How Loan Applications Impact Your Credit

When you apply for a personal loan, lenders will assess your credit score and history to determine your credit risk or creditworthiness. To do this, lenders run a hard credit check. When they run this check, theyre looking for indicators of financial health, like low credit balances and a good debt-to-income ratio.

A hard credit check will temporarily lower your credit score by five points or less. Your score will likely drop less than that if you have excellent credit. Your credit score will typically recover within a few months, but the hard credit check will stay on your credit report for two years.

Since applying for a personal loan requires a hard credit check, it is a good idea to be as prepared as possible. You are required to submit additional documents when you apply for a personal loan. These typically include proof of identity, employer and income verification and proof of address.

You Repay Your Personal Loan Regularly

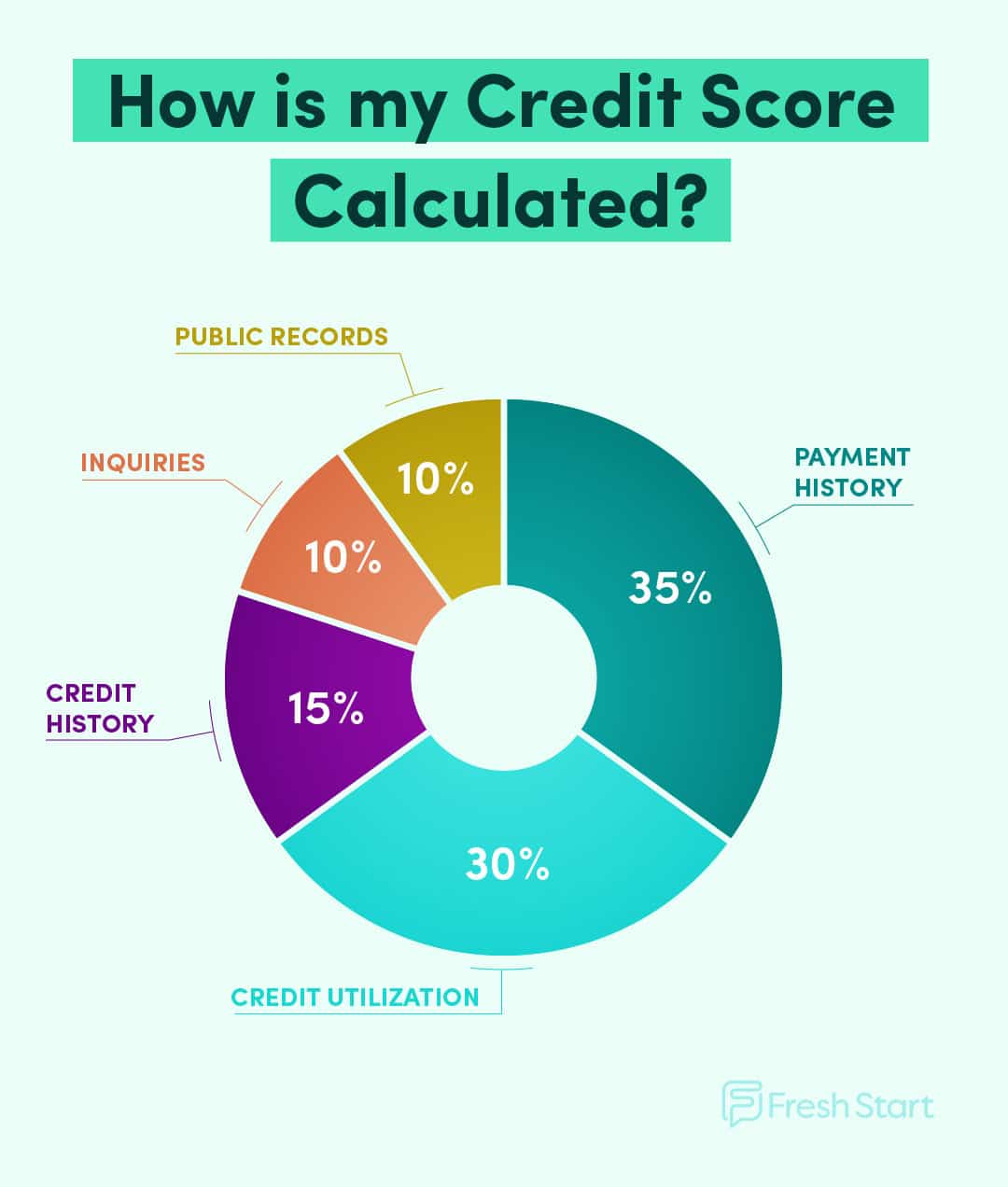

Both VantageScore and FICO, which are the different credit scoring methods available, consider your payment, as the most critical factor when calculating your credit score. Your ability to repay your loan makes up 35% of your total credit score. Having a consistent record for on-time debt payments helps build your credit score in the long-term.

Most online lenders report their borrowers repayment activity to at least one or all the three national credit bureaus. These bureaus are TransUnion, Equifax, and Experian. Working with an online lender that reports your repayment progress to one or all three bureaus means that you have to be consistent with your payments, as this will help build your credit score and reports.

How Much Can A Personal Loan Affect Your Credit Score

A hard inquiry by itself can hurt your credit score by up to 10 points, even if youre not approved for the loan in the end. If you miss a payment on your loan, even just once, your score could drop by up to 80 points.

Even after you’ve paid off your personal loan, the account will stay on your credit report for years after it closes. This can be good news if you managed the account well and always kept up with payments.

Debt accounts that were in good standing when they were paid off can stay on your credit report for up to 10 years after the accounts were closed, giving you a positive credit boost as long as they stay there.

Charged-off or delinquent debt meaning accounts you were late on or accounts that got sent to collections can only stay on your credit report for 7 years after the account was first reported as delinquent. However, the negative effects of the late or missed payments will likely begin to fade as time goes on, even before the account gets removed from your credit report.

Read Also: How To Cancel Experian Credit Report

Checking Your Report Hurts Your Credit Score

Regularly checking your credit report can be an excellent way to keep tabs on your credit profile. Checking your own report doesnt affect your score.

When you are pre-approved for a loan or mortgage, it is traditionally considered a soft pull since you havent applied for credit yet. Soft pulls do not impact your score.

On the other hand, when you take the next step and submit a formal credit application, the lender will make a hard pull to check your credit report, which may cause your credit score to drop a few points. The same is true when applying for a credit card or other credit applications.

Be careful about the number of credit cards or loans you apply for, especially if you plan on buying a home or car shortly. Multiple applications for credit and multiple hard pulls can lower your score and raise red flags for lenders.

What Is A Personal Loan

Personal loans are consumer loans that are taken out without a specific purpose. Unlike a mortgage or auto loan, personal loans can be used for most things, from paying off medical debt to renovating your bathroom and everything in between.

Secured loans, such as mortgages and auto loans, require some form of collateral to acquire. This means that their interest rates are typically very low. Personal loans are sometimes unsecured, meaning they dont require any kind of collateral, but that does mean that their interest rates can be higher.

That said, these kinds of loans still offer lower interest rates than many credit cards. For this reason, personal loans are often used for debt consolidation.

Personal loans can be acquired from a variety of lenders, most commonly banks and credit unions. Your credit score will determine your particular interest rate and how much you qualify to borrow.

Don’t Miss: How To Find Out Your Credit Score

Should You Use A Personal Loan To Pay Down Credit Card Debt

There are benefits to paying off credit card debt with a personal loan if the situation is right for you. In addition to a higher credit score, a personal loan can help streamline your finances. The right loan can allow you to consolidate multiple loans into one payment, shortening your to-do list and simplifying your life.

The biggest motive, however, should be to eliminate debt so you want to make sure you can pay off the loan timely.

Eliminating that debt can be nothing short of life-changing, Schulz says. It can free you up to build an emergency fund, save more for retirement, work toward buying a home or paying for your kids college. Its a big, big deal.

Is A Personal Loan Right For You

Thats a question that only you can answer, but hopefully the information here can help. Taking out a personal loan can affect your credit score in both positive and negative ways, and its important to recognize those pros and cons before borrowing funds.

One of the best ways to decide if a personal loan is right for you is to create a detailed monthly budget that outlines all of your expenses and existing debts. Whether youre planning to use the personal loan for debt consolidation or another expense, be sure the new monthly payment will work within your budget. After all, your ability to make on-time monthly payments will play a critical role when it comes to your credit score.

You May Like: How To Dispute An Error On Your Credit Report

What Is A Personal Loan And What Are Its Uses

A personal loan is a type of financing you can get from a bank, credit union, or online lender. They can be used for just about anything, including paying for:

- Large purchases

- School-related expenses

- Debt consolidation

These loans are a type of installment loan, meaning you make monthly payments to pay them off over time. They are typically unsecured, meaning you dont have to provide collateral, and have fixed interest rates. This makes your monthly payment the same, and its easier to work into your budget and calculate when the loan will be repaid. Their interest rates can also be lower than other alternatives, like credit cards, though that can depend on your credit score, history, income, and other factors.

Related:Everything You Need to Know About Personal Loans

How Does A Personal Loan Affect Your Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Theres no mystery to it: A personal loan affects your credit score much like any other form of credit. Make on-time payments and build your credit. Any late payments can significantly damage your score if theyre reported to the credit bureaus.

A personal loan can affect your credit score when:

-

You shop for a personal loan.

-

You apply for a personal loan.

-

You regularly repay your personal loan.

-

You miss a personal loan repayment.

-

You consolidate your debt.

Recommended Reading: How To Keep A Good Credit Score

What Factors Affect My Credit Scores

There are many different credit scores, and the factors that affect your scores can vary depending on which scoring method is used. Here are a few common factors.

- Payment history: FICO and VantageScore both look at your payment history to see if you have a track record of paying bills on time. Making full, on-time payments helps your scores.

- How much also affects scores in both models, and using close to the maximum amount available to you may lower your scores. Paying down credit card debt so that you dont owe more than 30% of your credit limit may help.

- Account length and mix: Having established credit history and using a mix of different types of credit like installment loans and credit cards can have a positive effect on your scores. On the other hand, if youve opened many new accounts recently, your scores may go down.

If your credit scores are low, you may want to work on improving your credit before applying for a loan.

Try not to fall behind on paying bills. If youre struggling to come up with the money to pay a bill on time, ask for a payment plan so your account doesnt go to collections.

Check that the info on your credit reports is correct. Request a copy of each of your credit reports and contact the credit bureaus if you find any mistakes.

You Consolidate Your Debt

Consolidating your debt into a consumer loan can help improve your credit score, as it lowers your credit utilization. This means a personal loan affects your credit score in a positive manner. To determine your credit utilization, lenders simply calculate how much available credit you utilize. Personal loans help add installment credit to your reports, and this further helps to improve your credit score

Also Check: How To Get My Experian Credit Score

How Personal Loans Affect Your Credit Score

Applying for and taking out a personal loan can both decrease or improve your credit score, depending on how well you manage the loan. Its inevitable that the hard credit inquiry when you apply will lower your score by a few points for a short period of time and will remain on your credit history for two years. However, if you make your payments on time each month and pay off the loan over time, you may see your score improve.

On the other hand, if you make late payments or miss payments, your score will be negatively affected. If you default on the loan and its sent to collections, or you have to file for bankruptcy, your score will be seriously impacted and may drop by dozens or even hundreds of points. Thats why its important to only take out a loan if you know you can afford it, and only borrow what you need.

Myths About Credit Scores That Could Hurt Your Chances At A Loan

Your credit score and credit report are among the most significant factors lenders look at when you apply for a loan or mortgage. If you have struggled with your finances in the past, learning about your credit score can be intimidating. But understanding your score and what goes into it is crucial to landing the loan you need.

There are many myths surrounding your credit score and what does or does not affect it. Lets look at some of the most common myths and the truth behind them.

Recommended Reading: Does Progressive Leasing Report To Credit

Personal Loans And Your Credit Score

Your credit score might fluctuate throughout your personal loan experience. It may rise and fall a few different times, including when you:

- Take on personal loan debt

- Repay personal loan debt

Most personal loans are unsecured, which means lenders use your credit score to determine how responsible you are with credit. But after youre approved for a loan, your credit score may go up or downand sometimes both.

Impact Of Personal Loan On Other Credit Score Factors

Using a personal loan is considered to be a better option than using your credit cards as far as the credit rating is concerned. This is because taking personal loans online or offline helps in reducing the ratio of credit utilisation which is the second most important factor for credit bureaus.

The other factors such as credit history length and credit mix are also positively affected through personal loans in most cases. In short, taking a personal loan can actually help you improve 90% of the factors used by credit bureaus for calculating your credit score.

Recommended Reading: Does Applying For Paypal Credit Affect Score

Compare Rates From Top Lenders

The process couldnt have been any easier. I filled out a short form that took me less than 2 minutes and within seconds I got multiple offers from lenders.

– Mike T.

It was important to me that I could review my offers without any impact to my credit score, before deciding on the best loan option.

– Carol R

I like the easy online and 100% paperless experience of Acorn Finance. I received my money two days after completing my application.

Rick Bormin Personal Loans Moderator

@rhandoo202008/12/21 This answer was first published on 08/12/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Yes, a Discover personal loan does affect your credit score, both when you apply and during the entire time that you are paying the loan off. Initially, a Discover personal loan will affect your credit score in a negative way, but the long-term impact can be very positive, assuming you repay the loan on schedule.

Recommended Reading: How Much Credit Score Is Needed To Buy A House

Does Getting A Personal Loan Affect Your Credit Score

A personal loan is a double-edged sword for your credit score. On one hand, paying off a personal loan and making on-time loan payments can increase your score. On the other hand, missing payments or defaulting can damage your credit.

For example, lets say you have three separate balances for private student loan debt with high interest rates. Youre several years out of college and have developed a solid credit score, so you take out a loan for debt consolidation purposes. As a result, you roll your debts into one new loan with a better interest rate.

Two possibilities emerge from this point: if you make your payments each month, you continue to raise your credit score and eventually pay off the debt. Conversely, if you miss payments, your credit will take a hit. Additionally, if you become unable to pay at all and default on the loan, your credit will take a major dive, leaving you with unaddressed debt and less ability to acquire another loan.

Our Standards For Debt

Once youve calculated your DTI ratio, youll want to understand how lenders review it when they’re considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This may put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Don’t Miss: What If My Credit Score Drops Before Closing

Best Networks For Credit Card Debt Consolidation Loans

The following five loan networks can help you arrange a personal loan of up to $10,000 or more. They arent direct lenders but rather online services that prequalify borrowers and match them to one or more loan providers. These loan finders charge you nothing for their service, and youre under no obligation to accept any loan offers that come your way.

SmartAdvances.com is an intelligent alternative that can rapidly hook you up with one or more direct lenders. You must collect at least $1,000 a month to prequalify for a personal loan.

You can use the websites personal loan calculator to determine the best repayment schedule. As a member of the Online Lenders Alliance , SmartAdvances.com is committed to a fair credit policy that complies with federal law.

Working Of Credit Score

Credit bureaus like CIBIL are responsible for maintaining the credit score of borrowers and users in India. The score ranges between 300 and 900 and anything above 750 is generally preferred by the banks. You can do a by visiting the official website of these bureaus.

The bureaus use their proprietary algorithms for calculating the of individuals based on these factors.

Recommended Reading: Will Bankruptcy Show On My Credit Report

Will A Personal Loan To Pay Off Credit Cards Help My Credit Score

Getting a debt consolidation loan with a low interest rate can help you if you direct those funds towards the credit card debt. This can help you pay off your debt and avoid the consequences for missed payments. Plus, if you manage to pay off your credit card debt in time, then you can watch your credit score rise up. A personal loan can be used for debt consolidation.