How To Write A Credit Report Dispute Letter

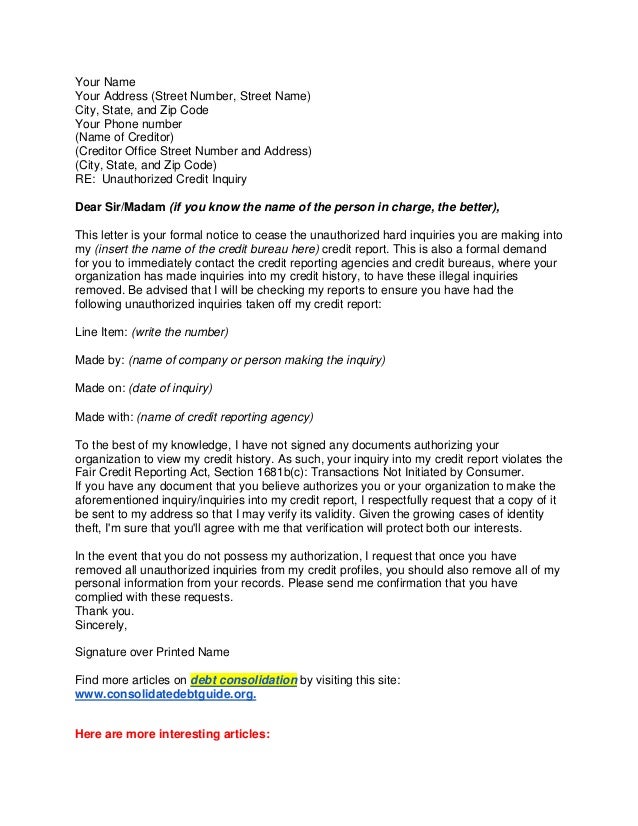

According to the Consumer Financial Protection Bureau, a credit dispute letter should have four main parts.

Take The Necessary Steps

There are additional steps you can take while you wait for your case to be processed. You can file an official police report, and put a freeze on your credit so as to prevent credit inquiries. A credit freeze can last from 90 days to 7 years and you can initiate it online.

It can take up to one year for the case to be resolved.

Information To Include With Your Inquiry Removal Letter

You should take the time to personalize your credit inquiry letter based on your situation. This can make your letter much more effective, and it will be taken more seriously. Here are a few rules you should stick to:

- Be courteous: Remember that there is a person on the other end of the letter, and it helps to be kind instead of combative.

- Send copies, not originals: Your letter should include a copy of your credit report with the disputed inquiry circled, it should not be the original copy. You should also include a dispute form with your letter, which can be found at each bureaus website.

- Edit beforehand: Have someone else proofread your letter, ideally someone who has sent a letter like this before.

- Use certified mail: Send the letter and accompanying enclosures by certified mail, with a return receipt requested. This way, you will receive a notice when the bureau has received the letter.

Below, youll find the addresses for the three major credit bureaus, to which youll send your letter.

You May Like: Does Mortgage Pre Approval Affect Credit Score

What Items To Enclose With The Credit Bureau Dispute Letter

The credit bureaus require you to verify your identity in order for them to investigate and send you dispute results back

Photo ID: This could be any state or government-issued identification

Proof of Residency: This could be a recent utility bill, or bank statement, mortgage statement, or a copy of your home rental agreement. It should show your name and current mailing address.

Proof of SSN#: This could be any state or government document showing your SSN#. Or a page from your tax return, W-2, paystub, or 1099, etc.

Any Supporting Documentation: This could include anything that could support your dispute claim, like a letter of deletion from the creditor.

Wait for 30 Days for the Dispute Completion:

Within 30 days after receipt of the letters by the bureaus, you should receive the investigation results from them.

Hard And Soft Inquiries

There are two types of inquiries that show up on your credit report- soft inquiries and hard inquiries. A soft inquiry does not show up and all offers are counted as soft inquiries. The reason you may be receiving a lot of unsolicited credit card offers is soft inquiries.

Most lenders read several credit reports to decide who to send offers to and it does not appear on the credit report since you had nothing to do with it.

Surprisingly, companies dont need your permission to make a soft inquiry. In fact, theyre quite common for landlords who screen tenants, credit cards companies determining pre-approved offers, and employers performing background checks.

Applications are considered hard inquiries and it is a result of an application for an auto loan, home mortgage, or credit. If you have applied for these, you will have an inquiry on the credit report.

Whenever you make an application, the lender will run a check on the credit and it will appear on the report. You need to remember that EVERY hard inquiry will show up on the credit report.

Hence, if you are looking around for a mortgage, the credit bureaus will be able to deduce that you are looking for a loan. Multiple inquiries in 45 days count as one hard inquiry.

A hard inquiry will require direct permission and it can impact the credit for one year. It will also stay on the report for two years. Hard inquiries are commonly used when you apply for a mortgage, apply for a new credit card, or finance a car.

Don’t Miss: How To Remove R9 From Credit Report Canada

How To Stay On Top Of Negative Credit Report Entries

Removing questionable negative items from your credit profile can be a long and time-consuming process that can seem daunting. Although a few points difference may not seem like a large priority, it is important to stay on top of these entries before they add up and get out of control.

If keeping your credit score high or improving your credit score is a top priority, Lexington Law Firm may be a good option for you. Lexingtons can help you with addressing questionable negative items on your credit report as you work on improving your credit.

Note: Articles have only been reviewed by the indicated attorney, not written by them. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice instead, it is for general informational purposes only. Use of, and access to, this website or any of the links or resources contained within the site do not create an attorney-client or fiduciary relationship between the reader, user, or browser and website owner, authors, reviewers, contributors, contributing firms, or their respective agents or employers.

Reviewed By

Stick To Their Recovery Plan

There will be different recovery plans but you will have to provide proof of identity, evidence that strengthens the claim and examples of when and where the theft occurred.

You will have to submit a formal letter to the Federal Trade Commission and they will give complete details you need to include in the letter. Once you do that, you need to follow the progress and adhere to the requirements.

There will be a lot of paperwork involved between the government and you. Continue to track the progress through the site you filed the report and stay attentive.

Don’t Miss: How Long Do Things Last On Credit Report

What Accounts You Should Never Challenge With Credit Bureaus

I absolutely cannot stress this enough When trying to repair your credit, DO NOT dispute any legitimate debts that fell behind recently, which you cannot afford to pay off.

Heres why Creditors can legally sue consumers within the statute of limitations they are allowed by the state the debtor resides in.So, check the statute of limitation for debts in your states before disputing any large unpaid accounts.

For example in California, the statute of limitations for debts is 4 years.

Heres what this means: If you live in California, creditors can sue you for up to 4 years from the time you defaulted on a debtDisputing accounts that lie within the statute of limitations may incite the creditor to take legal action against you.But this does not pertain to items that are resulting from identity theft.

How Many Points Does A Hard Inquiry Affect The Credit Score

Fico itself has put out very contradicting information regarding how inquiries affect scores. Based on my personal experience of sifting through thousands of credit files, Ive discovered inquiries wont bring down a credit score more than 10-15 points. There are individuals credit files Ive seen with over 30 inquiries and yet they have a near perfect credit score of 800.

Recommended Reading: What Credit Card Is Good For A 600 Credit Score

Will Removing Inquiries Increase Credit Score

Removing inquiries will not increase your credit score. The score will not change but there will be other benefits to consider. If the inquiries ended in denial, the creditors will not be able to see that anymore.

Credit seeking behavior is considered to be high risk and an inquiry is a quick way for a creditor to identify whether you are credit hungry or not. The top credit monitoring services can inform you about any suspicious activity. There might be no change in the score but there will be an improvement in the content of the report.

How To Dispute Different Types Of Incorrect Information

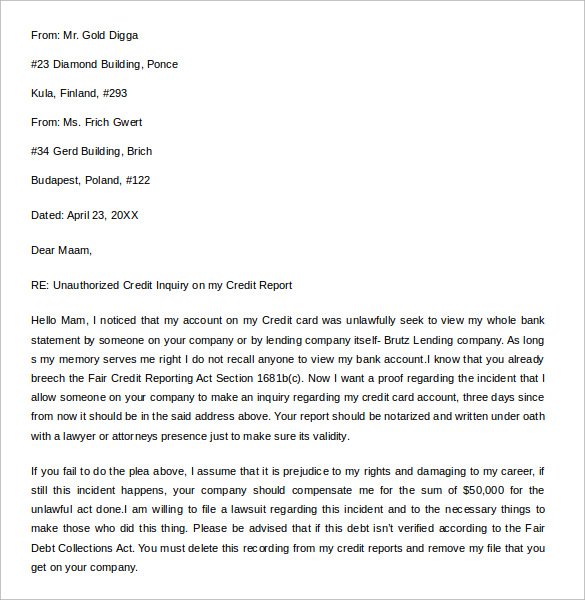

The way you should write your dispute letter depends on what kind of information you want to remove from your credit report.

Below are a few examples of issues you might address with a dispute letter, as well as language you can copy and paste into your letter template.

Incorrect personal information

This might be an incorrect address or any kind of identifying information thats listed incorrectly. Its important to make sure that this information is updated when you make major life changes, such as moving or changing your name.

You can address this by writing something like:

My report lists my old address at , but I have relocated to as of . Please find a copy of my lease enclosed with this letter, and please update my address accordingly.

Paid account showing a balance due

Use language like this to challenge an incorrectly reported balance:

The account shows that I still owe money to , but I paid the full amount owed on . Please find a copy of my payment history enclosed with this letter, and update the account to accurately reflect that I have paid it in full.

Fraudulent account on your report

Attach a copy of the Federal Trade Commissions identity theft affidavit along with your letter.

I was a victim of identity theft, and I do not recognize this account on my credit report. Please find a copy of my FTC identity theft affidavit enclosed with this letter, and remove the inaccurate accounts from my report.

Derogatory account more than 7 years old still on your report

Read Also: How To Improve Mortgage Credit Score

How To Dispute Accounts With Credit Bureaus: Phone Mail Online Or Fax

Most consumers dispute accounts by phone or online.This is a huge mistake!

The three major credit bureaus, Experian, Equifax, and Transunion, allow you to pull a free credit report directly from their websites every 12 months, or from annualcreditreport.com, or through sites like CreditKarma.

Those reports will provide you with a link to dispute online and a phone number for the credit bureaus customer service dispute center.

Phone and online disputes, although maybe the simplest ways to dispute. Any serious will tell you never to use this method.

Why? Consumers are at a disadvantage every time they do this.

Firstly, the credit bureaus make consumers agree to innocuous-sounding waivers, which in fact make clients give up their rights to re-investigation.

Second, without a proper paper trail, the credit bureaus do not have to fear the threat of lawsuits. So the bureaus can take online and phone disputes less seriously.

This means less thoroughly investigated disputes that lead to items not being deleted from the credit report.So using an actual credit dispute letter and mailing or faxing will serve you much better.

Watch this video to understand your state and federal rights, and how to utilize them to protect yourself and repair your credit:

How Can I Clean Up My Credit Myself

You can repair your credit all by yourself. In order to do this, you need to first know how to read and understand your credit report and dispute any inaccuracies.

You can also consider using top credit repair software to help with improving your credit. Besides that, you need to pay your dues on time and do not ask for credit unless you need it. Make regular bill payments and close outstanding loan accounts.

Don’t Miss: Is 665 A Good Credit Score

Time Frame For Removal Of Credit Entries

|

Currently active accounts in good standing |

Ongoing/indefinite |

|

Hard credit inquiry |

2 years |

Based on the above data, often a consumer may choose to simply wait it out until the negative entry is due for removal from credit bureau reports. Keep in mind that it might take a few months for all the credit bureau reports to be updated after reaching these limits.

Hard Inquiries Sometimes Appear In Error

There are several reasons that inaccurate hard inquiries might appear. All of them impact whether you receive credit and loans, and the interest rates that you receive for these loans. One cause of error is identity theft. When you receive a fraud alert, itâs sometimes because someone is using your personal information that they gained through identity theft to apply for credit or a loan in your name.

A hard credit inquiry carried out through identity theft will hurt your credit score, so the inquiry itself is worth disputing. If the fraud threatens immediate harm, you can put a on your record, to prevent anyone from accessing it until the issue is resolved.

Hard inquiries are supposed to last for only two years on a credit report. If one is older than two years, itâs in error. The mistake still hurts your credit score, so you should contest it. Additionally, a hard inquiry from a single application could mistakenly appear on your credit report multiple times. This is an innocent slip up, but you should still dispute it.

Sometimes retailers or lenders run unauthorized hard inquiries, where they look up a credit report by mistake and/or without permission. This can also happen if a merchant sends out multiple inquiries to try to get you the best financing for a loan. In situations like this, as long as the inquiries are all within 14 days of each other, they will only count as one inquiry against your credit score.

You May Like: Is It Bad To Check Your Credit Score

How To Write A Goodwill Letter To Creditors

When you sit down to write a letter to creditors to remove negative marks, itâs important to think about the person that will be reading your letter.

Would you want to be yelled at or accused of wrecking a personâs credit?

Rather than writing in an upset tone, do your best to write your goodwill forgiveness letter in a kind and respectful tone that would make a creditor want to forgive your past credit mistake.

When you write your letter, make sure you explain why they should remove your late payment from your credit reports.

If you simply made a mistake, such as falling behind on a student debt bill, let the creditor know.

Everyone makes an occasional mistake and the person reading your letter may sympathize with you.

Whatever you write, donât make excuses. Own up to the mistake. Show responsibility for your actions, but blatantly and directly ask the creditor to remove the late payment from your credit report.

Keep in mind, people reading your goodwill forgiveness removal letter have a job to do.

While you want to get the creditor to sympathize with you and remove the black mark, they donât have time to read long and detailed letters.

For that reason, respect the reader and keep your letter short and sweet.

You donât need to write a multiple page letter to say âSorry, I messed upâ.

Instead, a couple of paragraphs with the following details will probably work best.

The following are important details to include in the goodwill letter:

- The date

Alternative Ways To File A Credit Dispute

In addition to writing a credit dispute letter, there are other ways to file a credit dispute.

You can also file:

- Online: As mentioned, you can file an online dispute with the credit bureaus at the websites linked in the table above. Some creditors and debt collection agencies allow you to file disputes online as well youll have to check their website for more information.

- Over the phone: Similarly, all three credit bureaus allow you to file disputes over the phone. You can find the number to call on your credit report or on the companys website.

How should you file your dispute?

Theres no one right way to file a credit dispute. Filing by phone or online is quicker than via mail, but you can include more detailed information in a letter than you could by checking boxes online. You can also more easily keep a record of your dispute by copying the letter and sending it by registered post.

Don’t Miss: Does Credit Score Affect Car Insurance

If Warranted File A Dispute With The Corresponding Credit Bureau

If you dispute errors in your credit reports, including unauthorized hard inquiries, the credit bureaus are required to investigate. Theyre also required to correct information thats found to be inaccurate.

You can file a dispute with any of the three major consumer credit bureaus Equifax, Experian and TransUnion that has an inaccurate hard inquiry recorded for you on its corresponding credit report. Credit Karma members can dispute errors on their TransUnion® report through the tool.

You may be able to dispute inquiries online, but consider mailing your dispute. Look for sample credit dispute letters online, like the one available from the Federal Trade Commission, to help you draft your dispute letter.

If the credit bureau in question investigates and finds that the inquiry wasnt authorized, it should remove the inquiry from your corresponding credit report.

What Are Hard Inquiries And Soft Inquiries

Hard inquiries show up on your credit report. Soft inquiries do not. Applications usually count as hard inquiries. Offers usually count as soft inquiries.

A hard inquiry is often the result of an application for credit, like a home mortgage or an auto loan. Youve probably applied for either of those at some point in your life.

You can probably recall the volume of paperwork as something resembling a college textbook. When filling out these applications, the lender is required to provide you with a disclaimer. They are going to run a check on your credit and that it may appear on your credit report.

Its important to note that not EVERY hard inquiry will appear on your credit report. For instance, if you are shopping around for auto loans, the credit bureaus will typically be able to deduce that you are in the market for a loan.

They will know you are searching for approvals and/or comparing rates. According to TransUnion, if you have multiple inquires in a span of around 45 days, they will only count them as one hard inquiry.

Soft inquiries are the reason you may be getting a lot of unsolicited credit card offers in the mail. Lenders will scour millions of credit reports in order to determine who to send offers to. That kind of activity wont appear on your credit report, since you had nothing to do with it.

Don’t Miss: Does A Soft Pull Affect Credit Score