Financial Information On Your Credit Report

Your credit report may contain the following financial information:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a lien on a car that allows the lender to seize it if you dont make payments

- remarks, including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if you made your payments on time

- if you missed payments

- if your debt has been transferred to a collection agency

- if you went over your credit limit

- personal information thats available in public records, such as a bankruptcy

How Do I Get My Score

You are entitled to one free credit report per year by mail from Equifax and TransUnion. Spacing out your credit report requests allows you to check on your credit every six months or so. If you cant wait for a free report by mail, you can always get an instant credit report online from Equifax or TransUnion for approximately $15.

When you receive your credit report, youll notice that it does not list your three-digit credit score. Despite this, its still a helpful reference because it serves as the basis of your credit score.

If you know how a credit score is calculated, then you know how to look for factors on your credit report that might be influencing your score for better or for worse. Its also an easy way to look at account openings, account closings and what your repayment history looks like.

You can get access to your actual credit score from either Equifax or TransUnion for an additional fee .

Some commercials make it seem like credit scores are big, mysterious, randomly assigned numbers. But with a little research, a little patience and some good habits, you can influence your credit score in a positive way and not be caught off guard by a denied loan or an outrageous interest rate.

How Is Your Credit Score Calculated

Your credit score is calculated using five factors:

Most of the information is automatically removed after 6-7 years so that student loan payment you missed 20 years ago wont be haunting your score today.

1. Whats your payment history?

This is obviously the most important factor affecting your credit score. Prospective creditors want to know that you are going to pay them back. Your payment history covers all of your consumer debt: credit cards, lines of credit, student loans, car loans, cell phone payments on contract, etc.

- Do you pay your bills on time?

- How frequently do you miss a payment?

- How many times have you missed a payment?

- How old are your missed payments?

2. How much do you currently owe?

When creditors look at how much you owe, theyre trying to determine whether or not you are able to take on more debt. Can you manage with more?

Besides looking at the amount of debt that you currently have, lenders will look at whats called debt utilization ratio: thats the amount of credit youre using compared to the amount thats available to you.

For example, if you have a credit card limit of $5,000 and youre constantly hovering at $3,600, then youre using 75% your available credit on an ongoing basis. To a creditor, that indicates that youre struggling to pay off your existing debt.

- How much in total do you currently owe?

- How much are your payments?

- How much of your available credit do you use on an ongoing basis?

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Very Good And Excellent/exceptional: Above Mid

A lender could deny anapplication for another reason, such as having a high debt-to-income ratio, butthose with top credit scores likely wont have their applications deniedbecause of their credit scores.

People in this score range are also most likely to get offered a low interest rate and may have the most options when it comes to choosing repayment periods or other terms.

Should I just apply anyway?

Its best not to because each application can result in a hard inquiry, which could hurt your credit. You can research your likelihood of being approved by checking for a particular card or by getting prequalified for an offer .

Myth : You Should Never Close Your Oldest Credit Card

Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your . Closing your oldest card is bad for two reasons: It can lower your overall credit utilization ratio and shorten the length of your credit history, two major factors in determining your score. But if you have a strong mix of credit products, a big enough credit limit that you won’t go over a 30% CUR and only a few recent inquiries, the dip will likely be only a blip on the radar.

Recommended Reading: Remove Repo From Credit

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

How A Good Credit Score Can Help You

A credit score is a numeric representation, based on the information in your , of how risky you are as a borrower. In other words, it tells lenders how likely you are to pay back the amount you take on as debt.

In general, the higher your scores, the better your chances of getting approved for loans with more-favorable terms, including lower interest rates and fees. And this can mean significant savings over the life of the loan.

Having a good score doesnt necessarily mean youll be approved for credit or get the lowest interest rates though, as lenders consider other factors, too. But understanding your credit scores could help you decide which offers to apply for or how to work on your credit before applying.

Read Also: Do Authorized Users Build Credit Capital One

Save Money On Interest

Interest rates on credit cards and loans are directly related to the credit risk you pose, which is measured by your credit score. Excellent credit allows you to qualify for the lowest interest rates, which can save you thousands of dollars over your lifetime.

For example, if you apply for a $250,000, 30-year fixed mortgage and qualify for a low rate of 2.842%, youd pay a total of $121,818 in interest over the life of the mortgage. On the other hand, if you applied with a credit score of 640 and qualified for an APR of 3.455%, youd pay an additional $51,911 in interest over the life of the loan.

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Read Also: Does Paypal Credit Report To Credit Bureaus

How Do You Check Your Credit Score In Canada

Nearly half of Canadians dont know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.How do you improve your credit score?

When you understand how your credit score is calculated, its easier to see how you can improve it. Thats the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month so youre never running a balance. Making regular payments is one of the best habits to get into because youre always paying down your debt.

2. Close your newer accounts

3. Accept an increase on your credit limit

Just be careful you’re not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Read Also: Syncb Credit Inquiry

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780, also on a 300â850 range.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Also Check: Do Lending Club Loans Go On Your Credit Report

If You Are Approved You’ll Get Less Favorable Loan Terms

If you’re approved for credit, odds are you’ll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit. For example, one of Select’s best credit cards for bad credit, the OpenSky® Secured Visa® Credit Card, has a $35 annual fee though there are no annual fee options.

See our methodology, terms apply.

Your Last Collection Dropped Off Your Credit Report

When calculating credit scores, credit scoring models place people in different buckets, known as scorecards. Your credit profile is compared to other people in your scorecard to come up with your credit score. While you may have been at the top of one scorecard with the collection on your credit report, you may fall to the bottom of a different scorecard if any negative information falls off your credit report.

This type of credit score drop is outside of your control. Fortunately, as long as you keep paying your bills on time and keep your debt low, your credit score will improve.

Read Also: Does Titlemax Report To Credit Agencies

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life

- disability insurance applications.

What Factors Contribute To The Fico Credit Score

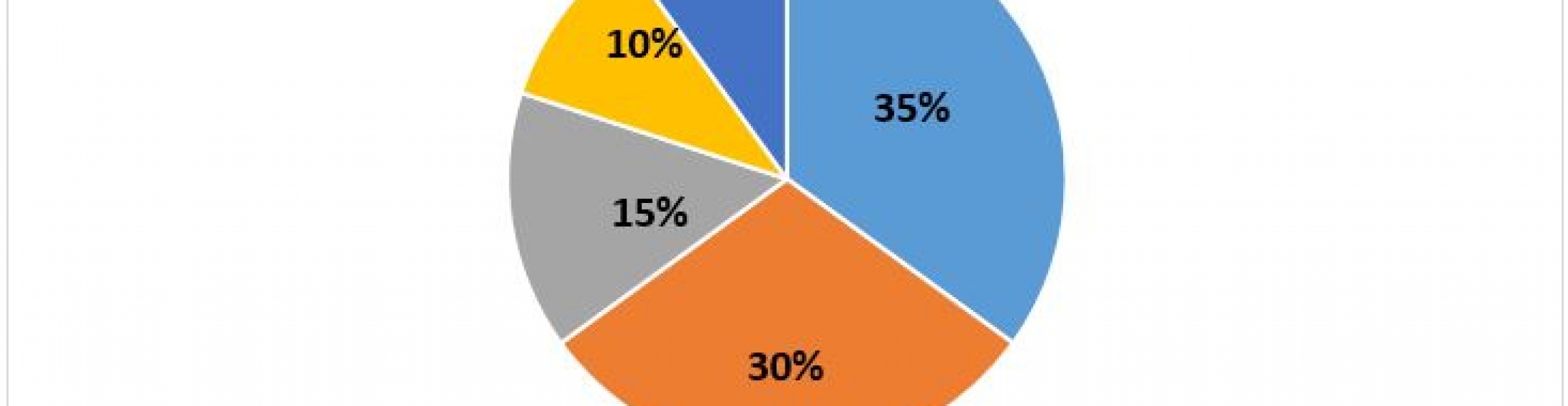

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Also Check: How To Remove Repossession From Credit Report

Your Unpaid Account Was Sent To Collection

To protect your credit score, it’s important for you to pay all of your accounts, not just your credit cards and loans. If you fall behind on the payments on your non-credit accounts , the defaulted balance could be sent to a collection agency and included on your credit report. Once a collection shows up on your credit report, it will almost certainly cause a drop in your credit score.

The Biggest Credit Score Myths

Like any industry, credit and lending is always changing. As the economy fluctuates up and down and federal regulations change to provide new guidelines and protections for consumers, it’s no surprise that credit card issuers change the qualifications for their financial services and products. You’ve probably heard a lot of credit card myths from people who’ve been in the game for a long time. But the truth is you shouldn’t always listen to them.

Below, we outline some of the most persistent credit card myths and explain exactly what’s true for today’s credit card user.

- Myth 1: You should never close your oldest credit card

- Myth 2: You need a perfect credit score

- Myth 3: Carrying a balance helps your credit score

- Myth 4: Checking your credit score will lower it

Recommended Reading: Remove Repossession From Credit Report

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

You May Like: Can Lexington Law Remove Repossessions