Paypal Credit Terms & Conditions

PayPal Credit requires monthly payments on your balance. You can make the minimum payment at the end of the month, make payments in any other amount whenever you like, or pay your balance in full at any time, similar to a credit card. For new accounts, PayPal Credit has a variable APR of 23.99% on standard purchases and cash advances . Being variable, the APR will fluctuate with the Prime interest rate. The minimum interest charge is $2.

As is the case with credit cards, PayPal Credit extends users an interest-free grace period in which to pay off their entire balance. You will not be charged interest if you:

- Have no balance at the start of your billing cycle.

- Or you had a balance at the start of the billing cycle and you paid the balance in full by the due date in that billing cycle.

PayPal Credit is currently promoting a 6-months special financing offer, in which you wont have to pay any interest on purchases of $99 or higher for 6 months. You will be charged interest if you dont pay the balance in full within 6 months. Note that this is not an introductory offer, but rather an ongoing promotion, so it may be around for years or could end next week.

To send money with PayPal Credit, PayPal will charge a flat fee of 2.9% + $.30 US dollars per transaction. This is the same fee you pay when you use a debit or credit card to send money through PayPal.

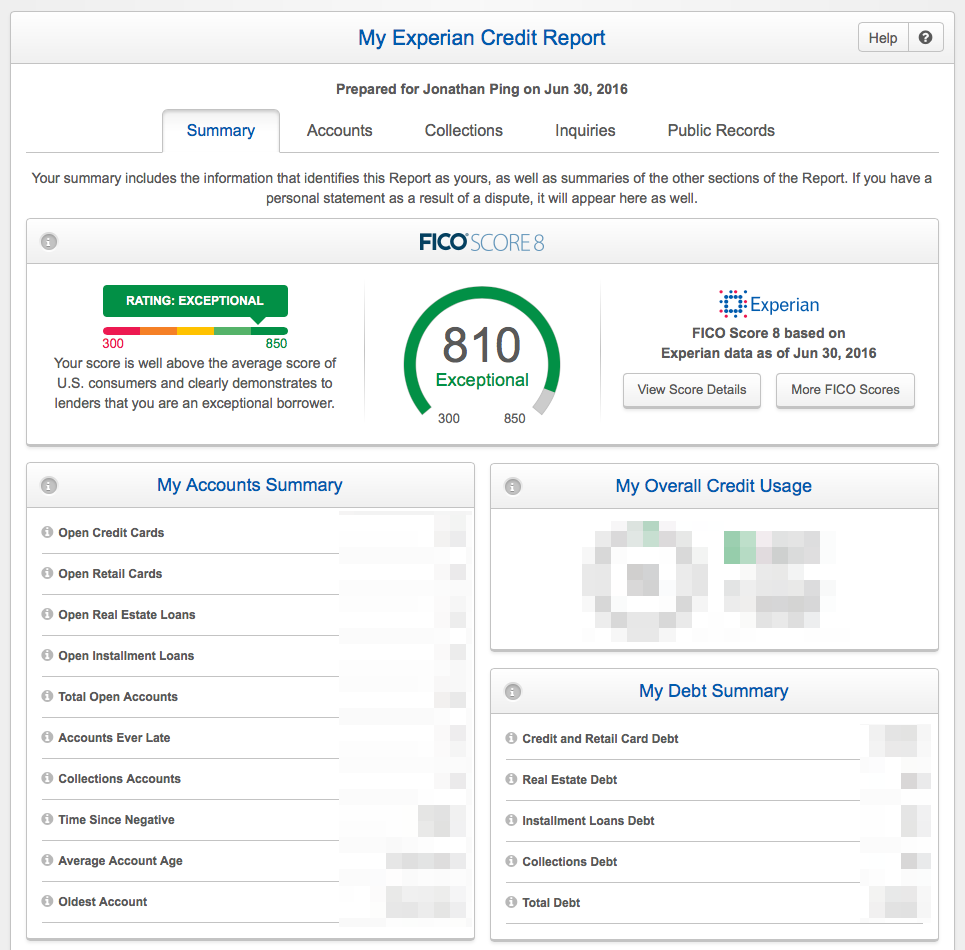

How Does This Impact My Credit Score

The SYNCB/PPC, SYNCB credit card, and any other SYNCB partnership counts as a line of credit in the eyes of the credit bureaus. That means any hard inquiries, credit misuse, and other activity will affect both your utilization and credit score.

In general, each new hard inquiry will lower your credit score up to five points. Of course, if you have multiple hard inquiries pulled, that number becomes compounded, lowering your score by the tens and maybe even twenties. Multiple hard inquiries also look bad to credit issuers, which will make it challenging to obtain a new credit card in the near future at a competitive interest rate.

Having closed accounts, on the other hand, affects your credit utilization rate. Closed accounts show that you have less credit. So, if you still owe any debts, having less credit causes your utilization rates to increase. This also has a negative impact on your credit score since it shows that you’re nearly reaching your credit limits with your current lenders.

Your closed accounts will still contribute to your length of credit history. However, it can take up to 10 years for closed accounts to be cleared from your credit report, granted they remain in good standingâi.e., you continue to pay off your debts on time and avoid late payments.

What Buy Now Pay Later Products Does Paypal Offer

- Pay in 4*: A short-term installment offering that lets customers pay for purchases of $30-$1500 in 4 interest-free payments.

- PayPal Credit**: A revolving line of credit that shoppers can use to pay over time, with a promotional offer of 6 months special financing on purchases of $99+.

As of November 2021

Recommended Reading: Usaa Fico Score

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Why Do Consumers Use Paypal Credit

Many people choose to use Paypal Credit because it allows them to finance their purchases, as well as make payments after 6 months of making the purchase without paying any interest. Paypal credit is available at any merchant that offers you the ability to pay with PayPal. Paypal promotes this service by advertising that you can be approved for Paypal credit in seconds.

That said, before you apply for PayPal Credit, you should know that by simply applying, youre authorizing Paypal and its partner to access your credit report, which will result in a hard inquiry being added to your credit report because youre essentially opening a line of credit to finance your purchase.

That said, the benefit for using PayPal Credit is that you get 6 months to pay off your purchase without paying a single dollar in interest. So, it might be worth it for some consumers to use PayPal Credit, but keep in mind that a hard inquiry will be placed on your credit report.

Although a single hard inquiry will not hurt your credit score by much, if you submit too many credit applications within a short period of time, you could significantly lower your credit score. As a rule of thumb, you should leave approximately 6 months between each hard inquiry thats added to your credit report.

You May Like: Centurylink Credit Check

Re: Does Amazon Monthly Payment Report To Credit Bureaus

Is this the installment plan that only applies to certain electronic gadgets sold by Amazon, and it’s always 5 installments?

If so, I would be very surprised if they reported any positive payment activity. I can’t see a company reporting for just 5 payments. And how would Amazon even get your SSN or date of birth to use for reporting? They don’t ask for DOB unless you try to buy certain items.

Holding A Paypal Balance

Any PayPal balance you hold represents an unsecured claim against PayPal and is not insured by the Canada Deposit Insurance Corporation or by any other provincial insurer of deposits. PayPal combines your balance with the balances of other users and invests those funds in liquid investments. PayPal owns the interest or other earnings on these investments. These pooled amounts are held separate from PayPals corporate funds, and PayPal will neither use these funds for its operating expenses or any other corporate purposes nor will it voluntarily make these funds available to its creditors in the event of bankruptcy.

PayPal is not a bank and does not itself take deposits. You will not receive any interest on the funds held with PayPal.

Read Also: Does Capital One Report Authorized Users To Credit Bureaus

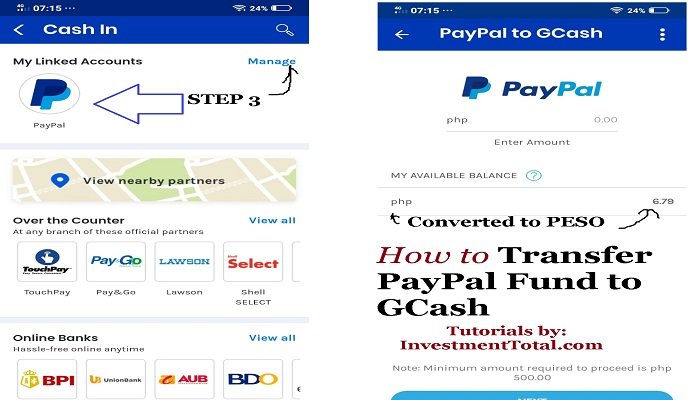

Payment Method Used For My Transaction

Selecting a preferred payment method

You can choose any of the payment methods in your PayPal account as your preferred payment method. You can select a preferred payment method in your account preferences on www.paypal.ca or in the PayPal app. There may be times when your preferred payment method cannot be used, for example, if you select a credit card that is expired.

You can set separate preferred payment methods for online transactions, in-store transactions and automatic payments with a seller.

If you have chosen a preferred payment method, it will be shown as the primary method of payment. If you have not chosen a preferred payment method, its still your choice.

The availability of certain payment methods may be limited based on that particular seller or the third party website you are using to complete the transaction.

If you have not selected a preferred payment method, or your preferred payment method is unavailable, we will show you available payment methods, including the payment method you used most often or most recently, at the time of transaction. You can also click on the Manage link to see all of your available payment methods, or add a new one, and select a payment method during the transaction.

Backup payment method

Sending money to friends and family

Automatic payments

You can cancel any agreement in your account settings on www.paypal.ca.

Bank account transfers

E-cheque

Synchrony Bank Checked Your Credit

Youll see SYNCB/PPC on your credit report if Synchrony Bank ran a credit check to determine whether or not to extend credit to you. This type of credit check can appear as a hard inquiry or a soft inquiry.

- Hard inquiries: These generally appear on your credit report when you apply for new credit, such as credit cards, store cards, or installment loans. For example, if you applied for a PayPal Credit credit card, Synchrony Bank probably triggered a hard inquiry when reviewing your application.

- Soft inquiries: These show up on your credit report when someone checks your credit but youre not actually in search of new credit. For example, if you received an unsolicited offer letter in the mail for a credit card issued by Synchrony Bank, then they may have triggered a soft inquiry during the prequalification process.

Thankfully, soft inquiries wont affect your credit score. Hard inquiries usually lower your credit score by several points, but the effect wont last more than a year, and the inquiry will fall off your credit report entirely after two years. Note that you usually cant remove a hard inquiry early unless the bureau added it to your report by mistake.

Recommended Reading: Tri Merge Credit

Send A Dispute Letter

If you see an item listed under SYNCB/PPC on your credit report that you suspect is a mistake, then you can dispute it by writing something known as a .

You should send your letter to whoever you think the error originated with. You can send it to:

- Synchrony Bank: Send your letter directly to them if you believe they made the original mistake .

- The credit bureaus: Write to the credit bureaus if you believe the error originated witih them .

Either way, its usually a good idea to send copies of the letter to both parties, the bureaus and your card issuer . They may contact each other as they investigate the matter, and its important to make sure everybody has received the relevant information.

If you think one of the credit bureaus added SYNCB/PPC to your credit report by mistake, use this to file a dispute directly with them. Send your letter to all of the bureaus that are reporting the mistaken hard inquiry or credit account.

Once youve filed your credit dispute, the credit bureau will be required to investigate and correct any inaccurate information on your report, usually within 3045 days.

Paypal Credit Pros & Cons

Its helpful to think of PayPal Credit as a great starter credit card or something convenient for PayPal users who like the interface and would like to use credit wherever PayPal is accepted. Those are some of the reasons it might work for you. But its low limits and high APR are not for everyone. Here is our list of pros and cons:

Don’t Miss: Syncb Ppc

Does Paypal Report To Credit Agencies

As of 2019, PayPal Credit is now reporting all of its user information to credit bureaus. The bad news is that if you are late on your payments or miss payments, it will also be published in your credit report, which will affect your credit score further. PayPal Credit can be used for some purchases, but youll have to submit a hard-to-fill form for most.

Important Information About This Agreement

- Assignment

- We may sell, assign or transfer any or all of our rights or duties under this Agreement or your account, including our rights to payments. We do not have to give you prior notice of such action. Any person, company, or bank to whom we assign this Agreement shall be entitled to all of our rights under this Agreement. None of your rights or obligations shall be affected by such assignment. You may not sell, assign or transfer any of your rights or duties under this Agreement or your account.

- Enforceability

- If any part of this Agreement is found to be void or unenforceable, all other parts of this Agreement will still apply.

- Governing Law

- Except as provided in the Resolving a Dispute with Arbitration section, this Agreement and your account are governed by federal law and, to the extent state law applies, the laws of Utah without regard to its conflicts of law principles. This Agreement has been accepted by us in Utah.

- Waiver

- We may give up some of our rights under this Agreement. If we give up any of our rights in one situation, we do not give up the same right in another situation.

Also Check: Who Does Chase Pull

Link Or Unlink A Payment Method

You can link or unlink a credit card, Visa debit card, Mastercard debit card or a Canadian bank account to your PayPal account as a payment method. Please keep your payment method information current . If this information changes, we may update it using information and third party sources available to us without any action on your part. If you do not want us to update your card information, you may remove your payment method from your PayPal account. If we update your payment method, we will keep any preference setting attached to such payment method.

Alternatives To Paypals Pay In 4

PayPals Pay in 4 is just one of many BNPL services you can use to spread out the payment for a purchase over time.

One of the more prominent alternatives is a credit card, but unless you have an introductory 0% APR, you might end up with a relatively high interest rate that hits you with interest charges for each month you dont pay off your purchase.

If you like the concept of Pay in 4 but want to compare similar options, here are some alternatives.

Also Check: What Is Cbna On My Credit Report

Managing Your Money In Multiple Currencies

Holding currency other than Canadian Dollars

Your PayPal balance may be held in any of the currencies supported by PayPal, and you may hold a balance in more than one of these currencies at the same time.

If you hold a balance in your PayPal account:

- We may allow you to convert the funds to a balance in another currency. If you convert funds in your account, PayPals transaction exchange rate will be used. We may, at our discretion, impose limits on the amount of money you can convert or the number of conversions you can perform.

- You may only withdraw the funds in Canadian dollars. We do not permit foreign currency withdrawals, including U.S. dollar withdrawals to USD-denominated accounts or debit cards. In order to withdraw funds in your account held in another currency you will have to convert the currency to Canadian dollars, or it will be converted for you at the time of your withdrawal. PayPals currency conversion rate, including our currency conversion fee, will be used.

To receive money in a currency your account is not currently configured to accept, it may be necessary to create a balance in your PayPal account in that currency or convert the money into another currency. Certain currencies can only be received by converting the money into another currency that PayPal allows you to hold. If the money is converted, PayPals transaction exchange rate will be used.

How we convert currency

Currency conversion choices

What Is Paypals Pay In 4

Pay in 4 is a BNPL servicealso sometimes called a point-of-sale installment loanthat enables you to make purchases at millions of online stores without paying the full price upfront. Instead, youll pay what you owe in four equal and interest-free installments.

While there are a few limitations and restrictions, you can use the program to make certain purchases more affordable by paying them off over time instead of all at once. Its especially beneficial for someone who would otherwise use a high-APR credit card that charges interest while they pay off the balance.

Also Check: Do Pre Approvals Affect Credit Score

How Can You Apply For Paypal Credit

If youre interested in PayPal Credit, you can apply for it directly on the PayPal website or through an online merchant where you shop. For example, if youre shopping at an online merchant, you will be given the option to pay using PayPal credit when you select PayPal as your payment method. Once you click on PayPal credit, you will have to add some information and submit your application. Your application will take a few seconds to process, and you will either be approved or denied for PayPal credit. If approved, a line of credit will be opened for you, and you can then use that line of credit to make purchases through PayPal.

Where Should I Add Pay Later Dynamic Messaging On My Site

- Add Pay Later messaging to product detail pages near prices or the add to cart button so customers know they can buy now and pay later when theyre deciding what to purchase.

- In checkout, remind customers that they can buy now and pay later by including Pay Later messaging on cart and checkout pages near cart subtotals.

Read Also: Can I Buy A House With A 588 Credit Score

Does Paypal Credit Show Up On Credit Report

PayPal does not affect your credit score however, the good news is that you do not need to worry. installment payments method, called Pay in 4 for instance, you no longer need to check credit scores or appear credit card companies-and PayPal charges its customers zero interest rates on payment installments.

How Do I Know If My Business Is Eligible To Promote Pay Later Offers In The Us

How can I find out more about Store Cash?When do the changes take effect?What am I getting?

- Customize discounts, redemptions, purchase limits, and campaign schedule details.

- Send offers to customers who added cart items but never checked out, or to customer who haven’t bought from you lately.

- Set stringent spending limits so campaigns can automatically end either on a specific date or when spending limit is reached.

What are the costs?

- When customers make a purchase using Store Cash, you pay 8% of each gross sale made during your campaign after discounts are taken. Gross sales exclude sales tax, shipping, gift wrap and insurance charges if the data is passed to PayPal.

- This fee is only applied on sales made. If you sell nothing, you pay nothing.

What else is happening with the changes?

- We’re phasing out campaigns launched before February 14, 2022. This is to help ensure a consistent experience for all merchants.

- Any active campaigns will be canceled as of February 14, 2022. We understand this may not be ideal, but we hope you’ll be excited about the new, improved campaigns you’ll launch and will bear with us.

- Your customers will still have 7 days to redeem offers in their wallets without campaign fees after your campaign is canceled.

- The campaign creation process is the same – you’ll just need to agree to the new Terms and Conditions before creating a new campaign.

Read Also: Does Sezzle Affect Credit Score