: Extended insurance on purchases made with the card; up to 25% off rentals at eligible Alamo and National Car rental agencies

How To Rebuild Your Credit With A Secured Credit Card

Once youve chosen a card from the list above, its time to think about rebuilding your credit score. Remember that as time passes and you use your credit responsibly, the credit bureau will automatically adjust your score. Here are some other rules to keep in mind:

- Always pay your credit card bill on time. This should go without saying, but its crucial to pay at least your minimum amount due every single month. If you easily lose track of due dates, set up automatic payment with your online bank, or use alerts in your calendar. A missed payment can set you back.

- Use your card. Yes, you read that right. Part of the point of having a card is to rebuild your credit reputation, which means demonstrating responsible use. Youre not simply trying to pay down debt; youre showing you can be trusted with a loan. Using your card even for small purchases and paying it off in a timely fashion is the best way to do so.

- Pay off your balance in full. And pay it off every month. Even though credit card use is an important part of building your credit, you shouldnt run a balance, as doing so will not only cost you in terms of interest, but can also hurt your credit score by increasing your credit-utilization ratio .

- Dont max out your card. When future lenders look at your usage history, theyll want to see that you put no more than 30% of the maximum allowed amount on the card. Otherwise, you might seem overextended.;

User Id And Password Guidelines

The perfect secure password is easy to remember, but difficult for outsiders to guess. Keep these tips in mind when creating your User ID and Password.

You should:

- Review the current Citibank Vulgar Language Policy.

- Make your User ID and Password two distinct entries.

- Make your User ID and Password different from the Security Word you provided when you applied for your card.

- Use phrases that combine spaces and words . NOTE: 1 space only between each word or character.

You should not:

- Use your name.

- Use multiple consecutive spaces.

- Use more than three consecutive or sequential digits unless your User ID is an email address .

- Use a single word that can be found in the dictionary.

- Use something readily identifiable, such as your name, birthday, spouse or child’s name, Social Security Number, phone number or street address. These can be traced directly to you and are easy for potential hackers to guess.

- Use letters or numbers that are near each other on the keyboard .

Need more suggestions? Have some fun and try one of these formulas:

- Choose a meaningful phrase with 6-8 words in it and take the first character of each word to make your password: wboh9ya.

- Insert two digits into a word .

- Replace the vowels or other letters in a short phrase with numbers or other characters.

- Misspell a word, drop some letters, add other characters, or make up crazy words using symbols instead of vowels or consonants.

- Drop the vowels in a long word . Even better, add some numbers .

Also Check: Does Zzounds Report To Credit Bureau

How Store Credit Cards Work

You’re probably aware that almost every retail store has a . After all, almost every cashier you’ll come across will ask whether you’d like to apply for their card. Most of these credit cards are financed through different banks or financial companies. Some of the most notable are those available through Target, Amazon, Walmart, Costco, the Gap family , and Best Buy.

Getting approved for a card from many retailers can be fairly easy, especially since the application can be done online or right at the cash register. That’s because these lenders have looser restrictions than traditional credit card companies.

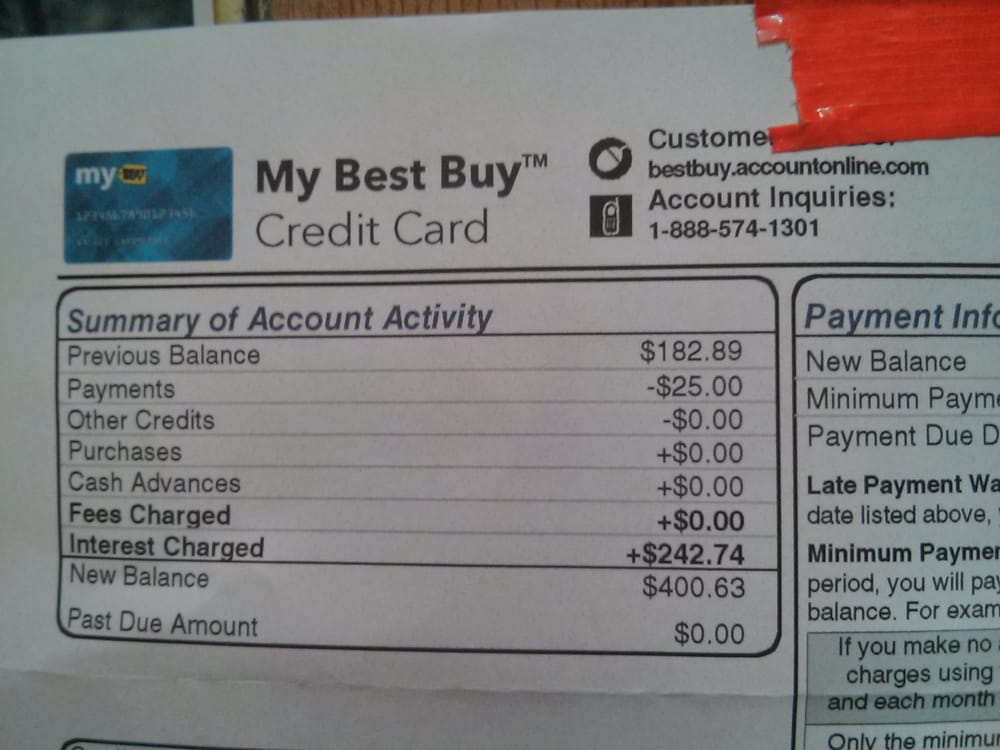

The majority of store credit cards have no annual fees and often come with a very manageable credit limit so, hopefully, you won’t be overspending. If you’re a frequent shopper at that retailersay at Best Buyyou can even earn points or other rewards. Best Buy offers two different credit card optionsthe My Best Buy Credit Card and the Best Buy Visa.

Pay Off Any Past Due Balances

If you have any charge-offs or collections, pay them off as soon as possible. The same is true for judgments and tax liens. Paying them off wont remove them from your credit report. But a paid delinquency is always better than an open one. Your credit score should begin to rise soon after these delinquencies are paid.

Read Also: Opensky Billing Cycle

What Your Score Means To Lenders

- 800 900 EXCEPTIONAL

We think its important to provide our cardmembers with free access to information that will help them understand and stay on top of their credit status. Thats why were providing you with your FICO® Score and information to help you understand it.

Your FICO® Score is calculated based on data from Equifax using the FICO® Bankcard Score 8 model and is the same score we use, among other information, to manage your account.; This model has a FICO® Score range from 250 through 900.

The FICO® Score Citi provides is based on information from your Equifax credit report based on the as of date included with your score. This may differ from scores you obtain elsewhere that may have been calculated at a different time using information from a different credit bureau or even a different score model. If you have additional questions regarding the FICO® Score model and how its calculated, please refer to the FICO® Score FAQ and Understanding FICO® Scores links under the Useful Links section below.

Your score wont be available if:

Selecting A Rewards Credit Card

Generally speaking, cards that earn you points are usually best used for travel redemptions. These cards will likely give you other ways to cash out your points, but the majority of the time, you get the most value for your points when redeeming for travel. Similar to cash-back cards, you want to pick a card that gives you the most points on the categories you spend the most money. You also want to figure out what type of travel you prefer; you could get an airline-branded credit card or a hotel-branded one. There are also credit cards that allow you to redeem for any type of travel. Regardless of what you go with, you need to know how the reward programs work so you can maximize your points.

Read Also: Aargon Collection Agency Address

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

My Best Buy Credit Card Vs Citi Double Cash Card_ 18 Month Bt Offer

The Citi double cash card is considered one of the best fixed-rate cash back credit cards. The card allows its clients to earn 2% on each purchase with limitless 1% cashback when you purchase, in addition to an extra 1% as you pay for those purchases. In comparison, it matches or beats all of the rewards on the My Best Buy credit card except for shopping from Best Buy stores.

The Citi double cash card rewards cardholders with statement credit, which is flexible than the rewards certificate earned with My best buy credit card. The statement credit can be used to offset desired expenses on your credit card bill.

The Citi double cash card is relatively more flexible and adaptable compared to the Best Buy credit card.

Also Check: Aargon Collection Agency Reviews

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

How Credit Scores Are Calculated

Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Scoring models may use different factors, or the same factors weighted differently, to determine a particular score. However, consumer credit scores generally share a few similarities:

- Scores are calculated based on the information in one of your credit reports.

- Scoring models try to predict the likelihood that a borrower will be 90 days late on a bill in the next 24 months.

- A higher score indicates a person is less likely to fall behind on a bill, and vice versa.

The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of 300 to 850and a score in the mid-600s or higher is often considered a good credit score. .

Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores. Here, we’ll focus on the actions you can take to help improve your credit scores.

Recommended Reading: Does Paypal Credit Affect My Credit Score

For Dining And Transit: Bmo Eclipse Visa Infinite*

While the TD First Class Visa Infinite covered above earns a solid flat reward on your everyday spending, the BMO eclipse Visa Infinite offers a strong boost in particular categories, which are broadly defined, too. Youll earn 5 BMO Rewards points on food and transit spending. That means in these categories youre getting a return of 3.5% per $1 when redeemed for travel . Other categories earn at a rate of 1 point per $1, which is just 0.71% in travel rewards. But theres a unique perk to make up for that: Youll receive an annual lifestyle credit of $50 to spend as you please. Also, travel insurance and new mobile device coverage are included.;

- Annual fee: $120 ;

- Welcome offer: Earn up to 60,000 points and a $50 lifestyle credit on the account.

- Earn rate: 5 BMO Rewards points per $1 on food purchases, including groceries, restaurants and delivery, as well as gas and transit purchases including taxis and rideshares; 1 point per $1 on everything else Income requirement: $60,000 personal or $100,000 household;

- Additional benefits: Travel insurance; up to $1,000 in new mobile device coverage; Visa Infinite privileges

How To Use My Best Buy Visa Credit Card Card

When you submit your application, pay attention to which version of the card youre approved for. If you only qualify for the My Best Buy Credit Card or the My Best Buy Visa Gold card , consider the limitations of each before opening your account.;

If you decide to open any version of the My Best Buy Visa Credit Card, have a spending plan in mind. Youll want to prepare for any purchases that qualify for special financing before you buy, so you can avoid taking on deferred interest . It may also be worth waiting until you have the money to buy it outright, and earn rewards on your purchase instead. Either option can be a good one if youre shopping for something expensive at Best Buy, such as a home entertainment center or new kitchen appliances.

As for the cards other rewards categories, you can earn on gas, groceries, and dining if you prefer to redeem your rewards at Best Buy. But if you have other cash back or rewards cards already in your wallet that earn in these categories like the Chase Freedom Unlimited® or Blue Cash Preferred® Card from American Express you may get more value from their more flexible redemptions.;

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Home Trust Secured Visa*

You might be new to Canada, have a problematic credit history, or are just starting out on your own financially. There are many reasons why you might need to build or rebuild your creditbut whatever the case, youll want to take steps towards achieving a healthy credit score. Thats where the no-fee Home Trust Secured Visa can come in. Unlike with conventional credit cards, its easy to be approved for a secured cardyou just need to be a resident of Canada and have a deposit. The Home Trust Secured Visa tops our list for its low minimum deposit and $0 annual fee. With this card, building your credit score is simple and affordable.;

- Annual fee: $0

American Express Cobalt Card*

With a high earn rate, a generous welcome bonus and easy-to-use points, the American Express Cobalt Card is our top pick as the best travel credit card for everyday spending.;

The points you earn can be redeemed for travel at a rate of 1,000 points for $10 for any flight on any airline with no blackout dates, or they can be used toward the American Express Fixed Points Travel Program, which lets you unlock even better value on round-trip flights. If you prefer to use your rewards for accommodations, you can transfer your points to one of the American Express Hotel partners, including Marriott Bonvoy.

- Annual fee: $155.88

- Earn rate: 5 points per $1 spent on dining out and groceries; 2 points per $1 spent on travel; 1 point per $1 spent on all other purchases

- Welcome offer: Up to 30,000 bonus points , plus, earn a bonus of 20,000 points when you spend $3,000 in purchases within your first 3 months of having the card

- Income requirement: $12,000

Read Also: How Bad Is A 524 Credit Score

Go Slow Applying For New Credit

Weve already touched on this factor, but its worth reminding you that lenders dont like seeing applicants applying for multiple lines credit. It could be an indication youre having budget problems, and looking to solve them by obtaining additional credit. You should apply for no more than one or two new lines of credit per year.

Con: High Interest Rates

This is something that most people cannot control. Of course, the better your credit score the lower your interest rates will be on all credit cards and loan accounts. Of course, the lower your credit score, the higher your interest rates. However, as of 2013, the average interest rate on the Best Buy credit card was anywhere from 25.24% to 27.99%, and thats a very high rate even for people with less than stellar credit.

The rates change from time to time, and with the economy slowly improving, many banks are lowering their rates. However, HSBC is the issuing bank behind the Best Buy credit card, and its common knowledge that they always have higher than average rates. This could mean nothing to you if you are someone who always pays your cards off in full each month. Without a balance, you dont have to pay astronomical interest charges. However, to those who are carrying a balance, this is a very hurtful rate. Lets take this into consideration; a Best Buy Credit card with a 24% interest rate and a balance of $1500 is paying an additional $36 per month in interest. If you make a purchase for $1500 and take a year to pay that off without special financing, youre actually spending $1932 on that purchase in the course of one year. If you bought the same $1500 item with a regular credit card with a 13% interest rate and spent 1 year paying it off, youd pay approximately $1734 on the purchase.

Read Also: Does Speedy Cash Report To Credit Bureaus