Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Correct Errors On Your Credit Report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If its a simple identity errorlike a credit card thats not yours showing upyou can get that corrected within one to two months. If its an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If theres a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian . You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If its an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

What Does A 640 Credit Score Mean

So what is a 640 credit score?

Generally speaking, having a credit score of 720 or higher is considered a good score. Since your score is at 640, you just need to make a few adjustments in order to be in good financial standing.

With a 640 score, you can get accepted for a few loans, but youre still at a disadvantage. By not taking the correct steps to increase your score, it can cause a hindrance to accomplish certain activities and milestones in your life.

Failing to raise your credit score will negatively affect your ability to obtain car loans, credit cards, and mortgages. Additionally, it can prevent you from completing basic lifestyle needs such as applying for utilities .

No matter how you got to your 640 scores, your credit will take some time to overcome. No credit score is permanent. This means you can increase them over time by taking effective action. If you look at your credit report and analyze your FICO score, you can identify multiple events that reduced your score.

As time progresses, the events that have caused a negative impact on your score will be diminished. If youre patient, avoid making the same mistakes, and take the proper steps to help improve your credit score, and your credit score will begin to increase.

You May Like: How To Remove Repossession From Credit Report

Is A Credit Score Of 630 Good Or Bad

The truth is, a 630 credit score isnt good. In fact, it typically falls into the fair category. With this credit score, it can be quite difficult to obtain a mortgage and might need credit repair to increase the chances of approval. It could also hinder your chances of getting some jobs or renting an apartment. In addition to that, it could cost you thousands of dollars every year in additional interest, compared to another consumer who has a credit score of 700 or higher.

Can You Get An Fha Loan With No Credit History

If youre applying for any kind of mortgage, including FHA, its a good idea to have at least two or three accounts open and reporting on your credit whether those are revolving accounts, like credit cards, or monthly loan payments. However, its possible to get an FHA loan with a thin or nonexistent traditional credit history. Before moving forward, there are some things you should know.

These loans are manually underwritten. That means your mortgage process can take longer. To get an FHA loan with no credit history from Rocket Mortgage®, you need to have a minimum of three nontraditional credit references.

Those references have to include at least one of the following:

- Utilities not reporting on the credit report

- Telephone service

The other two references may come from any of the following:

- Insurance premium thats not payroll deducted

- Childcare payments

- Retail store credit cards

- Rent-to-own

- Portion of medical bills not covered by insurance

- Car leases

- Personal loans from an individual with repayment terms in writing that can be supported by canceled checks

- A documented 12-month history of savings by regular deposits resulting in an increasing balance to the account. The account has to show at least quarterly deposits which arent payroll deducted. There should be no fees for insufficient funds

- A years worth of payments you made to an account on which youre an authorized user

Recommended Reading: What Credit Score Does Carmax Use

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Raising Your 630 Credit Score

Your FICO credit score is good, and you have a high chance of qualifying for a broad array of credit facilities. But if you can boost your score and reach the best credit score ranges, ten you might qualify for better interest rates so you can save even more money in interest. Here are a few tips for raising your credit score.

Get a secured credit card: getting a secured credit card can help increase your FICO score, even when youre not eligible for conventional credit cards. If the lender reports credit activity to the various credit because in the country, then you should make a deposit equal to your total spending limit. Any time you utilize the secured card, the events will be entered in your reports.

Consider getting a credit-builder loan: these specialty loans are meant to help boost your credit score, by showing your ability to pay on time. Once you take out this loan facility, the credit union puts the cash borrowed in an interest-generating account. It is a reasonable savings strategy, but the main benefit is that the credit unions will report those payments, which helps to boost your credit score.

Find out More Information about Your Score contact Ability Mortgage Group your Local experts in Maryland at

Don’t Miss: How To Remove Repossession From Credit Report

What Is A 630 Fico Score

Understanding your 630 credit score means knowing how credit scores are calculated and how they affect your life.

Credit scores are calculated by the FICO corporation based on everything in one of your three credit reports. This means your entire credit history from the time you started using loans and credit cards.

From this information, FICO calculates your score on a scale from 350 to 850 though its rare for anyone to have a score outside of the 450 to 800 FICO range. A 630 credit score isnt exactly in the middle but its pretty close.

That doesnt mean a 630 FICO is a good credit score though.

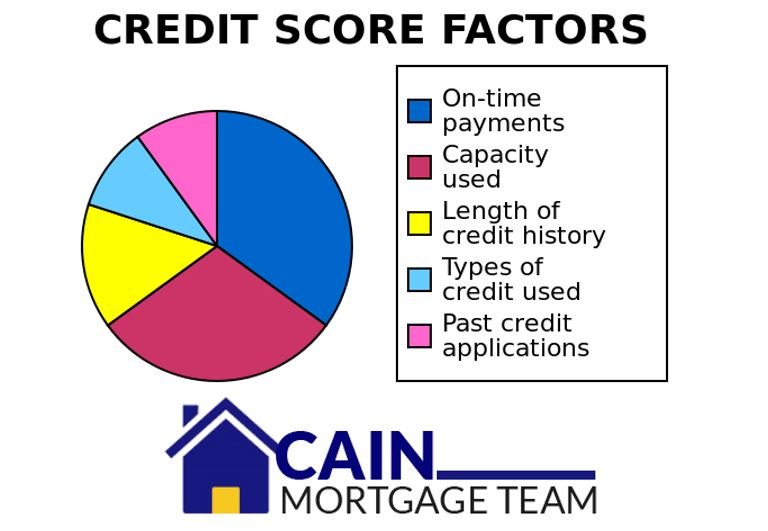

How Your Credit Score Is Calculated

Although no one knows exactly how your 630 Credit score is calculated, but as per general practices, different details from your credit report are used to formulate your credit score. The data taken from a credit report is usually a combination of five variables, where each variable is the information about credit extended to you through lenders and service providers.

Recommended Article:

Each variable has a percentage that shows its importance in formulating the credit score. If you want your credit score to fall in a Good or Excellent category and not in the Very Poor category, you need to keep these factors in your mind before applying for credit.

The five important variables are:

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Avoid A Card With An Annual Fee If You Can

If a card has a particularly large annual fee, in combination with a low credit limit, it will effectively reduce that credit limit. It will also increase the likelihood youll be carrying a balance and making interest payments.

Some of the cards weve included on our list do have annual fees, though all are below $100. Its best to avoid these if you can, but if not, just be aware that it will raise the cost of improving your credit score.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Read Also: Unlock Credit Experian

Can You Buy A House With A 630 Credit Score

It is possible but most Lenders would require a higher score. You might be wondering if there is an exact minimum credit score that qualifies one to purchase a home. The fact is, there is no fixed rule. However, we believe that you can comfortably acquire a house with a good score . This is with the assumption that you are purchasing a residence that matches your financial ability and obtaining a mortgage that suits you. Supposing all of the above is true and you are thinking of making a financial decision, a score of 660 is a safe score to assume you will qualify for a loan.

How You Can Improve Your Credit Score

You can improve your credit score above 650 by paying all of your bills on time and reducing your credit utilization ratio to 30% or less.

When your overall debt is 30% or lower, you’re rewarded with an improved credit score. Maintaining a low credit utilization ratio shows lenders that you have proper money management skills.

You are also less at risk for maxing out the overall amount of credit you have available, which helps puts lenders at ease when you apply for a new line of credit.

More:How to Improve Your Credit Score by 100 Points

Maintaining various lines of credit is fine and can be healthy for your credit, yet opening too many lines of credit can be a detriment to your overall score.

Too many lines of credit or credit inquiries can lower your credit score.

Work at building your credit and, if you are consistent with your efforts, you will see your score slowly rise.

This will happen over the course of several months and years, so be as patient as possible because your credit score definitely has a lot of potentials to improve to good standing.

Make the effort to improve your score to 700 or higher and more doors will open for you financially.

Ask a Question

Saturday, 08 Jul 2017 9:03 PM

You May Like: How Often Does Usaa Update Credit Score

Is A 630 Credit Score Considered Bad Credit

While your credit score will rise and fall over time, theres one score you need to work to when thinking about good or bad credit.

Thats the cutoff for prime lending, a FICO around 660, which is the point where youll qualify for certain federal loan guarantees. Qualifying for these programs is important because it makes it easier for banks to sell your loan to investors and is generally the point where traditional banks and credit unions decide whether to approve your application or not.

That doesnt mean you cant get a loan with a 630 credit score but it will make it difficult. Well get to the loan options on a 630 FICO later in the article.

So a 630 credit score isnt terrible credit, Ive had a score as low as 580 before and it wasnt fun. I couldnt get a loan and the few credit cards that would approve my application demanded super-high interest rates.

Fortunately though, a 630 credit score isnt too far from good credit. Youll be able to increase your score that 70-points within a year of regular payments on a loan or other credit. When you get over that 660 to 700 range, youll start to notice the rates on loans go way down. Youll also start getting approved for any loan you need.

Loan Options For A 630 Credit Score

Just because banks and credit unions wont approve your loan application doesnt mean youre completely locked out of credit. It just means you need to know where to look when applying for money.

I started using peer-to-peer loans and personal loans after destroying my credit score in 2008. I hit rock-bottom with a score of 580 FICO but was still able to get consolidation loans and a loan for home improvement, so I know its possible.

In fact, Ive seen people with a credit score as low as 520 get approved on some p2p websites.

Of course, that doesnt mean interest rates are going to be as low as those you see advertised on TV. Even at traditional banks, those rates are for only the best credit scores above 800 FICO.

But rates on peer-to-peer loans are still generally below credit card rates. Thats why using them in debt consolidation is so popular .

There are a few sites that specialize in bad credit loans that Ill mention here. Ive used PersonalLoans twice before but have also used others like BadCreditLoans and Upstart.

I like PersonalLoans because its a loan aggregator, networking different lenders to shop your application around for the best deal. You can apply for a peer-to-peer loan, personal loans and even traditional bank loans with one application.

| Peer to Peer Lending Site | P2P Borrower Fees |

|---|

Don’t Miss: How To Remove Repossession From Credit Report

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Mortgage Rates For Poor Credit

The average credit score needed to buy a house can vary, but it could be more challenging to qualify for a loan if your credit needs work.

You may find that mortgage offers that are available to you come with high interest rates that can cost you a lot of money. Its important to consider the long-term financial impact of an expensive loan, and it may be worth taking some time to build your credit before applying.

But there are some types of mortgages to consider if you dont qualify for a conventional loan. These government-backed loans that are made by private lenders include

- FHA loans

- VA loans

- USDA loans

If you qualify for one of these loan types, you may be able to make a smaller down payment, too.

No matter what your credit is, its important to shop around to understand what competitive rates look like in your area. Compare current mortgage rates on Credit Karma to learn more.