Can You Have A Credit Score Without Having A Credit Card

Yes, you can establish credit and have a credit score without a credit card. Credit card companies are not the only ones that report your payment and usage history to the three credit bureaus that report on your credit score, Experian®, TransUnion®, and Equifax®. Other actions, such as making repayments to a federal loan under your name to applying for a phone line can help build your credit score.

Do You Need A Credit Card To Build Credit

Credit cards are excellent credit-building tools, but there are other ways to build credit.

are a great example. Theyre pretty simple you choose a preset amount, you pay off that amount over a set loan term, then you get the money afterward. Credit builder loans are usually accessible to people with poor, limited, or no credit, which is a plus, providing a way to show that you can pay debt responsibly.

Paying other types of loans, including student loans, mortgages, personal loans, and auto loans, will also contribute to your credit scores. Just make sure you stick with a credit builder loan if youre exclusively trying to build credit. Other types of loans should be reserved for large purchases you actually need to make.

If you simply dont want your own credit card, you could always ask someone youre close with to add you as an on his or her account. The activity will be reported in your name, even if you dont use the card.

What did you think of this guide? Was it helpful? Was anything confusing? Let us know!;Use the Ask;button in the top right corner;of any page of the site to give us feedback or ask us any specific questions you have.

Building Credit Without Credit Cards

The need for good credit history is inevitable for most of us. When the time comes to buy a car or a home, rent an apartment, set up new utility accounts, obtain a cell phone, or handle other financial transactions, a healthy is crucial. For many, the first step in establishing a credit history is through the use of credit cards.

Luckily, only a small portion of your is based on having and using revolving credit products . However, consumers who can’tor don’t want toobtain a credit card can build a credit history in other ways.

Recommended Reading: How Are Account Numbers Displayed In A Credit Report

Check With Your Utility Company

The majority of utility providers only report derogatory information to the credit bureaus, but if you live in Detroit and you pay your bills on time, youre in luck. DTE Energy reports all payment histories, both positive and negative. Customers who pay their bills on time benefit from responsible management of this household expense.

Not in Detroit? Contact your utility provider to find out if it reports to the credit bureaus, and if so, put the bill in your name. If not, you can still use the positive payment history to your advantage. Most utility providers are happy to provide a letter of reference for an account holder in good standing.

Dont Apply For Too Many Credit Cards

Each credit application you make is added to your file and lowers your score. Why? Because too-frequent applications can be a sign of financial desperation.

Unfortunately, the ease of online applications â and the fact some customers enter âtrialâ submissions â means many have a lot on their file.

So do your research online, but talk to lenders rather than formally applying .

Recommended Reading: Does Applying For A Loan Hurt Your Credit Score

Tips To Improve Your Credit Score

How To Use A Credit Card To Build Credit

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Recommended Reading: Does Collections Affect Credit Score

Blue From American Express

Borrowers with a poor or fair score may qualify for a Blue from American Express card. There’s no annual fee, and you can earn 1 Amex Membership Rewards point per dollar spent. You can use these points to pay for things like travel, hotels, and gift cards. The main downside is that the interest rate is pretty high it’s a 24.99% variable rate. If you struggle to keep your balance low, this high rate could quickly rack up the amount you owe.;

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Read Also: Does Cancelling Finance Affect Credit Rating

How Long It Takes

Rapid means different things to different people. Rescoring providers typically promise one- to five-day turnarounds. Realistically, expect the process to take a weeka reputable lender can provide more detailed guidance. In some cases, it’ll take even longer before everything gets submitted and updated. It takes time to gather information, send payments, and mail documentation.

Applying For A Small Installment Loan

The first tactic you can use to build a cardless credit score is to apply for an installment loan through your bank, , or other nontraditional lender. If approved, youll be given a certain amount of loan money, which youll need to pay back by a specific date. The loan will be installment-based, meaning its divided into equal payments, making it easier to afford. Youll then pay back the loan over an agreed upon time frame, usually a couple of years, depending on its size. Once its paid in full, the payment schedule ends and youre free to walk away or apply for another loan.

Read Also: Does Credit Check Affect Credit Score

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When;you;check your own file, it;does;appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this; so it doesn’t play any role in any assessment of you.

Don’t Rush To Close Old Accounts

The age of your oldest account, the age of your newest account and the average age of all your accounts make up 15 percent of your credit rating. As long as you’re not paying annual fees on an open account, it can be worthwhile to let it collect dust. The longer you’ve had credit, the better your score.

You May Like: What Credit Score For Care Credit

Disputing Errors In Your Credit Report

This option only applies to those who already have an established credit report, but it is technically a way of increasing your credit score without actually using a credit card. As we said, a credit report is a record of all your credit accounts and credit transactions. Every transaction that you make, good or bad, gets recorded and remains in your report for a specified number of years, affecting your credit score in various ways. Thats why its good to review your credit report for errors at least once per year.

Want to know how long credit information stays on your credit report? Find out here.

Credit report errors caused by wrong or misspelled personal information, fraud or identity theft, can seriously damage your credit score, especially if they go unnoticed and uncorrected for months, even years on end. So, if you do review your credit report and discover an error of any kind, you can contact both credit bureaus and dispute it.

to learn how to dispute an item in your credit report.

Deserve Edu Mastercard For Students

TheDeserve® EDU Mastercard for Students is an excellent option for students who cant qualify for a credit card because they lack a U.S. credit history.

International students may also qualify without a Social Security number. Deserve uses its own underwriting model to determine creditworthiness for the card, evaluating things like financial documents, contact information, income and U.S. bank account balances to determine your ability to pay.

The Deserve® EDU Mastercard for Students;earns an unlimited 1% cash back on all purchases, a statement credit for a 12-month Amazon Prime Student subscription and a $30 statement credit every time you refer a friend who qualifies for the card. The card also reports to all three credit bureaus. The annual fee is $0.

As a Mastercard, it also makes an ideal travel companion, with broad international acceptance. There are no foreign transaction fees.

»;MORE: Review of the;Deserve® EDU Mastercard for Students

Don’t Miss: Is Using Your Overdraft Bad For Credit Rating

Ways To Build Credit Fast

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you’d like, there may be quick ways to bring it up. Depending on what’s holding it down, you may be able to tack on as many as 100 points relatively quickly.

Scores in the “fair” and “bad” areas of the ;could see dramatic results leading to more access to loans or credit cards, and at better terms.

Can You Improve Your Credit By 100 Points

If youre struggling with a low score, youre better positioned to quickly make gains than someone with a strong credit history.

Is a 100-point increase realistic? Rod Griffin, director of public education for credit bureau Experian, says yes. The lower a persons score, the more likely they are to achieve a 100-point increase, he says. Thats simply because there is much more upside, and small changes can result in greater score increases.

And if youre starting from a higher score, you likely dont need a full 100 points to make a big difference in the credit products you can get. Simply continuing to polish your credit can make life easier, giving you a better chance of qualifying for the best terms on loans or credit cards.

Here are some strategies to quickly improve or rebuild your profile:

Read Also: How To Remove Chapter 7 From Credit Report

Periodically Use Dormant Credit Cards

As your credit history grows, you likely qualify for credit cards with better rewards and interest rates. Instead of closing your first credit card, make occasional purchases to keep it active.

When you keep the card active, banks are less likely to reduce your credit limit or close the card. The credit bureaus look at each revolving credit account’s credit utilization ratio as well as your overall credit utilization ratio.

A credit line decrease impacts your total credit utilization ratio.

Closing an old credit card account can also hurt your score. If your old card charges an annual fee, see if you can downgrade it to one without an annual fee. You maintain your account history and that continues to strengthen your credit.

Fix Credit Report Errors

Sometimes, banks make reporting errors that hurt your credit score. Even if you havent missed a payment, many consumers overlook the benefits of a periodic credit report review.

Reviewing your credit report is free and only takes a few minutes. You can request free credit reports from Equifax TRU weekly through April 2021.

If you find an error, you will need to file a dispute with the credit bureau. No error is too small to dispute. Ive disputed incorrect phone numbers, which are correctly in minutes, which led me to discover unauthorized accounts .

If the error affected your score, you should see a pretty quick change once the credit bureau corrects the error.

Read Also: Do Medical Bills Show Up On Credit Report

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Choosing Your First Credit Card

If you dont already have a credit card, you may not have any credit history established yet. Checking your credit reports and scores in the previous step should give you a decent idea of where you currently stand credit-wise.

This section is about understanding your options for getting a first card. So this step doesnt have any direct impact on your credit until you decide to actually apply for a card in the next step.

The right first card for you should fit into your purchasing;habits and lifestyle. You shouldnt need to go out of your way to use it. If you already use a debit card;to buy things, you could start by making those purchases;on;a credit card instead.

In general, the better your credit is, the more options you will have when choosing a card. This means as you build your credit you could be able to qualify for cards that earn more rewards and provide more benefits . As you understand credit cards more, you can develop a strategy with several types of credit cards to maximize your benefits and rewards.

Most major financial institutions report credit card account activity to all three major credit bureaus, which is helpful when youre trying to build credit history. Banks are not required to report to the credit bureaus. Credit reporting is actually voluntary, but most card issuers do report.

Lets take a look at some of your options for your first credit card:

Apply for a Specific Card

Check for Pre-Qualified Offers

Become an Authorized User

Store Credit Cards

Recommended Reading: How Bad Is A Judgement On Your Credit Report

Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.

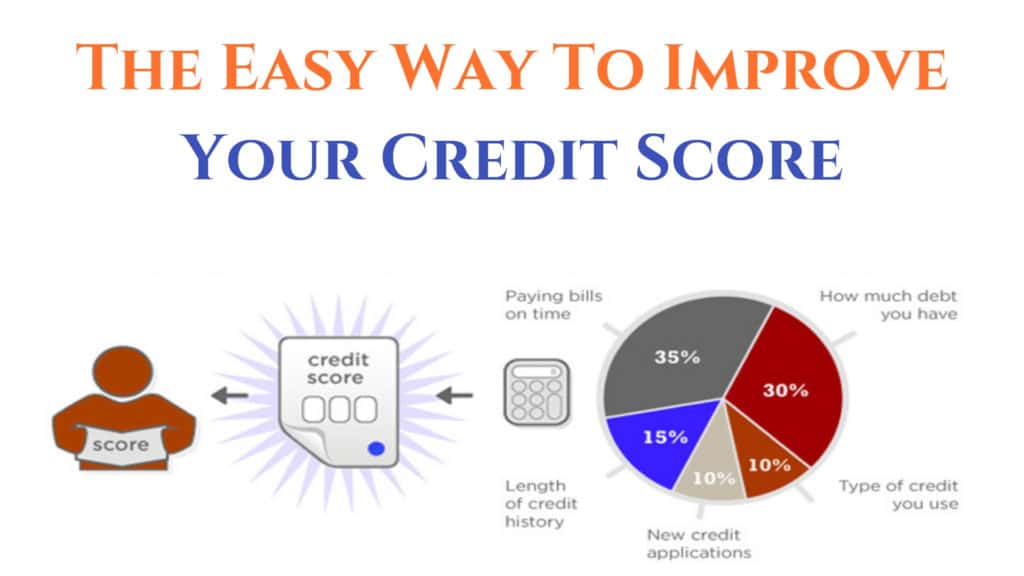

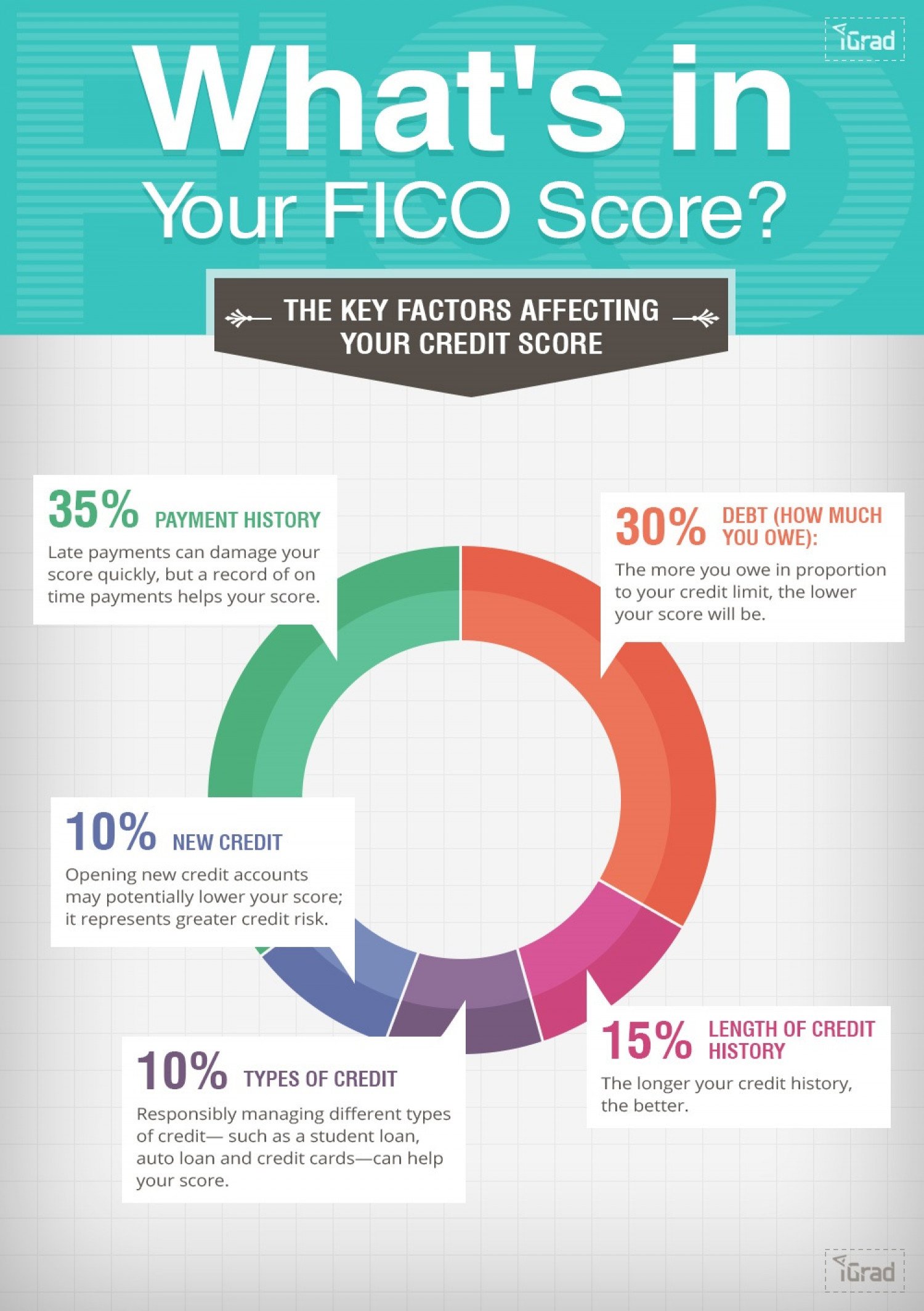

How Is Your Credit Score Calculated

A variety of factors are taken into consideration when calculating your credit score. The most popular criteria as utilized by FICO are:

A. Payment history: This makes up 35% of your credit score and is the most important factor influencing your score.

B. The amount owed: This makes up about 30% of your credit score.

C. Length of credit history: The longer this is, the better. It makes up about 15% of your credit score.

D. New credit history: The recent activity on your credit histories, such as new accounts and inquiries account for approximately 10% of your credit score.

E. Types of Credit: The different types of credit accounts you have make up the remaining 10% of your credit score.

Recommended Reading: Does Having More Credit Cards Help Your Credit Score