How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Get Money From The Retirement Account

This is a bit risky, but this is an excellent option if you are a loyal company employee with a good employment history. Withdraw funds from your retirement account, pay a sizeable down payment, or show your lender that you have lots of savings. Thatll remove the issue of bad credit, and your lender will offer you a mortgage. However, this option comes with some risks.

If you are 59-1/2 years old when taking such funds, youll have to pay a ten percent penalty on the withdrawal. You also have to pay taxes on this. If you get fired from your job before your time is up, you have 60 days to pay back this amount.

How Does Your Credit Score Affect Buying A Home

Your credit score affects your ability to buy a home as a major factor in whether youre approved for a mortgage. Thats because your credit score is a reflection of how likely you may be to default on your loan.

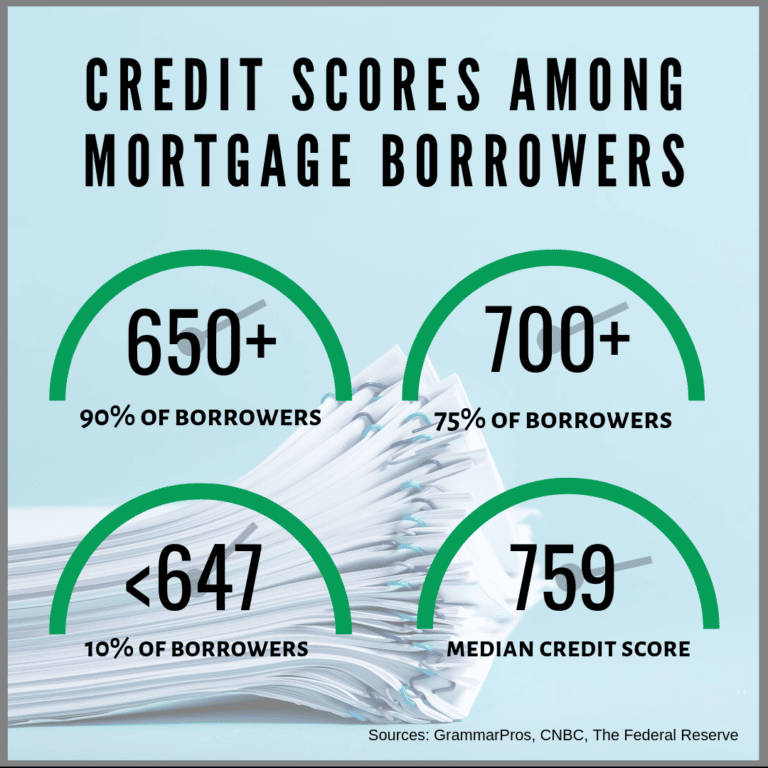

Weighing all the items on your credit reports, such as payment history and amounts owed, a complex calculation then creates your FICO score. FICO scores are the credit scores that 90% of lenders use. They give mortgage lenders a better idea of how you handle your finances.

Even after youre approved for a loan, your FICO score also affects the interest rate on your mortgage. Why is that a big deal? Well, depending on how expensive your loan is, youll likely end up paying tens of thousands of dollars in interest. Thats on top of your principal loan amount.

An interest rate of even just ¼ percent less can save you a lot of money over the course of a 30-year loan. So, its clear that your credit history is an important factor not just for getting approved, but also for getting the best interest rates to lower your monthly payments.

Don’t Miss: How To Remove Prescribed Debt From Credit Report

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is it spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collections?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable with you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

Also Check: When Does Bankruptcy Clear From Credit Report Canada

Getting Approved For A Mortgage Loan With A Low Credit Score

If you have a less-than-satisfactory credit score, you can improve your chances of approval by:

- Applying for an FHA loan

- Saving up enough money for a formidable down payment

- Keeping a large amount in your savings account

- Asking someone with a high credit score to apply as a cosignerReducing current debt to improve the debt-to-income ratio

- Shopping around for different lenders

If you want to take some time to repair your credit score, thats also a great personal finance strategy. You can consider renting while beefing up your credit score by:

- Paying all your bills on time to build a consistent payment history

- Keeping credit card balances low

- Checking credit reports to track the progress and discover errors

- Closing any unused credit cards

- Registering to vote

- Breaking the financial connection with an ex-partner with a low credit score

When asking, What is a good credit score to buy a house? you need to remember that it depends on many factors, including your efforts to improve your score.

Pro Tip:

If you purchased a house previously with a low credit rating and a high mortgage rate, you can refinance your mortgage once you have excellent credit to access lower interest rates.

The Basics What Is A Credit Score

Your credit score isnt just for getting a mortgage. It paints an overall financial picture. The term credit score most commonly refers to a FICO score, a number between 300 and 850 that represents a persons creditworthiness the likelihood that, if given a loan, she will be able to pay it off. A higher number corresponds to higher creditworthiness, so a person with a FICO score of 850 is almost guaranteed to pay her debts, whereas a person with a 300 is considered highly likely to miss payments.

The formula for calculating a FICO score was developed by Fair, Isaac and Company , and while the specifics remain a secret so that no one can game the system, FICO has made the components of the score public. The formula takes into account the following factors, in descending order of importance:

Also Check: How Long Is Credit Report Good For Mortgage

How Much Of A Home Loan Can I Get With A 720 Credit Score

With fixed-rate conventional loans: If you have a credit score of 720 or higher and a down payment of 25% or more, you don’t need any cash reserves and your DTI ratio can be as high as 45% but if your credit score is 620 to 639 and you have a down payment of 5% to 25%, you would need to have at least two months of …

Is 650 Good Enough To Buy A House

Any score between 700 and 749 is typically deemed “good,” while scores from 650 to 700 are “fair.” Excellent scores are usually those over 750. While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates and loan options.

Recommended Reading: What Credit Score For American Express

What Is A Good Credit Score For Buying A House

So far we’ve only discussed the minimum credit score that a mortgage lender will consider. But what type of credit score could qualify you for the best rates? FICO breaks its credit scores into five ranges:

|

FICO Credit Score Ranges |

| 800 and above | Exceptional |

Aiming to get your credit score in the “Good” range would be a great start towards qualifying for a mortgage. But if you’re wanting to qualify for the lowest rates, try to get your score within the “Very Good” range .

It’s important to point out that your credit score isn’t the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause the loan to fall through.

What Is A Good Credit Score To Buy A House

When you are looking to buy a house, your is one of the most important factors that lenders will consider. A good credit score can help you get a lower interest rate on your mortgage, which can save you thousands of dollars over the life of your loan. In this blog post, we will discuss what is considered a good credit score for buying a house and provide some tips on how to improve your credit score if it is not where you want it to be.

Recommended Reading: What Will My Credit Score Be After Bankruptcy

The Answer Depends On The Lender And Which Loan Type You Apply For

Your credit scores can be an important factor in the homebuying process. Thatâs because the lender will typically check your credit scores when you apply for a mortgage. A good credit score generally makes you an attractive borrower because it shows youâve managed your credit well. And the better your credit scores, the better chance you may have of being approved for a mortgageâand a lower interest rate.

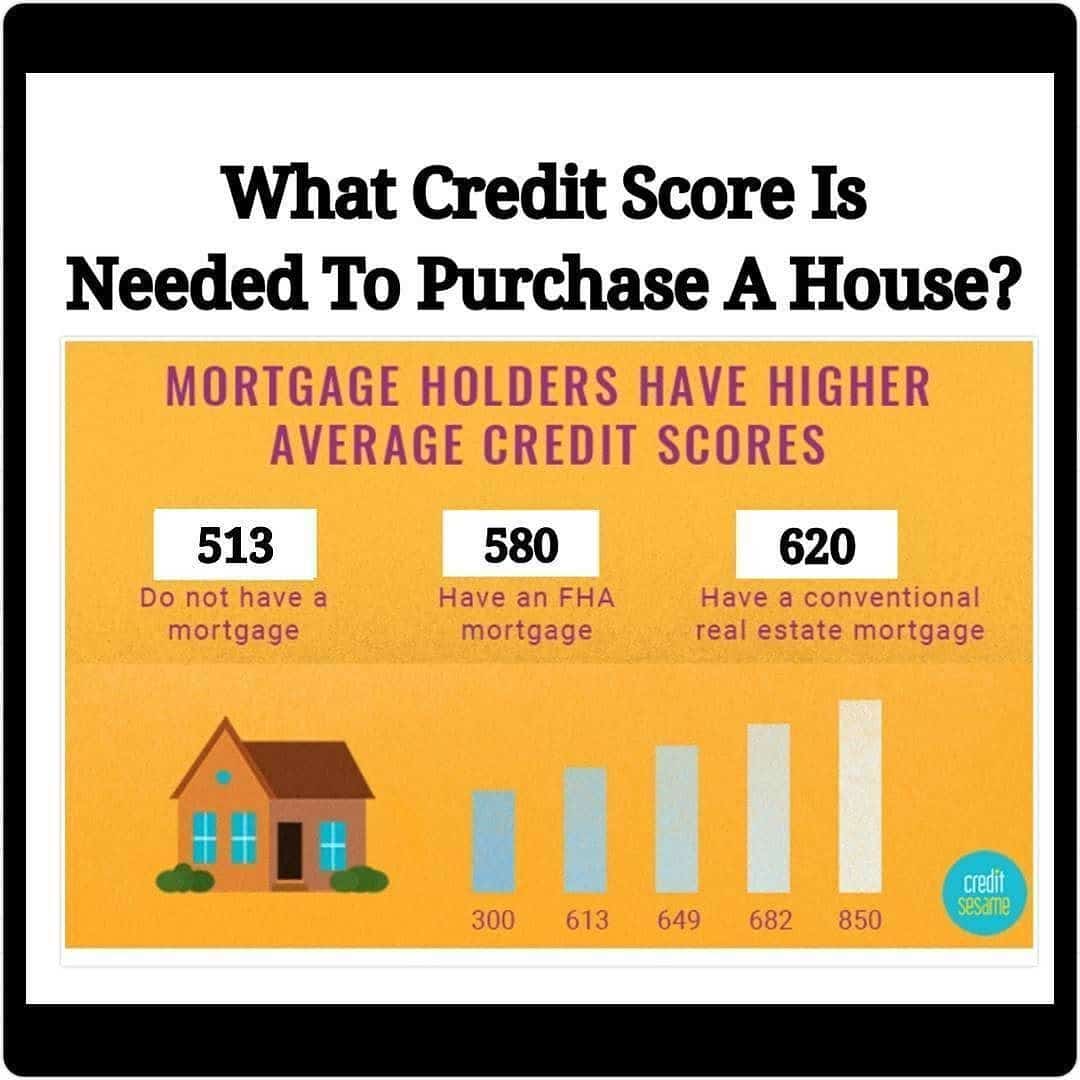

The minimum credit score needed to buy a house depends on the mortgage program and the lender. According to mortgage company Fannie Mae, a conventional loan usually requires a credit score of at least 620. But you may qualify for a government-sponsored loan with a lower score. Read on to learn more about credit scores and how they impact the homebuying process.

More Options For First

You can also explore newer mortgage programs available for homebuyers with low to moderate-income. The Freddie Mac Home Possible mortgage, for example, allows you to purchase a home with a down payment of just 3%. Fannie Mae also offers a 3% down payment option with the HomeReady loan, as long as you have a credit score of at least 620.

Read Also: How To See My Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Is 800 A Good Credit Score To Buy A House

While having a credit score of 800 seems lofty, even scores in the 700’s can help home buyers get lower mortgage rates. Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan.

Don’t Miss: Does Car Insurance Check Credit Report

What Is The Single Biggest Factor Affecting Credit Score

The single biggest factor affecting your credit score is your payment history. If you have a history of late payments, it will have a negative impact on your credit score. Other factors that can affect your credit score include your credit utilization, credit history, and the type of credit accounts that you have.

Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Read Also: Who Can Pull My Credit Report

How To Improve Your Credit Score To Buy A House

If your credit score is on the lower end of the spectrum, its smart to take steps to improve it before applying for a loan. This will unlock better interest rates and keep your costs as low as possible.

Lowering your credit utilization while increasing debt payments will help boost your score. Avoid applying for any new credit cards if you can, but dont close old accounts.

Here are three more tips to fix your credit enough to buy a home.

How long it takes to fix your credit enough for approval varies. It could take two months or two years. Once your score meets your goal, contact mortgage lenders in your area to see which loan options and interest rates you can get.

Next, youll get to search for a house and figure out how to handle the down payment. In some cases, you can buy a house with no money down. Down payment assistance is also available.

Mortgage And Credit Score Statistics

- 786 is the median credit score in the U.S. for those taking out a mortgage, according to Q2 2021 Federal Reserve Bank of New York data.

- Minnesota, New Hampshire and Vermont are home to those with the highest average credit scores in the country, while Mississippi, Louisiana and Alabama are home to those with the lowest, VantageScore reports.

- The average mortgage debt is $229,242, according to 2021 data from Experian. Generation X borrowers have the highest average mortgage debt, at $259,100.

You May Like: How To Get Your Credit Score To 800

Other Factors That Mortgage Lenders Consider

Anyone who has applied for a mortgage since the 2008 housing crash will tell you that the modern mortgage lender wants to know everything about a borrower short of the number of hairs on their head before giving them a loan.

Not only will they pull your credit report and examine your credit history, but theyll also thoroughly examine every aspect of your finances.

Unfortunately, that means bad credit isnt their only excuse to stick you with a higher interest rate. But on the bright side, it also means that you may get away with an average credit score if your other financial metrics are positive.

Lets take a look at the three most important factors that lenders consider in addition to your credit score.

What Do Mortgage Lenders Look For On Your Credit Report

Because mortgages require borrowing so much money, lenders want to be sure they can really trust you to pay it back. If youve had bills go to collections or youve filed for bankruptcy, these could be red flags. Lenders also look for derogatory items and delinquent accounts.

Your FICO score is based on information in your credit reports. This three-digit number provides lenders a snapshot of your financial habits. The more missed or late payments on your credit reports, the more likely it is that your FICO Score will be low, according to Rocket Mortgage.

Your credit report is a financial report card. Your credit score is the grade. It goes up or down based on how well youve paid back money youve borrowed in the past with credit cards, car loans and student loans, for example.

Your credit report is a financial report card. Your credit score is the grade.

These are the most critical factors in your credit score:

- Timeliness of payments

- New credit accounts

- Types of credit used

If you have a very low score, you might have a better chance of qualifying if youre able to offer a higher down payment . You can get advice from a housing counselor through the Department of Housing and Urban Development.

Read Also: Will Credit Karma Lower My Score

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.