What Are The Income Requirements For An Fha Loan

To start, the FHA loan does not require a specific income value but still has financial requirements to be eligible. Borrowers will need to prove they will be able to pay back the loan in full before a lender will approve you. Lenders strongly consider your debt-to-income ratio, which compares your debts to monthly income. Lenders like to see your monthly income to be greater than the amount you spend on your monthly payments. Typically, lenders like to see a ratio of 31:43 percent.For example, lets say a borrower earns $3,000 per month. To meet ratio requirements, it would be best to keep monthly mortgage payments below $930 because it is 31% of $3,000. Do not forget to factor in other financial obligations, such as credit card debt, student loans, and other bills. It is recommended that all your combined monthly payments be less than $1,290 .

How To Qualify For An Fha Loan

You’ll need to satisfy a number of requirements to qualify for an FHA loan. It’s important to note that these are the FHA’s minimum requirements and lenders may have additional stipulations. To make sure you get the best FHA mortgage rate and loan terms, shop more than one FHA-approved lender and compare offers.

It’s important to note that lenders may have additional stipulations.

Understanding Your Debt To Income Ratio

Your DTI takes into account your debts, or fixed monthly expenses. It includes your mortgage, minimum credit card payment, student loan, auto loan and other debts. It doesnt include variable expenses like groceries, utilities, gas, health insurance and car insurance.

DTI is calculated with the following formula:

Monthly expenses / Gross Monthly Income

With a median FICO® Score below 580, your DTI cant go over 45% of your gross monthly income. These two ratios have a major impact on how much house you can afford.

In addition to the restrictions laid out above, its important to note that very few lenders offer these subprime FHA loans. At Rocket Mortgage®, you have to have a median FICO® Score of at least 580 to qualify.

You May Like: 586 Credit Score

Benefits Of An Fha Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

Debt In An Fha Dti Ratio Calculation

You must disclose all debts and open lines of credit on your loan application. You might wonder why you need to describe your open line of credit. These can become debt if the homebuyer goes on a shopping spree before closing, so the FHA directs lenders to keep an eye on open lines of credit.

Let’s start by calculating a back-end DTI ratio with example numbers.

The FHA calls the back-end ratio the total fixed payment expense DTI Ratio. Disclose your college loans, balances on your credit cards, auto loans, and how much you’ll pay in both auto insurance and homeowners insurance. Include any personal loans from family, and other debts.

Spousal and child support obligations are considered debt to the person required to make the payments.

Now let’s use the same numbers to calculate a front-end DTI ratio:

The FHA calls the front-end DTI ratio the total mortgage expense DTI Ratio.

Don’t Miss: How Do I Unlock My Experian Credit Report

My Credit Score Isnt So Great What Are My Options

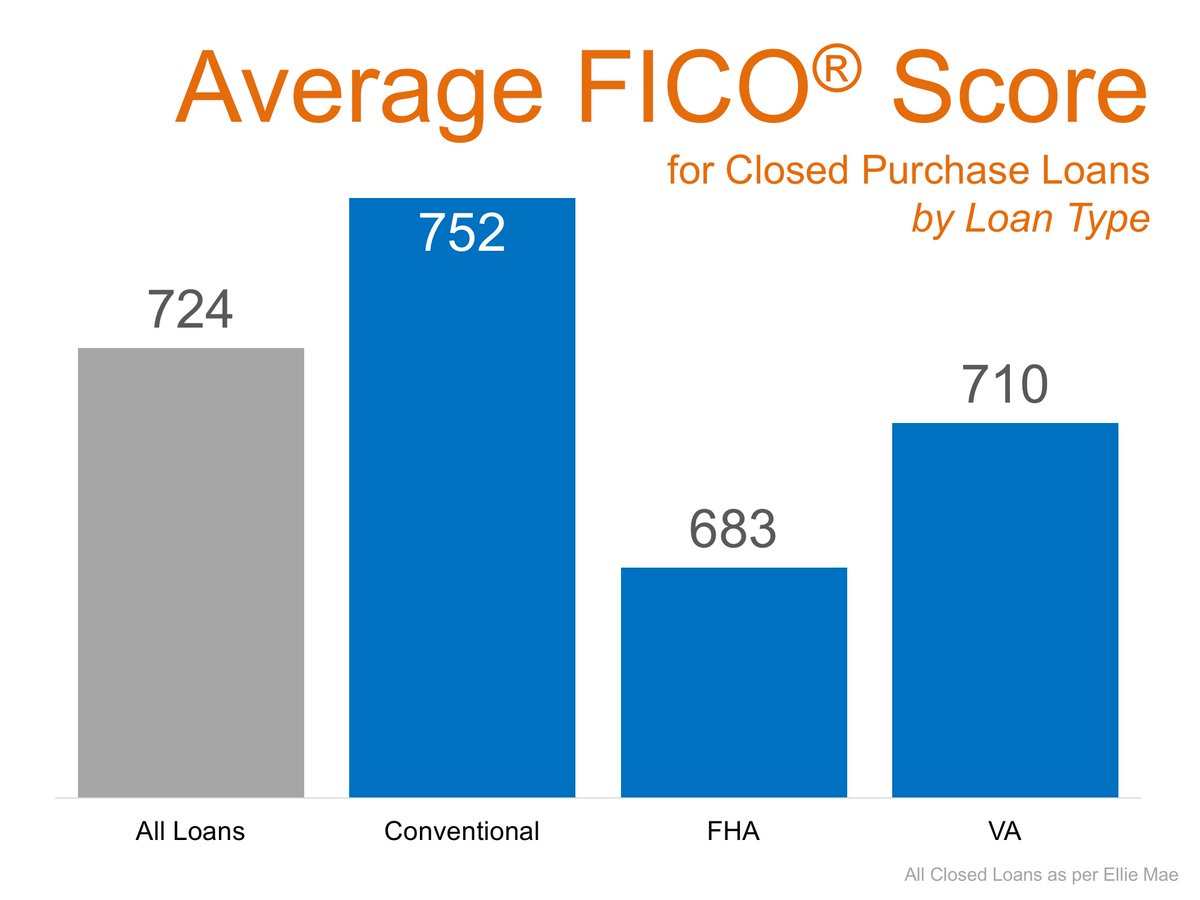

If dont have the 620 credit score needed for a conventional loan, youve still got options. Government-backed mortgages like the FHA, VA, and USDA loans have more flexible guidelines than conventional loan requirements.

If dont have the 620 credit score needed for a conventional loan, youve still got options. Government-backed mortgages like the FHA, VA, and USDA loans have more flexible guidelines than conventional loan requirements.

USDA loans, which are insured by the U.S. Department of Agriculture appear to have a higher credit score requirement than the conventional loan credit score minimum at first glance: 640 vs 620.

However, the 640 minimum is a USDA guideline but not a hard and fast rule. The USDA allows lenders to approve borrowers at lower credit scores if they have compensating financial factors such as a very low DTI or significant savings.

| Loan Type |

|---|

Official Hud Guidelines For Credit Score

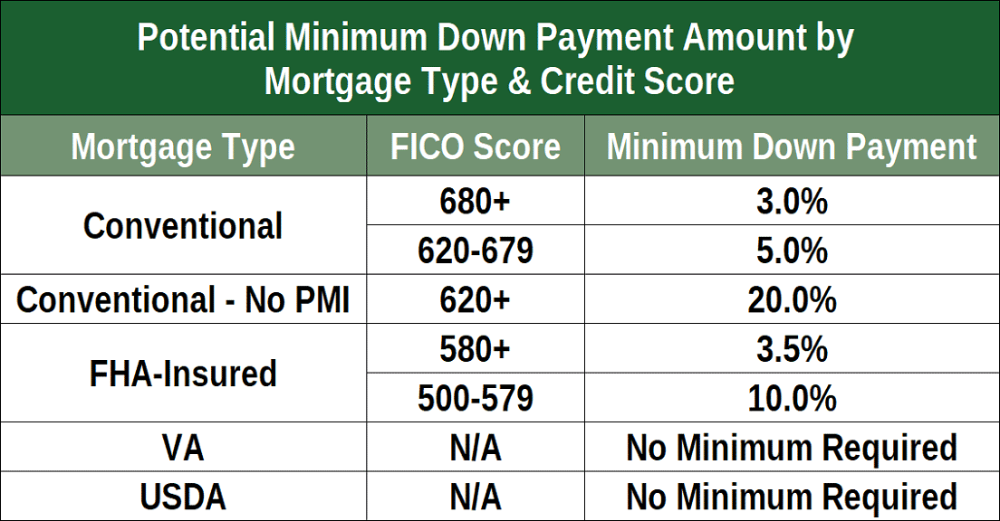

According to the U.S. Department of Housing and Urban Development , borrowers must have a credit score of 580 or higher to get an FHA loan with a 3.5% minimum down payment. Borrowers with credit scores between 500 and 579 and get approved with a down payment of 10%. Those with credit scores 499 or lower are not eligible for an FHA loan.

The purchase price of a property determines the down payment. Mortgage insurance is required when a borrower puts down less than 20%. FHA borrowers who put down less than 10% pay mortgage insurance for the life of the loan.

Recommended Reading: Experian Boost Paypal

What Credit Score Do You Need To Buy A House

Its possible to get an FHA loan with a credit score of 580 or 500, depending on the size of your down payment. VA, USDA, and conventional loans do have a set minimum credit score but lenders will generally require a credit score of at least 620.

Of course, remember that the minimum square will tell you whats required to qualify, but a lower credit score also usually means higher interest rates.

This table outlines the minimum credit scores typically needed to buy a house based on the type of loan: conventional, FHA, VA or USDA.

| Loan Type |

- Co-borrowers who do not plan to live in the home

- Down payment gift money, but no down payment of their own

- Properties that are in need of repair

Without FHA, millions of homeowners would be stuck renting years longer than they should. Yet, there is still room for FHA to expand its capacity to serve more aspiring homeowners.

Minimum Fha Credit Score Requirements In 2020

News alert : Some lenders have increased FHA credit score requirements in 2020, due to the ongoing economic crisis. Learn more here.

This article explains the minimum credit score requirements for FHA loans in 2020. It is intended for home buyers and mortgage shoppers who plan to use an FHA-insured loan to buy a house in 2020.

At a Glance: In a hurry? Here’s the gist of this lesson in 100 words or less. The official minimum credit score for an FHA home loan is 500. In order to take advantage of the 3.5% down-payment option, however, you will need a score of 580 or higher. Borrowers with scores between 500 and 579 are required to put more money down, at least 10%.

Mortgage lenders frequently set their own minimum credit-score requirements for FHA loans, and they are usually higher than the official cutoff. In 2020, most lenders want to see a score of 600 or higher. But some are beginning to ease their standards a bit.

Don’t Miss: How To Unlock My Experian Credit Report

Can You Get An Fha Loan If You Have A Tax Lien

Borrowers with delinquent tax debt are ineligible unless currently in repayment plan. Repayment plan tax liens are not required to be paid in full if documentation is provided indicating the borrower is in a valid payment plan.

The following is required:

What Is The Fha Waiting Period For Borrowers With Previous Bankruptcy

Bankruptcy does not automatically disqualify a borrower from obtaining an FHA loan. Minimum 2 years since discharge of chapter 7 bankruptcy. Borrower with less than 2 years discharge may qualify for financing so long as they meet the extenuating circumstances as defined by FHA/HUD. Same rule applies for borrower with chapter 13 bankruptcy.

However, borrower with chapter 13 bankruptcy may still qualify if the bankruptcy has been discharged less than 2 years if the lender is willing to do a manual underwrite with satisfactory payment history under the chapter 13 plan.

Read Also: Sync/ppc On Credit Report

Va Mortgage: Minimum Credit Score 580

VA loans are popular mortgage loans offered toveterans, service members, and some eligible spouses and military-affiliated borrowers.

Withbacking from the Department of Veterans Affairs, these loans do not require a down payment, nor any ongoing mortgageinsurance payments. They also typically have the lowest interest rateson the market.

Technically, theres no minimum credit score requirement for aVA loan. However, most lenders impose a minimum score of at least 580. And many startat 620.

Similar to FHA loans, VA loans dont have risk-basedpricing adjustments. Applicants with low scores can get rates similar to thosefor high-credit borrowers.

Bad Credit Mortgage Faq

What credit score is considered bad credit?

Can a cosigner help me get approved?

Yes, a cosigner with a good credit history could help you secure a loan, assuming your lender allows cosigning. However, this is a big ask since the mortgage loan would affect your cosigners ability to borrow for his or her own needs. Plus, your cosigner would be on the hook for your mortgage payments if you cant make them and in the event of foreclosure or even late payments, their credit would take a huge hit. Most home buyers prefer co-borrowing with a spouse or partner. Co-borrowers become co-owners of the home and share in its equity.

Will a bad credit mortgage require higher closing costs?

While theres not necessarily a direct correlation between lower credit scores and higher closing costs, borrowing with bad credit does limit your loan options, which can lead to higher borrowing costs. For example, lets say you have a FICO score of 510 and can find only one lender willing to approve your FHA loan. If that lender charges a higher-than-average loan origination fee, you wont have the option of shopping around for lower fees from other lenders.

Does mortgage insurance cost more when you have bad credit?How do mortgage lenders afford bad credit loans?Should I improve my credit score before buying real estate?

Read Also: Removing A Repossession From Credit Report

Federal Housing Administration Loans Vs Conventional Mortgages

FHA loans are available to individuals with as low as 500. If your credit score is between 500 and 579, you may be able to secure an FHA loan if you can afford a down payment of 10%. If your credit score is 580 or higher, you can get an FHA loan with a down payment for as little as 3.5% down. By comparison, you’ll typically need a credit score of at least 620, and a down payment between 3% and 20%, to qualify for a conventional mortgage.

When it comes to income limitations and requirements for FHA home loans, there is no minimum or maximum.

For an FHA loanor any type of mortgageat least two years must have passed since the borrower experienced a bankruptcy event . You must be at least three years removed from any mortgage foreclosure events, and you must demonstrate that you are working toward re-establishing good credit. If you’re delinquent on your federal student loans or income taxes, you won’t qualify.

| FHA Loans vs. Conventional Loans |

|---|

Where To Get An Fha Loan

FHA loans are backed by the government, but you apply and obtain them through FHA-approved lenders. You can find a list of approved lenders on the Housing and Urban Development website.

Keep in mind that because the government doesn’t directly finance these loans, it doesn’t set the interest rates or termsthe lenders do. That means the costs of FHA loans can vary, so it could be worth shopping around to find the best deal.

Additionally, while FHA loans tend to have competitive interest rates, HUD recommends homebuyers still compare FHA loans with other types of mortgages in case an FHA loan isn’t the most affordable option. While FHA loan interest rates may be the lowest option for those with credit issues, a conventional loan may have better rates for those with stronger credit.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Do Lenders Know What Credit Score The Lender Will Pull For Me

Private lenders typically see a different credit score than what youd see in a free credit monitoring app. Free apps may inflate your credit score compared to your real score think of it as your mortgage credit score.

Your mortgage credit score is often lower than what the app tells you because mortgage lenders must be more stringent. The app isnt letting you borrow hundreds of thousands of dollars, but lenders are. And, the free score likely reflects just one of your three scores from credit bureaus.

For instance, a lender pulls your credit and gets the following scores:

- 685 from Experian

- 660 from Equifax

Your mortgage credit score for qualification is 672 because its your middle score.

Its not uncommon for someone with these scores to receive a 720 or even 740 as their free credit score. But as the saying goes, you get what you pay for.

The best way to know for sure where you stand is to work with an FHA lender that can pull your actual credit score as part of the preapproval process.

The lender may charge a small fee around $35 to cover the cost of pulling your credit. But the fee is worth it to find out whether you qualify for an FHA loan and how much home you can afford.

Minimum Credit Score Requirements For An Fha Loan

Technically, you can get approved for an FHA loan with a median FICO® Score of as low as 500, but there are some serious drawbacks to an FHA loan with a score that low.

The first is that youll need a down payment of at least 10%. Secondly, when qualifying with a score that low, its considered a subprime loan. What that means from a practical perspective is that even if you can get the loan, you wont get the best terms and could end up with a much higher rate.

Finally, you have to have some very low qualifying ratios. To qualify with a median FICO®Score of below 580, you need to pay close attention to two ratios: your housing expense ratio and your overall debt-to-income ratio .

Also Check: Why Is There Aargon Agency On My Credit Report

What You Need To Know

- Aspiring homeowners with credit scores as low as 500 may be able to get approved for an FHA loan if they dont qualify for a conventional mortgage

- Besides your credit score, lenders will also look at other factors like your debt-to-income ratio, the size of your down payment and income history

- Every lender has different standards for FHA loans even if your credit score qualifies, you may still be turned down

What Are Fha Guidelines For Employment History And Loan Income Requirements

A two-year employment and income history is required for both employees and self-employed borrowers by way of pay stubs, tax returns and W2s or 1099s.

Borrowers with court ordered alimony and child support must document receipt of the income for a minimum of three months and proof that it will continue for at least three years.

Also Check: Does Affirm Show Up On Credit Report

What To Do If You Have Bad Credit

The 2020 minimum credit score for FHA loans is 500. Most lenders require a score of 600 or higher, though some are relaxing their standards below this point. Despite this easing trend, borrowers who fall below the 600-or-up threshold may have a harder time qualifying for an FHA-insured mortgage. But that doesn’t mean they are powerless. There are things you can do to improve your score.

Most importantly, make sure you pay all of your bills on time — especially credit cards and installment loans. Your payment history on these types of accounts influences your credit score more than any other factor. Even a single late or missed payment can drop your FICO score by 50 – 100 points, depending on the circumstances. If you want to improve your credit situation, you have to pay all of your bills on time. There is no way around it.

Reducing your debt burden could also boost your score, especially if you are “maxed out” on one or more of your credit cards. According to myFICO, the company that created the FICO scoring model: “when a high percentage of a person’s available credit is being used, this can indicate that a person is overextended and is more likely to make late or missed payments.” This in turn can lower your score.